IPO of Clarios International Inc.: Environmentally-friendly Batteries

5 minutes for reading

Ever since humanity started actively using electricity in its everyday and business life, the topical question has been how to keep and contain it. Despite the fact that the world’s first electric storage cell was invented in the early nineteenth century and has been constantly improved, this subject remains quite topical to this day.

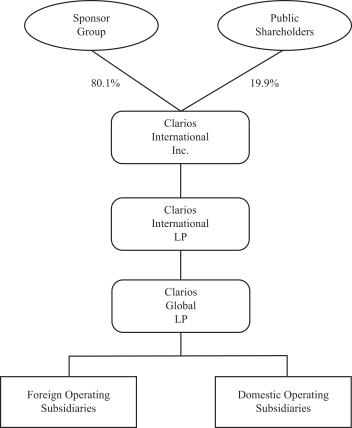

Clarios International Inc., the world’s leading manufacturer of low-voltage batteries, has filed a request to the SEC for an IPO at the NYSE. The company was assigned with the “BTRY” ticker. The IPO date hasn’t been announced yet. While the company is preparing for the IPO, we have time to take a closer look at its business.

Business of Clarios

The company was founded over 100 years ago, in 1885. Over such a long period of existence, it has been able to take the lead in the sector of manufacturing batteries for different transport. The company’s solutions power 1 in 3 cars in the world, while its staff is over 16.5 thousand employees.

Apart from cars, Clarios’ batteries are used in:

- motorcycles.

- sea transport.

- specialized sport transport.

- field-specific manufacturing equipment.

The company adheres to high environmental manufacturing standards and that’s one of the key advantages Clarios has over its competitors because it helps to avoid pressure from regulating authorities. When it comes to ecology, the company's advantages are:

- Clarios recycles 8,000 batteries every hour.

- The company’s carbon footprint is 90% less than its competitors.

- 99% of production materials can be used after recycling.

All these standards allowed the company to become a monopolist on European, Middle Eastern, African, North and South American markets. As for the Asian-Pacific region, Clarios is in the Top-3 of the market leaders. Now let’s take a closer look at this.

The market and competitors of Clarios

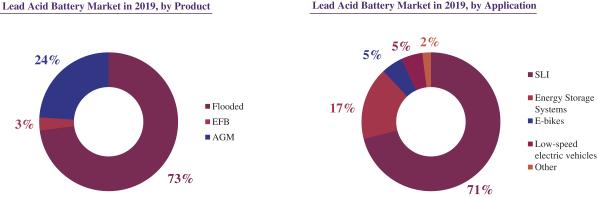

The company is the leader of its sector. Clarios International Inc. is totally dominating the area of low voltage lead batteries. According to AVICENNE Energy, this market’s volume in 2019 was $38 billion, while the entire battery market was $89 billion.

Low-voltage lead batteries are widely used in car manufacturing. According to IHS Markit, as of 2020, the number of actively used cars was 1.3 billion. By 2030, this number is expected to reach 1.6 billion – a 23.08% relative growth.

Financial performance

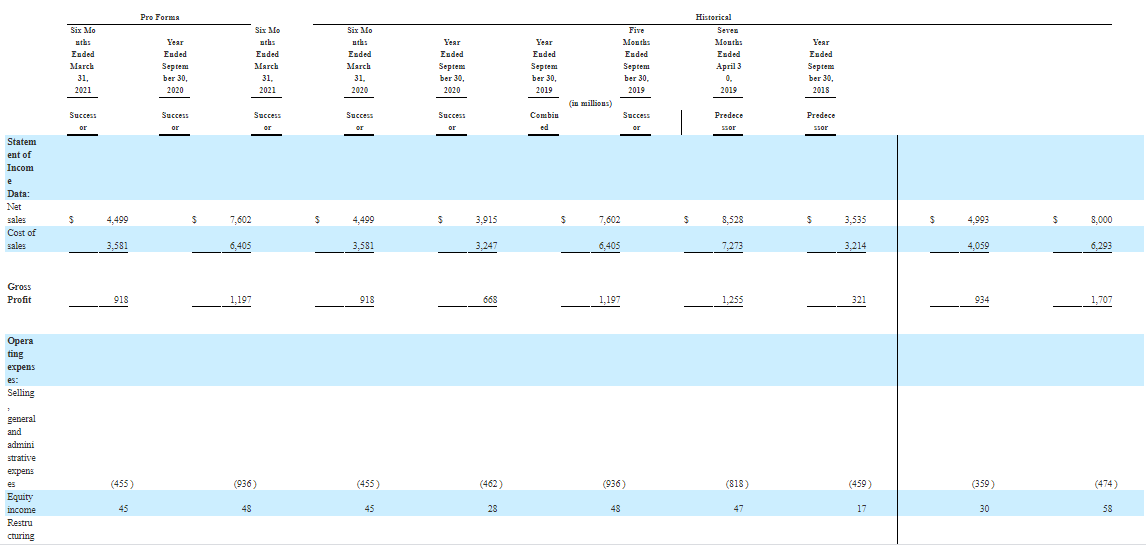

At the time of the IPO, the company doesn’t generate the net profit, that’s why we’ll start analyzing its financial performance with the revenue. According to the S-1 form. The company’s sales in 2020 were $7.6 billion, a 115.05% increase relative to 2019. Such quick growth was caused by a “low base effect” because the revenue in 2019 dropped by 55.81% if compared with 2018 – from $8.00 to $3.54 billion. Over the last 12 months, the revenue was $8.19 billion.

The gross profit in 2020 was $1.19 billion, a 272.89% growth relative to 2019. In 2019, this indicator lost 431.78% if compared with 2018. In absolute terms, the 2018 number hasn’t been met. It impacted the net profit as well. The net loss in 2020 was $196 million, a 26.84% decrease relative to 2019. This is a positive tendency that may continue this year.

Cash and cash equivalents on the company’s balance sheet are $550 million. At the same time, one should pay attention to the company’s debt, which is quite high at $8.65 billion and forms a negative free cash flow. The company’s own capital is $1.83 billion.

One may draw a conclusion that Clarios has been actively recovering its 2019 losses. However, the company’s debt is a threat to its financial stability.

Strong and weak sides of Clarios

Having acquired comprehensive information on the company’s business model, let’s highlight its strong sides and risks of investing in Clarios shares.

I believe the company’s strong sides are:

- Being a monopolist in most economic macro-regions.

- Complete production cycle: no critical dependence on contractors.

- The company uses cutting-edge environmentally-friendly manufacturing technologies.

- A 100%+ revenue growth is 2020.

- The company has been on the market for over 100 years.

Risks of investing in Clarios are:

- Strong competition from Asian manufacturers.

- The company is loss-making and doesn’t pay dividends.

- Pandemic-related logistic issues.

IPO details and estimation of Clarios capitalization

The underwriters of the IPO are:

- National Bank of Canada Financial Inc.

- Siebert Williams Shank & Co., LLC.

- Santander Investment Securities Inc.

- J.P. Morgan Securities LLC.

- Barclays Capital Inc.

- BMO Capital Markets Corp.

- BofA Securities, Inc.

- Credit Suisse Securities (USA) LLC.

- Deutsche Bank Securities Inc.

- Goldman Sachs & Co. LLC.

- HSBC Securities (USA) Inc.

- Citigroup Global Markets Inc.

- RBC Capital Markets, LLC.

- Credit Agricole Securities (USA) Inc.

- ING Financial Markets LLC.

- Scotia Capital (USA) Inc.

Clarios is planning to sell 88.10 million common shares at the price of $17-21 per share. If shares are sold at the highest price in this range, the IPO may have raised $1,67 billion and the company’s capitalization might be up to $9.67 billion.

To assess the potential upside of the company’s shares, we use two multipliers, Price-to-Sales (P/S) and Price-to-Book (P/B) ratios. At the time of the IPO, P/S is 1.18, while P/B is 3.22. Considering the potential revenue growth this year, the first multiplier may drop to 1.10. As a rule, companies finish their lock-up period with P/S and P/B at 3 and 5 respectively, that’s why the upside for Clarios shares may be from 55.28%% (2.41/1.89*100%) to 154% (3/1.18*100%). The latest number is possible only in the best-case market scenario.

Underwriters cancelled the IPO scheduled for August 5th and the new date hasn’t been announced yet. Considering everything mentioned above, I’d recommend this company for mid-term investments.