IPO of AMTD Digital: Digital Financial Services

6 minutes for reading

The coronavirus pandemic is an extremely unusual event, the consequences of which can be traced in many aspects of people’s lives. One of them is an increase in the demand for fintech services. Branches of banks, insurance companies, brokers, and other financial institutions were closed. Nevertheless, the industry continued working and many other companies found a way to boost financial department digitalization, which required comprehensive solutions for their purposes.

AMTD Digital developed a fintech platform of digital solutions as a part of the AMTD SpiderNet ecosystem. The platform allows start-up companies to save on the implementation of digital financial solutions early in their career. The company is scheduled to have an IPO on Thursday, June 24th, at the NYSE, and its shares will start trading the next day, the HKD ticker.

Business of AMTD Digital

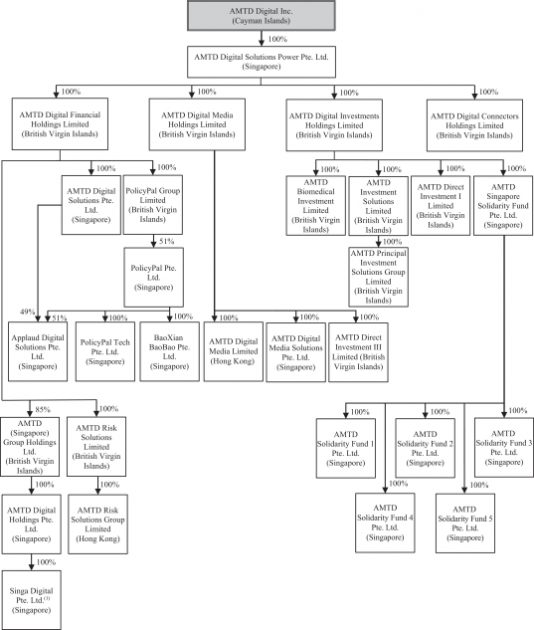

The company was founded in 2019 during the separation of AMTD Global Markets business when all fintech assets were given to AMTD Digital. The company is headquartered in Hong Kong and run by Mark Chi Hang Lo, the Group Vice President, who earlier was the head of PineBridge Investments Emerging Markets. The company’s staffing profile is only 50 employees.

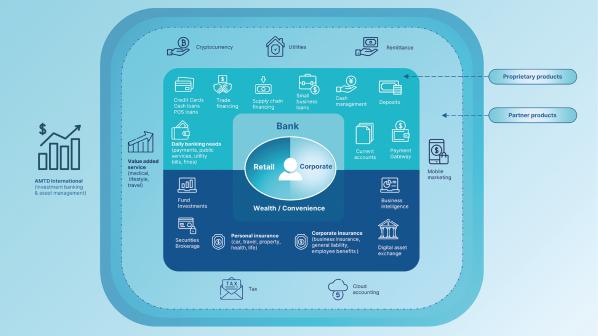

AMTD Digital divided its business into the following sectors:

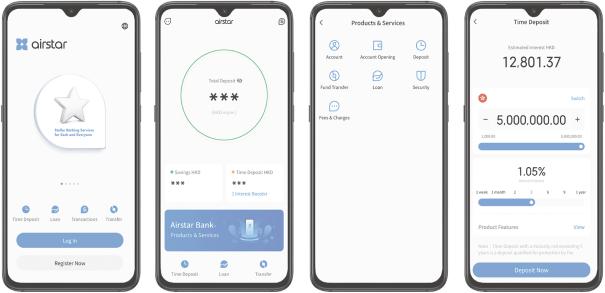

- Airstar Bank and Singa Bank – digital banks that offer comprehensive financial services to retail and corporate clients, small and medium-sized businesses in Singapore. Singa Bank was partially created by such companies as SP Group and Xiaomi.

- PolicyPal – an online insurance platform, which operates in Singapore with individuals, small and medium-sized businesses.

- AMTD Risk Solutions – a leading insurance broker in Hong Kong, which provides services to legal entities.

- CapBridge – a built-in internet platform, which allows hi-tech start-up companies and funds from Singapore to attract financing.

Within the frameworks of the AMTD SpiderNet ecosystem, the issuer offers online banking services, distributes and promotes media content, and invests in innovative tech companies. AMTD Digital owns shares of Appier (a developer of marketing solutions implementing AI technologies), DayDayCook (a culinary content brand), and a popular inline platform called WeDoctor.

All this makes the company a leading fintech service in Asia. Such a high diversification of investments allows AMTD Digital to find an individual approach to every client. Most of the company’s revenue is fees and commissions for the digital financial services it provides. Let’s find out how perspective the company’s market is.

The market and competitors of AMTD Digital

According to marketing research from Google, Temasek, and Bain, the financial digital market services volume in the Asia-Pacific Region was $11 billion in 2020. By 2025, it may reach $38 billion, with an average annual growth rate of 28%. The key reason for this surge will be a digital payment expansion, which, in its turn, will boost investment, lending, and insurance markets.

Competitors of AMTD Digital are classic financial institutions, fintech companies, and mobile insurance platforms.

Financial performance

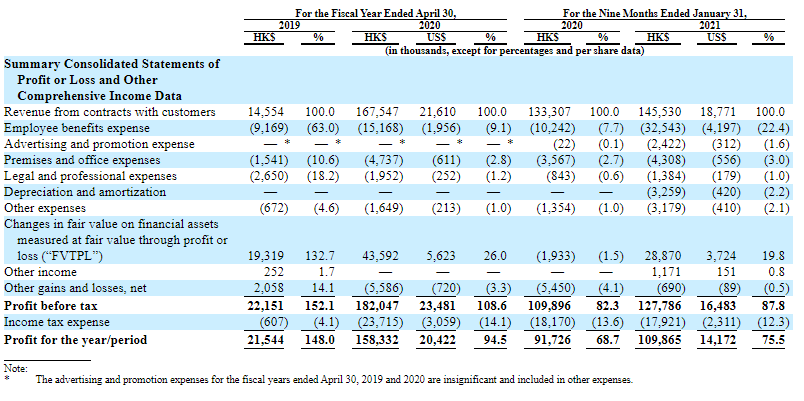

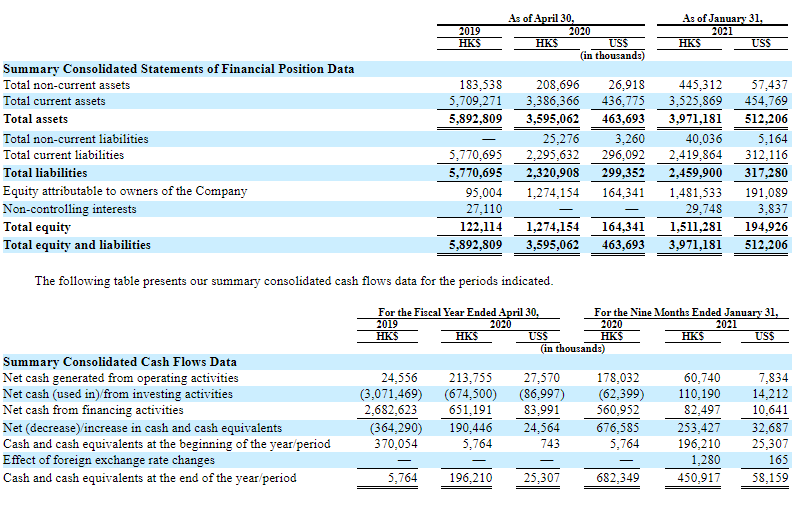

AMTD Digital is filing for an IPO being profitable with wide profit operating margins. According to the F-1 form report, the company’s revenue over the 9 months of the 2021 financial year was $18.77 million with a relative growth of 9.2% against the same period of 2020. At the same time, it's worth remarking that due to increased staffing expenses, operating expenses over 9 months of the 2021 financial year have almost trebled if compared with the same period in 2020.

Nevertheless, AMTD Digital’s net profit over the above-mentioned period was $14.17, a 19.8% relative growth in comparison with 2020. As a result, the profitability was 78.34%, which indicates the company’s business margin.

Cash and cash equivalents on the company’s balance sheet are $58.6 million, while its total liabilities equal $320 million. The stockholder equity is $192.7.

The company’s business is effective, earns the net profit, and has an acceptable debt load. All these factors taken together imply quite high financial stability.

Summarizing the above, we may emphasize a low revenue growth rate, as well as an acceptable growth rate of the net profit and profitability. The company’s major task for the nearest future is the fulfillment of its market potential because the sales growth rate is lower than that of the target market volume.

Strong and weak sides of AMTD Digital

Let’s highlight the advantages and risks of investing in this issuer’s shares. Among the strong sides of AMTD Digital, I would name:

- A promising target market.

- Sound management.

- Business margin.

- Innovativeness.

- The company generates net profit.

The following factors might be considered as the company’s weaknesses:

- Unfavourable legal structure in Asia.

- To develop its business, the company can participate in the rounds of financing.

- The company is quite young and its successful activity history is rather short.

IPO details and estimation of AMTD Digital capitalization

During the IPO at the NYSE, AMTD Digital is planning to sell 16 million American depositary shares (ADS) at the price of $6-8 per share and raise $120 million with the capitalization of $1.4 billion. The underwriters of the IPO are AMTD Global Markets Limited, Livermore Holdings Limited, and Maxim Group LLC.

To assess AMTD Digital’s capitalization, we use two multipliers, the Price-to-Sales (P/S Ratio) and the Price-to-Earnings (P/E Ratio). At the time of the IPO, multipliers are 59.96 and 60.50 respectively. We should admit that the numbers are extremely high, that’s why the growth potential during the lock-up period is only about 20%. On the whole, the price dynamics will be defined by the company’s report for the third quarter of 2021.

Considering all that said along with the current market environment, I’d recommend adding AMTD Digital shares for speculative investments and it would be wise to enter this position in small “batches”.

About us:

R Blog RoboForex - actual news and reviews on the Forex and stock markets, as well as financial markets analytics. The authors of the R Blog publish daily articles on trading and investments so that our readers can get the most complete and multifaceted information that helps to improve their level of knowledge about trading in the financial markets.

Contact us:

Chief editor - Timofey Zuev

Address: RoboForex Ltd, 2118 Guava Street, Belama Phase 1, Belize City, Belize

Phone: +65 3158 8389

E-mail: info@roboforex.com