Weber Inc. IPO: Best Barbecue Ever

5 minutes for reading

On summer holidays, we most often prefer lying on the beach, swimming in the ea, and cooking things outdoors to treat our families and friends. To make meat on fire, you basically need a couple of bricks and some sticks; however, not everyone would go so simple. The industry of goods for country-side leisure is developing along with the growing demand for comfort; many owners of country houses opt for grills on wood, coal, or gas.

Weber, a company making various goods for cooking outdoors, is planning an IPO on August 4th at NYSE. Trades will start on the next day under the ticker WEBR. IPOs of companies with a stable and profitable business have become a rare occasion, so I am especially curious about the reasons for the success of Weber.

Business of Weber

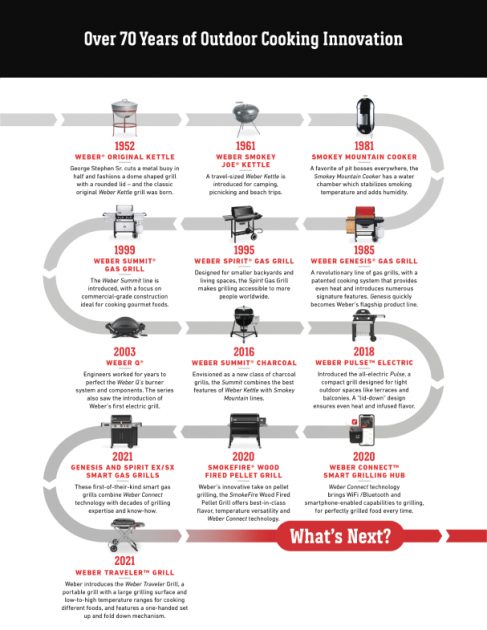

The company started operating almost 17 years ago, in 1952. The headquarters is in Palatine, Illinois. The company was founded by George Stephen Senior as soon as he got his first patent for his original coal grill. Since 2018, Chris M. Scherzinger has been the company’s CEO.

Since its foundation, the company has acquired a horde of fans worldwide, from amateurs to pro chefs. Weber offers a whole range of goods for outdoor cooking.

The issuer is a unique international company with a vertically integrated structure. Weber is selling its goods via distributors, its own chain of shops, and online. Direct sales have been number one in the sales structure of the company since 2018.

The company keeps extending its assortment, opening doors to new markets. The assortment includes:

- Coal grills

- Gas grills

- Electric grills

- Pellet grills

- Weber Connect original technology-supported racks.

The company works in the sector of consumer goods that does not grow as fast as the high-tech sector. No to the market perspectives of Weber.

The market and Weber rivals

The company takes up 24% of the global market of goods for outdoor cooking, 23% in its parent jurisdiction (USA). Other countries where the company occupies a substantial part of the market are Germany, Australia, France, and Canada. The company is featured in 78 countries total.

According to Grand View Research, in 2019, the global market of grills for barbecue amounted to 4.8 billion USD. The source also forecasts that by 2025, it will have reached 7 billion USD. Mean annual speed of growth in 4.5%. After lock-downs due to the pandemic, consumers started spending more and more time at the countryside with their friends, which partially was a good influence for the company’s sales.

The main rivals of Weber are:

- Big Green Egg

- Broil King

- Napoleon

- Ziegler & Brown

- Kingsford

- Nexgrill

Financial performance of the company

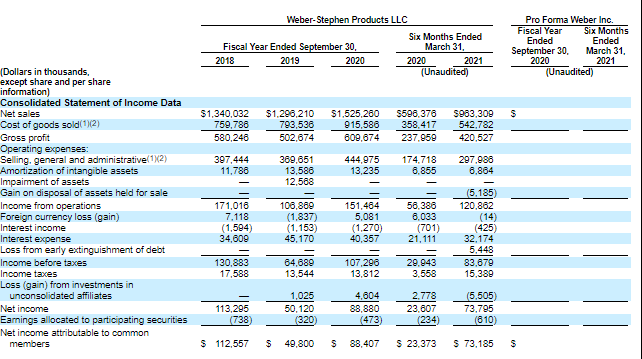

The company with such a long history demonstrates growth of revenue and a stable net profit. According to the S-1 report for the financial 2020 that ended on September 30th, Weber sales amounted to 1.53 billion USD, which was 18.06% than a year before. However, in 2019, this result was inferior to 2017 – by 3.28% to 1.30 billion USD.

Over 6 months that ended on March 31st, 2021, the revenue amounted to 963.31 million USD, which is 61.53% more than in the same period of 2020. As you see, the pandemic even helped the business grow. No look at the dynamic of the net profit.

In the financial 2020, the net profit was 88.88 million USD, which is 77.73% more than in the same period of 2019. As the revenue, it also tuned out below the results of 2018 – by 55.76% this time.

Over the first 6 months of 2021, which ended o March 31st, net profit reached 73.79 million USD, which is 212.54% more than in the same period of 2020. Quite impressive, isn’t it?

Weber pays 1.36% of its revenue (25.64 million USD) as tax. The company has 379.94 million USD on its balance. Its general liabilities are 1.3 billion USD which is more than normative values and makes a negative money supply of 915.81 million USD.

The operational and net profitability are 11.41% and 7.35%, respectively. Free money flow is 274.06 million USD. Note the high speed of growth of revenue and net profit – over 50%. However, never ignore the company’s substantial liabilities.

Strong and weak sides of Weber

Upon checking the company’s performance, take a look at its strong and weak sides. The company’s advantages are:

- A long history of success.

- Family character of business.

- Market leaders in a good niche.

- Generating net profit.

- The business only grew during the pandemic.

The risks of investing in Weber would be:

- Unstable revenue and net profit.

- No dividends paid to investors.

- The target market grows very slowly (less than 5% a year).

IPO details and capitalization

The underwriters of the IPO are KeyBanc Capital Markets Inc., BofA Securities, Inc., Wells Fargo Securities, LLC, UBS Securities LLC, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC и BMO Capital Markets Corp.

Weber is going to sell 46.88 million if normal stocks at 15 to 17 USD per share. If the IPO happens at the higher border of the range, its volume will amount to 750 million USD. In this case, capitalization will amount to 4.56 billion USD.

To evaluate the company’s perspectives, let us use the P/S and P/E coefficients (multipliers). At the moment of the IPO, P/S will be 2.41. With the revenue potentially growing this year and the current capitalization, it might drop to 1.89. During the lock-up period, such companies normally have the P/S at 3 and P/E at 40. Hence, the upside of these stocks is from about 22% (40,00/32,98*100%) to 24% (2,41/1,89*100%).

Judging by everything said above, I recommend the company for investments.