AMD Shares Reacted to News about Buyback

3 minutes for reading

The board of directors of an American microcircuit electronics manufacturer AMD prepared cool news for investors: the corporation is planning a buyback of its shares. What does it mean? When will this happen? How did the quotations react? I’m also eager to find out the answers.

AMD announces a buyback

On May 19th, on the official website of a tech corporation Advanced Micro Devices (AMD), there appeared information that the company is planning a vast buyback of its own shares for $4 billion.

We don’t know yet when the program will start. They only say that the buyback can be put to a halt or stopped at any moment. The shares of the IT corporation will be bought in the open market. The board of directors decided to initiate the buyback because the financial results of Q1, 2021 were bright.

AMD report for Q1, 2021 and financial forecasts

On April 27th, the developer and manufacturer of chips presented its financial results of January-March, 2021. According to the report, the revenue grew by 93% compared to the same period of 2020, reaching $3.45 billion.

The net profit managed to grow by 242.6%, from $162 million last year to $555 million. Sound cool, doesn’t it? The return on stock amounted to $0.45, which was 221% more than in January-March last year.

In the company, they expect the revenue to grow by 4% more this quarter, nearing $3.6 billion. As for yearly forecasts, the revenue is expected to leap up by 50% compared to the results of 2020.

AMD shares growing

It’s hard to say that the news about the buyback of shares disturbed the market and set the quotations of the tech corporation up to the ceiling. However, let’s be happy about the word “growth” being the main one in the phrase “moderate growth”.

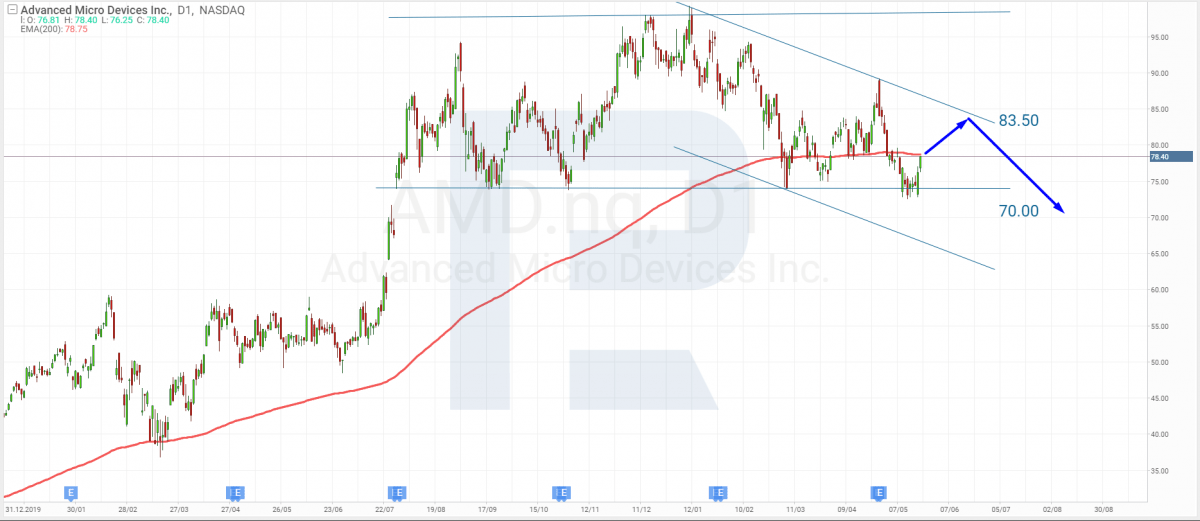

On May 19th, the shares of Advanced Micro Devices, Inc. (NASDAQ: AMD) closed with growth by 2.4% at $76.23. On the next day, the growth repeated itself, so the price reached $78.06. Since January, the quotations have dropped by 14.9% from $91.71.

Here is the opinion of Maksim Artyomov, analyst, about the future of the American microcircuit manufacturer:

“For the last to trading sessions, AMD shares have been growing after the information about the buyback appeared. When this article was being prepared, the quotations demonstrated a test of the horizontal support level, bounced off it, and reached the 200-days Moving Average. If they break it away, growth should continue, aiming at $83.5.

Then, upon testing the upper border of the descending channel, the price might bounce off it and form another descending impulse. In such a case, the price, renewing the nearest lows, will head for $70. If the buyback will make investors more confident, the upper border of the channel might be broken, so that the growth will continue, aiming at $100”.

Summing up

A strong quarterly report inspired the board of directors of AMD to launch a program of shares buyback. They plan to spend up to $4 billion on this. The shares will be bought in the open market. It isn’t clear how long the program will last. However, the market reacted almost immediately: the shares grew by 5% in two days.