Which Stocks to Buy When Inflation Is High?

10 minutes for reading

The USA has issued consumer inflation data; it reached 4.2% against 2.6% previously. These digits shocked market players, and stock indices headed down immediately. The S&P 500 lost 4.4% after 3 days, NASDAQ 100 dropped by 5.7%, while the VIX Fear Index grew by over 30%. Investors are slumping into a panic.

Indeed, the situation disturbs the stock market; it is especially threatening for companies with large debts. However, there are always such companies who make good money even with high inflation. Let us check the list of such companies today.

It is no use speculating on the reasons for such inflation — I gave them in the previous article:

Now we need to figure out who will profit from these circumstances. They might not last long, but the results of Q2 that ends in July will be disappointing for some companies. To find beneficiaries of the inflation growth, try putting on the shoes of a person that has money in their pockets but expects it to devaluate.

Quite logically, this person (if they do not invest in stocks) will start thinking about how to spend their money. And if earlier they used to postpone buying expensive goods, now when consumer prices are growing, and the purchasing power of money is shrinking every day, time for shopping comes. As a result, the buyer goes to the shop. This is what Americans are doing now.

Buffett notes high demand for goods

At the annual shareholders' meeting of Berkshire Hathaway Inc. (NYSE: BRK.A), Warren Buffett was asked a question about inflation. He replied that the companies and retail sales chains under his management face a shortage of goods. However, customers come to them, make a prepayment, and are ready to wait for even three months just to get rid of their money.

Retailers raise prices but customers are not scared off. They get warned about possible violations of delivery time – but this neither stops them. Buffett thought this insanity would stop when the government stopped giving out lump sums; however, demand remains high.

Wages in the USA grow

The thing is, when revenues started growing, companies began raising wages. For example, in McDonald’s (NYSE: MCD), employees are now earning 10% more.

Amazon.com (NASDAQ: AMZN) is hiring 75,000 employees extra and pay up to 1,000 USD bonuses to newcomers. This is why the amount of money in people’s hands does not decrease.

Lockdown in the USA gets softer

Of course, the service industry suffered the most from the pandemic; however, last week, the head of the US Centers for Disease Control and Prevention Rochelle Walensky announced that those who had been fully vaccinated could stop wearing masks and keeping social distance.

This means that business activity in services will soon recover; this branch will generate income, help decrease unemployment, and make the solvent population grow.

What goods and services will Americans spend money for?

Now we can only guess.

The travel industry might enjoy increased demand because people are craving for going to the sea; however, things are unpredictable here. The coronavirus situation in India looks threatening; things are neither stable at other tourist destinations; no one knows whether borders will open for travelers at all.

In the end, the travel industry is quite a risky investment, but in case all the bans are lifted, it can show impressive profitability. Among the companies of the sphere, I would single out:

- Carnival Corporation & plc

- Royal Caribbean Group.

Carnival Corporation & plc

The Carnival Corporation & plc (NYSE: CCL) is the world’s largest transnational cruise company owning a fleet of over 100 vessels. It manages 20 subsidiaries working in North America, South Europe, and Australia. Due to the pandemic, Carnival had to sell 18 liners. The company became losing, and its debts increased from 9 to 25 billion USD.

Carnival’s revenue shrank from 4.8 billion to 26 million USD. The company is starting to work practically from zero. Its advantage is its fleet ready to take tourists to cruises as soon as the horizon clears up. However, with such debts, investments in this company remain risky.

Its shares are trading much lower than the pre-crisis level, which is quite fair, with the current revenue. On the chart, there is a support level of 24.50 USD. This is the price that investors are ready to buy Carnival’s shares at – the quotations have bounced off this level several times. The nearest resistance is now 30 USD.

Royal Caribbean Group

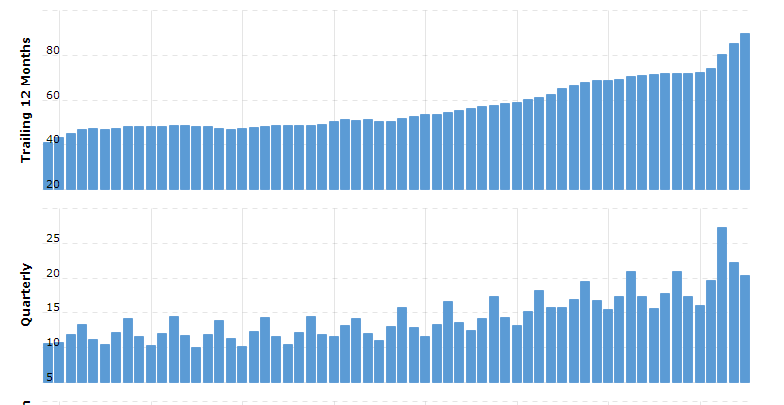

The second -argest cruise company is the Royal Caribbean Group (NYSE: RCL). It owns 36 vessels and takes up to 23.6% of the market of cruises.

Royal Caribbean revenue also suffered from the pandemic, falling from 3 billion to 42 million USD. Its debts rose 2.5 times reaching 20 billion USD. The management gives no forecasts for the growth of the income yet due to actual COVID-19 restrictions. Its base is also low, but as long as its fleet is smaller than that of Carnival, it will be easier for the company to fill them with tourists and reach its pre-crisis levels.

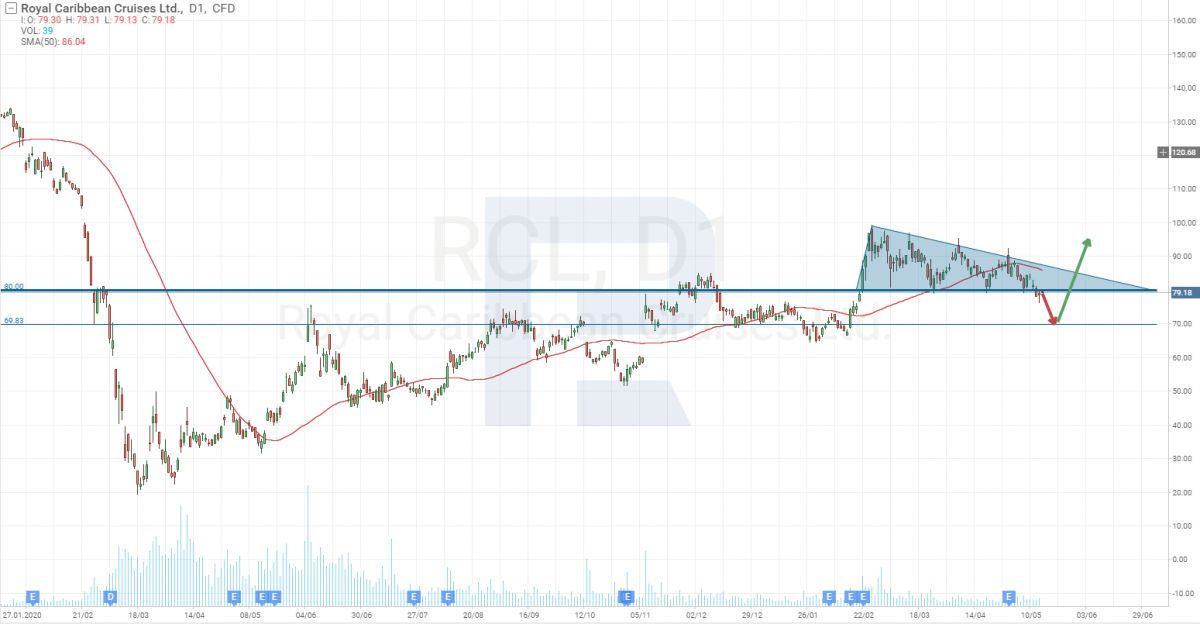

Royal Caribbean shares are trading at the support level of 80 USD, but there is a Triangle on the chart, promising a temporary decrease to 70 USD.

Booking Holdings Inc.

The services of a company that helps with accommodation will also enjoy demand. Here, the capitalization leader is Booking Holdings Inc (NASDAQ: BKNG).

Booking Holdings is an American tech company that provides tourist accommodation, car rental, and air ticket booking services. The company works via websites supporting 42 languages and valid for 227 countries. The company’s database holds about 2 million accommodation facilities.

Naturally, during the pandemic, the revenue of the company dropped but not as dramatically as at cruise companies. The decrease was under 50%, and now the revenue is gradually recovering. In Q2, 2021, the income of the company is forecast to reach 2 billion USD. This is 300% more than in the same period last year.

Booking shares have just been trading at their all-time highs and have overcome pre-crisis levels as early as November 2020. Now the shares are trading at the support of 2,170 USD, and investors are interested – the price has bounced off it several times.

Which company to choose for investments?

Investments in the tourist industry remain risky. Things depend on restrictions here. Choosing among the above-mentioned issuers, you might think that cruise companies have a higher potential for growth. On the other hand, will people be happy at a liner with a lot of other people – or will they opt for a hotel room or a small house at the shore, which implies minimal contact with others?

This comparison makes investments in Booking Holdings more logical. The only scary thing is the stock price that is already above the pre-crisis level.

Construction and repair

While traveling perspectives remain vague due to the coronavirus situation, spending on construction and repair is a worthy and stable expense item in times when inflation grows. The main goal is to pay for a good, no matter if it is delivered a couple of months later. The most important here is that the money is spent, and inflation will not affect it anymore. It is only vital to contract with the seller that they will not increase the price until the good is delivered.

In this case, you can pay attention to retail sales. Their expenses consist of the maintenance of a real estate object and wages of the employees.

The expenses of manufacturers grow with the growth of the price for the raw material; to increase its real revenue, the company needs to increase production.

As for a shop, it only needs to find one more manufacturer that will let it expand the product range and thus increase revenue. Here, check the Home Depot and Lowe’s Companies, Inc.

The Home Depot

Home Depot, Inc. (NYSE: HD) is the largest retailer of building materials and repair tools. It has 2,144 shops in the USA, Canada, Mexico, and China.

Even in the pandemic, the income of the company showed no negative dynamics. Its revenue hit records and in Q1, 2021 its reached 32.2 billion USD. The profit from selling goods and services is also at all-time highs. For the last 20 years, the company has been paying dividends every quarter, which are now 1.87% annually.

To speed up the delivery of goods to clients, The Home Depot opened three new sorting centers in Florida. The company makes a profit, its revenue is growing, hence, its shares are popular among investors. The quotations are nearing their all-time highs. At quarterly reports, the shares might renew the highs at 345 USD per share.

Lowe’s Companies. Inc.

Lowe’s Companies, Inc. (NYSE: LOW) is another large American retailer, owning 2,197 shops in the USA and Canada. It specializes in household goods and appliances. The pandemic did not influence it much, and positive dynamics in its revenue were preserved.

As well as the Home Depot, the company pays dividends stably and sometimes carries out Buybacks. In 2019, it announced a Buyback of 10 billion USD. Such events influence the stock price positively, which means this way the company stimulates investors to hold the shares in their portfolios.

The shares are trading 60% above the pre-crisis level. With the financial performance of the issuer, this growth is fair. Currently, on the chart, there is a support level of 195 USD. However, keep in mind that they are quite far away from the 200-days Moving Average. This might predict a correction to 180 USD.

The shares of gold companies

The money supply grows much faster than gold is mined, especially in 2020. The price of gold cannot avoid being influenced by this fact, so it keeps growing. Obviously, investments in gold will bring you a profit when inflation is growing.

You can invest directly in gold or opt for the shares of gold-producing companies. As for the US market, the largest gold companies in terms of capitalization would be:

- Newmont Corporation (NYSE: NEM)

- Royal Gold, Inc. (NASDAQ: RGLD)

- Hecla Mining Company (NYSE: HL)

- Kinross Gold Corporation (NYSE: KGS)

Closing thoughts

The growth of inflation means that the economy is growing. When inflation is under control, this is good for all because it makes the revenue of companies grow, raise wages; businesses expand, and invest in research, which results in discoveries that push humanity forward.

It is much worse when inflation gets out of control but Jerome Powell states that the current surge in inflation is temporary, and the Fed has ways to suppress it in case of emergency. One way is to cut down on the QE program, and the Fed is likely to resort to it this year. This will lead to a correction in the stock market but do not get scared, leave some cash to buy decreasing shares.