IPO of Robinhood Markets: Noble Bandits of Financial Markets

6 minutes for reading

Recently, there appeared few companies, whose brands became a common noun. We all know Jeep, a pioneer of the entire vehicle class, hot tubs from Jacuzzi, a recording device developed by Dictaphone, and sports footwear manufactured by Keds. And now, after the stock index crash in March 2020, a lot of retail investors appeared on the market, who are called “robinhoods” after the application of Robinhood Markets.

On July 1st, Robinhood Markets submitted an IPO request to the Securities and Exchange Commission (SEC) by the SEC S-1 Form. The IPO date hasn’t been announced yet. The company will be trading at the NASDAQ, under the “HOOD” ticker. Let’s go deeper into the company’s business and find out whether its shares are interesting for investing in.

Business of Robinhood Markets

Robinhood Markets was founded in 2013 by Stanford students Baiju Bhatt and Vladimir Tenev. The company created an application with the same name, thanks to which the world of trading and investments welcomed a lot of retail investors. Robinhood is very popular with dominating generations of millennials and zoomers, young people, who have been living online on the Internet since, perhaps, their births.

The key products of Robinhood Markets are:

- Robinhood Gold

- Current accounts (linking to a bank card)

- Fractional shares

- Cryptocurrency trading

- Training through Robinhood Learn

Robinhood Gold is a fee-based service ($5 per month), which offers clients additional market data, analytics from MorningStar, and an option of instant account depositing. As of the end of the first quarter of 2021, the service had 1.4 million users.

Robinhood Learn is a department of training and analytics, which is a part of “Snacks”, a media with 32 million subscribers. The company offers free access to closed news channels, such as Barrons, Reuters, and Wall Street Journal. Using this service, users are free to create their own lists of the most interesting instruments (Robinhood Lists).

Over the last 12 months, the company’s client base has quadrupled. As of March 31st, 2021, there are over 18 million active accounts at Robinhood with $80 billion under management. On average, the account balance of each client is $4.4 thousand.

The company says that the average age of its clients is 31. Most of them have little experience in the industry and that’s the reason for their losses. As a result, last week FINRA fined Robinhood $70 million for “misinforming clients and encouraging risky strategies”.

The market and competitors of Robinhood Markets

In the USA, investment activities are very popular with the population. An overall level of financial awareness is on average higher than in other advanced economies. In 2020, there were over 50 million private investors, which is almost the same as the population of some countries, for example, Ukraine.

Robinhood’s key competitors are the largest brokerage companies:

- Fidelity

- Schwab

- TD AmeriTrade

- E-Trade

- Interactive Brokers

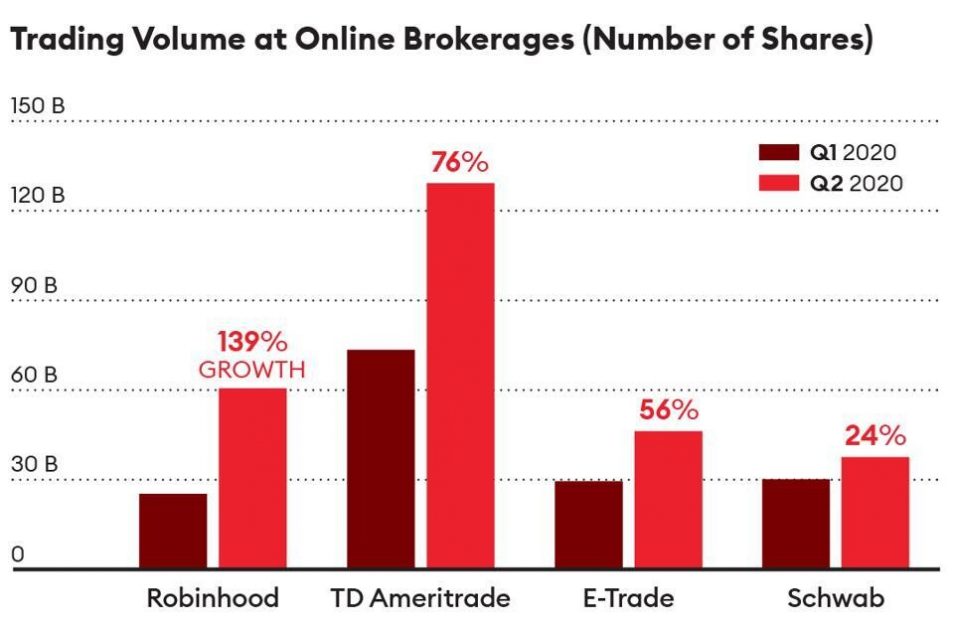

The company’s main advantage is zero commission for transactions and no fees for using the platform. Taken together, these factors helped the company to develop a client base faster than its competitors.

Financial performance

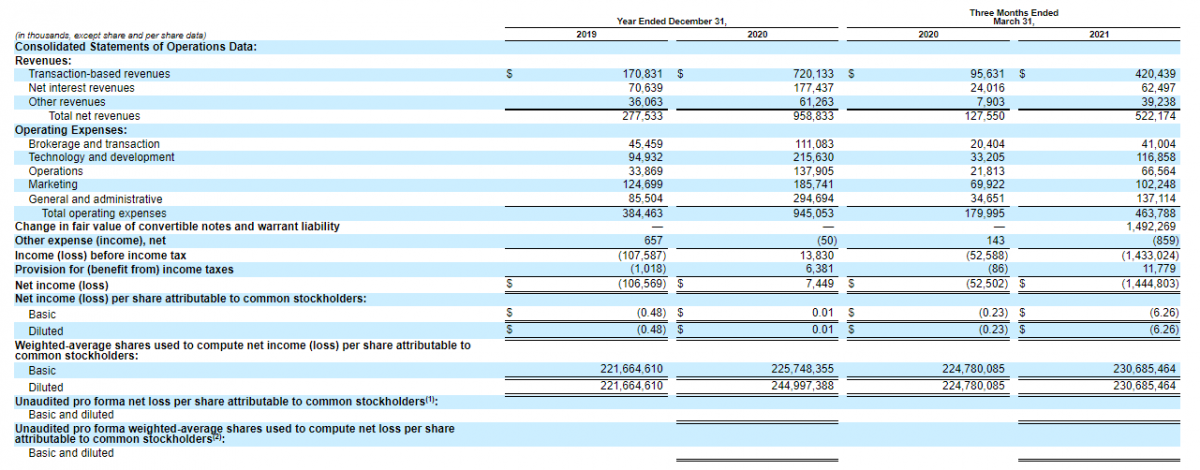

Robinhood Markets is filing for an IPO being profitable at the year-end of 2020, although in the past it repeatedly recorded losses. However, it’s okay for fintech companies. Robinhood’s revenue has been growing at a very impressive pace, so let this parameter be the first to be analysed.

In 2020, the company’s sales were $958.83 million, a 245.81% increase relative to 2019. In the first quarter of 2021, this parameter reached $522.17 million, a 409.38% increase if compared with the same period of 2020. Over the last 12 months, the company’s revenue was $1.35 billion.

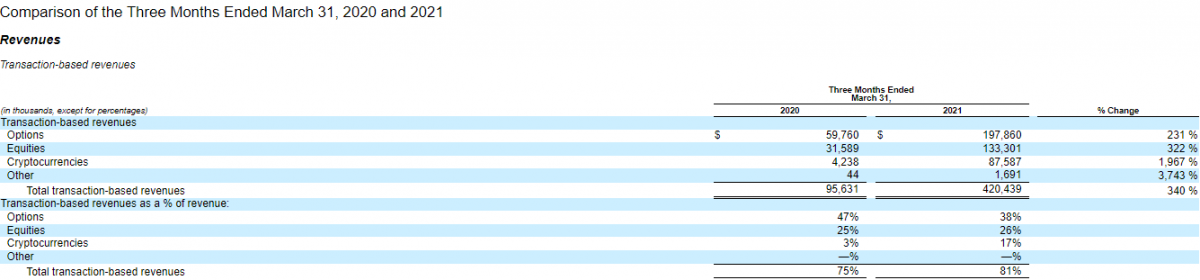

The key contributors to Robinhood’s revenue are:

- "Payment for order flow", when the order is executed not by Robinhood but market makers, which pay the company its commission.

- Robinhood Gold subscription.

- Commissions from cryptocurrency trading (Dogecoin mostly).

Robinhood’s net profit in 2020 was $7.45 million against the net loss of $106.57 million the year before. The company earns about 2% of its clients’ assets. In the first quarter of 2021, there was a loss of $1.4 billion caused by issued bills correction. It happens when a share price increases relative to the loan sum and Robinhood records paper losses. That’s why one shouldn’t panic because it influences the company’s business only indirectly.

Strong and weak sides of Robinhood Markets

Having analyzed the company’s business model, we can highlight its strong and weak sides. I believe Robinhood’s advantages are:

- The company’s target audience is dominating generations of millennials and zoomers.

- At the year-end of 2020, Robinhood recorded the net profit.

- The company’s revenue has been growing by over 200% every year, making it the leader of the industry in this aspect.

- Easy-to-use and user-friendly product.

- No commission for transactions.

- Sound marketing: the brand has become a common name.

The following might be considered as risks of investing in Robinhood:

- The company had been loss-making for a long time and is not planning to pay dividends.

- The essential part of the company’s revenue was generated by commissions from trading a cryptocurrency, namely Dogecoin. Even the issuer itself is not sure whether the coin will remain popular in the future. Thereby, there might be drops in the profit.

- In the future, Robinhood may face the problem of retaining its client base because investors quickly lose their money due to the misuse of risky instruments.

- The company has been fined by FINRA on numerous occasions for low-quality information support offered to trades.

IPO details and estimation of Robinhood Markets capitalization

During the latest round of financing in September 2020, the company raised $800 million. The underwriters of the IPO are Siebert Williams Shank & Co., LLC, Samuel A. Ramirez & Company, Inc., Loop Capital Markets LLC, Academy Securities, Inc., Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, Barclays Capital Inc., Citigroup Global Markets Inc., Santander Investment Securities Inc., BTIG, LLC, BMO Capital Markets Corp., Rosenblatt Securities Inc, Piper Sandler & C, Wells Fargo Securities, LLC, Mizuho Securities USA LLC, and Wells Fargo Securities, LL. The volume and the price range haven’t been announced yet.

To assess the company’s potential capitalization, we use a multiplier, the Price-to-Sales ratio (P/S ratio). For fintech companies during the lock-up period, it may reach 35-40.

In this case, the potential capitalization of Robinhood Markets may be $45-55 billion ($1.35 billion * 40). If the current growth continues at the same pace, the company’s revenue by the end of 2021 may reach $4 billion. If it happens, a valid estimate of the company value may be $160 billion.

Considering all that said, I’d recommend this company for mid/long-term investments.