IPO of Paymentus Holdings Inc.: a Fintech for Smaller Businesses

5 minutes for reading

More and more technological companies pay attention to satisfying the needs of small and medium-sized businesses. This category of clients has an obvious advantage over retail consumers through a higher financial responsibility and clearer requirements. For example, developers of SaaS platforms are now more active in offering solutions for the easy and quick creation of websites, online shops, and other similar things.

Fintech companies are also engaged in this. Paymentus Holdings Inc., the company we’re going to talk about, offers technologies for making non-cash payments, and most of its clients are small and medium-sized businesses.

The company’s IPO will take place at the NYSE on May, 25th, while its shares will start to be traded the next days, the “PAY” ticker. Lets’ find out why Paymentus Holdings is attractive and what prospects its shares have.

Business of Paymentus Holdings Inc.

The company was founded in 2004 and is currently headquartered in Richmond, Virginia. The company’s President/CEO is Dushyant Sharma, who earlier was a co-owner of Derivion, the company that developed a SaaS platform for processing payment orders. The key product of Paymentus is a cloud platform for making bill payments

The company’s key clients are so-called “billers”, individuals or entities that issue invoices for their goods or services. As of December 2020, Paymentus had over 1,300 business clients of such type. In total, the platform was used by more than 16 million people.

The platform is powerful enough to work with billers of any size and industry: insurance, government services, utility bills, healthcare, telecommunications, and finance.

Thanks to a wide network of billers with different requirements for bill payments, Paymentus has a great opportunity to get quality feedback to help the company implement innovations and improvements to the platform. The company’s product provides clients with a simple and clear payment method based on multi-channel payment system infrastructure, which forms an “all-in-one” payment ecosystem.

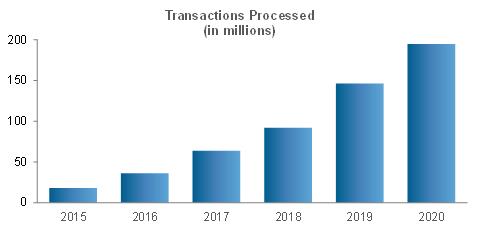

Needless to say that the business development was positively influenced by the coronavirus pandemic last year. In addition to that, the target market of Paymentus Holdings Inc. is rapidly developing as such.

The market and competitors of Paymentus Holdings Inc.

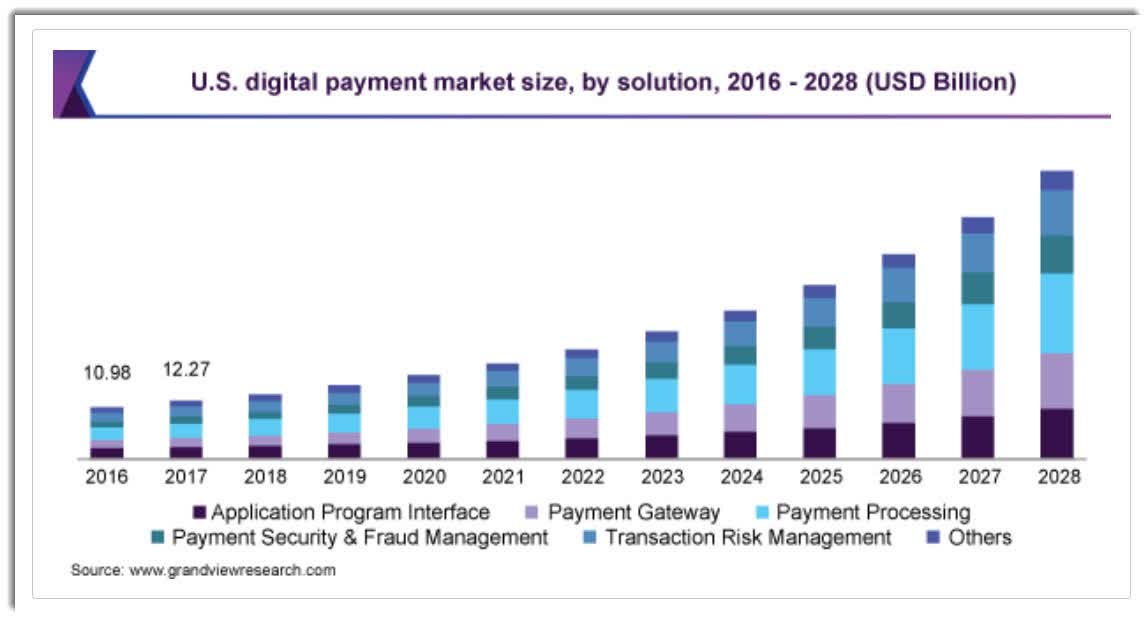

According to Grand View Research, the global digital payment market in 2020 was $58.3 billion and is expected to reach $241 billion by 2028. An average annual growth rate is 19.4%, which will allow the company’s business to add over 25% in the same period.

Key factors of such a quick development will be the expansion of smartphones, increase in e-commerce, and all-around implementation of online payment technologies.

In this light, the company’s competitors can be divided into three groups:

- Providers of outdated payment methods.

- Internal bank systems.

- Pay-by-phone systems.

Financial performance

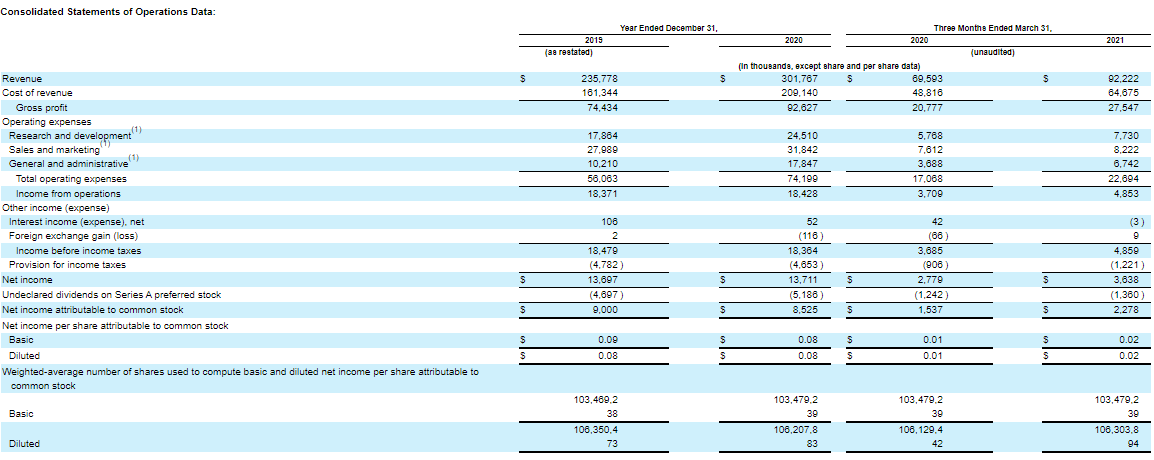

Unlike other technology companies, Paymentus Holdings Inc. is filing for an IPO being profitable, that’s why we’ll analyze both its earnings and the net profit.

According to the S-1 form, the company’s net profit in 2020 was $13.71 million, a 0.15% increase relative to 2019. Over the first three months of this year, this indicator equaled $3.68, and that’s 30.94% more than the same period last year. In the last 12 months, the company earned $14.57 million. As we can see, the business margin is improving.

Now let’s talk about sales dynamics. In 2020, the company’s earnings were $301.77 million, a 27.98% increase if compared with 2019. In the first quarter of 2021, the indicator was $99.22 million, a 32.5% increase relative to the first quarter of 2020. The total earnings over the last 12 months were $324.39 million. If the company is able to keep this “speed”, its earnings at year-end 2021 might be $400 million. As we can see, the growth rate is gathering pace.

At the end of the first quarter of 2021, cash and cash equivalents on the company’s balance sheet were $49.6 million, while its total liabilities equaled $45.4 million. The company’s business is effective, earns the net profit, and has an acceptable debt load. All these factors taken together imply quite high financial stability.

Strong and weak sides of Paymentus Holdings Inc.

Let’s assess the risks and advantages of Paymentus Holdings Inc. Among its strong sides, I would name:

- The company generates the net profit, although it doesn’t pay dividends.

- Paymentus Holdings Inc. operates on a very promising market with an average annual growth rate of 19.4%.

- The company’s earnings add 25% every year.

- A high client retention rate.

- Plenty of channels for getting different types of feedback from clients.

- Sound management.

Risks of investing in these shares are:

- The current sales growth rate will reduce.

- Low business margin.

- Solid competitors.

IPO details and estimation of Paymentus Holdings Inc. capitalization

During the previous rounds of financing, the company raised $30 million. The major investors are Accel-KKR and Ashigrace LLC. The underwriters of the IPO are PNC Capital Markets LLC, Fifth Third Securities, Inc., Raymond James & Associates, Inc., Nomura Securities International, Inc., C.L. King & Associates, Inc., AmeriVet Securities, Inc., Wells Fargo Securities, LLC, Goldman Sachs & Co. LLC, Robert W. Baird & Co. Incorporated, Citigroup Global Markets Inc., BofA Securities, Inc., and J.P. Morgan Securities LLC.

During the IPO, the company is planning to raise $100 million by selling 10 million common shares at the price of $19-21 per share. If shares are sold at the highest price in this range, the company’s capitalization may be up to $2.32billion. Paymentus Holdings Inc. is planning to spend this money on its corporate-wide purposes, operating capital, and purchasing new technologies.

To assess the company, we use two multipliers, the Price-to-Sales (P/S Ratio) and the Price-to-Earnings (P/E Ratio). The company’s P/E is 272.09, so it’s highly unlikely to grow, while P/S equals 7.69 and that’s below average for the tech sector (10-12). As a result, the upside for Paymentus shares might be from 30% to 56%.

With all that said, I would recommend this company for mid/long-term investments.