Quarterly statements from Twitter, Snap, and Intel

5 minutes for reading

Today, we’ll give you a review of the most interesting quarterly statements that were published at the end of the previous trading week. Financial reports for the second quarter of 2021 from such American IT corporations as Twitter, Snap, and Intel are already here. How does that sound? We think it’s great.

Twitter report: the biggest revenue growth over 7 years

On July 22nd, Twitter, the company that owns a popular microblogging platform of the same name, shared its success over April-June. The most impressive thing for investors was the fact that the company’s quarterly revenue expanded by 74% in comparison with the same period of 2020.

It is noteworthy that Twitter hasn’t demonstrated such big numbers over the last seven years. Thanks to amazing advertiser demand, the advertising revenue alone added 87% up to $1.05 billion.

However, not only the revenue skyrocketed – the number of social network users jumped 7 million and the number of daily users reached 206 million. Still, the published statistics didn’t drive up an upsurge of the company’s shares. On July 22nd, Twitter (NYSE:TWTR) shares added only 0.04% and reached $69.57. The next day though, the improvement was more significant, +3.05% up to $71.69.

Important data from the report

- Revenue — $1.19 billion, +74%, forecast — $1.06 billion.

- Return on share — $0.08, −95%, forecast — $0.08.

- Net profit — $65.6 million, +105%.

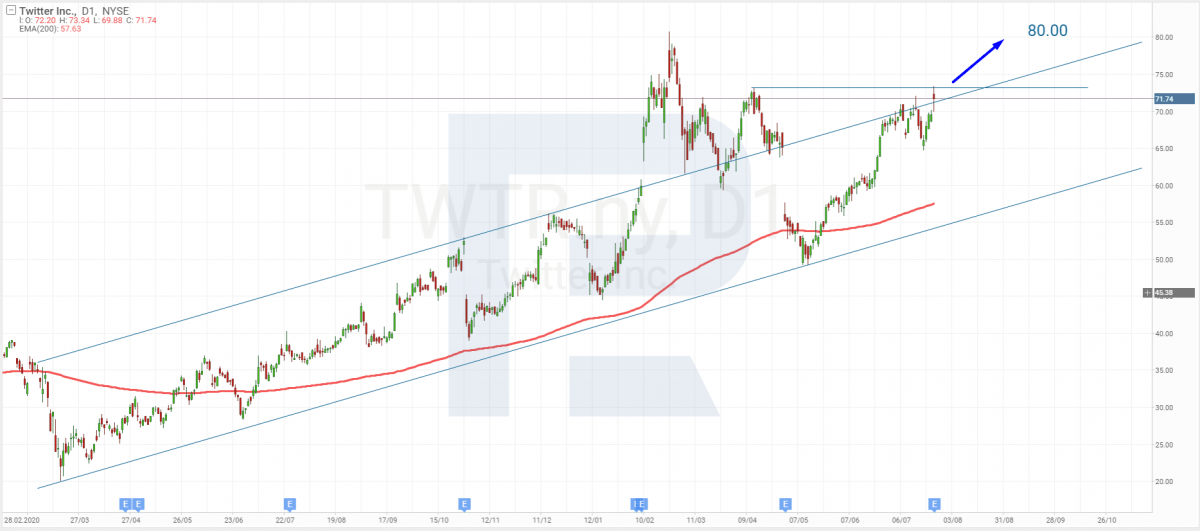

Tech analysis of Twitter shares by Maksim Artyomov

“After completing the correction, Twitter shares continue growing to update its closest highs. By now, the price has left the ascending channel by breaking the resistance level. The asset is still trading above the 200-day Moving Average to indicate the ascending tendency.

In the nearest future, the price may form a slight pullback, which may later be followed by another wave to the upside with the target at $80”.

Snap report: the loss cut in half

A quarterly statement published on July 22nd by Snap, which owns a popular messenger called Snapchat, surpassed Wall Street analysts’ expectations. The active audience expanded by 23% and reached 293 million users.

Inspired by this financial data, the IT sector representative even revised its forecasts for the third quarter of 2021. Now the company expects its revenue growth to be 58–60% if compared with the same period of 2020. According to the forecast, the revised EBITDA value will be $100–120 million, which is a 78–114% increase.

Investors were really active in their response to the company’s financial report for the second quarter. At the end of the trading session on July 23rd, Snap (NYSE:SNAP) shares added 23.82% and reached $77.97. during the trading session, the high was at $79.18 per share.

Important data from the report

- Revenue — $982.1 million, +116%, forecast — $846 million.

- Return on share — $0.1, +220%, forecast — minus $0.01.

- Net loss — $151.7 million, −53%.

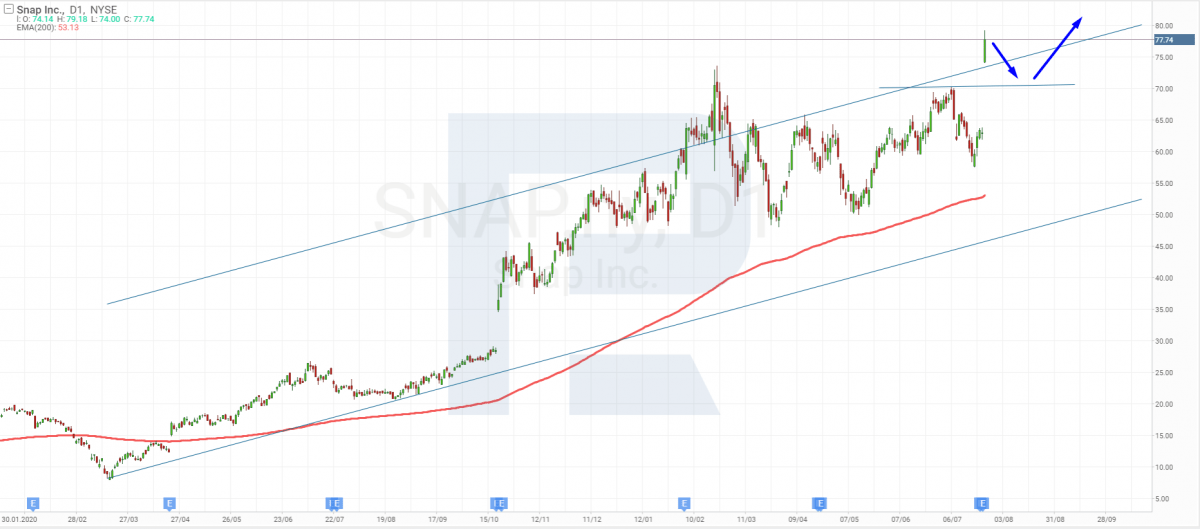

Tech analysis of Snap shares by Maksim Artyomov

“Inspired by a double-digit increase in the revenue, Snap shares have added over 24%. All this implies a further uptrend. At the moment, after breaking the resistance level, the asset has formed a price gap. As it often happens, the market doesn’t like any “voids”, so the instrument is expected to eliminate the gap, at least partially.

In this case, the price may return to the resistance level at $70, test it, and then continue growing with the upside target at $80”.

Intel report: revenue and profit are decreasing, shares are cheapening

Just like the previous two companies, Intel also released its financial statement for the second quarter of 2021 on July 22nd. Over the course of three months, both revenue and profit couldn’t show any growth. Intel explains this decline by increasing expenses on chip manufacturing, expansion of and renovation production, and limited supplies.

Revenue of the Intel department engaged in sales of PC chips increased by 6% if compared with the similar period of 2020 up to $10.1 billion. However, sales of chips for data centers dropped 9% — the quarterly revenue from this segment reduced to $6.5 billion.

Market players’ response to this news was negative. On July 23rd, Intel (NASDAQ:INTC) shares lost 5.29% down to $53. During the trading session, the price fell even deeper as that day’s low was at $52.32.

Important data from the report

- Revenue — $18.5 billion, −6%, forecast — $17.8 billion.

- Return on share — $1.28, +4%, forecast — $1.07.

- Net profit — $5.06 billion, −1%.

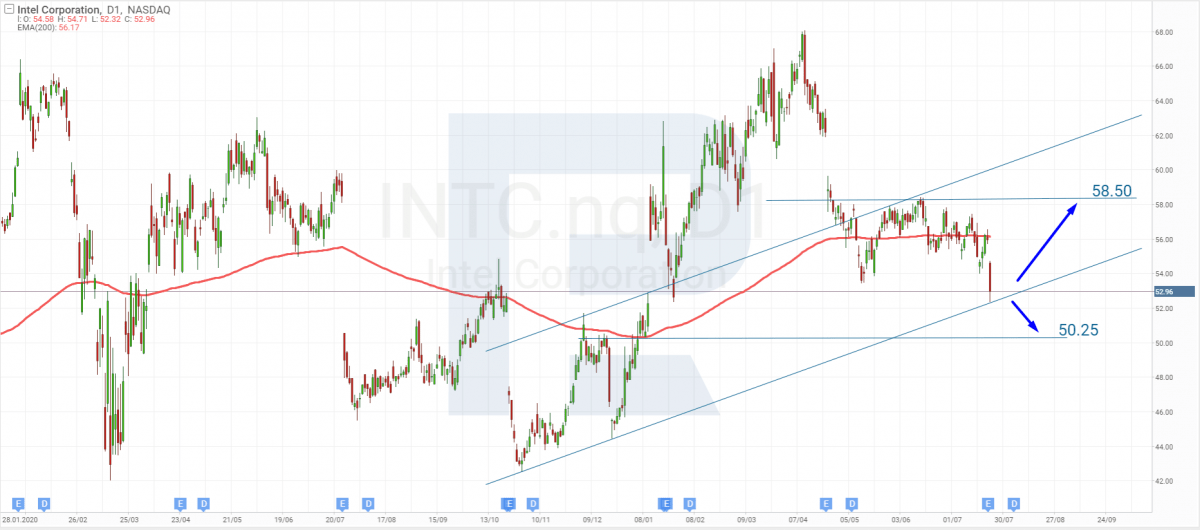

Tech analysis of Intel shares by Maksim Artyomov

“Intel has lost pretty much recently as the price is currently moving close to rising channel’s downside border. If the asset breaks the support level, it may continue trading downwards. The downside target is the next support area at $50.25.

In the future, the asset may test the support area, rebound from it, and then resume its ascending tendency. As long as the price is trading below the 200-day Moving Average, bears will control the market. At the same time, an alternative scenario implies a rebound from the channel’s downside border and another growth. In this case, the ascending movement may reach the next resistance area at $58.5”.

Summing up

On July 22nd, such technological corporations as Twitter, Snap, and Intel, published their financial statements for the second quarter of 2021. The first company reported the biggest revenue growth over seven years, the second – a 50% decline in losses, while the third one announced drops in both revenue and profit. Twitter and Snap shares went up, while Intel took a beating.