Alibaba Quarterly Report and Shares of Chinese Video Game Makers Falling

5 minutes for reading

Today, my article will be devoted to tech companies from China. This week, a report for Q2 was presented by Alibaba Group but I'll be talking not only about this. Criticism of online games from state-supported media pushed down the shares of Tencent, NetEase, Bilibili, and other manufacturers of this product. As you see, we definitely have things to talk about. Let's get started.

Alibaba Group report didn’t impress investors

On Tuesday, August 3rd, the results of April-June were reported by one of the largest Chinese corporations — Alibaba Group. Comparwd to the statistics of Q2, 2020, overall revenue increased by 34%, reaching $31.87 billion; revenue from cloud services grew by 29%, amounting to $2.48 billion, while revenue from electronic commerce rose by 35% to $27.9 billion.

Moveover, Alibaba representatives stared that the already large-scale program of buying back stocks would be increased from $10 billion to the record $15 billion. Note that in Q2 this year the company bought stocks for $3.7 billion.

The reported financial results had a feeble influence over the company's quotations. On August 3rd, the stock price of Alibaba Group (HK: 9988) at the Hong Kong exchange grew by just 0.83% to 193.5 HKD.

As for the stock price of the IT giant at the New York stock exchange (NYSE: BABA), they dropped by 1.35%. This must be due to the growing pressure from the Chinese government on Chinese tech companies that trade at foreign stock exchanges. As you remember, Alibaba quotations have already lost 15.2% since the beginning of this year.

Important report details

- Revenue — $31.87 billion, +34%, forecast — $32.54 billion

- Return on stock - $0.32, -6%

- Net profit - $6.6 billion, -8%

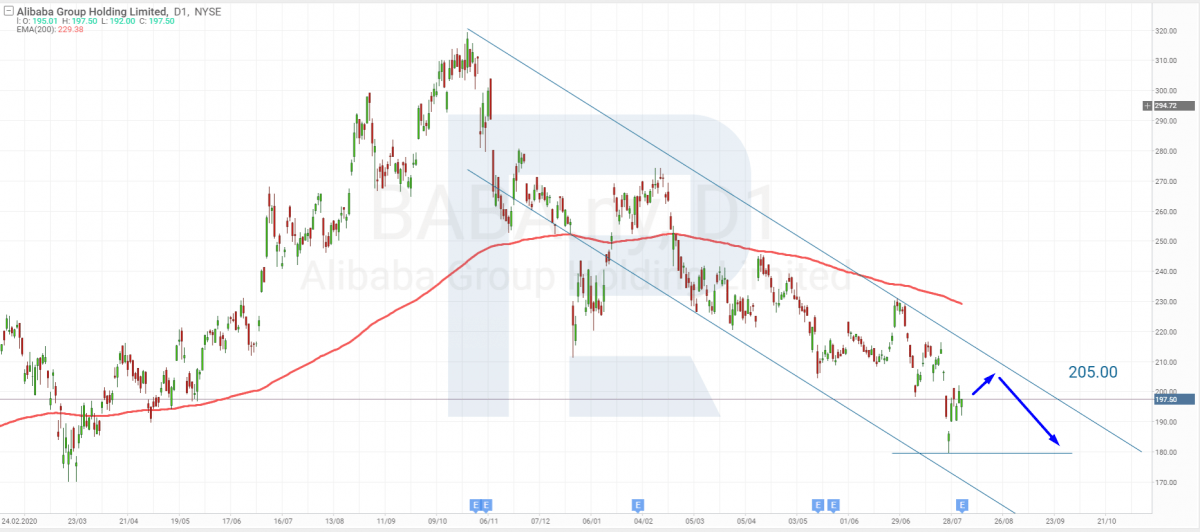

Tech analysis of Alibaba shares by Maksim Artyomov

"On D1, the quotations keep correcting inside a general downtrend. Upon testing the support level at $180, the quotations are trying to regain lost positions, heading for the upper border of the channel

I suppose that next they'll test the resistance level at $205, bounce off it, and go on declining. The 200-days Moving Average supports the decline of the quotations because it's going down as well".

Shares of Chinese video game companies collapsed

On August 3rd, a Chinese state-supported newspaper Economic Information Daily attacked online games, developer companies, and people who spend their time at such useless leisure. You can guess how aggressive the whole thing sounded if I say that it used such wording as "electronic drugs" or "wit opium".

Investors interpreted all this as a sign of state regulators being ready to interfere with the entertainment sphere. This immediately affected the quotations of such large Chinese companies developing video games as Tencent NetEase, and Bilibili.

At the close of the trading session in the Hong Kong exchange on August 3rd, Tencent shares (HK: 700) dropped by 6.11% to 446 HKD. As for the OTC stocks of the IT giant (TCEHY), that day they lost 7.32%, reaching $56.83.

NetEase in the Hong Kong exchange (HK: 9999) dropped by 7.77% to 145.9 HKD. The stock price of this video game developer in NASDAQ (NTES) demonstrated a deeper slump — by 11.41% to $93.06.

Bilibili shares in Hong Kong exchange (HK: 9626) closed 3.44% down, at 645.5 HKD. At NASDAQ, the decline was more noticeable — by 7.06% to $84.

Tech analysis of Tencent, NetEase, and Bilibili shares by Maksim Artyomov

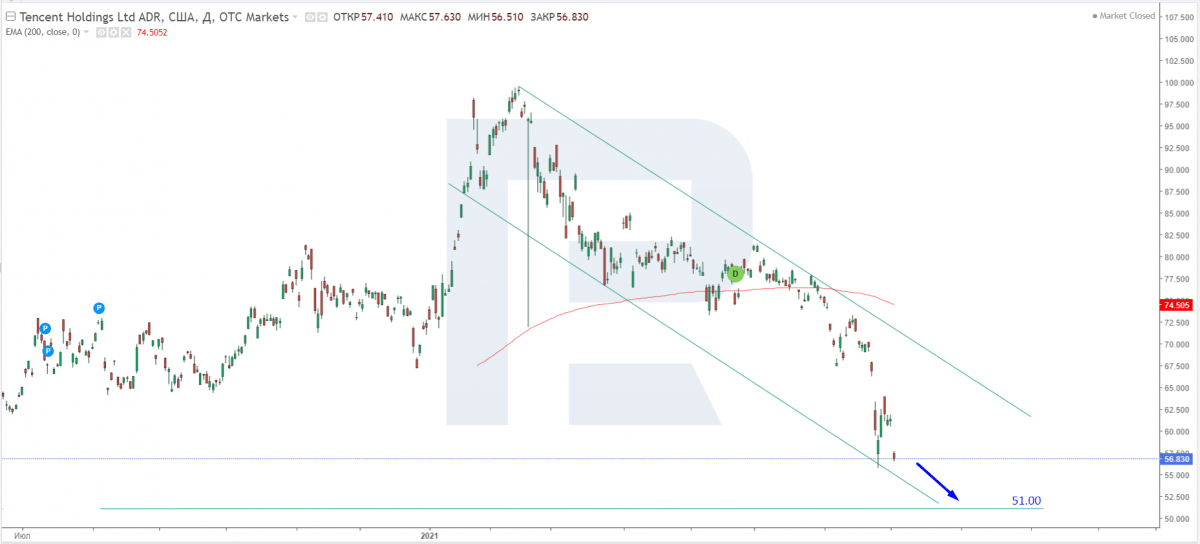

Tencent

"Tencent shares keep falling. At the last trading session they were falling, almost reaching the lows of this year. I think, the price is going to break through the support level and keep declining inside the descending channel.

This is supported by the 200-days Moving Average: the price rests under it. The aim of the movement is the support level of $51"

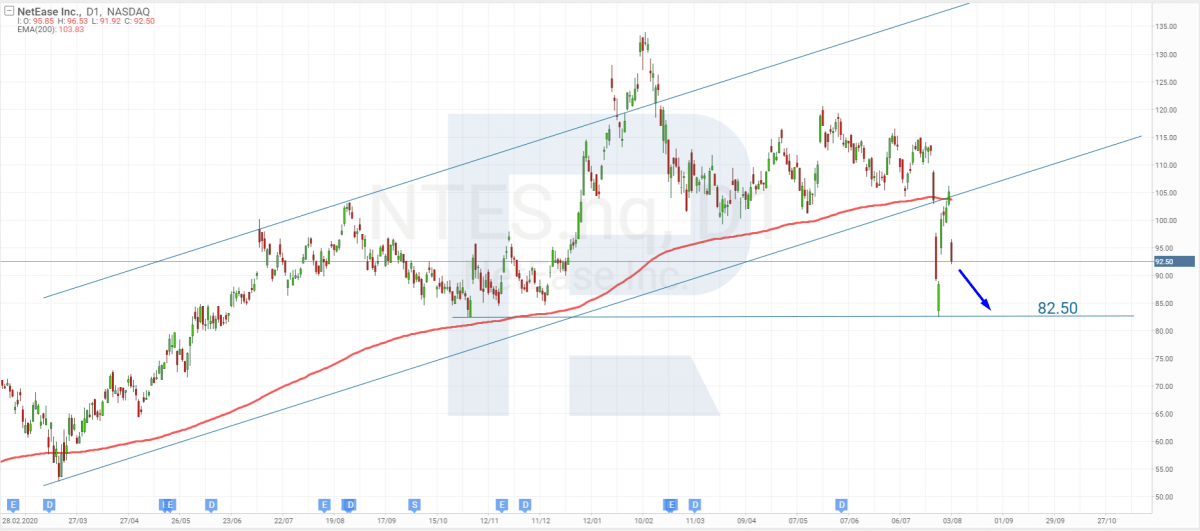

NetEase

"NetEase closed the last trading session with a decline, regardless of a gap. Testing the support level near $82.5, the quotations might soon return to it.

Another signal supporting the decline is the 200-days MA crossed by the quotations from above. After the support level is tested, it might be broken away, and the falling might continue to the next support level".

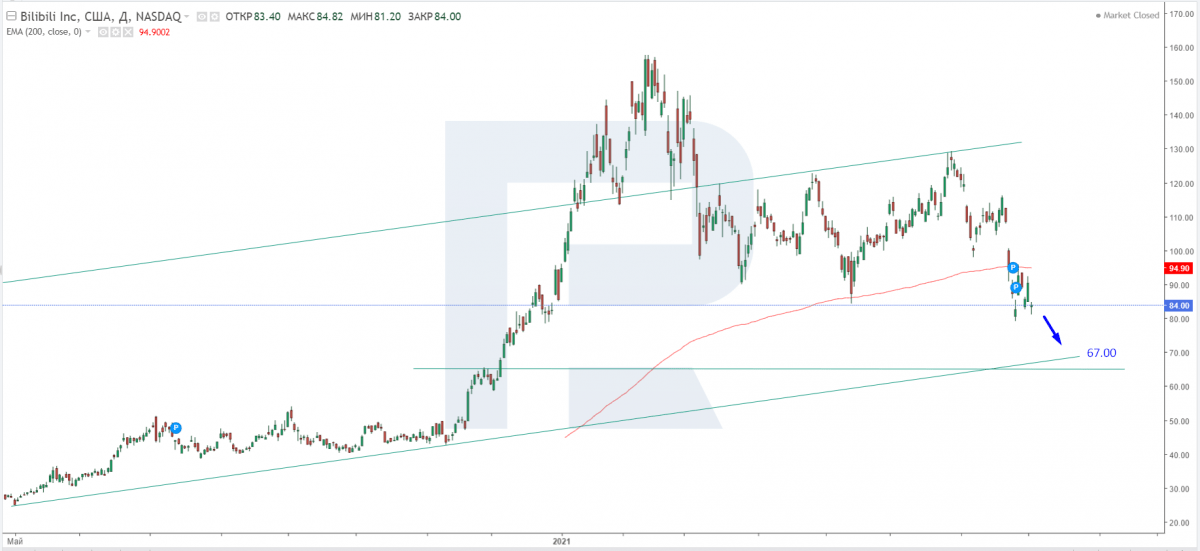

Bilibili

"The quotations have crossed the 200-days MA and keep declining with minor pullbacks. Currently, we may suppose that the aim of the falling is the support level of $67.

Upon testing this level, the quotations may bounce off it and keep developing the downtrend. In the nearest future, the price is likely to bounce off the support level and continue growing instead of breaking through $67 and declining".

Summing up

Chinese authorities are trying to put large tech companies under more control, especially those that are either trading in foreign exchanges or were planning to start it.

Alibaba Group has just started to recover after the IPO of its subsidiary Ant Group, while the company had to pay a huge anti-monopoly fine, struggling with the general pressure from regulators. In the report for Q2, 2021, the corporation demonstrated growth of revenue by a third and an extension of the buy-back program. However, this didn't satisfy investors and analysts.

As for Tencent, NetEase, and Bilibili, their stocks were dragged down by the criticism from the Economic Information Daily newspaper. Many market players interpreted this as the beginning of a campaign against the game industry.