Coronavirus Landed Aircraft. Airline Stocks: Sell Only

8 minutes for reading

The coronavirus pandemic has made one of the hardest hits to the entire aviation industry. The stocks of many airlines have become cheaper by more than 70%. Any investor is now able to buy the stocks of any of those companies at the lowest price possible.

However, is buying airline stocks now worth it? What risks will the investor face?

Everyone knows that many countries have already closed their borders. Passenger air transportation has reduced to a minimum, and the tourist industry is on the verge of an abyss so that we will soon be reading the news about the bankruptcy of many companies.

Airlines and the tourist industry are tightly connected, however, air carriers can make some money on cargo transportation, and this is the opportunity they are now using to survive.

The coronavirus has increased the demand for medical equipment, hence, the amount of cargo transportation by air from the Asian market has also grown. Simultaneously, the cost of a cargo flight has doubled or even tripled. Several weeks ago, cargo delivery from Hong Kong to Europe by Boeing 747 or 777 cost 300,000 USD; a couple of days ago, the price reached 800,000 USD.

Meanwhile, for the passenger airplanes not to stay idle, airlines adapted them for cargo transportation, too. The construction does not allow to dismantle the seats for the load to be spread evenly, so the cargo is secured right on the seats.

It turns out that the companies dealing with both passenger and cargo transportation might manage somehow, while those carrying out passenger flights only will have hard times.

What happened with airlines after September 11th, 2001?

History shows that the probability of the bankruptcy of airlines is very high.

For example, a year after the terror act on September 11th, 2001, United Airlines (NASDAQ: UAL) went bankrupt, and 4 years after the events - United Airlines followed it. As for the flow of passengers, it restored in 2004 only.

In our situation, the restoration is extremely hard to predict as no one knows when the pandemics will come to an end. Moreover, the conditional "end" will be followed by slow recuperation of the economy and only then - by a burst of passenger flights.

What did airlines do before?

Before the crisis, the income of airlines was growing, and so was doing the greed of stockholders and the management. 90% of the income was spent on repurchasing the stocks and dividend payments, which was good for the stock price. This is what each and everybody mad money on.

When the crisis struck, many had no money to solve the problems of the hard times, hence, airlines ran to the US government, asking for money.

It has been two months only since the moment when countries started closing the borders, but it is already clear that many companies will fail to survive May without help from the authorities.

What will governmental help result in?

On April 14th, 2020, 10 airlines asked the US government for help sized 25 billion USD. With this help, their debts will increase, and they will assume new commitments.

Until September 2020, the airlines that receive the help will have to comply with the following demands:

- Save 90% of workplaces;

- Stop repurchasing stocks and paying off dividends (do not count on dividends from now on);

- Return 30% of the sum received.

Where to get money from? Who might be affected?

So, there emerges a question: where will they find the money if the passenger flow does not restore?

The answer is simple. If there are no passengers, airplanes are standing idle. Hence, companies will start selling airplanes. United Airlines has already put 22 Boeings on sale. First hand, this will affect Boeing (NYSE: BA): its orders have already decreased by 7% in the first quarter of 2020.

Also, leasing companies will suffer. Many airlines use their services instead of buying airplanes, and leasing companies receive their percent. Increased market supply of used airplanes will make leasing companies decrease the rate to keep their services attractive or buy airplanes from the market to decrease the supply, which will automatically affect their income.

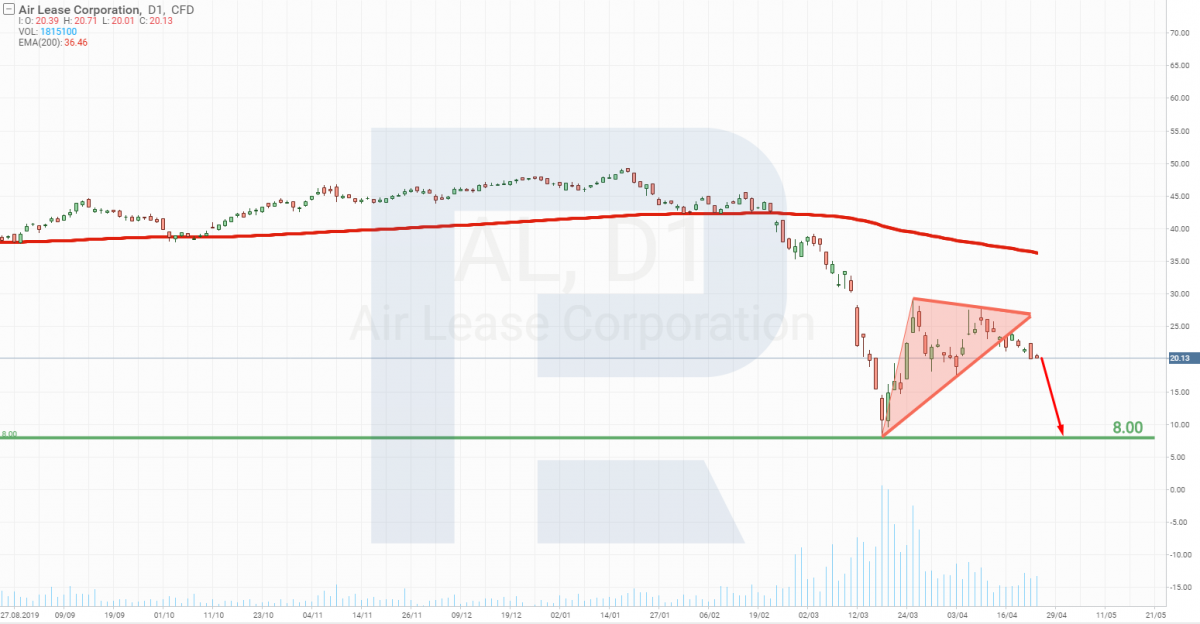

The stocks of the American Air Lease Corporation (NYSE: AL) have fallen by more than 50% already and, judging by the stock price chart, this is not the bottom yet: the Triangle means a further decline.

In the end, investors will start looking for the companies that will be still paying dividends, thus, the demand for the stocks of airlines will drop. In this situation, it is hardly possible to make money on the growth of the stock price.

What if a company fails to pay off the debts?

Before the crisis, companies had their debts, and now they will only increase.

Take a look at Delta Air Lines, Inc. (NYSE: DAL). On April 22nd, it presented its financial results for the first quarter of 2020. The net profit fell from 1.09 billion USD in the previous quarter to -534 million USD, i.e. the company became losing.

To manage this situation somehow, the first option for the management will be filing a bankruptcy application. For the employers, this will not mean losing their workplaces, most of them will be preserved, the company will just free of its debts.

Option number two: the struggling company will be merged by a larger one. This is what happened after September 11th. 9 large airlines were united in 4 that are now controlling 80% of the US market. These companies are:

- American Airlines Group Inc. (NASDAQ: AAL)

- United Airlines Holdings, Inc. (NASDAQ: UAL)

- Delta Air Lines, Inc. (NYSE: DAL)

- Southwest Airlines Co. (NYSE: LUV).

The remaining 20% of the market is distributed between smaller airlines, such as Spirit Airlines, Inc. (NYSE: SAVE), which stocks have fallen by 74%, JetBlue Airways Corporation (NASDAQ: JBLU), which stocks have fallen by 64%, and Allegiant Travel Company (NASDAQ: ALGT), which stocks have fallen by 62%.

How to detect a weak company?

It is report season now: companies are presenting their financial results for the first quarter of 2020. The key point is whether the company has managed to remain profitable, i.e. look at its net profit.

The lack of a profit means that the company can neither develop nor repurchase the stocks or pay dividends. All it can do is looking for credits to support its business and increase its debts. Such companies are to be avoided, especially nowadays.

Does tech analysis confirm the weakness of the stocks?

If the fundamental background of a company is very negative, tech analysis may either confirm further falling of its stocks or, vice versa, demonstrate the perspectives of growth, which means a mistaken interpretation of the current situation.

In our case, the tech analysis of the stocks of the 4 largest US airlines looks negative. There are Triangles on the charts, promising a further decline in the stock price.

In the stocks of smaller companies, the picture is similar. Moreover, the papers of Spirit Airlines and Allegiant Travel Company have already broken away the lower border of the Triangles, signaling further falling.

Warren Buffet started to sell stocks of Delta Air Lines

At the beginning of April, Warren Buffett started to get rid of the Delta Air Lines stocks, selling them for 314 million USD. Earlier, Buffett's share in the company reached 11%, which obliged the fund to provide all information about the trades with this company. Now, the share has fallen below 10%, letting the fund free of the commitment. As a result, Buffett may go on decreasing his share in the company, and we will know this only three months later from the repost of the Berkshire Hathway fund.

However, now, another thing has become important. Warren Buffett is a long-term investor, and such investors use the falling of stock prices as a unique opportunity to increase their share in the company. The fact that Buffett is selling his stocks means that he is sure of the negative scenario.

Bottom line

Do not try to catch the bottom, this is too risky and pricy. If something costs little, you do not always need to buy it. The stocks of airlines are now cheap but this is not due to investors being scared and retreating to cash but due to serious troubles in the branch. The two preceding crises that affected the branch only indirectly led to bankruptcies and mergers of some companies. The present crisis hit airlines more than others, and for some companies, it will end in bankruptcy.