Tesla and NIO Stocks Dropped Due to Autopiloting Systems

4 minutes for reading

Today's article is devoted to the situation around the quotations of electric car-makers, such as the US Tesla and Chinese NIO. This week, the two companies got united not only by the sphere of business but also by some troubles in the autopiloting systems. While you were looking forward to this new article (and I hope you were), I found out the most curious details of the situation and Maksim Artyomov prepared a tech analysis of Tesla and NIO stock.

Regulator will check if Teslas are safe; the company’s shares drop

On August 16th, Bloomberg made it known that the US NHTSA started an investigation into the safety of autopiloting systems of Tesla cars.

The reason for the investigation was eleven accidents that happened, among other things, due to some malfunctioning in the autopiloting systems of the electric cars. Note separately that the accidents happened between January 2018 and mid-2021.

According to the NHTSA, the accidents had 17 people injured and 1 dead. The regulator is going to check 765,000 of Tesla electric cars, i.e. the vehicles manufactured between 2014 and 2021.

The information about an investigation going on reflected negatively in the stock price of Tesla (NASDAQ: TESLA): on August 16th, the quotations dropped by 4.32% to $686.17 and on August 17th — by 2.98% more to $665.71. As analysts note, this is a this month's low of Tesla quotations.

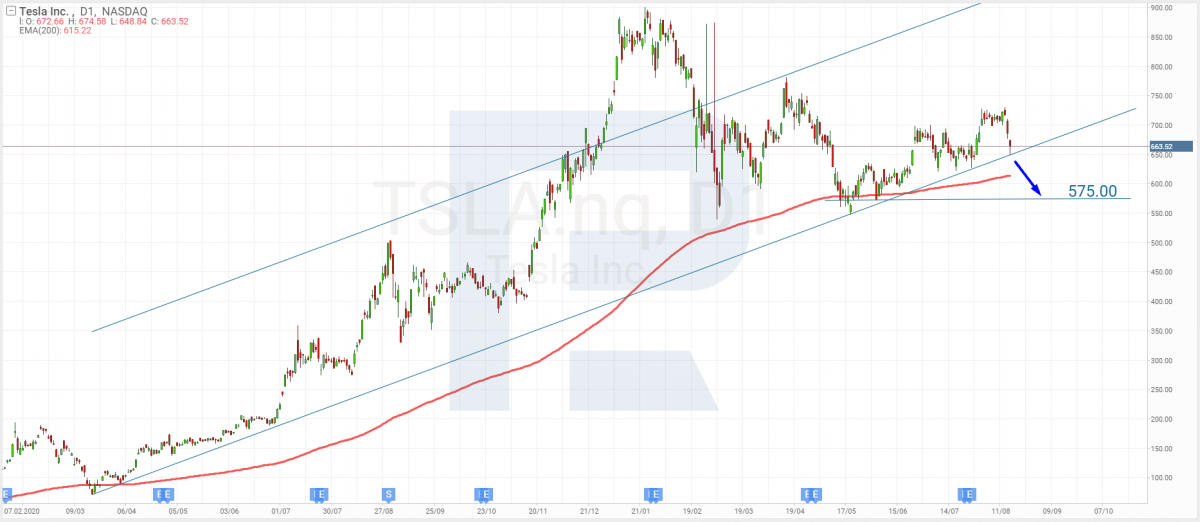

Tech analysis of Tesla shares by Maksim Artyomov

On D1, Tesla shares keep declining inside an ascending channel, and the quotations have reached its lower border. Pushed by the investigation and rumors about some malfunction in the autopiloting system, the shares might go on falling.

In the future, the price might break through the lower border of the channel and head for the support level, which is the 200-days Moving Average. If news is bad, the price might test the level, break through it, and go on falling. The aim will be the next support level of $575.

NIO stocks fall after a deathly accident

Last week in China, a NIO ES8 electric car got into an accident that resulted in a death. According to MarketWatch, this car type has several systems installed on it that make it easier to drive the vehicle.

Note, however, that they are not a full-scale autopiloting system, i.e. do not drive the car fully by themselves, sparing the driver of watching the road and controlling the situation.

The information about the accident that led to a person dying immediately reflected in the stock prices of the Chinese car-maker. On August 16th, NIO class A shares (NYSE: NIO) lost 5.87% of their price, falling to $38.62

Note especially that the quotations have been falling fast for six trading sessions in a row, losing 15.7%, regardless of strong quarterly statistics. A week ago, the company reported growth of the revenue by 127.2% to $1.31 billion and a decline in losses by 63.5% to $0.07 per share.

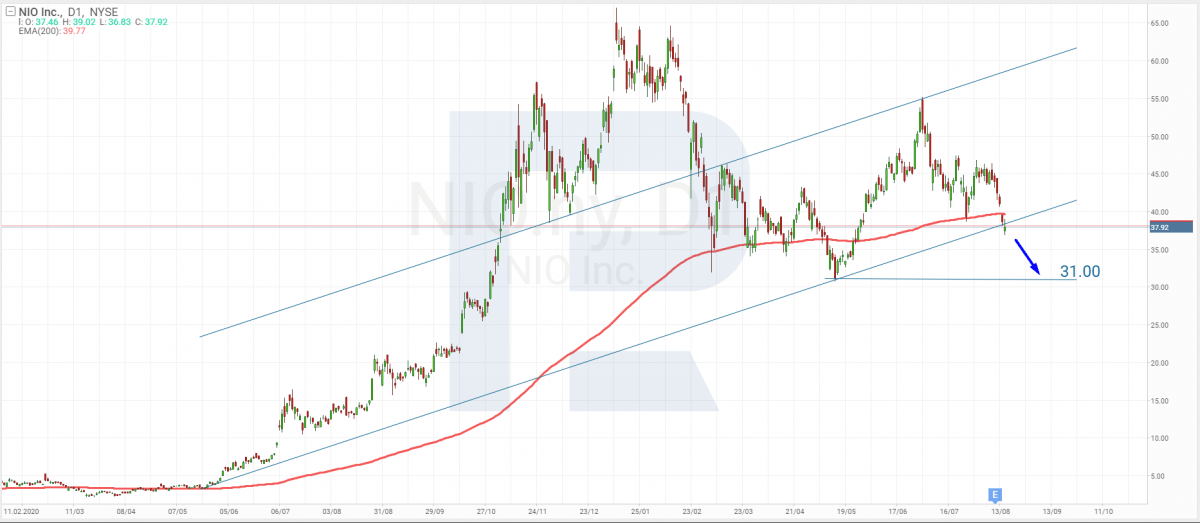

Tech analysis of NIO shares by Maksim Artyomov

NIO stocks follow the shares of Tesla and go on falling, pushed down by negative news. The price reached the lower border of the channel and secured under it, breaking it away. During the last trading session, the 200-days MA was broken away.

Judging by all the negative factors, the quotations will go on falling to the support level of $31. Lack of trust in investors might play against the company's interests and make the quotations fall deeper down, in which case we should expect a test of $25.

Summing up

At the beginning of this week, the stock price of electric car-makers Tesla and NIO fell by 4.32% and 5.87%, respectively. The quotations shrunk because of the information about some problems with the autopiloting systems.