Top League: Quarterly statement from Apple, Alphabet, Microsoft, and Facebook

7 minutes for reading

We’re rubbing our hands with pleasure all on edge to tell you about financial reports for the second quarter of 2021 from such IT giants as Apple, Alphabet, Microsoft, and Facebook. The most important financial data, forecasts for the next quarter, and, of course, tech analysis of these corporations from Maksim Artyomov – buckle up and enjoy the ride for the next few minutes.

Alphabet report: increase in advertising expenses as a sign of the global economic recovery

Businesses are slowly increasing their advertising budgets and it surely has a positive influence on the financial statistics of one of the biggest market players on the digital advertising market. For example, Alphabet’s revenue in this sector in the second quarter was $50.44 billion, a 69% increase if compared with the same period last year.

The results of a very popular video hosting YouTube are also very impressive. This platform’s revenue in April-June was $7 billion, an 89% increase. As a comparison, the total revenue of Netflix was $7.34 billion.

Alphabet perseveres in its attempts to continue battling Amazon and Microsoft in the cloud and artificial intelligence industries. Yes, Google Cloud still hasn’t been able to climb into positive territory but the volume of expenses went from $1.43 billion to $591 million, and that’s a 59% decrease. At the same time, Google Cloud’s revenue added 54.3% up to $4.63 billion.

Because of a renewed growth of the new COVID-19 case, the corporation decided not to announce its forecast for the third quarter. However, it found something else to surprise investors with: the company’s share buyback program, which equals $50 billion, will accept both Class A and C shares.

On July 28th, the next day the statement was released, Alphabet’s Class А (NASDAQ:GOOGL) shares added 3.18% up to $2721.9, while Class C (NASDAQ:GOOG) shares lost 0.3% down to $2727.6. On July 29th, the first type of shares lost 0.23% down to $2715.6, while the second one added 0.12% up to $2730.8.

Important data from the report

- Revenue — $61.88 billion, +62%, forecast — $56.16 billion.

- Return on share — $27.26, +169%, forecast — $19.34.

- Net profit — $18.53 billion, +166%.

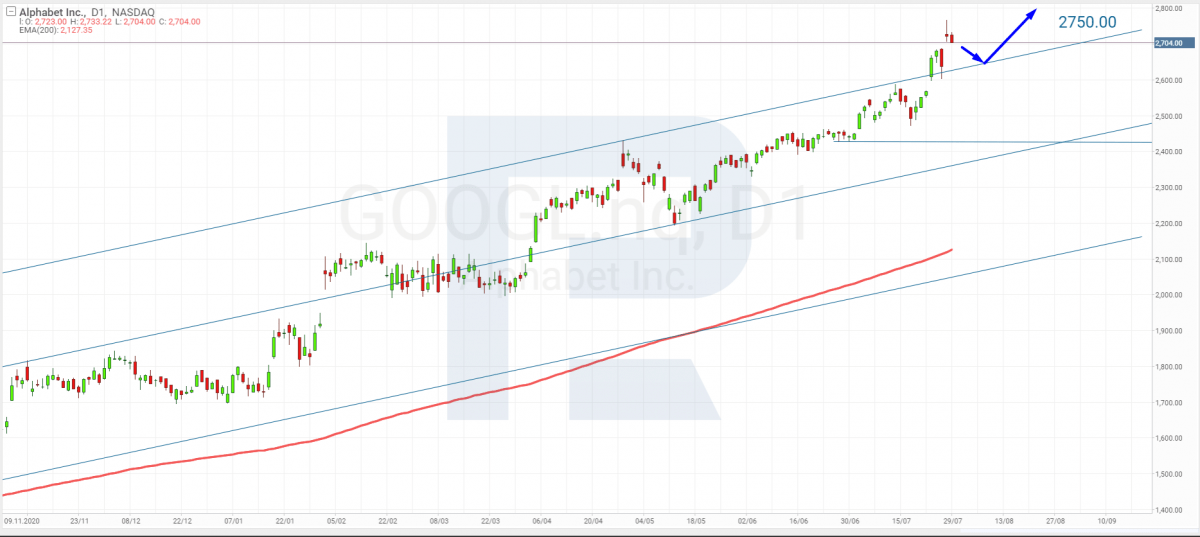

Tech analysis of Alphabet shares by Maksim Artyomov

“After updating their all-time highs, Alphabet, shares are forming another correctional wave. Considering that the price has left the channel, one may assume that the correction will make it get back inside and then the ascending tendency will continue. Despite the news, the growth potential remains quite high. The correctional target is the support level at $2,423.

In the future, Alphabet Inc has every chance to rise and reach $2,750. A signal in favour of this idea is the 200-day MA, which continues moving upwards”.

Apple report: record-breaking revenue and microchip supply problems

The first biggest revenue item was sales of iPhones: in the second quarter of 2021, this segment added 49.78% up to $39.57 billion if compared with the similar period of 2020.

The second place was taken by services, including App Store, as well as TV and music subscriptions: +33% up to $17.49 billion, a record-breaking reading.

The biggest sales volume was in China – it expanded by 58% up to $14.76 billion. In Europe, sales growth was 33.7% up to $18.9 billion, while in South and North Americas – 33% up to $39.57 billion.

Apple claims that the financial data could have been much better if it hadn’t been for microchip supply problems. The same reason makes the company management predict declines in revenue and net profit growth rates in the third quarter. More accurate forecasts for the next reporting period haven’t been announced yet.

However, it was enough to force Apple (NASDAQ:AAPL) shares to plunge by 1.22% down to $144.98. The next trading session saw the price recover by 0.46% and each $145.64.

Important data from the report

- Revenue — $81.43 billion, +36%, forecast — $73.3 billion.

- Return on share — $1.3, +10%, forecast — $1.01.

- Net profit — $21.74 billion, +93%.

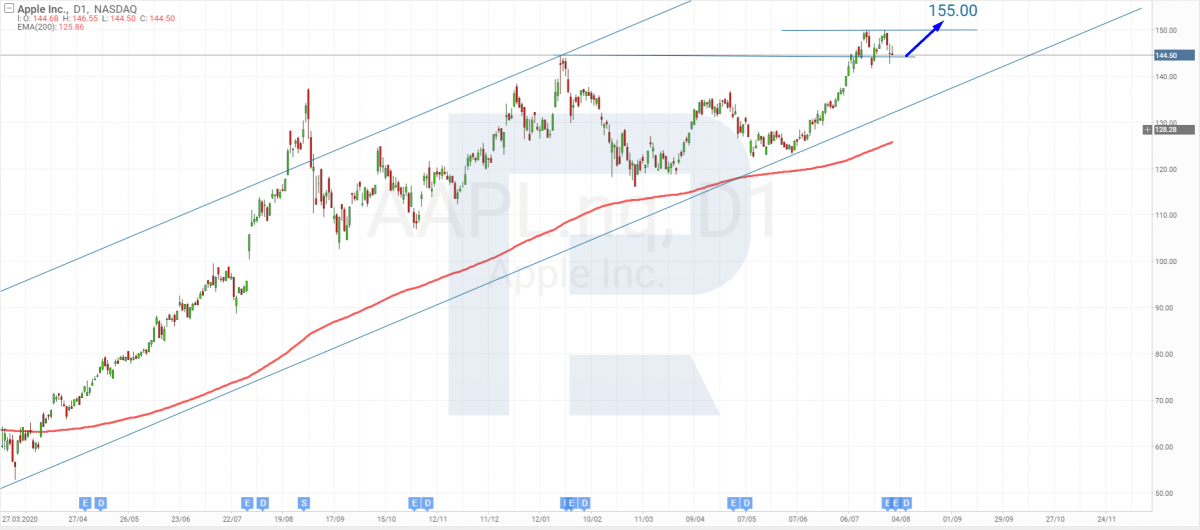

Tech analysis of Apple shares by Maksim Artyomov

“In the daily chart, Apple shares continue the correction within the uptrend. After updating its highs, the price rebounded from the resistance level twice. Considering that the asset continues moving inside the ascending channel, one may assume that the instrument may complete the correction in the nearest future and resume trading upwards.

A signal in favour of this idea is the 200-day MA, which is currently moving upwards below the price. The upside target is at $155”.

Facebook report: advertisement ensured the fastest revenue growth since 2016

In April-June, the social network’s advertising business expanded by 565 in comparison with the same period of 2020 and reached $28.58 billion. It should be noted that it’s 98.3% of the company’s entire profit.

The total monthly number of Facebook, Instagram, FB Messenger, and WhatsApp users was 3.5 billion people, having added 12% in the second quarter. As for the social network itself, the number of its daily active users expanded by 7% and now equals 1.91 billion people.

Facebook warned that the second half of 2021 would be marked by a decline in the growth rate of its financial performance. One of the reasons for that is revised rules of targeted advertising on different devices, including Apple gadgets after the iOS updates. This news immediately made Facebook (NASDAQ:FB) shares plummet by 4% down to $358.32.

Important data from the report

- Revenue — $29.08 billion, +56%, forecast — $27.89 billion.

- Return on share — $3.61, +101%, forecast — $3.03.

- Net profit — $10.4 billion, +101%.

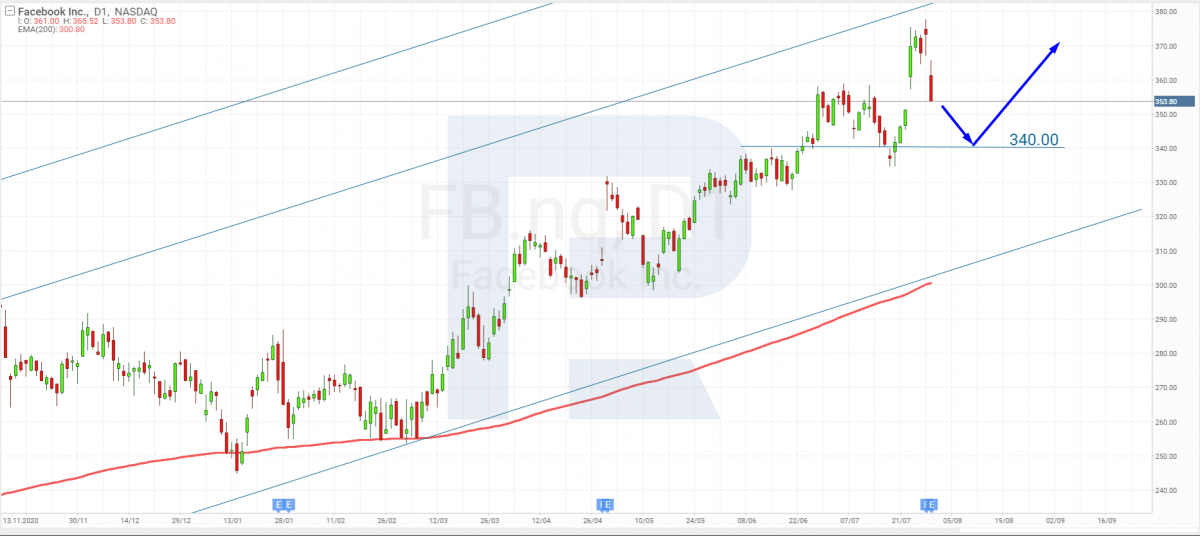

Tech analysis of Facebook shares by Maksim Artyomov

“After skyrocketing earlier, Facebook shares continue the correction. At the moment, the asset is eliminating the gap and falling towards the support level. The downside target is at $340.

Considering that the 200-day MA continues moving upwards, one may assume that the price may resume growing after finishing the pullback. The upside target is the local high”.

Microsoft report: impressive revenue growth of the cloud service

Yes, it was Azure, Microsoft’s cloud platform, that had a significant influence on the corporation’s total revenue. In the second quarter of 2021, this segment added 51%. Another impressive revenue growth was recorded in the advertising business, 53%.

Sales of Microsoft 365 also didn’t let down: in April-June, the revenue here added 25%. In general, the company managed to surpass the expectations of Wall Street analysts for the tenth consecutive quarter.

However, the company’s financial statement didn’t impress investors: on July 28th, Microsoft (MSFT) shares dropped 0.11% down to $286.22. The next trading session ended with a slight growth of 0.1% up to $286.5.

Important data from the report

- Revenue — $46.15 billion, +21%, forecast — $44.24 billion.

- Return on share — $2.17, +49%, forecast — $1.92.

- Net profit — $16.5 billion, +47%.

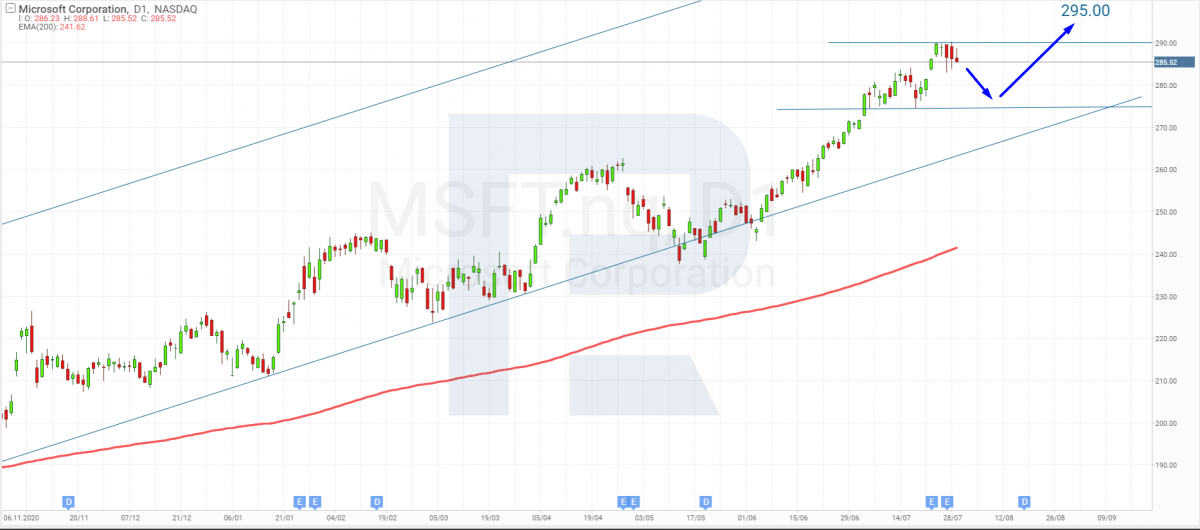

Tech analysis of Microsoft shares by Maksim Artyomov

“In the daily chart, Microsoft shares are testing the resistance level. After updating the high, the asset is correcting within the ascending channel. Considering that the price is above the 200-day MA, one may assume that the instrument may continue the uptrend in the nearest future after completing the correction. The correctional target is $275.

Later, the price may break the resistance level, update its highs, and continue trading upwards. The upside target is at $295”.

Summing up

This week, Alphabet, Apple, Facebook, and Microsoft reported their financial successes for the second quarter of 2021. The first company demonstrated an Impressive growth rate of its advertising business and YouTube, while Apple bragged about its record-breaking revenue of $81.43 billion.

Mark Zuckerberg’s company impressed its investors with a 56% revenue growth but warned that the second half of the year might be marked by a decline. At the same time, financial data of the Azure cloud platform from Microsoft may be considered as a confirmation of the fact that the company will continue battling Amazon in the cloud service industry.