Privia Health Group, Inc. IPO: Effective Medical Assistance

6 minutes for reading

A lot of countries implement reforms in their healthcare systems and many acknowledged that the most effective was insurance medicine, which implies certain decentralization in the healthcare delivery structure. Family therapists, who need to maintain management records at the level of a small clinic, are stepping forward. The acquired data is used for evaluating the quality of provided services and searching for the most problematic areas.

This Thursday, there will be an IPO of Privia Health Group, Inc., which created an online platform for doctors. The platform helps them to optimize the healthcare delivery process and improve patient care quality. The company’s shares will start trading at the NASDAQ this Friday, the “PRVA” ticker. Let’s find out why the company is so popular with US doctors.

Privia Health business

Privia Health was founded in 2007 and is currently headquartered in Virginia. To build an effective business model, any company should decide on the particular issue of its target audience it wants to solve. American doctors often face different difficulties in servicing their clients and getting feedback on the provided services. An online platform from Privia helps to solve three major issues doctors face in the USA:

- Adaptation to expenses compensation model based on value ("VBC").

- Administration of medical practices in accordance with the US Healthcare Department of Health and Human Services requirements.

- Involvement of patients in assessing the quality of the provided medical services and encouragement of doctors for the quality patient care.

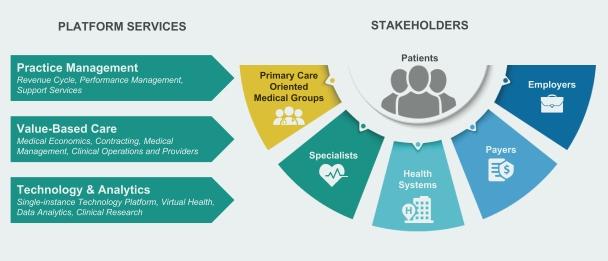

Above you can find the Privia platform model, which includes:

- Practice management.

- Value-based care.

- Technology and analysis.

Privia’s key advantage is that its technological solution significantly cuts expenses spent on getting insurance compensations. The platform offers Patient and Physician portals, which allow a combination of 48 medical specialties. Also, there is an opportunity to consult medical experts, thus decreasing the cost of these services.

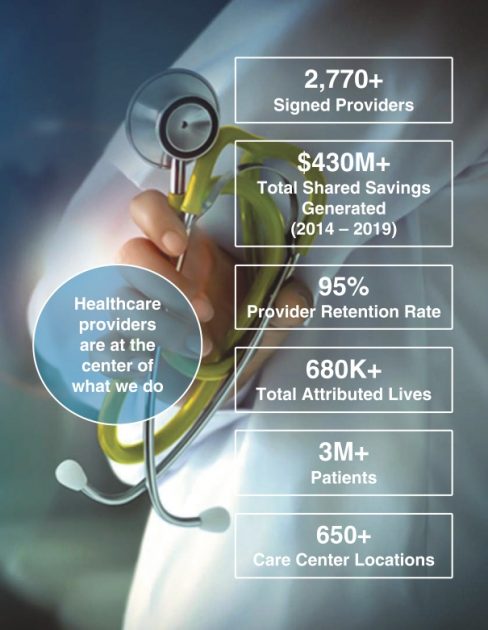

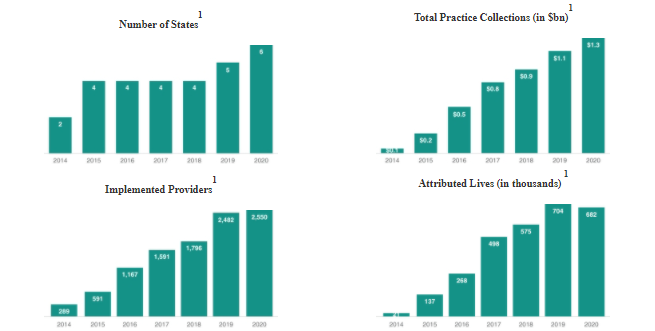

The company is operating in six states and the district of Columbia, covering the 20 largest areas according to the MPSA classification. The platform hosts over 3 million patients, 2,700 providers of healthcare services, and 650 practice locations. Taking into account the company’s development dynamics, one of its management’s key tasks is expanding to other state markets.

The market and competitors of Privia Health

According to the research carried out by Grand View Research, the healthcare management market in 2020 was $13.9 billion and may reach $62 billion by 2027. An average annual growth rate is expected at 20.5 %.

Probably, demand from doctors will nothing but increase out of necessity to reduce medical expenses – the healthcare system is one of the most expensive areas in the USA. With each passing day, digitalization covers more and more spheres of our lives, that’s why the average annual growth rate of this market may be higher than forecasted.

Privia Health’s major competitors are:

- VillageMD

- Oak Street Health

- One Medical

- Agilon health

- Aledade

Financial performance

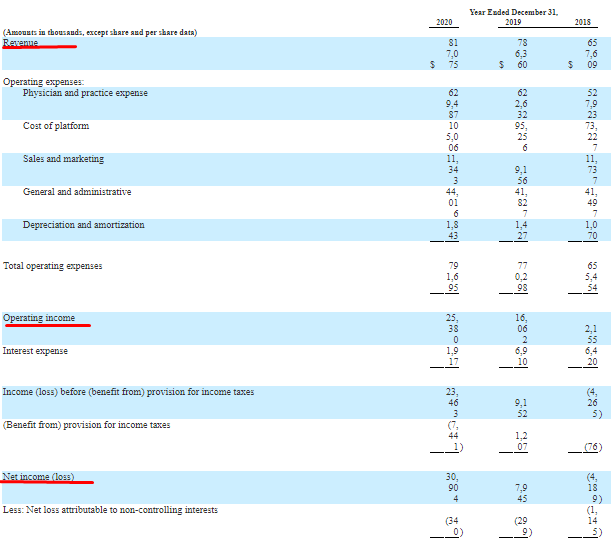

Unlike many other technology companies, Privia Health is filing for an IPO being profitable and that’s quite rare these days. So, let’s run a comprehensive analysis of the company’s financial performance.

The company’s net profit in 2020 was $30.9 million with a 388% relative growth over 2019. In 2018, the company recorded a loss. As we can see, business performance is rising, while the rate of return on investments is decreasing.

At the same time, the company’s operating income is also improving: in 2020, it was $25.38 million, which is a 58.03% increase if compared with 2019. Still, the revenue isn’t rising at the same pace. In 2020, it was $817.08 million and that’s a 3.92% increase over 2019. If we compare 2019 and 2018, this number was 19.58%. It’s quite clear that the company will have to expand to other states to avoid serious declines in revenue growth.

An important indicator for assessing financial performance is EBITDA (Earnings before Interest, Taxation, Depreciation & Amortization), which describes the company’s ore activity effectiveness. In 2020, EBITDA was $29.37 million, a 62% increase over 2019.

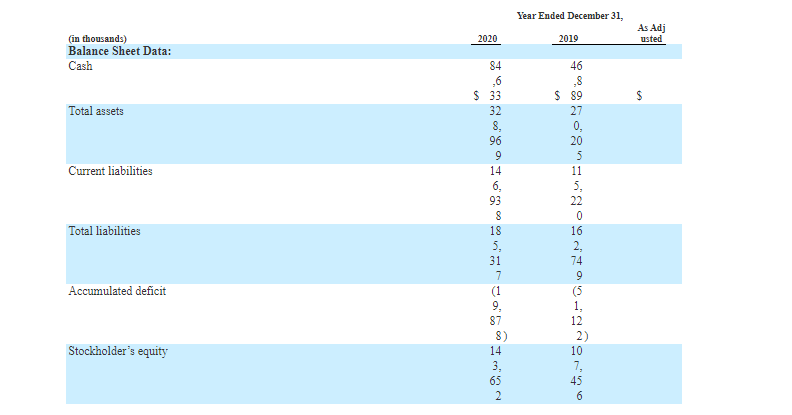

Cash and cash equivalents on Privia’s balance sheet are $84.63 million, while the total liabilities are equal to $185.32 million. At year-end 2020, the company’s free cash flow was $38.5 million. Overall, the company is financially stable with the decline in the revenue growth rate being its key disadvantage.

Strong and weak sides of Privia Health

Considering all the information above, let’s identify the company’s strong and weak sides. Advantages of investing in Privia Health shares are:

- The company generates the net profit.

- The target market may reach $62 billion by 2027.

- Privia has a high potential for development both in the USA and outside it.

- The company’s technological product offers its target audience a comprehensive solution.

- Solid management.

Risk factors of investing in these shares are the following:

- The revenue growth rate has been falling since 2019.

- The company’s operating activities are so far limited by the US area.

- The net profit is not stable; Privia’s is not planning to pay dividends.

IPO details and estimation of Privia Health capitalization

During several preliminary rounds of financing, the company raised $165 million. The underwriters of the IPO are R. Seelaus & Co., LLC, Truist Securities, Inc., Canaccord Genuity LLC, William Blair & Company, L.L.C., Siebert Williams Shank & Co., LLC, Goldman Sachs & Co. LLC, Credit Suisse Securities (USA) LLC, and J.P. Morgan Securities LLC. During the IPO, Privia Health is planning to raise $351 million by selling 19.5 million common shares at the price of $17-19 per share.

At the time of the IPO, the company’s capitalization will be $2.19 billion. To assess the company, we use two multipliers, the Price-to-Sales (P/S Ratio) and the Price-to-Earnings (P/E Ratio). After the IPO, P/E will be 70.1, which means that investments in the company will return in more than 70 years given the current financial performance remains the same. For young technological companies, this number is rather valid. This ratio implies no upside.

After the IPO, P/S will be 2.68. an average value of this ratio in the healthcare sector is 5. If the company’s revenue resumes growing with its previous pace, the upside for Privia shares may be 86.56%.

I would recommend to shares of this company as a high-risk investment with increased profit potential. It would be wise to enter this position in small “batches”.