Quarterly statements from IBM, Netflix, Coca-Cola

6 minutes for reading

The season of financial statements for the second quarter of 2021 is in full swing and today we’ll tell you about the success of three companies at once, IBM, Netflix, and Coca-Cola. So, let’s find out what numbers published by them made investors happy this week, who the market responded to, and what our analyst Maksim Artyomov has to say about their shares.

We’d like to remind you that IBM, Netflix, and Coca-Cola reports for the first quarter of 2021 can also be found in our blog.

IBM report: the biggest revenue growth over 3 years

An American technology corporation IBM published Its report for April-June on July 19th. The remarkable thing is that the statistics turned out to be much more interesting than analysts predicted. The aspect that took the spotlight was the company’s revenue, which demonstrated the most impressive growth over the last three years.

It seems like the strategy of the IBM Chairman and CEO Arvind Krishna is working. It was he who suggested to re-target the company’s efforts from manufacturing hardware and creating software to the development of artificial intelligence and cloud technologies. This segment’s revenue added 13% up to $7 billion.

Over two days after this strong statement was published, International Business Machines (NYSE:IBM) shares added 2.45% up to $141.3. However, the trading session of July 22nd ended with a drop of 0.42% down to $140.71.

Important data from the report

- Revenue — $18.75 billion, +3.5%, forecast $18.29 billion.

- Return on share — $2.33, +7%, forecast — $2.29.

- Net profit — $2.1 billion, +8%.

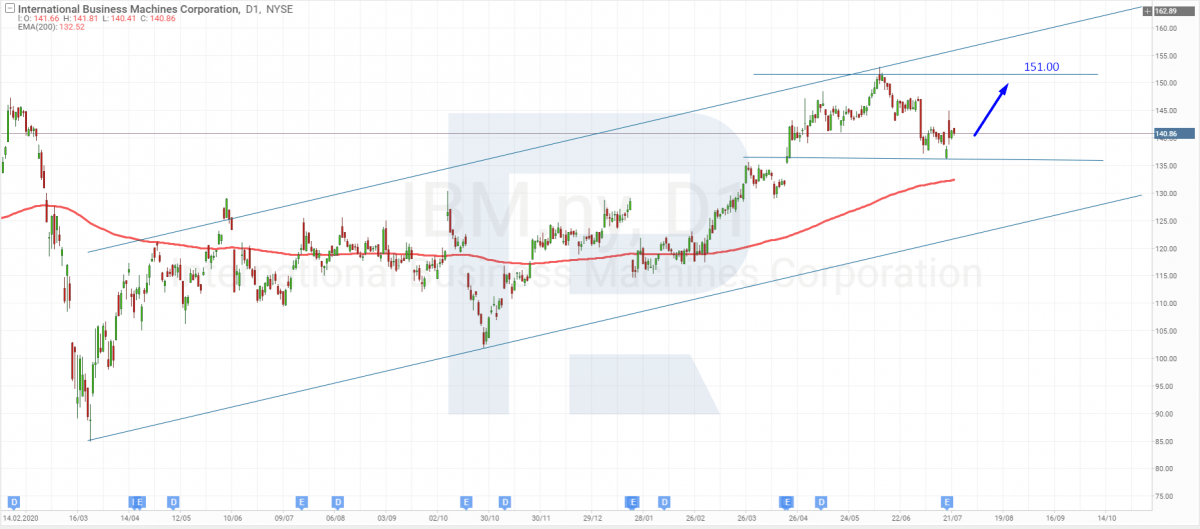

Tech analysis of IBM shares by Maksim Artyomov

“Inspired by the revenue growth, IBM shares continue moving sideways. After testing the support level, the price rebounded and is now in a borderline state – whether to continue growing or return to the support level. Taking into account the company’s revenue growth, one may assume that the good news may help its shares to recover losses.

The upside target is the closest resistance level at $151. A signal to confirm this bullish scenario is the 200-day Moving Average: the asset continues trading above it”.

Netflix report: the first decline in the number of American and Canadian subscribers in two years

On July 20th, Netflix, the company that a popular streaming platform with the same name, shared its financial data for the second quarter. The total number of subscribers was 209.2 million, a 1.54 million increase over the last three months.

Although this indicator was better than analysts predicted (forecast was 1.12 million), the growth rate of the number of paid subscribers slowed down. However, it was not the thing that made investors unhappy – the number of American and Canadian subscribers declined for the first time in two years as the company has lost 433 thousand users over April-June.

At the same time, the good news is that Netflix is planning to enter the video games market. The company said that both proprietary games and licensed products of other companies would be added to its subscription. The things you have to do to attract new clients, right?

On the day of the statement release, Netflix (NASDAQ:NFLX) shares plunged and since then have been moving within the downtrend, it’s three consecutive trading sessions. Over this period, shares lost 3.85% down to $511.77.

Important data from the report

- Revenue — $7.34 billion, +19.4%, forecast — $7.32 billion.

- Return on share — $2.97, +86.8%, forecast — $3.18.

- Net profit — $1.35 billion, +87.5%.

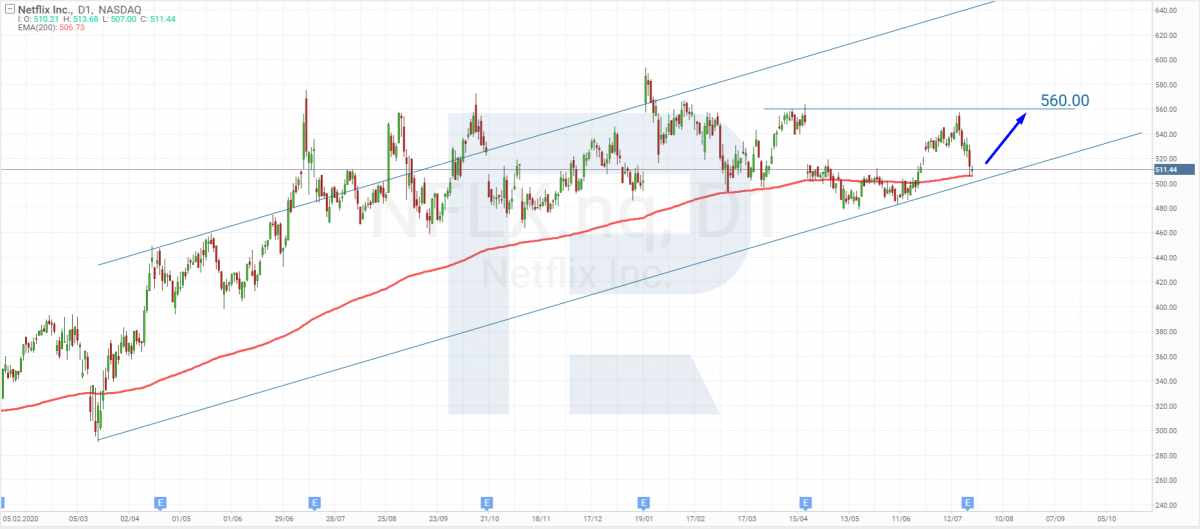

Tech analysis of Netflix shares by Maksim Artyomov

“After losing subscribers and investors’ trust, Netflix shares continue falling. By now, the price has reached the rising channel’s downside border and the 200-day Moving Average. A test of the support level, provided that investors remain positive, may result in a rebound.

In this case, the asset may resume its ascending tendency with the upside target at the closest resistance level at $560. If later the price breaks the resistance level, it may be heading to update its all-time highs”.

Coca-Cola report: increase of pre-pandemic numbers

Another company that reported on its financial results for the second quarter is Coca-Cola; it happened on July 21st. The slow recovery of the global market helped the company to finally beat its pre-pandemic numbers.

Inspired by its sound report, the company revised the forecasts for 2021 and now expects its organic revenues to add 12-14% instead of 10%. As for the revised return on a share, it is now expected to add 13–15%, although it wasn’t expected to be more than 10%.

When the quarterly report was published, Coca-Cola (NYSE:KO) shares added 1.29% up to $56.55. However, the next trading session was not so optimistic: shares lost 0.14% down to $56.47.

Important data from the report

- Revenue — $10.1 billion, +42%, forecast — $9.24 billion.

- Return on share — $0.61, +17.3%, forecast — $0.55.

- Net profit — $2.64 billion, +48%.

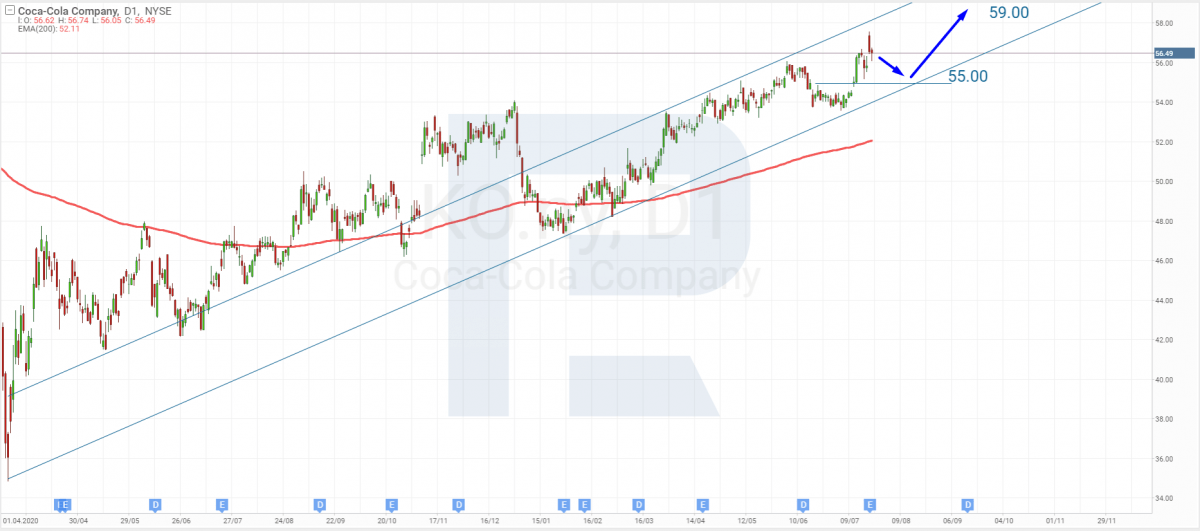

Tech analysis of Coca-Cola shares by Maksim Artyomov

“Inspired by the revenue growth, Coca-Cola shares skyrocketed and updated their highs, although later, when this frenzy died down, this movement was followed by a new decline to eliminate the price gap. At the moment, the asset is expected to return to the support level at $55.

Considering that the 200-day Moving Average continues growing, one may assume that the price may later rebound from the support level and resume growing. In this case, the upside target will be at $59”.

Summing up

This week, successful statements for the second quarter of 2021 were published by such popular companies as IBM, Netflix, and Coca-Cola. Judging by the statistics from IBM, one may draw a conclusion that a shift of priorities towards artificial intelligence and cloud technologies paid off: the revenue has demonstrated the biggest improvement over three years.

Netflix experiences a slowdown in the growth rate of the number of new subscribers, while its key market is doing terrible – the number of paid users reduced by 433 thousand. To attract new clients, the company is planning to enter the video games market.

Coca-Cola was happy to announce that the quarterly report for April-June surpassed pre-pandemic numbers. that's quite understandable, of course – in many countries, social restrictions are being removed, people are getting vaccinated, restaurant business and entertainment sector are recovering.