Why Are Volkswagen, Toyota, and General Motors Shares Going Down?

5 minutes for reading

Last week was tough not for Chinese companies only but also for certain representatives of the global car industry. The shares of Volkswagen, Toyota, and General Motors started going down speedily.

Let's find out what was the reason and what horizons open in front of the car-making giants. And, of course, Maksim Artyomov has a fresh tech analysis of car-makers ready for you.

Car industry suffers losses due to shortage of semiconductors

This year, the global shortage of microchips harms the plans and income of car-makers a lot. Companies have to alter their long-existing business processes. For example, some processing powers stop completely or work part-time.

Moreover, for certain markets, they make vehicles of limited functionality. For example, for Brazil the German Volkswagen made a series of Fox hatchbacks lacking the infotainment system with a multimedia display.

Major Audi plants on a halt

According to Spiegel, on August 19th, the main plant of the German Audi stopped producing cars. 6 thousand employees in Ingolstadt are working part-time, presumably until the end of this month.

In Neckarsulm, the situation is the same. 4 thousand employees were affected there. Plants standing idle will even worsen the lagging of Audi in terms of cars supplied: the shortage of semiconductors has already made the company produce 50 thousand fewer cars in the first half of 2021.

On August 19th, this news made Volkswagen AG (FWB: VOWG), the owner of Audi, lose 3% of the stock price, reaching €284.2. The next trading session also clos3d with a decline by 1.62% to €279.6. Note that this was the worst decline of VAG in August.

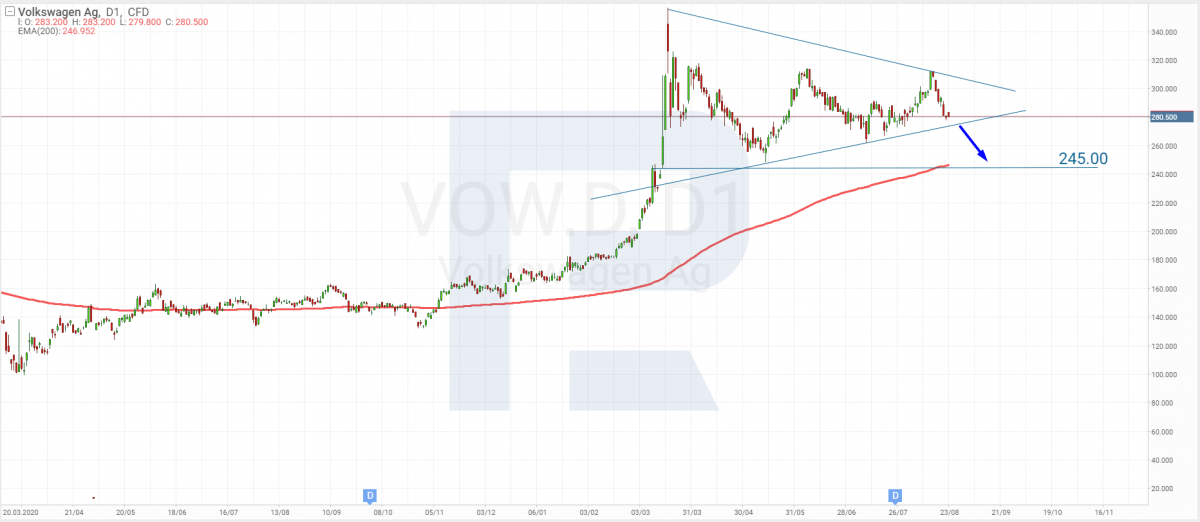

Tech analysis of Volkswagen AG by Maksim Artyomov

Compared with the rivals, Volkswagen AG shares are trying to recover. On D1, the quotations have formed a tech analysis pattern called Wedge. Judging by the news, they will go on declining.

If the support line of the Wedge is broken, the price might drop to the 200-days MA, reaching €245. If investots believe in the company again, the price might bounce off the MA and continue growing.

Toyota will decrease production by 40% in September

As you might guess, the shortage of semiconductors affected the Japanese giant as well: next month, Toyota will make 40% fewer cars. According to Nikkei, this makes 360 thousand cars: 140 thousand cars less produced in Japan, 80 thousand cars — in China and the US, 40 thousand cars in Europe, and 100 thousand cars in other Asian countries.

Such news could not but affect the stock price of Toyota Motor (NYSE: TM): on August 19th, the quotations dropped by 4.09% to $168.55. On the next day, they kept falling — by 2.31% this time, reaching $164.66. This has become the most drastic decline since May. Note that the quotations of Toyota have been falling for 5 sessions in a row, losing 9.2% total.

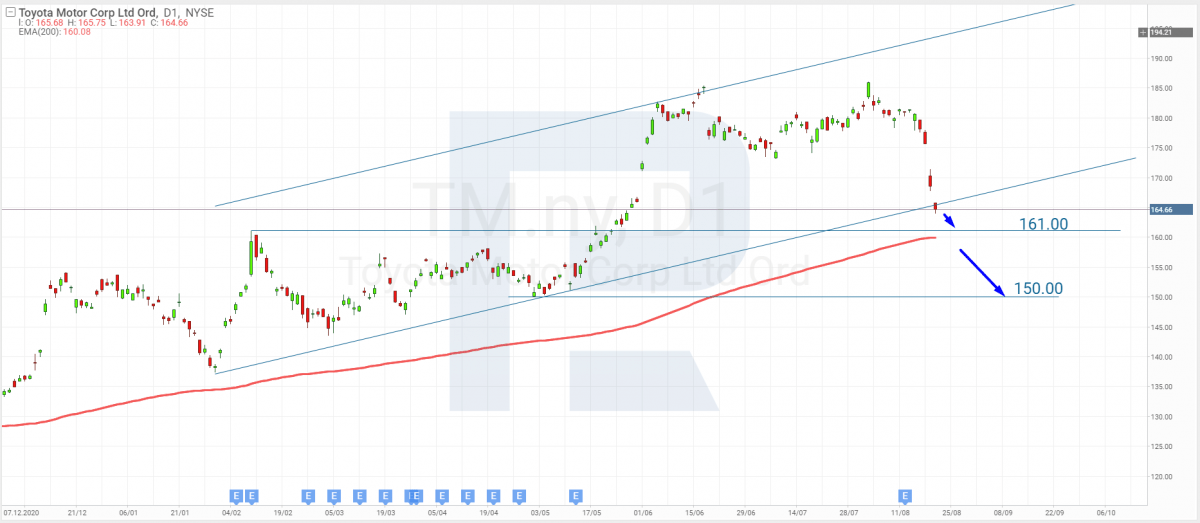

Tech analysis of Toyota Motor by Maksim Artyomov

The shares of Toyota Motor keep up with the stocks of other car-makers, falling down. On D1, they have broken through the lower line of the ascending channel and are trying to secure below it.

Judging by the steep decline of the last few sessions, this week the price might reach the 200-days MA at $161. If the level, is broken away, the decline might continue to the support level of $150.

General Motors: plants standing idle, stocks falling

On August 19th, General Motors announced that its producing powers in the USA, Canada, and Mexico will either work part-time or not work at all. This is again due to the shortage of microchips and semiconductors. According to GM analysts, such troubles with production and supply of vehicles will make the yearly operational profit shrink by $1.5-2 billion.

General Motors plants were to start work again on September 6th, but by the last information, only Spring Hill and Lansing Delta Township will resume work this day. These plants produce Buick Enclave and Chevrolet Traverse. As you know the plants were shut down on July 19th. Other producing powers will get back to work on September 13th and 20th. Yet the start may still be postponed.

When the info above was heard, General Motors shares (NYSE: GM) headed down as expected — by 3.46% to $49.08. Over the next trading session, the situation persisted: minus 0.57% more, reaching $48.8. You know what? This has become the worst result since January this year.

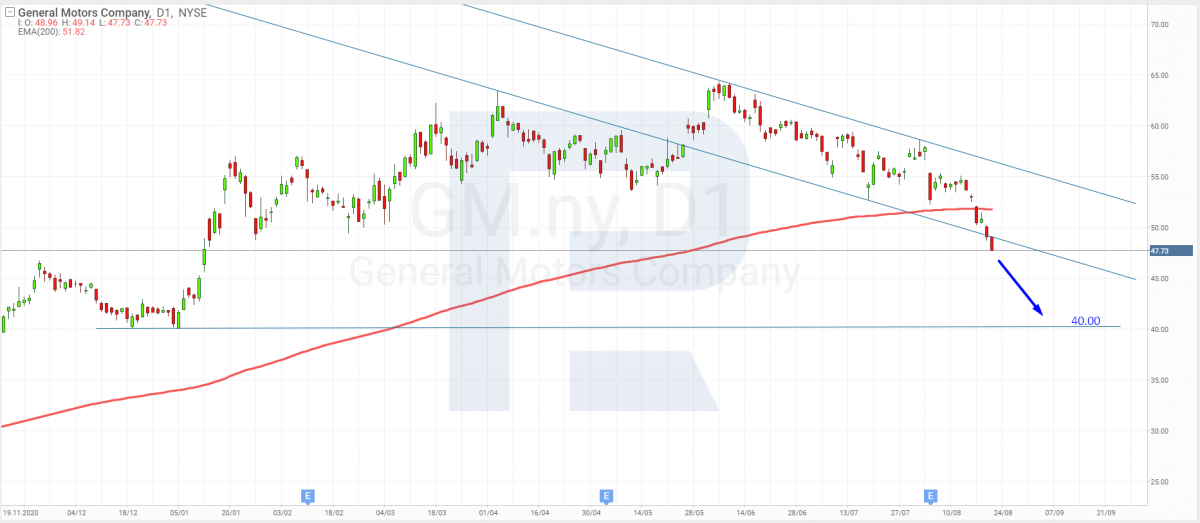

Tech analysis of General Motors by Maksim Artyomov

On D1, GM shares are falling. With all the recent news and the shortage of chips, they have broken through the 200-days MA and keep falling. As long as the lower border of the descending channel has also been broken, this can be called "speeding up the downtrend".

There is no end to be seen to the shortage of spare parts, so I suppose the stock price will keep falling. The aim for the nearest future is the support level of $40.

Summing up

On Thursday, August 19th, Audi, Toyota, and General Motors reported a decrease in the volumes of produced cars. They say plants will be standing idle because there's a shortage of chips for electronic systems in cars. The shares of the car-makers started falling: VW — by 3%, Toyota — by 4.09%, and GM — by 3.46%. Experts say, the shortage of semiconductors will persist over 2022.