IPO Paycor HCM Inc: Human Capital Management in the 21st Century

6 minutes for reading

The most important resource for any company is people. The human factor will always play a critical role in business. Wise management of personnel consisting of two people is as important as working with the staff of several thousand employees. People are very much alike but have many unique aspects at the same time. Combining these aspects and use them to a company’s advantage is one of the most difficult tasks for any manager. Luckily, nowadays there are a lot of advanced and cutting-edge technologies to help them analyze data and build algorithms through Saas platforms.

Today, there will be an IPO of Paycor HCM Inc., a leading provider of platforms for managing human capital in the USA. The IPO will take place at the NASDAQ and the company’s shares will start trading tomorrow, under the ”PYCR” ticker. Let’s discuss aspects of the company’s business and products.

Business of Paycor HCM Inc.

Paycor HCM Inc. was founded in 1990 with its headquarters in Norwood, Ohio. The company is run by Raul Villar Jr., who earlier was the head of AdvancedMD. Paycor’s mission is to improve the quality of human capital management by implementing cutting-edge solutions for acquiring analytical information online.

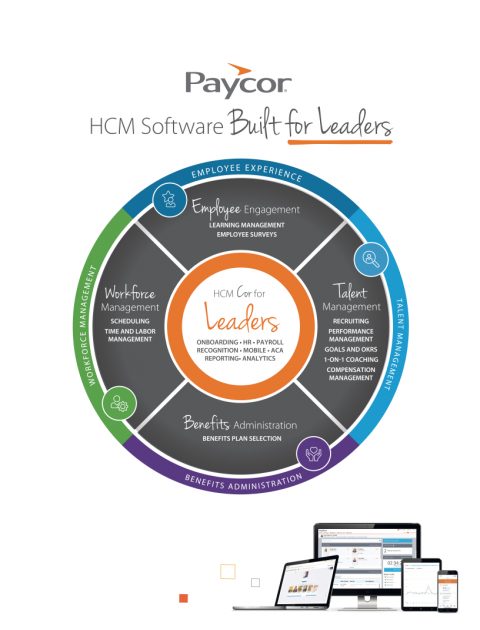

The company’s unified cloud platform allows improving the personnel management procedure, being a single employees database. It takes into account the hobbies, personal talents, and psychological aspects of each employee. The platform is flexible and scalable, thus providing businesses with the opportunity to pursue a reasonable personnel policy.

Paycor’s product allows:

- Managing payroll fund.

- Managing personnel by setting goals and monitoring deadlines.

- Managing perks and benefits for particular employee groups.

- Taking into account employees’ personal talents.

- Involving employees into corporate culture.

Over the last 3 decades, human capital management has evolved from simple personnel record keeping to an entire system for improving labour efficiency, thus making corporate HR departments strategically important.

The company’s major clients are medium and small-sized businesses. Over 28,000 firms with a total staff of almost 2 million employees use Paycor’s platform. Before analysing the company’s financial performance, let’s take a look at the HCM market volume.

The market and competitors of Paycor HCM Inc.

According to Paycor’s estimations, its target market in the USA might reach $22.5 billion by 2022. The average annual growth rate from 2017 to 2020 was 9.2%. As of 2020, there were 1.3 million medium and small-sized businesses with 61.2 million employees.

The key growth factors will be the necessity to introduce standard rules for human capital management and business processes. The USA is leading advanced economies in the implementation of cloud technologies for HR and HCM.

Paycor’s key competitors are:

- Automatic Data Processing (ADP)

- EmployWise

- SumTotal

- Workday (NASDAQ: WDAY)

- Ceridian HCM (NYSE: CDAY)

- Ultimate Software Group (NASDAQ: ULTI)

- Oracle (NYSE: ORCL)

- SAP (NYSE: SAP)

- Kronos (NYSE: KRO)

As we can see, the list of competitors has both famous and relatively unknown companies.

Financial performance

Paycor suffered pretty much from the COVID-19 pandemic because a lot of medium and small-sized businesses closed due to the lockdowns. The company’s revenue over the last 12 months was $335.63 million, while the free cash flow was just $5.3 million.

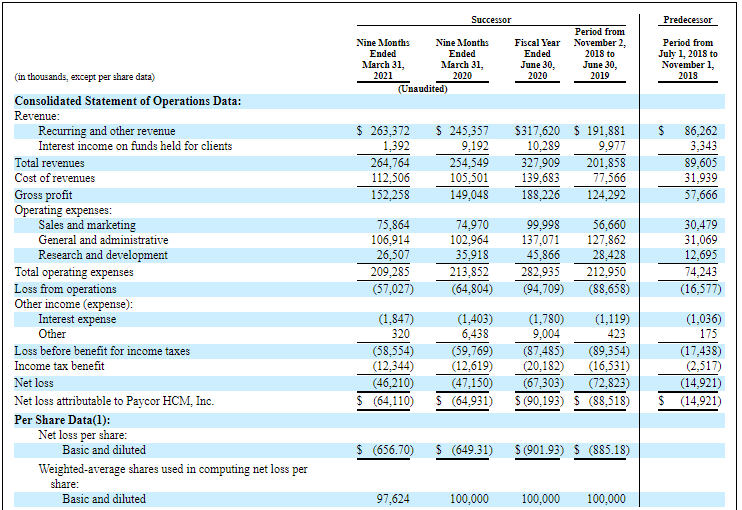

According to the S-1 financial statement form, the revenue over the last 9 months as of March 31st, 2021, was $264.76 million with a 4.01% relative growth if compared with the same period of 2020. In the fiscal year that ended on June 30th, 2020, the revenue was $327.91 million with a 12.50% increase in comparison with 2019. The revenue tends to reduce but the situation may quickly change on the recovery growth. The 3rd quarter report will be pivotal.

The company’s loss over the last 9 months as of March 31st, 2021, was $64.11 million with a 1.26% drop if compared with the same period of 2020. The gross period over the last 9 months as of March 31st, 2021, was $152.26 million with a 2.15% relative growth in comparison with 2020.

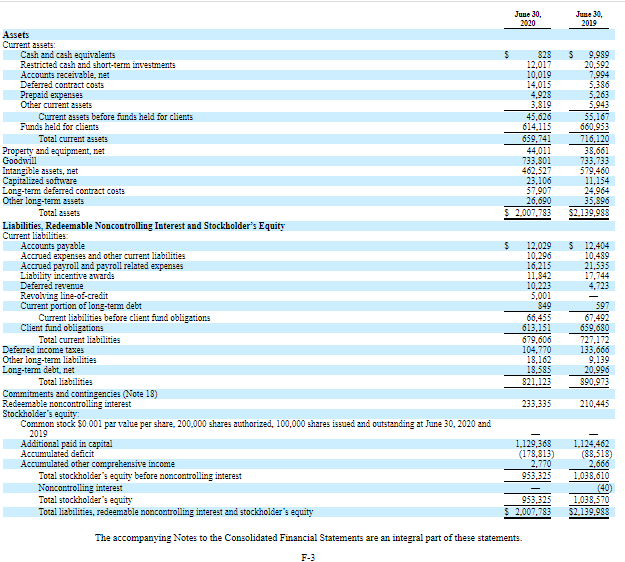

The company’s total liabilities equaled $43.77 million, while cash and cash equivalents on its balance sheet are $25.44 million. As we can see, Paycor has a heavy debt load (its negative cash position is $18.11 million). Nevertheless, its target market prospects and the global economic recovery give grounds for expecting positive financial results at year-end 2021.

Strong and weak sides of Paycor HCM Inc.

Having acquired comprehensive information on the company’s business model, financial performance, and target market, let’s highlight its strong sides and investment risks. I believe Paycor’s strong sides are:

- The product that meets all demands of the company’s target audience.

- A highly scalable business model that can be easily introduced to international and global markets.

- Sound management.

- HCM market leadership.

- Underwriters of the IPO are leading investment banks.

The following might be considered as risks of investing in Paycor:

- The revenue growth rate dropped due to the coronavirus pandemic consequences.

- Heavy debt.

- The company doesn’t generate net profit and isn’t planning to pay dividends.

- Strong competition in the industry.

IPO details and estimation of Paycor HCM Inc. capitalization

During the IPO, Paycor is planning to sell 18.5 million common shares at the price of $18-21 per share. If shares are sold at the highest price in this range, the IPO may raise $360.80 million and the company’s capitalization might be up to $3.34 billion.

The underwriters of the IPO are Truist Securities, Inc., Stifel, Nicolaus & Company, Incorporated, Robert W. Baird & Co. Incorporated, Raymond James & Associates, Inc., Needham & Company, LLC, JMP Securities, LLC, Fifth Third Securities, Inc., Cowen and Company, LLC, Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, Jefferies LLC и Credit Suisse Securities (USA) LLC.

Since the company doesn’t generate net profit, to assess its potential capitalization, we use a multiplier, Price-to-Sales ratio (P/S ratio). At the time of the IPO, P/S is 9.88. For the tech sector, the average P/S value for the companies filing for an IPO is 15. In this case, the upside for the Paycor shares may be 51.82% (15/9.88 * 100 - 100).

Considering all that said, I’d recommend this company for short-term speculative investments.