Best Medium-term Strategies: Larry Williams's Moving-Average Based Strategy

4 minutes for reading

Larry Williams described this strategy in his book "Long-term Secrets to Short-term Trading". It suits both Forex and other financial markets. With timeframes, things are more complicated: technically, the strategy suits TFs from M1 to MN but as long as from opening to closing the position more than one candlestick can pass, trading on small TFs can be unprofitable due to fixed spreads, like in Forex.

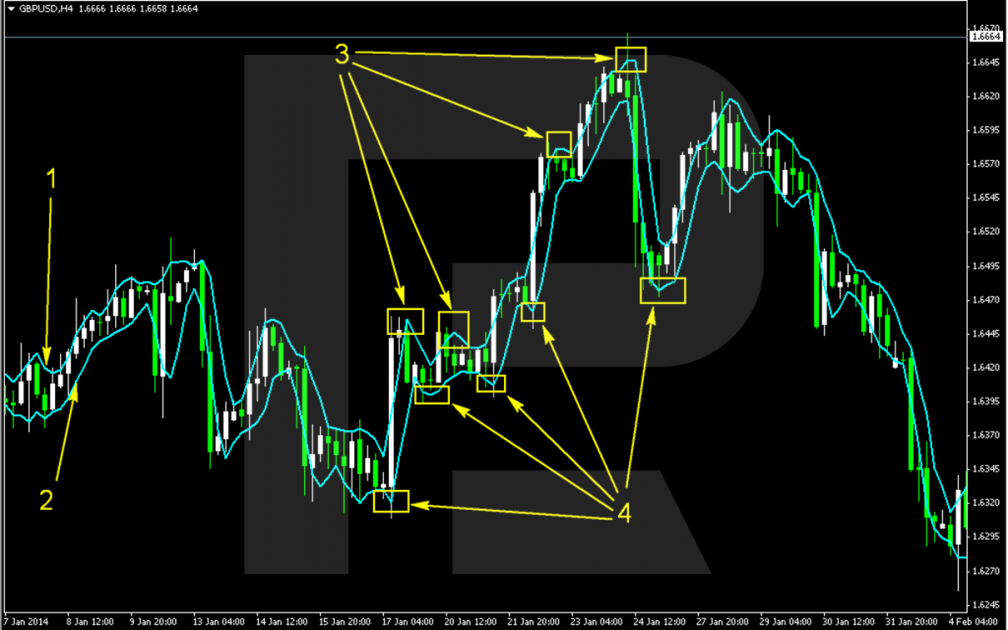

The desktop of Larry Williams strategy

Explications:

- A Simple Moving Average with a 3 period drawn through High

- A Simple Moving Average with a 3 period drawn through Low

- Local highs of the SMA (High)

- Local lows of the SMA (Low)

As a result, we get a channel that will work by a special algorithm along the prevailing trend. The prevailing trend is the one that has recently renewed local extremes of the MAs. If the highs have been renewed, the trend is ascending; if the lows have been renewed, the trend is descending.

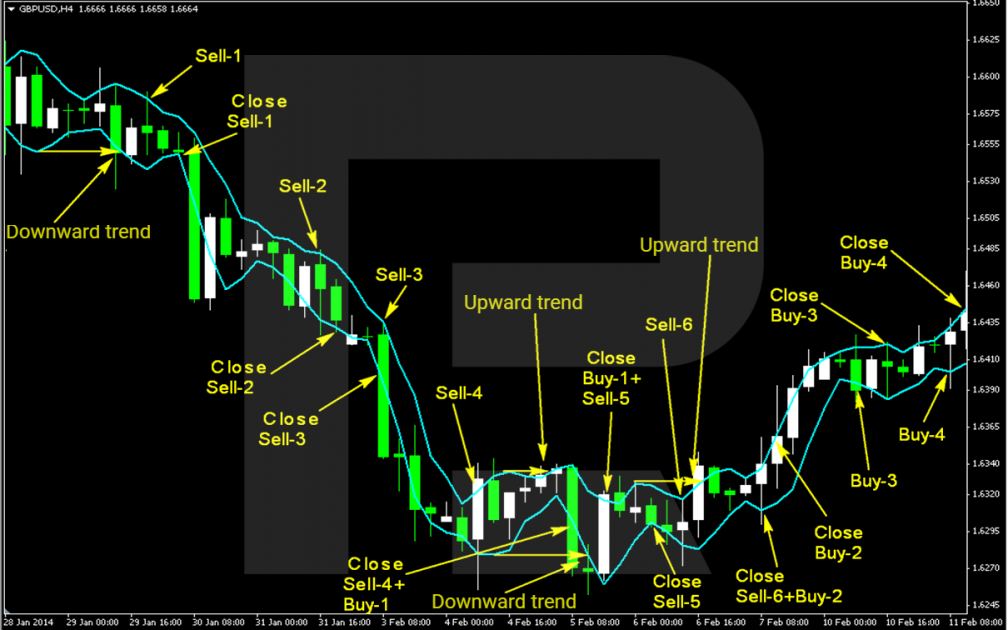

Signals to buy by the strategy

Larry Williams suggests the following conditions for buying: in an uptrend, open a position when the price touches the SMA (Low) and close it when the price touches the SMA (High). As soon as one trade is closed, open another one and keep going until the trend changes to descendin. If a signal to buy coincides with a trend reversal, skip the signal and start trading when the trend becomes ascending again.

An example of signals to buy:

Note that in the picture, there are several buying opportunities, but keep in kind that only one position must be opened and closed before you open the next one.

Signals to sell by the strategy

For selling, the main trend must be descending. Sell as soon as the price touches the SMA (High) and close your position when it touches the SMA (Low). As soon as one trade is closed, open the next one by the same algorithm. If the conditions appear at a price reversal, also skip the signal and start selling again as soon as the trend changes for a downtrend again.

An example of a signal to sell:

Do not forget that only one position must be opened at a time, and the next one can be opened as soon as you close the first one.

Stop Loss and Take Profit in Larry Williams strategy

This strategy implies no Stop Loss, or at least, the author says nothing about this in his book. As an SL, use a trend reversal and an opposing signal. In other words, imagine you are in an uptrend and open a long position as soon as the price touches the SMA (Low); however, the trend changes for a descending one. Then you can close you long position as soon as a signal to sell emerges, or when the price touches the SMA (High)

Take Profit is neither used.

Money management by Larry Williams

As long as we do not have an SL, trade a certain lot, not a fixed deposit share.

An example of trading by the strategy

Note that all trading operations in the example could be closed with a profit. This means the strategy can be as profitable as easy. The main trick is to use a TF large enough for the profit not to be eaten up by spreads and commission fees.

The only disadvantage is that it does not let you step away from the screen to be in time opening and closing positions. Still, it is worth it with profitable sequences being so long.