Good Quarterly Report Did Not Save Oracle Shares from Falling

2 minutes for reading

The shares of Oracle (NYSE; ORCL), an American company producing software, providing server equipment and cloud services, had been growing for three sessions in a row. However, after the quarterly report was issued and forecasts for the next three months were made, the shares simply crashed. We wanna know what’s happened. Are you in?

Did they drop that badly?

The shares of the tech company began on March 10th. While investors were waiting for the quarterly report for Q3 of financial 2021, the shares dropped by 0.72%.

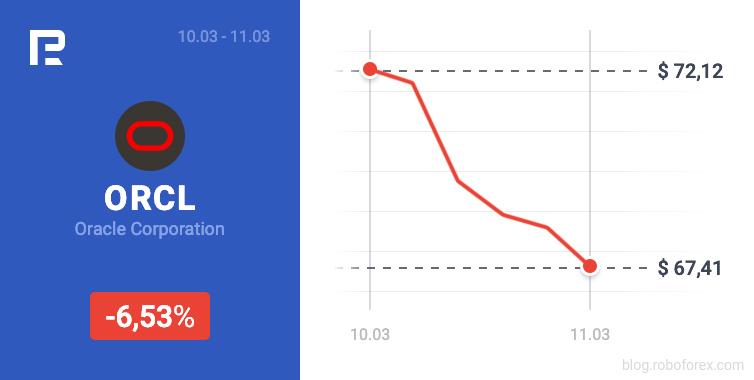

The day after the report appeared, they slumped by 6.53%, from 72.12 to 67.41 USD. Mind that earlier, the shares kept growing for three sessions in a row, reaching the high of 72.64 USD.

The gist of the report

The revenue in December-February amounted to 10.1 billion USD, which is 2.95% higher than a year ago and 0.15% higher than Wall-Street analysts had forecast.

Compared to Q3, 2020, the revised return on stock reached 20% or 1.16 USD. Meanwhile, experts had forecast no more than 1.11 USD. The net profit grew by 95% from 2.75 billion to 5.02 billion USD (compared to the statistics of last year).

How quarterly revenue is distributed between branches?

| Sector | Revenue | Share of the overall revenue | Difference with Q3, 2020 |

| Cloud services and license support | $7,25 billion | 72% | +5% |

| Cloud and local licenses | $1,28 billion | 13% | +4% |

| Hardware | $829 billion | 8% | −4% |

| Services | $737 billion | 7% | −5% |

What does Oracle forecast for the current quarter?

According to CNBC, the company’s CEO Safra Catz claimed that in Q4 of financial 2021 the revenue would grow by 5-7%.

As for the revised return on stock, it should be between 1.2 and 1.24 USD. Note that this forecast is below what analysts promise to Refinitiv – they forecast 1.28 per share.

Summing up

Oracle reported quite satisfactory results of Q3, 2021 (financial): the revenue rose by 2.95%, the income – by 95%. The statistics were beyond Wall-Street expectations, unlike the forecasts for the current quarter.

Weak expectations of the management for the upcoming 3 months made the shares drop: on March 11th, they fell by 6.53%. even the news about the increase in quarterly dividends by 33% to 0.32 USD per share, didn’t save the situation.