Biden's Plan for $1 trillion Accepted by Senate: Metallurgy Stocks Grown

4 minutes for reading

We will dive in the American context today. Namely, into President Biden's plan to renew the infrastructure considerably, voting in the Supreme House of Congress, and the reaction of the stock market to this. For dessert, as a nice tradition — fresh tech analysis of stocks by Maksim Artyomov.

Most Senators support Biden’s infrastructure plan

On August 10th, the Supreme House of Senate voted for Joe Biden's plan of renewing the infrastructure and creating extra workplaces. The program presumes spending $1 trillion from the budget for modernizing communal and energy systems, constructing and repairing roads, and supporting alternative energy sources.

In the Senate, where places are divided equally between Democrats and Republicans, the plan was supported by 69 votes. Sure, Democrats had to trim the project noticeably to get necessary support of Republicans. Tax stimuli and subsidies remained unvoiced, and appropriations for infrastructure-only parts of the plan were reduced.

Anyway, the project was accepted, and this is all that matters. As you remember, it then goes to the House of Representatives, with the majority being Democrats. This means, voting will go smoothly.

Stocks of US metallurgists growing

As I have said, $1 trillion from the US budget might be spent on modernizing the infrastructure. The news about supportive voting provoked an immediate positive reaction of large manufacturers of metals, construction materials, and equipment.

The most prominent growth was demonstrated by the shares of steel-making companies Nucor (NYSE: NUE) and Cleveland-Cliffs (NYSE: CLF) and a manufacturer of copper and aluminium Alcoa (NYSE: AA). On August 10th, the quotations of the first company leaped up by 9.58% to $118.1 and of the second one — by 5.05% to $26.02. As for the manufacturer of aluminum and cuprum — one of the market's largest — the shares rose by 8.24% to $43.87.

August 10th through 12th, Nucor shares grew by 16.2% to $125.24. Alcoa shares also boast three positive sessions in a row: they grew by 11.4% to $45.15. Meanwhile, Cleveland-Cliffs shares failed to keep growing and on August 11th already started falling. As a result, they closed the last session at $25.72.

Tech analysis of Nucor, Alcoa, and Cleveland-Cliffs shares by Maksim Artyomov

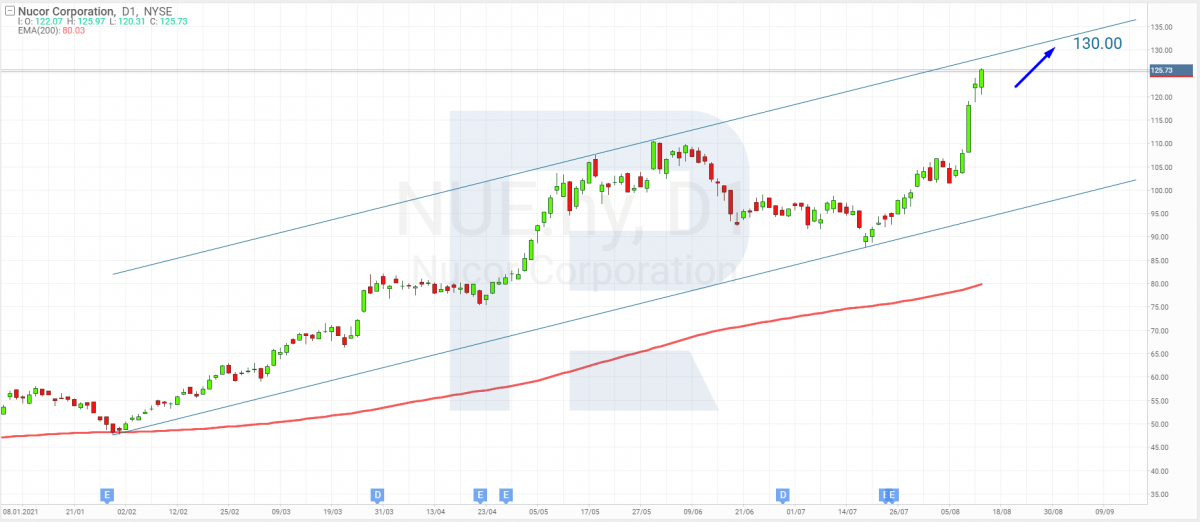

Nucor Corporation

The shares of Nucor Corporation continue the uptrend, renewing the highs. I presume that the current trend will stay, and the price will reach $130. This viewpoint is supported by the 200-days Moving Average that already goes below the price and is growing.

On its way to $130, breaking through the upper birder of the ascending channel, the price might form a correctional wave, which, in turn, might give further opportunities for growing.

Alcoa Corporation

On D1, the quotations renewed the nearest high and headed for the upper border of the ascending channel. In the future, with all the good news, we should expect a minor correction and further growth.

The aim is the resistance level of $50. Another supporting signal is given by the 200-days MA that lies below the quotations and is growing.

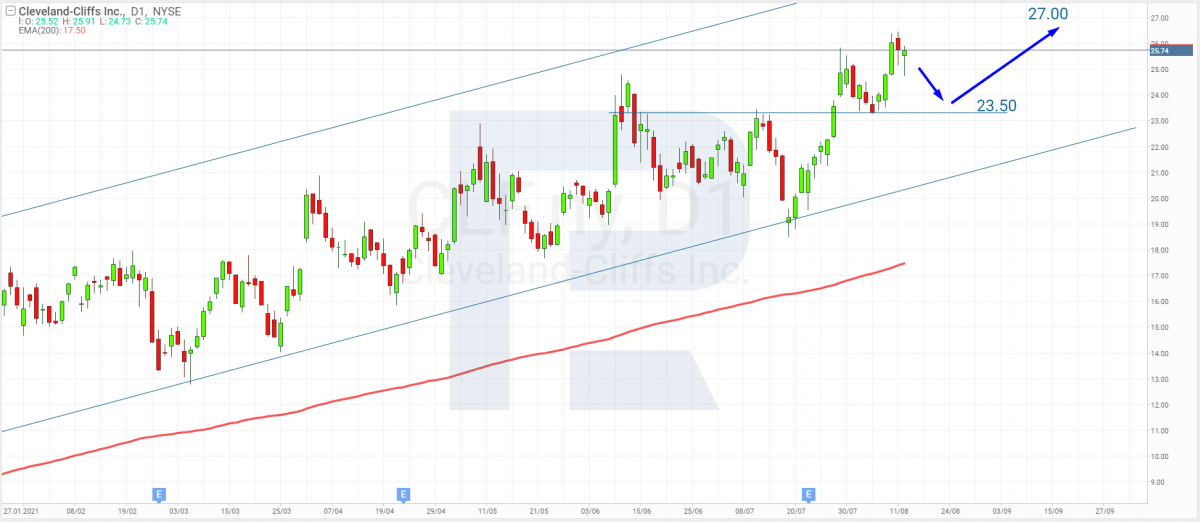

Cleveland-Cliffs

These shares have renewed the highs several times this year. On D1, I expect another correction before resuming the uptrend. The aim of the pullback is likely to be at the support level of $23.5.

After the correction is over, the price will get a chance to remain in an uptrend. The aim of growth will be the resistance level of $27. The 200-days MA also confirms growth.

Summing up

On August 10th, the Senate accepted Joe Biden's plan for modernizing the infrastructure and creating workplaces. This will require $1 trillion of budget money. However, the plan first must be accepted by the House of Representatives.

The news made the shares of metallurgists, developers, manufacturers of construction materials, and equipment. The most prominent growth was demonstrated by the shares of Nucor, Alcoa, and Cleveland-Cliffs. See the tech analysis of these shares above.