News about Restructuring Made Dell Shares Go Up by 8%

4 minutes for reading

The world of tech giants gave us more interesting news. This time I’m talking about the American Dell Technologies corporation specializing in computer technology, cloud data storage, and software creating and selling.

Dell Technologies keeps restructuring

On April 14th, Bloomberg let us know that Dell considered selling Boomi – a department working on cloud data storage. Analysts say it could be sold for $3 billion.

This isn’t yet the whole plan of restructuring the company. The Wall Street Journal says that the corp is looking for ways to make VMware an independent company.

Why is separating VMware good for the corp?

As you remember, VMware is a company specializing in cloud calculations and visualization technologies; Dell holds 81% of its shares. As early as July last year, there were rumors that the company was planning to sell its share for $50 billion.

Now they’re talking over the separation of the company that will bring its shareholders impressive dividends. According to the WSJ, the total sum is somewhere between $11.5 and $12.5 billion. Dell will get $9.3-$9.7 billion out of it to decrease its debts.

Mind that after the restructuring, VMware will still have to agree with Dell management on creating and selling new products.

Dell Technologies Shares Grew

As soon as the media spoke about selling Boomi and separating VMware, the shares of the tech conglomerate started growing.

On April 15th, the stock price of Dell Technologies (NYSE: DELL) grew by 6.71% to $98.92 per share. In April totally, the quotations grew by 12.22%, while in 2021 – by 34.97%.

This is what Maksim Artyomov, analyst, says about the perspectives of Dell:

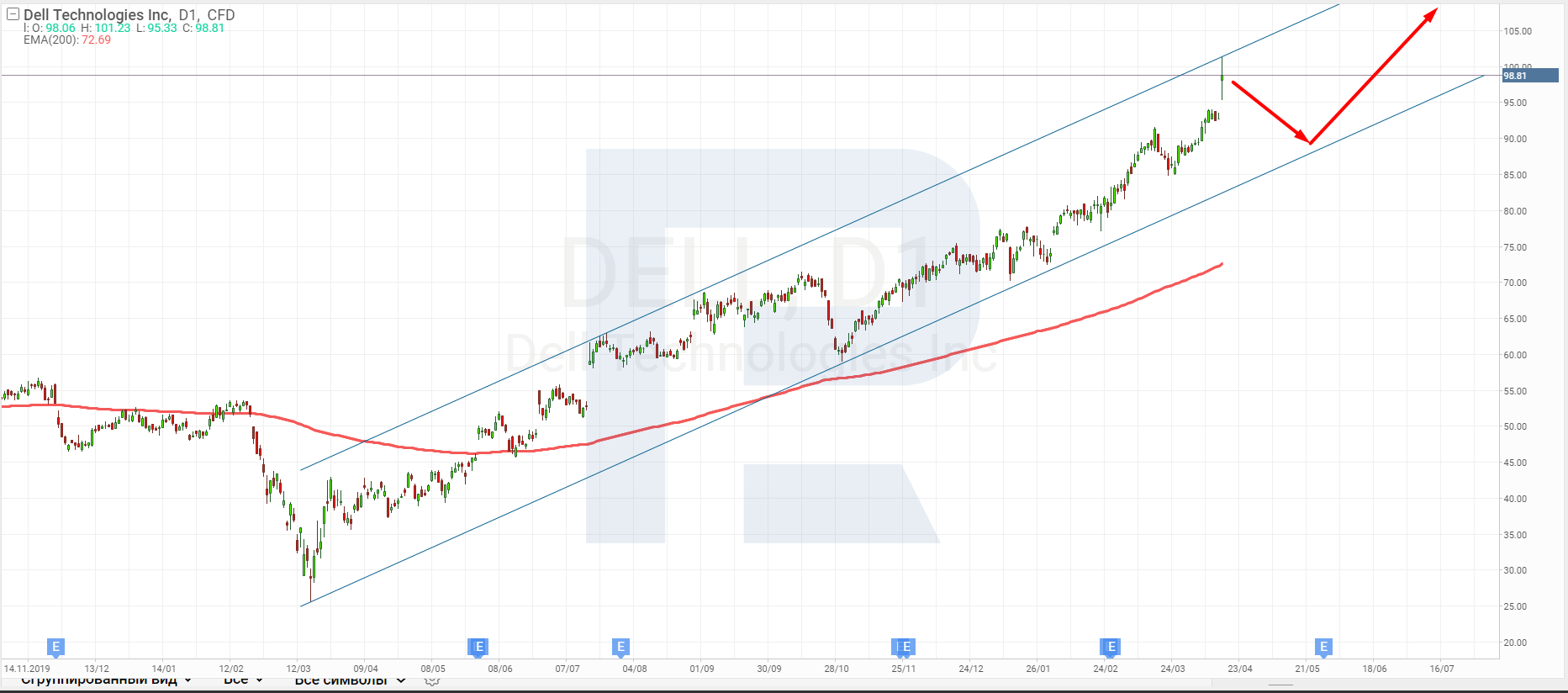

“DELL keeps restructuring, and such news pushes its quotations up to new highs. On the chart, there has been a clear uptrend since this March. Of course, there are pullbacks, but this is a natural thing to happen.

Currently, the quotations are still trading above the 200-days Moving Average, which means buyers are strong. In the previous trading session, the price reached the upper border of the channel and pulled back slightly. The preceding trading session opened with a gap, and now we may hope that it will get partially covered.

In the nearest future, we might witness the previous scenario repeat itself: pulling back, the price will reach the lower border of the channel, bounce off it, and keep growing. As long as DELL quotations have renewed their highs and have set a new one, I suppose the price will not stop there.

After another test of $100.00, the price has all the chances to keep growing to $125.00. In the nearest future, DELL is planning to pay its shareholders substantial dividends, which, in turn, increases the chances for further growth of the price and securing of the company’s positions”.

What changes happened to Dell earlier?

The IT conglomerate has been trying to alter its structure for the last couple of years to optimize and balance it. On February 18th last year, Bloomberg announced that Dell Technologies had sold its cyber-safety department RSA for $2.08 billion.

That time the quotations hardly reacted to the news: they grew by just 1.08%, reaching $53.34 per share. According to the last quarterly report, in November-January, the company’s profit reached $26.11 billion; its net profit was $1.23 billion, and its net return on stock - $1.58.

Summing up

Dell didn’t stop on selling RSA and keeps restructuring. Now the IT giant plans to get rid of Bloomi and single out VMware in a separate structure. The first operation can bring $3 billion and the second one - $9.3-$9.7 billion.

With these rumors spreading, the stock price of the company increased – by 6.71% to $98.92. As for the whole of 2021, the stock price has grown by almost 35%.