Gates Foundation Got Rid of Apple, Amazon, and Twitter Shares

3 minutes for reading

Let’s talk about Melinda and Bill Gates. No, not about their divorce – there are much more interesting things going on. Namely, they are rebalancing the portfolio of their charitable foundation. Mister and misses Gates started a full-scale sale, getting rid of a whole range of shares of authoritative companies, including Apple, Amazon, Twitter, Walmart, FedEx Corporation, United Parcel Service, and Canadian National Railway.

Which shares did Bill & Melinda Gates Foundation sell?

We got to know about the sale that happened in Q1 this year from the papers sent to the US SEC.

The rebalancing touched upon several corporations. For your convenience, I’m giving you not only the names of the companies and the volume of sold shares but also their price dynamics at the closing of the trading session on May 18th.

- Walmart (NYSE:WMT) — 4 million shares, +2.17%, $141.91.

- Canadian National Railway (NYSE:CNI) — 3 million shares, −0.06%, $108.44.

- United Parcel Service (NYSE:UPS) — 1.7 million shares, −1.06%, $213.99.

- FedEx Corporation (NYSE:FDX) — 1.5 million shares, −1.04%, до $306.05.

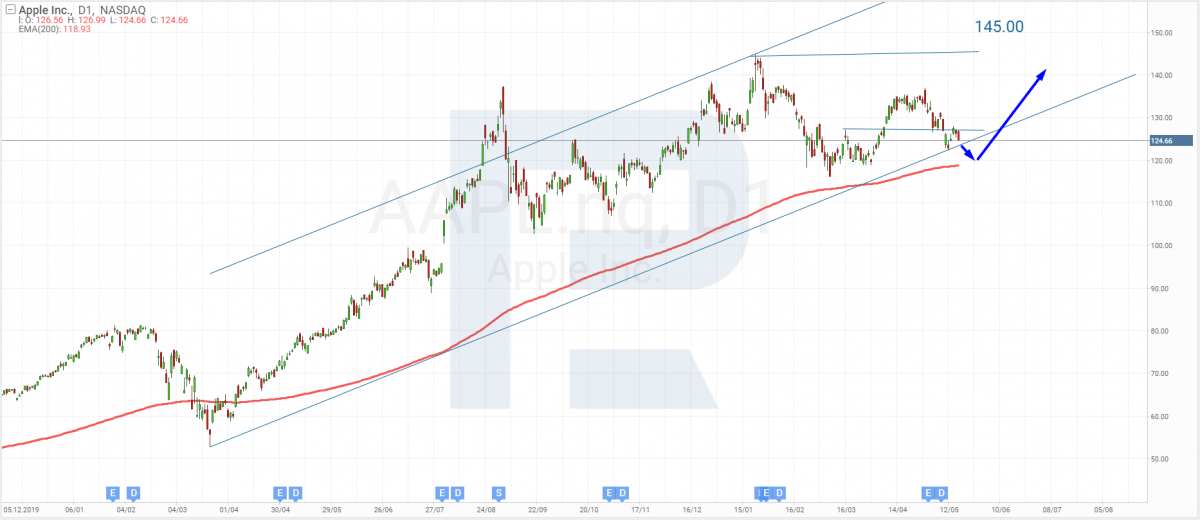

- Apple (NASDAQ:AAPL) — 1 million shares, −1.12%, $124.85.

- Liberty Latin America (NASDAQ:LILAK) — 677 thousand, −1.91%, $13.9.

- Liberty Latin America (NASDAQ:LILA) — 276.4 thousand, −2.56%, $13.74.

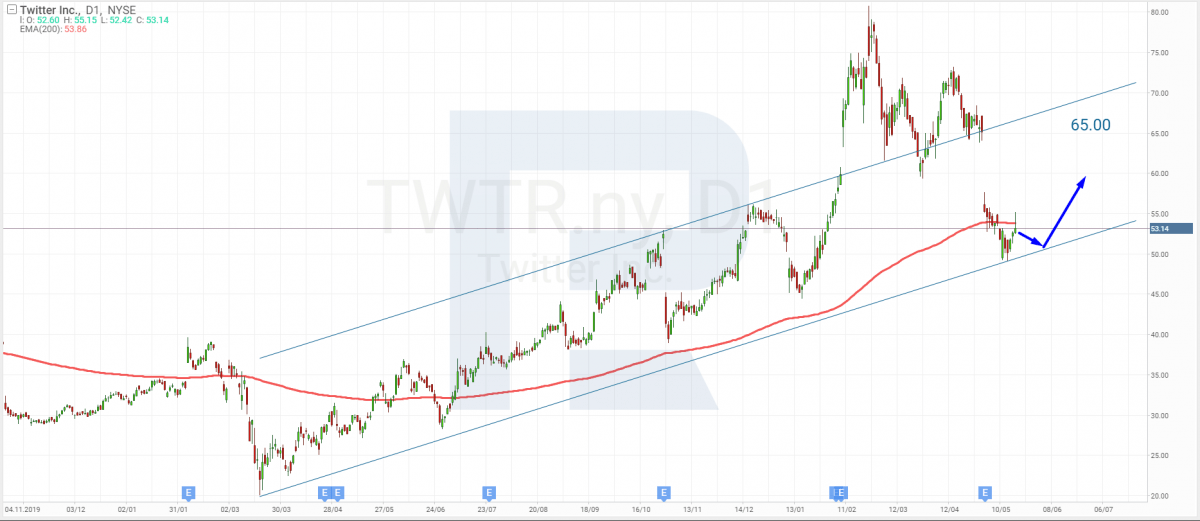

- Twitter (NYSE:TWTR) — 272.4 thousand, +1.12%, $53.19.

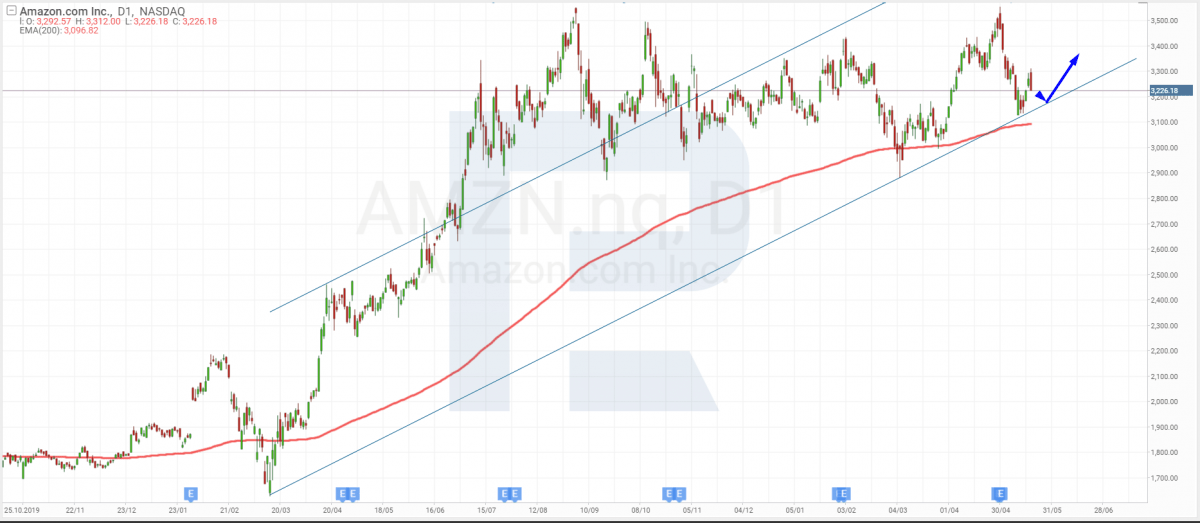

- Amazon (NASDAQ:AMZN) — 30.2 thousand, −1.17%, $3232.28.

Which shares did the Foundation buy?

For the first time Bill & Melinda Gates Foundation supplemented their portfolio with the shares of the “South-Korean Amazon” – Coupang. As you remember, Coupang carried out an IPO in March this year. The trading platform entered the NYSE and managed to raise $4.6 billion. The Gates Foundation bought over 5.7 billion of these shares.

Moreover, the charitable foundation bought over 81.86 million of the Mexican Coca-Cola FEMSA. Note that the Foundation had already had about 6.2 million shares of the world’s largest Coca-Cola manufacturer in terms of bottles produced. Thus, this asset grew by 1,317%.

What happened to Twitter, Amazon, and Apple shares?

My colleague Maksim Artyomov provides more details about the quotations of the IT giants:

“Breaking through the 200-days Moving Average, Apple quotations go on declining. The catalyst of further falling might be the sale of the part o their portfolio by Bill & Melinda Gates Foundation. The entity sold about a million stocks. The aim in this case is the lower border of the channel. Next, the price might bounce and continue the uptrend. The aim of the growth will remain $145”.

“On the previous trading session, regardless of the sale, Twitter quotations didn’t drop much. Currently, they remain under the 200-days MA, heading for the lower border of the channel. Later, the price might bounce and continue the uptrend, aiming at $65 after the correction”.

“As for Amazon shares, the sale by the Foundation led to a significant decline during the previous trading session. The price keeps declining towards the lower border of the ascending channel. We should expect a test of the support level and, perhaps, a bounce off it. The pullback might head for $3,100”.

Summing up

We got to know that Bill & Melinda Foundation carried out a rebalancing of its portfolio. The sale touched upon the shares of Apple, Amazon, Twitter, Walmart, FedEx Corporation, United Parcel Service, and Canadian National Railway.

Due to this, at the closing of the trading session on May 18th, the quotations of six out of eight companies dropped. Only Walmart and Twitter shares grew.