Which Stocks to Buy in Falling Market?

12 minutes for reading

Debts are the problem that companies all over the world will be facing in the nearest future. The pandemic and more specifically, the quarantine made the debt load on issuers increase too noticeably. To avoid bankruptcy, enterprises had to loan money from the government or financial institutions.

However, the time to pay off the debts has come. While the economy is growing alongside the income of companies, this is not a problem, but what if the growth slows down? How to choose stocks for investments in such circumstances? All answers are in the article below.

US government supports business

Let us get started with the measures that the government takes to save business.

The US government has been supporting actively both business and people. While in the latter case it helped by money with no liabilities, in the case of enterprises, the government bought bonds, and businesses were later to pay interest.

The money that companies received was used to keep the business afloat: namely, pay wages and maintain their property. Then restriction measures began to be abolished, and companies could see their revenue restore.

Money supply in the USA is growing ever so fast

A huge mass of money has flooded the economy, which was a rescue for business and people.

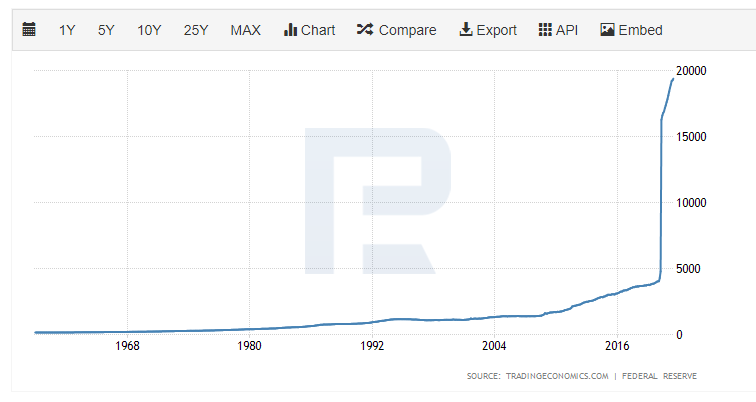

To realize the scale of the work of the printing machine check the chart of the growing money supply in the USA since 1965.

Looking at it, anyone would struggle finding words to describe the increase in the money supply in the USA in 2020.

But where did the money go?

If you look at the chart of the S&P 500 index, you will immediately know the answer. A huge part of the money was poured in the stock market. According to some polls in the USA, Americans chiefly used the “COVID” money to buy stocks.

Growth of money supply made inflation increase

After the initial quarantine restrictions were lifted, businesses returned to more or less normal functioning. Employees started receiving wages that kept growing with time, while the government kept paying the COVID money as well. The income of Americans started increasing, which led to growing demand for goods and services, which got reflected in the prices.

One could feel that increase in prices even on a different continent.

Because they received money as it was, many Americans refused to go to work. As a result, there appeared a shortage of workforce, and employers had to run to extra stimulation measures, such as lump sums paid at the moment of employment. All in all, Americans are doing good, unlike the rest of the world, where prices are growing but the income does not.

Revenue of companies is at the high

Another sign of Americans feeling all the might of the printing machine (in the good sense of the word) is the revenue of businesses growing higher than ever before.

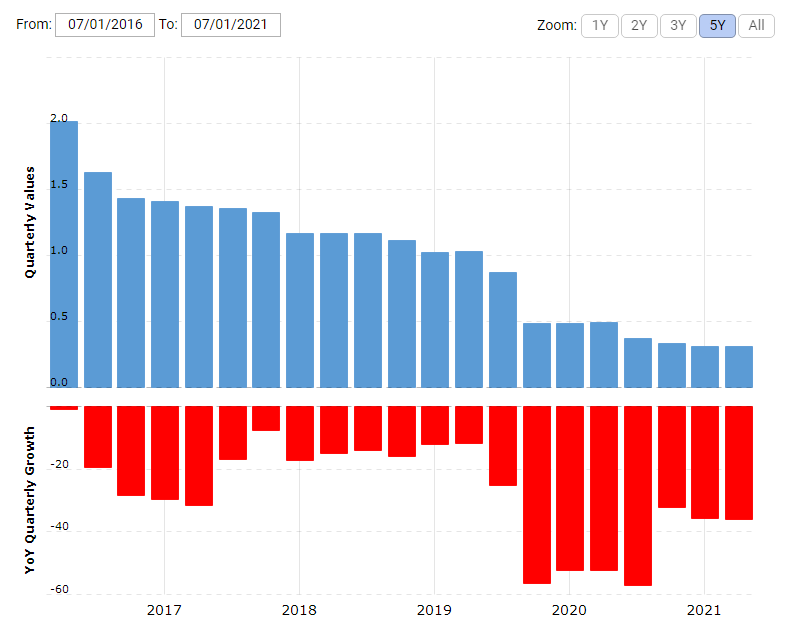

If you look at the issuers of the S&P 500, you will see 90% of them reporting the income of Q2 higher than forecast, while the revenue of most companies was also at the highs. With such revenues, no one really cared about the debts. The company makes money, so it is able to pay off its debts.

US government cut down on the allowances

A shortage of workers at plants slows down the growth of the economy. To push people towards finding a job, the government started cutting down on the COVID allowance. This is the first signal of the income of people falling, though not much yet.

Next, high demand for goods and services led to a steep increase in commodity prices and a shortage of raw materials. For example, wood prices have increased by 400% over the last 18 months, which made wood houses pricier. Trying to save money, people started using alternative materials, which sent prices for them to space as well.

Oil prices also reacted by growth. The quotations of black gold doubled from the lows of 2020, which gets reflected in fuel prices, which gets reflected in goods shipping prices.

What did the growth of money supply lead to?

Why am I telling you all this?

The time when people were enjoying the printing machine is coming to an end. It resulted in the growth of prices for goods and services. The inflations that Central banks were dreaming of in 2020, is already three times higher than planned. To counter it, the Federal Reserve System would have to lift the interest rate.

But what a miracle! Inflation stopped growing on its own. The report for July shows that in the USA, it has been at 5.4% for two months in a row.

What does it mean? This means that the demand from people is falling. With such prices, this is no surprise.

Falling demand will make the revenue of companies fall as well. Here is where we get to the question: how does one pay of their debts if their income is shrinking?

Experts started saying the, looking back, Q2 would turn out to be the best for issuers because in Q3, many businesses would show no improvement compared to Q2, and Q4 would become a disappointment altogether.

Companies without debts attract investors

In such circumstances, investors will be looking at companies with a small debt load. This is, in fact, already happening. Look at an example with the shares of American Airlines Group Inc. (NASDAQ: AAL) and Advanced Micro Devices, Inc. (NASDAQ: AMD).

Airlines are those who suffered the most from the pandemic. The US government sent billions of dollars for their rescue. However, the debt of American Airlines keeps growing. At the beginning of 2021, the long-term debt of the airline amounted to 29 billion USD; by now, it has reached 37 billion USD.

Naturally, the revenue of the company has not reached the pre-crisis level but has been growing for the last 5 quarters. The number of flights is also increasing, and in Q2, 2021 American Airlines even reported a positive net profit.

What is the result? The number of American Airlines flights is growing constantly, which means potentially the revenue can grow. The vaccination campaign is also a good influence on the company’s business, and the airline has a net profit. These are arguments for investing in the company, as long as the market lives on expectations.

However, if you look at the share price chart, you will see that the company’s securities do not enjoy demand. The shares are trading at their local lows and do not even hint on the pre-crisis levels. Investors have no interest in them.

Now let us look at Advanced Micro Devices. The pandemic had no negative influence on it. Quite on the contrary, at that time the company was paying off its debts, decreasing the debt size.

The money allocated for such payments originated in the constantly growing revenue, which is now at its highs. Is it scary to invest in such a company? Of course, not. Now take a look at its share price chart. Last month, the shares renewed their all-time high.

All in all, market players suggest investing in companies with a low debt load, though the airline has a clearer potential for the growth of the revenue than Advanced Micro Devices.

Almost-closing thought

The doping that the economy has been working on is now losing its power. Now we have to deal with the consequences. Inflation has stopped growing, which means the demand has fallen. Hence, the revenue of companies might suffer.

Experts are also suspicious about the reports for Q3. All this might draw stock prices down and make S&P 500 correct. Analysts of banks are also waiting for a correction: they say that the index might drop by 5-10%.

Which stocks o buy in correction?

A correction in the stock market is a good way to buy stocks at a lower price. But which stocks are worth looking at?

This is the constant headache for long-term investors because they want to be at least somewhat sure that the price of the shares they have bought will grow. In our circumstances, this is not a question too hard to answer.

If the pandemic made the debts of many companies grow, so that a slowdown in the economy might make it hard for them to pay off debts, then check the companies that have no to little long-term debts.

First of all, we are not looking at Alphabet Inc. (NASDAQ: GOOG), Facebook (NASDAQ: FB), or Apple (NASDAQ: AAPL). The reason is the beginning global trend to fight monopolies. Apple is already doing favors to developers, while Europe is advancing at Google and Facebook, which might end in huge fines and a loss of a part of the market.

For long-term investments, always choose companies that regulators are okay with because these institutions operate billions of dollars. Such companies are, for example, S&P 500 companies.

Then things go simple. Study financial performance and find companies with minimum debts. I have singles out three issuers that I am presenting to you. You can always make your own analysis and find a couple more companies to diversify your portfolio.

Ulta Beauty, Inc.

The first one is Ulta Beauty, Inc. (NASDAQ: ULTA). Ulta Beauty is a retailer of cosmetic goods in the USA. The company also has its trademark Ulta Beauty Collection. On January 30th, 2021, it was managing 1,264 shops in 50 states.

In 2020, its revenue fell, and the company had to loan 800 million USD from the US government. By the beginning of 2021, though, the company had fully paid it off, and its revenue rose 250 million USD over the pre-crisis level.

Ulta Beauty shares are trading in an uptrend, close to their all-time high.

If there starts a correction in the stock market, the stock price of Ulta Beauty might drop to the 200-days Moving Average at 330 USD. This will be a good opportunity to buy the shares for a long-term investment.

Intuitive Surgical, Inc.

The next company, Intuitive Surgical, Inc. (NASDAQ: ISRG), alongside its subsidiaries, develops, produces, and sells surgical systems da Vinci, corresponding instruments, and accessory in the USA and abroad. The company was founded in 1995, with its headquarters in Sunnyvale, CA. It is a global leader in the sphere of minimally invasive robotic surgery.

The yearly revenue of Intuitive Surgical has reached 5.16 billion USD, which is the company’s all-time record. It does not have a long-term debt, and the pandemic had a limited influence on the company, which resulted in a slight decrease in the revenue.

The share price chart of the company is a dream of a long-term investor. Since 2020, the stock price has grown by 250%. The growth was followed by mild corrections that allowed buying the stocks at a lower price. Only once they neared the 200-days MA, bounced off it, and kept growing. They are currently quite far from it, which suggests a possible correction.

There is one event that might allow buying the stocks at a more affordable price. The company has scheduled a split of shares with a coefficient of 1 to 3 for October 5th. This means that the stock price will drop from 1,000 USD to 330 USD.

Normally, if the company is strong, its shares continue growing after a split. A bright example is the shares of NVIDIA Corporation (NASDAQ: NVDA) and Apple that have recently carried out splits. Their share price is now higher than after the splits.

F5 Networks, Inc.

Finally, let us focus on F5 Networks, Inc. (NASDAQ: FFIV). This is an American company providing services around the Internet and various apps. It is also involved it fighting online fraud. F4 Networks solutions are for safety, productivity, and accessibility of web apps.

Before the pandemic, the company used to have no debts at all; however, at the beginning of 2020, it loaned 379 million USD. It was decreasing every quarter, and now amounts to 355 million USD. With a free money flow of 768 million USD and a quarterly net profit of 90 million USD such a debt does not look burdensome.

As the shares of the companies above, these ones are also trading in an uptrend. However, there is a detail. Since the beginning of 2021, there is a range in which the shares are trading now.

The lower border of the channel is 180 USD, the upper one is 215 USD. This gives a hint to which levels the shares might drop. A breakaway of the upper border of the channel will mean that investors are ready to buy even at the highs.

Closing thoughts

A correction in the market is the best time to buy stocks. Experts forecast a decrease in stock indices this autumn (at the chart of S&P 500 you can see it begin already).

Hence, it is important to buy the shares of such companies that will be ready to return to previous levels. The best idea is to address companies that have low debt loads. For now, their shares are too expensive, so do not rush at buying them.