Pfizer Shares Reacted Feebly on Good Quarterly Report

3 minutes for reading

We haven’t talked about pharma companies producing vaccines against COVID-19 for quite a while. Seems we’ve been wrong because the companies are, indeed, flourishing. Pfizer’s financial report for Q1, 2021 is the best confirmation. Let’s get into the detail of the first three months of 2021.

Pfizer report for Q1, 2021

On May 4th, the American pharma company presented its quarterly report and boasted quite impressive results. The profit from selling the vaccine leaped up by 204%.

Note that the sales of almost all the products of the company grew. The revenue from selling drugs for the treatment of rare diseases, compared to the statistics of January-March 2020, grew by 29%; from selling anti-cancer drugs – by 18%, and immune diseases – by 9%.

Important report details:

- Revenue - $14.6 billion, +45% (forecast - $13.54 billion).

- Return on stock - $0.93, +47% (forecast - $0.76).

- Net profit - $4.9 billion, +45%.

- Revenue from the anti-coronavirus vaccine - $3.5 billion (forecast - $2.2 billion).

Pfizer forecasts for the year

In accordance with the newly emerging strong statistics, the pharma giant amended its forecasts for this year. They expect the revenue to reach $70.5-72.5 billion in 2021. Earlier the forecast was $59.4-61.4 billion. The return on stock has been improved from $3.1–3.2 to $3.55–3.65.

The yearly revenue from sales of the anti-COVID vaccine created together with the German BioNTech has also been revised: from $15 billion to $26 billion, which means growth by 73%. Note that in Q1 vaccine sales made 24% of the overall revenue. The company plans to deliver 1.6 billion doses this year.

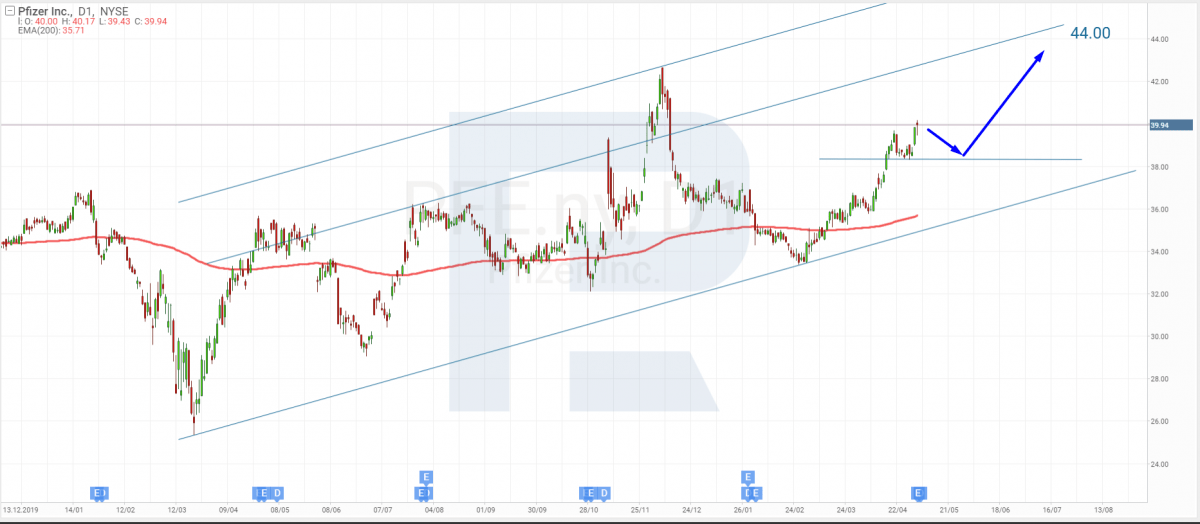

Tech analysis of Pfizer shares

On May 3rd, a day before the report was presented, the stock price of Pfizer (NYSE: PFE) grew by 3.05% to $39.83. After the publication, the quotations rose by just 0.3% to $39.95.

This is what my colleague, analyst Maksim Artyomov, says about the perspectives of Pfizer:

“After the revenue grew so, the quotations stopped correcting and started recuperating. On D1, after a test of the support level, the quotations bounced off and started growing inside the ascending channel.

The shares are still trading above the 200-days Moving Average, which means investors and speculators are interested in buys. Renewing the nearest high, the price will get an opportunity to go on developing the uptrend. The aim of further growth is the all-time high of $42.6. In case it is renewed, the quotations might head for $44”.

Summing up

Pfizer reported growth of its quarterly revenue and profit by 45%. Sales of the vaccine against COVID-19 yielded $3.5 billion, which was 59% than forecast.

Strong statistics from January-March 2021 allowed the management to revise the forecast. They expect the revenue to reach $70.5-72.5 billion, return on stock - $3.55–3.65, and the revenue from selling the vaccine - $26 billion.