What's Going On with Robinhood Markets Shares?

3 minutes for reading

A bit more than a week ago, on July 29th in particular, a company called Robinhood Markets entered NASDAQ. This company is an American online broker, popular among private investors, that became especially popular when Reddit users decided to boost the stock price of GameStop, a retailer chain selling game consoles, computer games, and accessory.

Bloomberg has already called this IPO the worst start at the exchange. This week, the shares were so volatile that NASDAQ had to pause trades several times. What's going on with the shares of the online broker, what are the reasons for it, what does our analyst Maksim Artyomov think. Let's find the answers below.

Robinhood Markets shares are growing fast

The first trading session was an unlucky start: the stock price dropped to $34.82, which is significantly lower than the starting price of $38 per share. However, this week, the stocks of Robinhood Markets (NASDAQ: HOOD) sped up noticeably. Between August 2nd and 4th, they grew by 100%, from $35.15 to $70.39.

CNBC says that the initial stock price growth can be explained by the increased interest from the ARK Fintech Innovation trust, managed by Cathei Wood. Between July 29th and August 3rd, the trust bought 3.3 million of the company's shares. This inspired private investors, particularly the subscribers of the notorious r/wallstreetbets subreddit. At the beginning of the year, they declared a war against Wall Street, boosting up GameStop and other "meme" shares.

According to Vanda Securities Pte, on August 3rd, private investors bought Robinhood shares for $19.4 million, which helped the quotations close at $46.8. On the next day, the agitation even grew, sending the stock price higher. The closing price was $70.39, which means growth by 50.41%. During the day, the price high was $84.12.

Robinhood shares: a sharp turn

On August 5th, Marketwatch informed us that the online broker had decided to make more shares available at NASDAQ, placing 97.8 million stocks more. The informer claims to quote official SEC information. As you remember, at the IPO, 55 million of normal A class shares were sold.

The company's representatives claim that the secondary placement was initiated by shareholders. The company will sell convertible bonds, and the money will fully go to sellers as the company will receive nothing.

This news could hardly smooth things out or help the quotations from a fast decline. On the same day, the quotations closed with a 27.59% decline at $50.97.

Tech analysis of Robinhood Markets shares by Maksim Artyomov

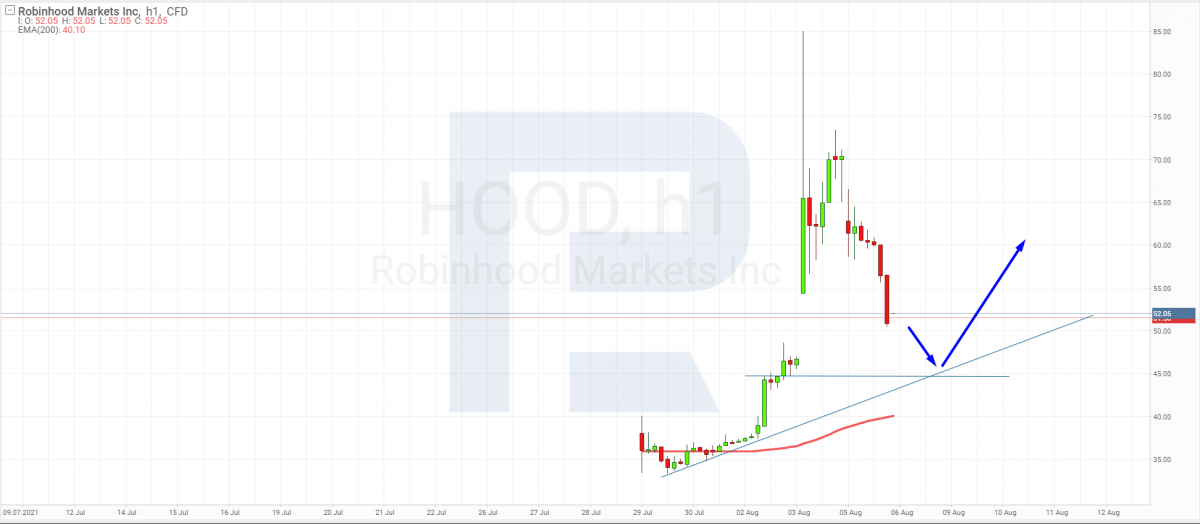

"Judging by the chart, Robinhood turned out to be much worse than it had seemed. Upon sky-rocketing, the quotations slid down equally fast. We can conclude now that the stocks were pumped up by speculators who skimmed the cream and are now letting the price drop to its optimal value.

The target level for falling is the support level of $44.5. When the agitation subsidrs, the quotations will get a chance to bounce off the support and perhaps form an uptrend".

Summing up

At the end of July, Robinhood Markets carried out a disaster of an IPO that drained its capitalization by $29 billion. However, Cathei Wood who has founded the speedest-growing investment company on the globe (called ARK Invest), got interested in the shares and made them grow.

Then private investors from the r/wallstreetbets community joined in, lifting the quotations to $70.38. As you remember, over the first three days of this week, the shares grew by a bit more than 100%. However, the news about a secondary placement dropped them by almost 28%.