Airlines: Illusion of Reliable Investment

9 minutes for reading

The share of fully vaccinated population in the USA has reached 41%. Those who have received their two dozes of the vaccine are allowed to stop wearing masks and keeping social distance. Vaccination is good for the country’s economy, and GDP forecasts have been revised lately.

Unfortunately, the growth of stock indices has stopped; they only demonstrate increased volatility. The market seems overheated, and now we need companies with clear and bright perspectives from all sides as investment options.

Airlines look very like such companies. Borders opened and lockdowns lifted are leading to people beginning to travel, especially on the verge of summer vacation.

As a result, the revenue of airlines is bound to grow. However, should we buy their stocks now? This article is devoted to US largest passenger airlines and whether they are worth investing in right now.

Passenger flow decreasing; help from the government

To get started, let us recall that the pandemic decreased passenger flow by 65%. Airplanes were standing idle; some companies started to get rid of spare planes. In such a situation, the revenue of airlines naturally dropped; companies became losing, so the government had to help them survive.

Four largest US companies - American Airlines Group Inc. (NASDAQ: AAL), United Airlines Holdings, Inc.(NASDAQ: UAL), Southwest Airlines Co.(NYSE: LUV), and Delta Air Lines, Inc. (NYSE: DAL) – lived through the crisis, and federal help played the main part in their survival.

Steep growth of debt load

The other side of the medal is the steep growth of their debt load that made the companies increase the number of flights, on the one hand, and maintain huge debts, on the other.

One company mentioned above saw its share capital become negative; another one is right on the verge of such a situation. For creditors, this means that in case these companies go bankrupt, they will never see their money even if all the property of the companies will be sold. Hence, creditors are vulnerable.

However, as the saying goes, if you owe 100 USD to a bank, this is your problem, but if you owe it 1 million USD, this is the problem of the bank. In this situation, creditors assume the risk, and now this is their job to make the companies work as hard as possible to fulfill their bond obligations.

Is the risk of bankruptcy high?

The risk is rather high. Let us recall the terror act of September 11th, 2001. Afterwards, Delta Air Lines and United Airlines went bankrupt over three years. Meanwhile, each company has a high debt load. In United Airlines, the situation even worsened when oil prices headed up and simultaneously, the company had to increase the employees’ salary.

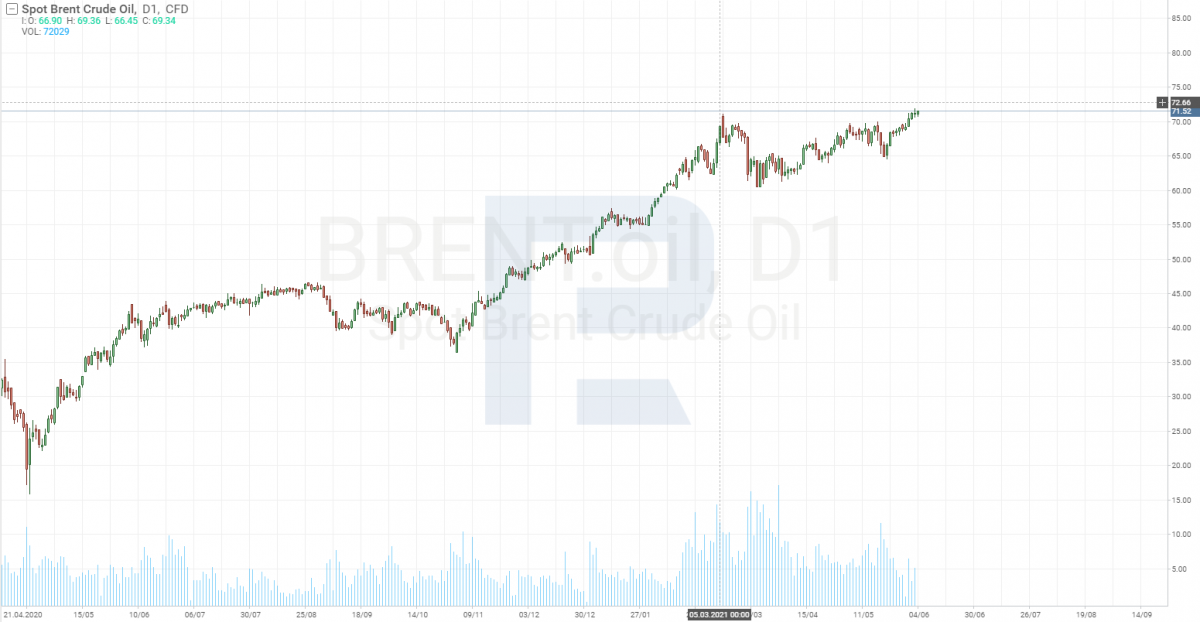

Take a look at the chart of Brent oil. The price is growing.

In the USA, salaries are growing. Some companies pay one off awards to new employees. This means businesses are fighting over workforce, and people will do their best o sell their time to employers at the highest possible price. As a result, the situation of the previous years is repeating itself, and it is exactly what led to the bankruptcy of companies.

And now let us discuss each airline in more detail, starting with the outsiders.

United Airlines Holdings

To see which company is the outsider of the sector, you only need to check its price chart. The same is valid for determining the leader.

See below the charts of American Airlines Group, United Airlines Holdings, Southwest Airlines Co., and Delta Air Lines.

Only Southwest Airlines shares have reached the pre-crisis level. The outsider is United Airlines, the quotations of which are trading 35% below the pre-pandemic level.

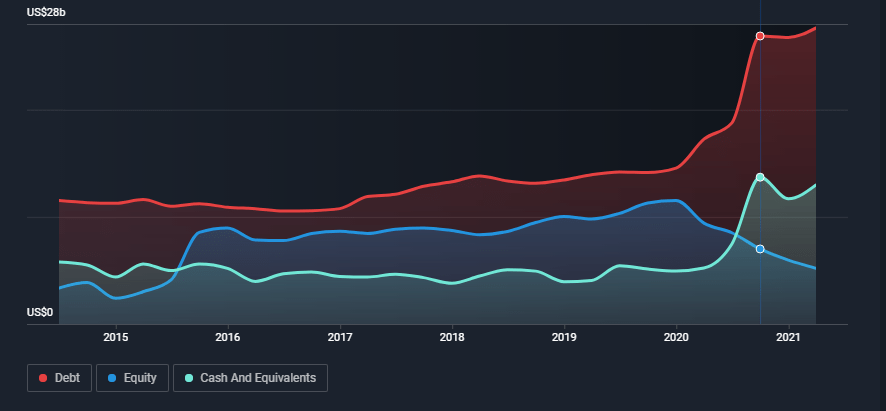

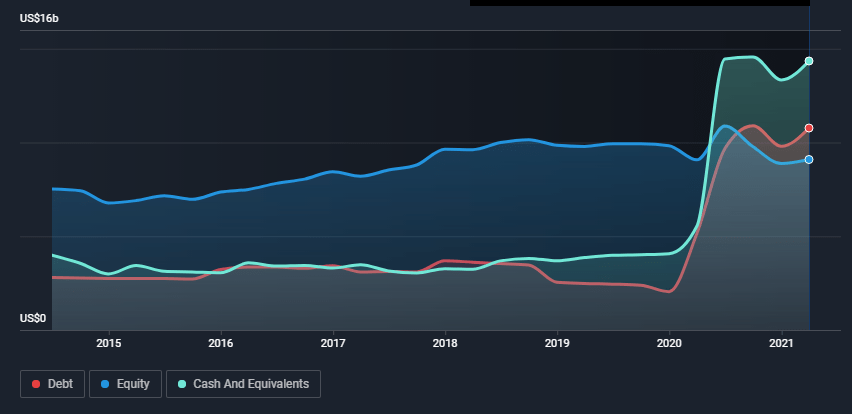

Now let us check the growth of the debt load of United Airlines and see whether things are indeed this bad.

The chart shows that even before the crisis the company had debt problems but the share capital remained positive, i.e. the company’s assets surpassed its debts.

However, in 2020, the share capital started falling steeply.

We may conclude that the growing debt influenced this imbalance as long as the share capital is calculated as the ratio of assets to the debt. If the latter is growing, the formed might start decreasing.

However, companies are taking more and more loans for the development of business, which means they are increasing their asset size, and then the growth of debts is not as crucial. However, in this case, there is no development at all; the company is just struggling to save itself.

What happens if the share capital becomes negative?

Judging by the dynamics, this might happen quite soon.

In this case, creditors will have to decide whether they are ready to risk and go on supporting the company or whether the time has come to demand performance of obligations with no chance for restructuring. Otherwise, all the company’s assets will not be enough to satisfy the claims of its creditors.

This situation is dangerous for the airline as much as for its creditors. The only hope is an increase in United Airlines assets tat can be allocated for maintaining loans. Otherwise, the company might fall prey to another decrease in the revenue.

As a result, investors are unwilling to risk, hence, the demand for United Airlines shares drops. This is why the company’s shares are trading so far away from the pre-crisis level.

American Airlines Group Inc.

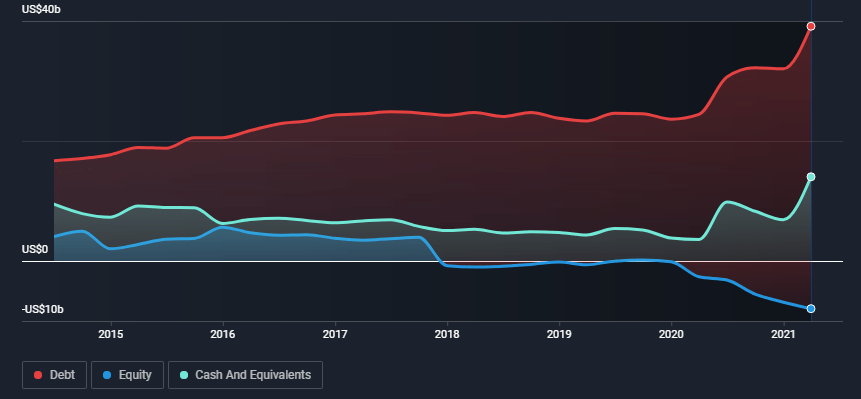

Next – to American Airlines Group Inc. Its shares are trading 20% below the pre-crisis level. If we check the diagram of the debt and the share capital, we might consider the company the weakest one in the sector.

Compared to United Airlines, American Airlines shares are closer to the highs of 2020. But if we zoom out the chart, we will see the quotations trading in a downtrend since 2018. As for United Airlines, before the pandemic they traded in an uptrend.

The answer to why the shares of American Airlines have been declining since 2018 is on the diagram above. That year, the debts of the company surpassed its assets. Hence, investors started to get rid of American Airlines shares gradually.

Moreover, the shares attracted speculators who aimed at making a profit on the decline. Currently, these stocks have the highest Short Float values of all the airlines mentioned: other companies have it below 2%, while American Airlines features a 13% Short Float. This means investors are counting on bankruptcy.

Delta Air Lines

Things are hardly better in Delta Air Lines. Last year, it was of Warren Buffet’s favorite companies, but later in 2020 he got rid of these stocks.

The assets of the company are nearing the size of its debts and soon might even drop below it, which will make the share capital negative.

Hence, to the shares of this airline, the same thing might happen as to American Airlines shares – they might start a lengthy falling from the current level.

The company is only saved by inflating its assets, while investors are not eager to see it go bankrupt. Short Float is at about 2%.

Southwest Airlines Co.

The leader among the airlines we have mentioned is Southwest Airlines Co. Its shares did not only reach the pre-crisis level but even went farther.

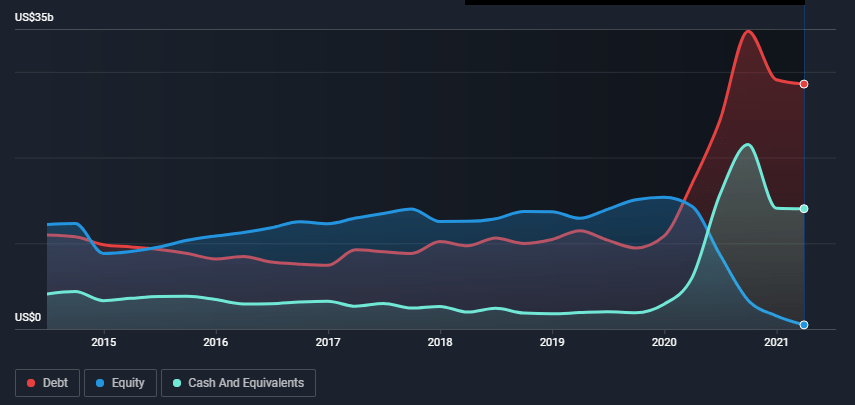

But are things so good? The answer is easy to find, just have a look at the chart.

The assets of Southwest Airlines Co. are 10 billion USD larger than its debts. The share capital is positive and growing. The debt load grew in 2020 but did not influence the company too much.

The company has enough money to pay off all its debts. Naturally, investors are not afraid to invest in this company, so its shares are enjoying demand.

If you are ready to risk, choose a financially stable company; time shows that such an investment choice usually pays off.

Closing thoughts

Presently, I would not recommend investing in airlines. The market is living on expectations, and the restoration of passenger flow was included in prices in advance. Here I would say that some positive news have already been accounted for by the share price of airlines.

For example, look at Southwest Airlines shares. They are trading at pre-crisis levels though passenger flow has not reached the level of 2019 yet. Hence, the shares can be called overbought, which means a decline might follow after some investors take the profit.

Another risk for airlines is the growth of oil prices. This makes fuel more expensive and entails additional spending that the company puts either to passengers or to its own balance.

When the debt load is high, and the Fed might increase the interest rate, airlines cannot afford extra expenses. In this case, passengers will pay more, which will influence the passenger flow in a certain company.

The pandemic is subsiding thanks to the vaccination campaign but this does not put an end to the trouble of airlines.

I have no idea how the situation will be developing in reality, but I have a feeling that the time to invest in airlines has not come yet. The only airline that you can count on is Southwest Airlines. Investments in other companies are highly risky because they can either bring a profit or go bankrupt.