Oil Prices Leaping High Waiting for OPEC+ Meeting

3 minutes for reading

Yesterday OPEC+ had a meeting. Waiting for this event, the price for Brent and WTI futures headed upwards steeply. Let's discuss what highs they reached, what decisions exporting countries made, and what's going on with the quotations of oil companies.

Results of OPEC+ meeting

On June 1st, the representatives of the oil quartel met for a discussion. According to Argus Media, the plan of oil production for this and the next months will be preserved. In June, the volume of produced oil will increase by 350 thousand barrels a day, and in July — by 441 thousand.

In OPEC+, they're sure of stable oil demand. They say the car season has started in the USA, and in Europe, the mobility of population is increasing thanks to the successful vaccination campaign.

Moreover, the quartel notes that member countrids are sticking with the agreement on oil production regulations strictly, as well as with the agreement on the decreasing world oil stocks.

Growth of oil prices

Waiting for the OPEC+ meeting, the market was optimistic. On June 1st, the price for an August Brent futures (BQ1) grew by 1.89% to $71.31, rising above $71 for the first time since March 8th.

On the same day, the price for a July WTI futures (TN1) demostrated growth by 1.45% to $67.93. The high of its daily chart was $68.87. Last time the price rose over $68 on October 17th, 2018.

Shares of oil companies growing

- Exxon Mobil Corp (NYSE: XOM) — +3.58%, $60.46.

- BP PLC ADR (NYSE: BP) — +3.01%, $27.02.

- Chevron Corp (NYSE: CVX) — +2.76%, $106.65.

- Royal Dutch Shell PLC ADR (NYSE: RDSa) — +2.54%, $39.59.

- Total SA ADE (NYSE: TOT) — +2.29%, $47.76.

Tech analysis of oil futures and Exxon Mobil shares by Maksim Artyomov

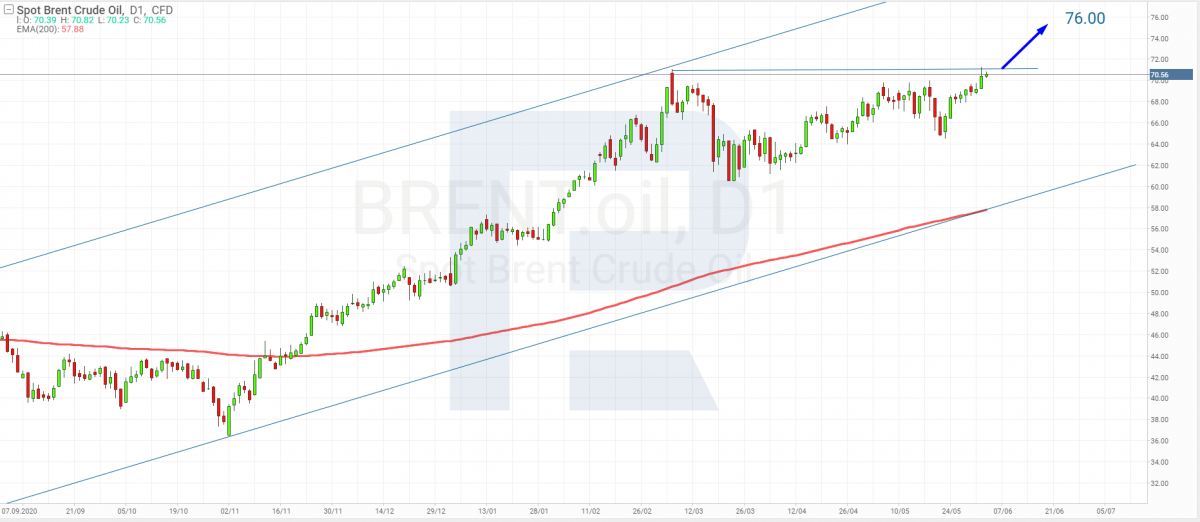

"The news pushes oil prices up. On D1, Brent has renewed a local high. The quotations keep on inside an ascending channel. As long as the price rests above the 200-days Moving Average, the trend is likely to continue. The aim of the growth after a breakaway of the horizontal resistance level is $76".

"WTI oil, breaking through the horizontal resistance level, continues to grow. Renewal of the nearest highs might further stimulate the quotations. The price remains above the 200-days MA, which is also supporting growth. The aim is $77".

"The shares of Exxon Mobil Corporation are recuperating after a decline. Bouncing off the lower border of the channel, the price is growing. The nearest target level is $62.5. As long as the quotations are trading above the 200-days MA, they're likely to renew the high in the nearest future. The next aim of the growth might be $73.5".

Summing up

OPEC+ had a meeting where they announced their plans for gradually increasing oil production over the next two months. Moreover, the growth of global oil demand was estimated quite optimistically.

The prices for Brent and WTI oil reacted positively, demonstrating growth by 1.89% and 1.45%, respectively.