Coronavirus COVID-19: 6 Companies Working on Vaccine

9 minutes for reading

COVID-19. Unofficially, we have a vaccine. Officially, we might have it in May.

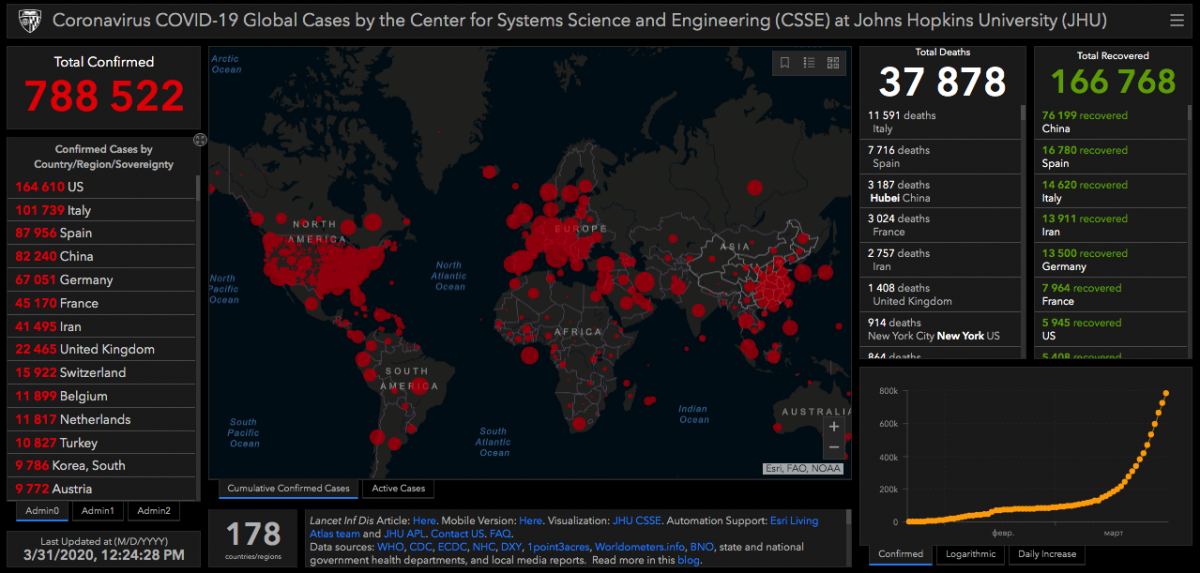

According to many experts in the healthcare sphere, the spreading of COVID-19 over the world has not reached its peak, and we do not have a vaccine against this disease yet. Currently, the first place in terms of the number of diseased among countries is taken by the USA. China, though it was the source of the infection, has managed to stop its spreading, so now it occupies the fourth place in terms of the number of the sick.

Note that stopping the spreading of the virus is not the same as learning to cure people of it. There is no vaccine yet, and now it is very important to mark time until we get the vaccine. Hence, quarantine is the only way of fighting the virus.

Pharmaceutical companies have long started inventing a vaccine against the enemy; however, before it gets to the market, it has to pass all the stages of trials. As long as the WHO has announced a pandemics, the number of stages is decreased.

For example, in normal conditions, pre-clinical testing (when the drug is tested on animals) takes 1 to 2 years, but in the present circumstances, this stage takes 1-2 months. The permission to sell the drug usually takes 4 years to receive, but this time the company may only need 4 months to get it.

In this article, we will discuss what companies are closer to the final stage of testing than others. The stocks of such companies will attract the most vivid attention of investors because the demand for the vaccine will exceed its production power, which means the company will make a maximum profit selling it.

Testing drugs

Before a drug comes into the market, it passes 5 stages of testing. I have already spoken about this in detail in the article "FDA: How to Find Stocks of Promising Healthcare Companies?"

In short, the stages are as follows:

- Stage 0: pre-clinical testing on animals

- Stage 1: clinical testing on healthy volunteers. The researchers select the doze and detect side effects.

- Stage 2: testing on the diseased. The researchers check the effect of the drug and its safety.

- Stage 3: the number of the testees is increased (to 400 people minimum), including by the diversification of their demographic backgrounds. We may call it the final stage of testing before the drug comes into the market.

- Stage 4: the vaccine goes on sale, long-term side effects are detected and tacked.

So, we can say that a drug passing the third stage is a candidate for the vaccine that will soon go on sale.

Now, many pharmaceutical companies are developing their medicines against coronavirus. Unfortunately, most of those drugs are at the stage of pre-clinical testing only, while many companies still cannot make up their minds about which drug to send to the trials.

Johnson & Johnson: no candidate for the vaccine

The world-known company Johnson & Johnson (NYSE: JNJ) is still defining its candidate for the vaccine. They are planning – together with Beth Israel – to present the drug for testing and start Stage 1 (upon passing Stage 0) at the end of 2020 only.

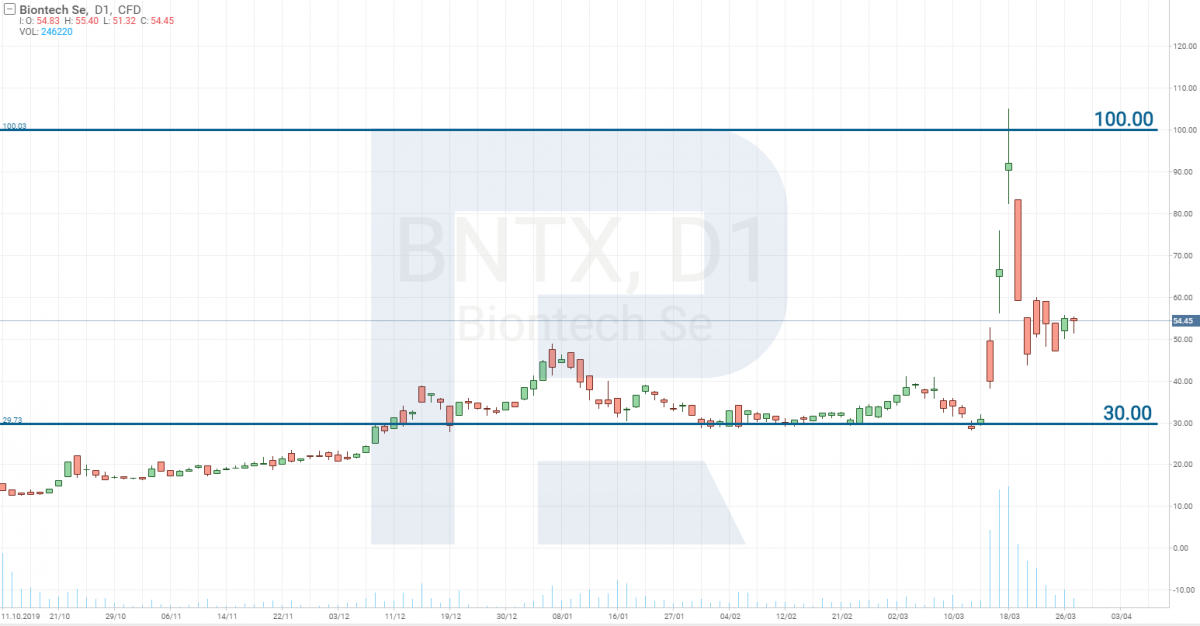

Pfizer and BioNTech SE – Stage 0

Pfizer (NYSE: PFE) has decided to unite with the German BioNTech SE (NASDAQ: BNTX) in developing the vaccine. This was the company to which Donald Trump offered a large sum of money for inventing the vaccine for the US citizens only (imagine how totally he is lacking humaneness). As a result, the stocks of BNTX grew from 30 to 100 USD in three days.

However, it will be fare to note that their medicine is yet on the pre-clinical stage of testing, i.e. too far away from going on sale. Thus, their stock price fell as quickly as it had grown.

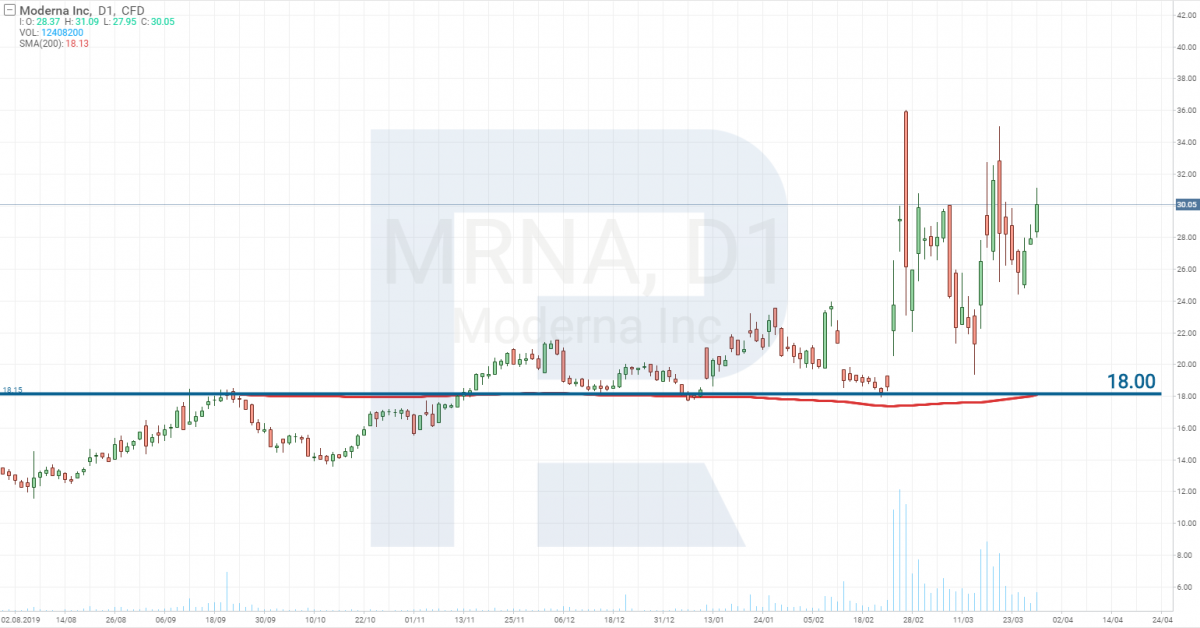

Moderna Inc – Stage 1

Smaller companies adapt better to the changing market conditions, hence the drugs of several of them are now passing Stage 1.

Moderna Inc (NASDAQ: MRNA) announced that on March 16th, the first patient on Stage 1 received their dose of the vaccine. 45 healthy volunteers aged 18 to 55 participate in the testing. Stage 1 is planned to be passed on June 1st, 2020.

There is increased volatility in the stocks of this company now.

Inovio Pharmaceuticals – Stage 1

Inovio Pharmaceuticals, Inc. (NASDAQ: INO) is also planning to start Stage 1 testing of the vaccine in April 2020. Earlier, the company was granted 9 million USD for the development of the drug, then it got 5 million more from the fund of Bill and Melinda Gates. And on March 23rd, it signed a military contract with the US Department of Defense, by which it will receive 11.9 million USD more.

At the moment, the stocks of this company have reached profitability of 470%. However, at present, Inovio Pharmaceuticals is facing an avalanche of class action suits for the compensation for damages from the falling of the stock prices that followed their growth.

In March, the director-general of the company Joseph Kim, after a meeting with Trump, announced that Inovio Pharmaceuticals had created a vaccine against the virus, thus confusing market participants who are now trying to restore justice.

Regeneron Pharmaceuticals and Sanofi – Stage 2

On Stage 2, there is now a drug called Kevzara, developed together by Regeneron Pharmaceuticals (NASDAQ: REGN) and Sanofi.

On March 16th, the companies announced that they have started tests on those suffering gravely from the coronavirus. Currently, testing is carried out in the USA. The goal is to find out whether the vaccine decreases the body temperature and the need for additional oxygen. Before, 21 volunteers participated in the testing, and the latter was carried out in China (because there were no diseased in the USA yet). The body temperature of the testees, indeed, fell, and in 7% of the cases, the need for additional oxygen also decreased.

The stocks of this company cost over 400 USD, and, as you may see, there has not been such a steep decline there as in the SP&P 500 index. From the point of tech analysis, this stock is considered strong and recommended for buying.

Gilead Sciences Inc – Stage 3. The vaccine is on sale

The company that is closer to the development of the vaccine than any other one is Gilead Sciences Inc. (NASDAQ: GILD).

Their medicine is already on Stage 3. This means the vaccine is ready. It only needs testing on a large number of patients.

Gilead Sciences Inc. is a biopharmaceutical company creating and selling medicines all over the world. It was founded in 1987, and one of the drugs it has developed is Truvada meant for adults with HIV. Also, Gilead Sciences Inc. was the first company to create a medicine against hepatitis C.

On March 3rd, the company started testing a drug called Remdesivir; testing takes place in Hong Kong, Singapore, South Korea, and the USA. 600 patients with a moderate form of COVID-19 and 400 patients with a severe form participate in the testing.

The results of Stage 3 will be ready in May 2020. However, there are people cured by the drug. One of them is a US citizen who went to the doctor after 4 days of dry cough. The test for the coronavirus was positive, and the next day the saturation of his blood with oxygen started decreasing. After taking Remdesivir, the patient’s state changed from very severe to simple cough, the intensity of which was also decreasing.

Currently, the WHO is waiting for the results of the testing to officially announce the creation of the vaccine against COVID-19.

Thus, potentially, we may get an approved vaccine against the coronavirus in May 2020, which is much quicker than I speculated at the beginning of the article. The reason is that, instead of creating a drug from scratch, Gilead Sciences Inc. suggested using the medicine that had been used against Ebola and is widely sold at pharmacies.

Americans have started buying up Remdesivir, and the company hardly manages the increased demand. Their production facilities are working at their maximum but this is not enough to satisfy the demand for the drug.

Factually, we can cure COVID-19 by Remdesivir, but officially, this has not been confirmed yet.

Closing thoughts

The development of a vaccine from scratch is a costly and lengthy process, that is why large pharmaceutical companies, such as Pfizer and Johnson & Johnson, unite with the companies that have something to be tested.

Other companies search for the vaccine among the existing drugs that might require some improvements.

However, we are interested in making a profit on the growth of the stock price, and each of the companies presented above has a chance to bring the vaccine against the coronavirus to the world. Therapy may include other medicines, and some people may be allergic to Remdesivir.

The stocks of the cheapest issuers may yield higher profitability than those costing over 100 USD per stock.

Moreover, one drug may increase the income of a small company significantly, while in the case of Pfizer, for example, a profit of 1 billion USD from selling such a drug will make only 0.5% of its overall income.

The news about the vaccine created will explode like a bomb. The stocks of such a company may sky-rocket at the moment, but after agitated growth, a decrease always follows. Hence, if this happens to a company named above, use it for speculative trades that will let you make a quick profit and pay special attention to the stocks of Gilead Sciences Inc. (NASDAQ: GILD)

In the long run, everything is very complicated. As long as COVID-19 was named pandemics, other companies may be licensed for producing the vaccine. This may be done to satisfy demand all over the world as soon as possible. And if the vaccine will be a drug already present on the market, its patent may become invalid.

Be extremely careful about the stock market and make well-weighted decisions only.