Knowbe4, Inc. IPO: Cybercrime Protection

6 minutes for reading

From time to time, there are headlines in the media mentioning another cyberattack on global corporations and individuals all over the world. Any cyberattack starts with a violation of fundamental security rules by employees: when they click doubtful links or open suspicious emails. Having a basic knowledge of cybersecurity is now as important for employees as knowing fire safety rules.

KnowBe4 is one а the leading providers of SaaS platforms for teaching employees how to securely work online and avoid phishing (attempt to acquire sensitive data). KnowBe4 filed an S-1 IPO form at the NASDAQ to the SEC. The company got the “KNBE” ticker. The IPO is scheduled for April 22nd and the company’s shares will start to be traded the next day.

KnowBe4 business

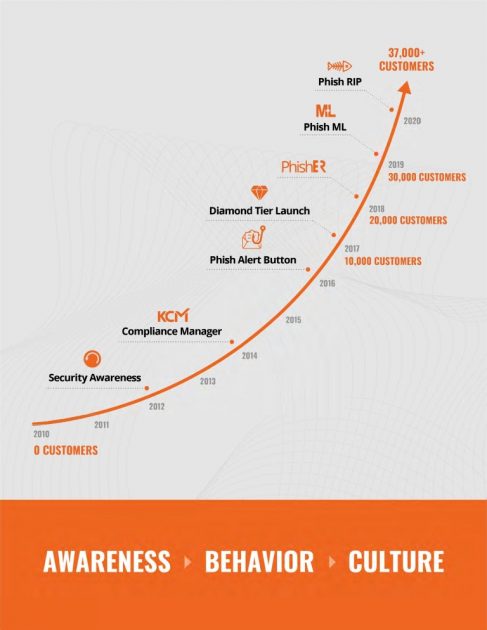

KnowBe4 was founded in 2010 by Stu Sjouwerman, a famous cybersecurity professional and the company CEO. Along with his CEO duties, Stu is currently Editor-in-Chief of Cyberheist News, an e-magazine tailored to deliver IT security news. The company’s platform allows organizations to minimize the human factor influence during cyberattacks by teaching their employees and constantly providing them with the latest news on types and natures of fraudulent schemes.

When creating the platform, KnowBe4 employed an integrated approach that combined employee awareness, cloud software, artificial intelligence, machine learning, and data analysis. The company believes that people are both the key asset and the major security threat. In its platform, KnowBe4 applies social engineering, which helps to customize employee training programs with consideration to possible schemes of manipulating human psychology, because sometimes people don’t even realize that somebody is trying to steal some secret information from them.

The company offers the following services:

- Security awareness training.

- E2E cybersecurity management.

- Risk analysis and compliance.

KnowBe4 effects sales both directly to new clients and through its business partners, with the latter making over 37% of the company’s revenue. More than 37,000 organizations have become clients of KnowBe4. The share of international sales in the company’s revenue has doubled over the last couple of years, from с 6.0% to 11.9%. The coronavirus pandemic had a positive influence on the company’s business development rate because a lot of employees all over the world switched to the home office. Now let’s talk about the company’s target market.

The market and competitors of KnowBe4

With every passing year, international companies invest more and more money in cybersecurity and employee training. According to IndustryARC, the global IT security and anti-phishing market in 2019 was $922 million and may reach $1.94 billion by 2025 with an average annual growth rate of 11.3%.

As estimated by Kevin Mitnick, an American computer security consultant and also a KnowBe4’s Chief Hacking Officer, the company’s target market in 2020 was $15 billion with North America accounting for more than 30% of this sum. In case this growth rate remains the same (from 10 to 15%), by 2025 the market may reach $25 billion.

The company’s major competitors are:

As we can see, the list includes transnational corporations. However, IT security is not their primary sector, that’s why KnowBe4 may become the leader in this industry given the current growth rate described above.

Financial performance

Just like many other companies in the technology sector, KnowBe4 doesn’t generate the net profit, that’s why let’s analyze its revenue dynamics, which rose pretty much from 2018 to 2020. The company’s sales were $174.89 million in the last year alone, which is a 45.04% increase if compared with 2019.

Relative revenue growth in 2019 was 69.13% in comparison to 2018, while an average growth rate was 57.08%. As a result, this year’s revenue may reach $275 million. One should also note the increase in KnowBe4’s gross profit, which was $148.16 million, a 48.16% increase relative to 2019. The year before, this value was 68.82%.

The company’s net loss is reducing quite fast. KnowBe4 may reach a breakeven point as early as this year.

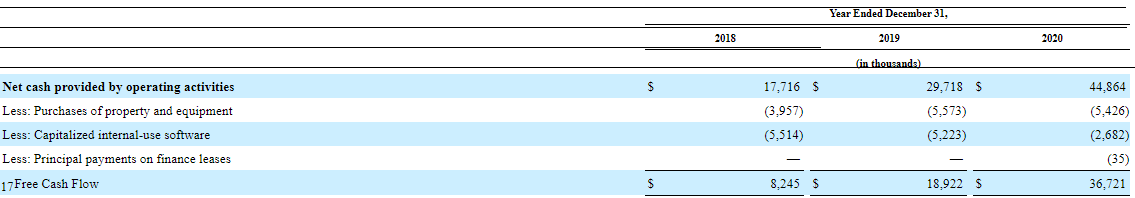

At year-end 2020, the company’s free cash flow was $36.72 million, which is a 94.08% increase if compared with 2019. Cash and cash equivalents on KnoeBe4’s balance sheet are $86 million, while the total liabilities are equal to $221 million.

The efficiency ratio of the company’s marketing costs is 0.7, which means that each $1 of marketing costs makes $0.7 revenue. This indicator is the company’s growth area. I would like to draw attention to a high revenue growth rate and positive dynamics in cost reduction.

Strong and weak sides of KnowBe4

After studying the company’s business model, we can identify its advantages and weak sides of KnowBe4. I guess its advantages are:

- The company’s revenue growth rate is over 40%.

- The address market is estimated at $15 billion.

- The gross profit growth rate exceeds 30%, which may help the company reach a breakeven point as early as this year.

- KnowBe4’s platform meets all requirements of prospective clients.

- Unlike its competitors, KnowBe4 implements social engineering methods in its platform.

Risk factors of investing in these shares are the following:

- The company is still loss-making and is not going to pay dividends. The net loss decrease is not stable.

- The revenue growth rate will go down.

- KnowBe4 is competing with large transnational corporations, which have great financial and intellectual resources.

IPO details and estimation of KnowBe4 capitalization

The IPO is scheduled for April 22nd. KnowBe4 is planning to sell 11.8 million common shares at the price of $16-18 per share. The raised volume is expected to be up to $212.4 million. During the previous rounds of financing, KnowBe4 attracted $158 million.

The underwriters of the IPO are such investment banks as Piper Sandler & Co., Needham & Company LLC, Cowen and Company LLC, Canaccord Genuity LLC, Truist Securities, Inc., Morgan Stanley & Co. LLC, Goldman Sachs & Co. LLC, KKR Capital Markets LLC, Citigroup Global Markets Inc., UBS Securities LLC, Robert W. Baird & Co. Incorporated, and BofA Securities, Inc.

After the IPO, the company’s capitalization may be up to $2.84 billion. To assess the company’s shares growth potential during the lock-up period we use the Price-to-Sales ratio (P/S Ratio). At the IPO, KnowBe4’s ratio may reach 16.24 (2.84/0.17488). For technological companies, an average P/S ratio is 25. As a result, the upside of the company’s shares is 54.03%, that’s why I would recommend to add KnowBe4 to both mid- and long-term investments.