Olo Inc. IPO: Digitalization in the Restaurant Business

6 minutes for reading

Nowadays is probably the first time since the start of the century when many owners of “analog” businesses started thinking of digitalizing their workflow systems and sales analysis. The sector of delivery services has been developing at the same period and the restaurant business required actionable analytics of client orders in the first place.

Olo Inc., the company which offers solutions for digitalizing the restaurant business, filed an S-1 IPO form at the NYSE with the “OLO” ticker on February 19th, 2021. Olo Inc. has raised $81.3 million during the six financing rounds since 2005. Let’s talk about the company’s recipe for success and decide whether its shares are worth investing in.

Olo Inc. business

Olo Inc. is a SaaS (cloud) platform for managing an online segment of a business. It can be quickly and easily integrated into a restaurant ecosystem and helps to control order at every stage of customer communication. Customers, in their turn, may order delivery from their favorite restaurant on the Olo website, third-party market places, or social networks. By doing this, the company has diversified the source of customer orders from restaurants. Due to the fact that Olo may reach more clients, their average check increases.

The platform consists of 3 parts:

- Ordering – takes orders.

- Dispatch – chooses the most convenient delivery method.

- Rails – customizes the menu in accordance with customer preferences and geography-specific aspects.

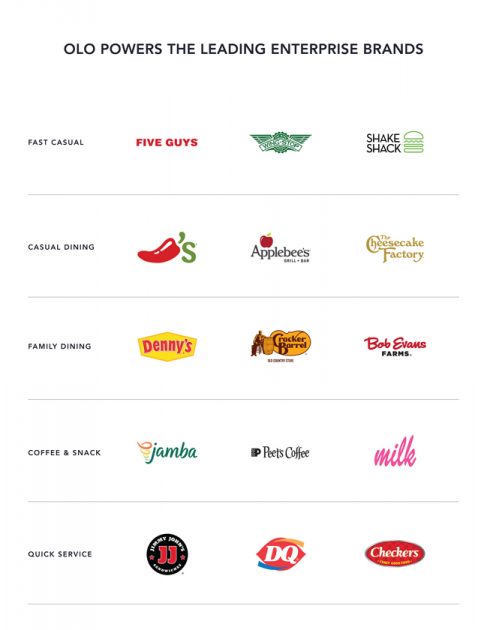

Last year, the total cost of the orders process by the platform was $14.6 billion. Olo processes about 2 million orders every day. Over 400 restaurant brands, such as Cracker Barrel, Jamba, The Cheesecake Factory, Wingstop, and others, which combine more than 64,000 restaurants, have already become the company’s clients.

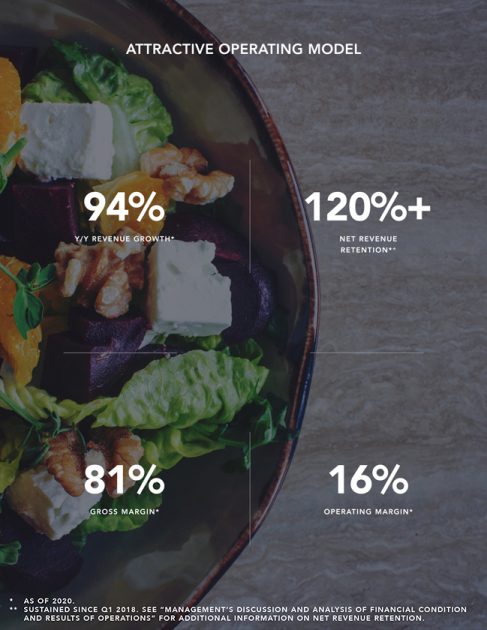

The company’s major asset is that after revisiting the platform, its users usually increase their order by 20% on average. As a result, the retention ratio is about 120%. Olo operates in the B2B segment, where clients shape long-term relationships in case of successful cooperation.

The company’s business was clearly pretty much supported by the coronavirus pandemic. Apart from taking orders, Olo provides restaurants with client order analysis to help them make their services faster and more customer-focused. Such an approach exactly meets the needs of nowadays customers, who believe that the quality of a provided service is not a sufficient condition for choice.

The market and competitors of Olo Inc.

According to US National Restaurant Association, in 2019, the restaurant audience spent about $863 billion, which is more than consumer spending on food products. At the same time, the size of the food industry in 2019 was $1.6 billion. In 2020, the total consumer spending in restaurants dropped to $659 billion. However, Freedonia Group believes that this number may exceed $1.1 trillion by 2024.

Nowadays consumers expect the restaurant business to offer an individual approach, as well as the opportunities to get required services in a quick and quality way. A vivid signboard and a good chef won’t necessarily attract enough clients, that’s why Olo barely has any competitors in this segment, except for DoorDash and UberEats maybe, classic delivery companies. However, these companies don’t have any comparative benchmark software, that’s why they can’t be called appropriate competitors.

Financial performance

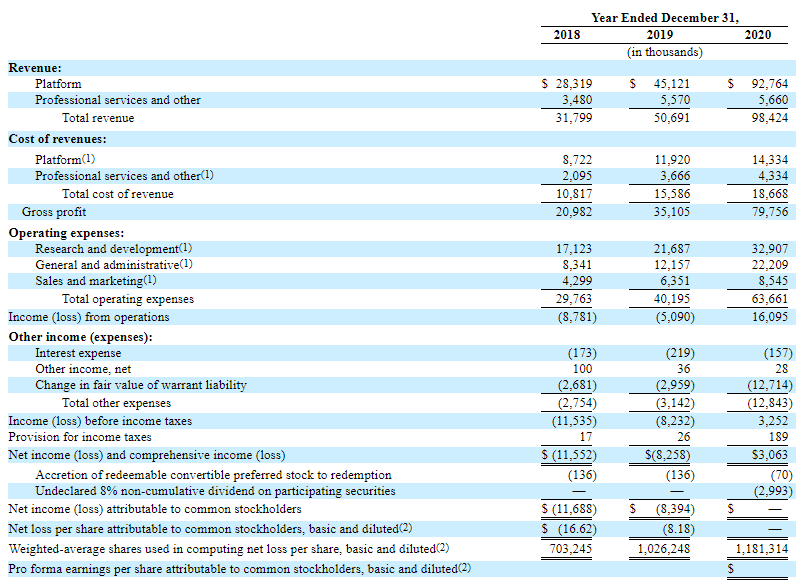

Olo Inc. is filing for an IPO with some sound financial performance. At the time of applying, Olo already took the net income for 2020. The revenue growth rate is also very impressive.

The company’s total revenue in 2020 was $98.42 million, which is a 94.16% increase if compared with 2019. In 2019, this increase against 2018 was 59.45% (from $31.80 million to $50.69 million). More than 94% of sales are made through the Olo platform, while the rest of them come from third-party marketplaces.

The net income in 2020 was $3.06 million against the net loss of $8.26 and $11.54 million in 2019 and 2018 respectively. The gross profit in 2020 was $79.76 million, which is a 127.17% increase in comparison with 2019. If the company’s operating expenses continue decreasing, the net income in 2021 may add over 100%.

At the same time, the cost of production of services added 18.22% in 2020, which is much slower than the revenue growth rate and that’s a positive signal for the future.

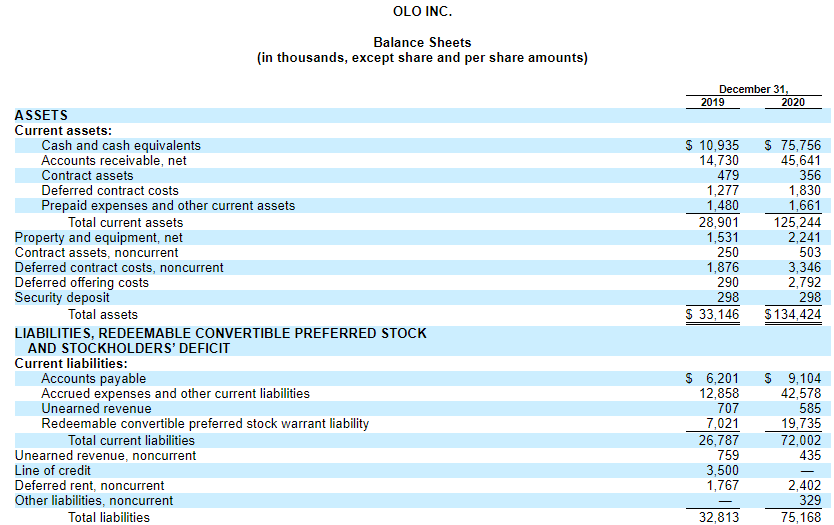

Cash and cash equivalents on the company’s balance sheet are $76.86 million, which are enough to cover its current liabilities of $72 million. The total liabilities of Olo Inc. are $75.17 million.

Based on the above, we can say that the company is highly stable financially. Revenue and net income are increasing, the cost of production of services is reducing, and the company has enough money to cover its liabilities.

Strong and weak sides of Olo Inc.

Being knowledgeable about all information concerning the company’s business and its financial performance, we can evaluate all pros and contras of investing in its shares.

Among the strong sides of Olo Inc. are:

- The market where the company is operating may reach $1.1 trillion by 2024.

- The company is profitable at the moment of filing for an IPO.

- It barely has any competitors and there are no similar companies in the industry.

- Revenue added 94.16% in 2020.

- The average revenue growth rate is 76.81%.

- The COVID-19 pandemic made the business stronger.

- The company is cooperating with all leading restaurant chains in the USA.

Risks of investing in Olo are the following:

- The company has been in the market since 2005 but received its net income only in 2020.

- Heavy reliance on clients of its platform. If there is a cheaper direct substituteб the company’s financial results may plummet.

- The company doesn’t pay and is not planning to pay dividends.

- The current revenue growth rate will slow down.

IPO details and estimation of Olo Inc. capitalization

During the six financing rounds, the company’s institutional investors were PayPal Ventures, Tiger Global Management, and и RRE Ventures. The underwriters of the IPO are Truist Securities, Inc., Stifel, Nicolaus & Company, Incorporated, William Blair & Company, L.L.C., Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, RBC Capital Markets, LLC и Piper Sandler & Co. The proposed maximum aggregate is $100 million but it may increase manifold closer to the IPO date.

To assess Olo’s potential capitalization we use the Price-to-Sales ratio (P/S Ratio). Big Commerce (BIGC), a public company that is also engaged in software development in the B2B segment and trading at the stock exchange with a ratio of 26.15 as of this writing. At the time of heavy growth, the ratio was 40, considering that Big Commerce is still loss-making.

As a result, Olo’s potential capitalization is $2.57 billion (0.98 million * 26.15), that’s why we may recommend to add shares of this company to your mid- and long-term investment portfolio.