IPO of WCG Clinical: a new Level of Medical Research

6 minutes for reading

When the coronavirus entered our lives, the entire world started keeping a wary eye on testing procedures of vaccines from different manufacturers. However, we should remind you that pharmaceutical companies conducted hundreds of thousands of clinical trials of different medications and vaccines even before that. Medical workers had a lot to do: planning, research optimization, involvement of patients, and ethical practices. To make clinical trials successful, all these things must be solved holistically.

WCG Clinical is engaged in solving key problems that impair the effectiveness of clinical research in the process of making new medications. WCG filed for an IPO at the NASDAQ and got the “WCGC” ticker. The IPO date hasn’t been announced yet, that’s why we have plenty of time to assess how attractive the company’s shares might be for investments.

Business of WCG Clinical Inc.

WCG Clinical was founded in 2012 as a part of the other company, Western IRB. The key investor was Arsenal Capital Partners. The company headquarters is in Princeton, New Jersey. WCG’s mission is to improve the quality and the speed of conducting clinical trials of new medications.

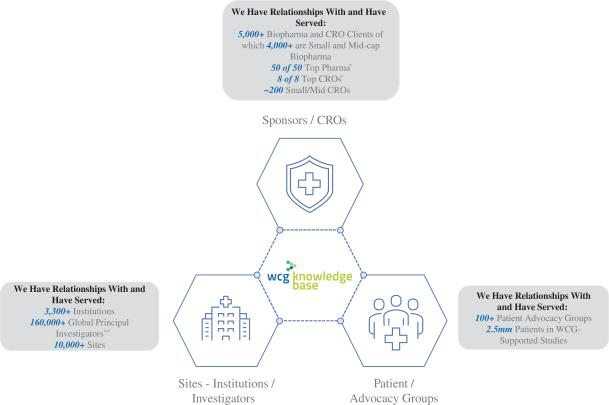

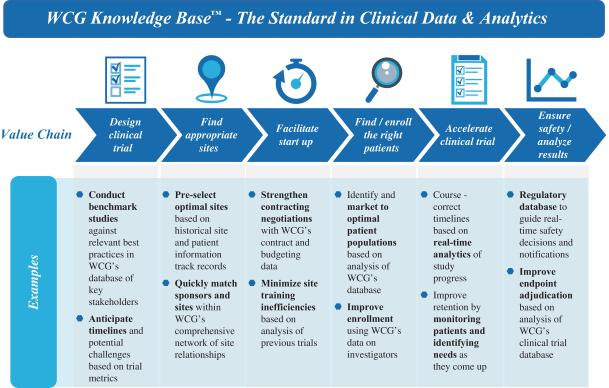

The company’s most important product is software that includes technological solutions for providing comprehensive support to clinical trials of new medications and vaccines. WCG Clinical is an intermediary between sponsors, research facilities, and patients. The interaction scheme can be found below.

Market players work in the WCG ecosystem, which is a base of knowledge and contacts. It gives a boost to more effective cooperation between interested parties. WCG is a single coordination centre.

The company also provides ethical examination services. Western IRB, WCG’s parent company, has a 50-year history in the ethical examination market. It gives the company an edge over its competitors in “fighting” for experienced market players.

WCG operates in 71 countries. The company’s solutions were used in clinical trials of 87% of medications approved by the US FDA over the last year. Throughout the company’s entire history, it has had over 5,000 biopharmaceutical firms, 10,000 research facilities, and several million patients as its clients.

Financial performance

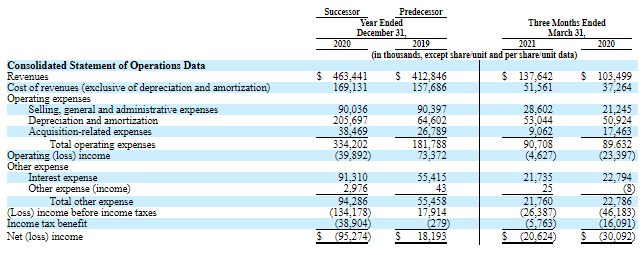

WCG Clinical does not generate the net profit, that’s why we’ll start analysing its financial performance with sales. According to the S-1 form, in 2020, the company’s revenue was $463.44 million with a 12.25% increase relative to 2019. However, in the first quarter of 2021, the indicator added 32.98% in comparison with the same period of 2020 and was $137.64 million.

If this pace continues, the company’s revenue at the end of 2021 might reach $616.31 million. Sales over the previous 12 months are $497.59 million and that’s quite impressive result.

The company’s net loss in 2020 was $95.27 million, which looks rather sad if compared with the net profit of $18.19 million in 2019. We should note that the net loss is reducing: in the first quarter of 2021, it was $20.62 million, a 31.47% decrease relative to the same period of 2020. If the company’s revenue grows faster, WCG has every chance to reach a break-even point at the year-end.

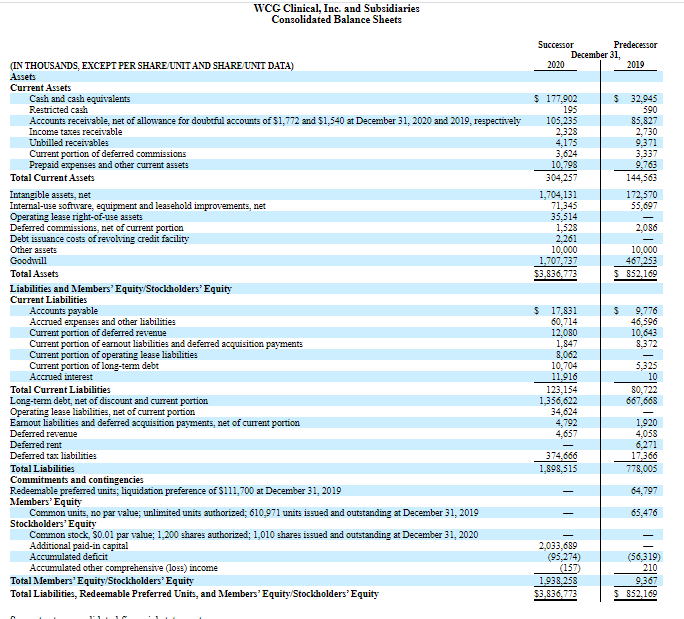

Cash and cash equivalents on the company’s balance sheet are $174.99 billion, while its long-term debt is rather high and equals $1.41 billion. WCG Clinical spends a lot of money on the improvement of its software. The gross profit margin is 63.14%.

The company’s weak side is substantial debt obligations but the revenue growth rate this year afford ground for expecting a return to profitability and a decrease in the debt load.

The market and competitors of WCG Clinical Inc.

According to the research from EvaluatePharma, the global pharmaceutical development in 2021 is estimated at $195 billion, and the segments WCG specializes in cover 4.62% or $9 billion. As a result, the company’s share of the market is 5.55%. The market is expected to improve by 14% every year from 2021 to 2023.

The company’s key premises for the strategy of growth are:

- Development of its ecosystem.

- Expansion of the platform due to mergers and acquisitions.

- Increase in the average bill of the current customer base.

- Expansion to new regional markets.

The company’s key competitors are:

- Labcorp

- Syneos

- PPD

- ICON

- IQVIA

- Meppace

Strong and weak sides of WCG Clinical Inc.

Having acquired comprehensive information on the company’s business model, let’s highlight its strong sides and investment risks. I believe WCG’s strong sides are:

- A 31.47% increase in revenue in the first quarter of 2021.

- A 50-year history of the parent company Western IRB.

- Proprietary ecosystem.

- Successful cooperation with the industry regulators in the USA.

- Sound management.

- A promising target market with a 14% annual growth rate.

Risks of investing in WCG shares are:

- Strong competition in the industry.

- Unstable net profit, hence no dividends.

- High debt.

IPO details and estimation of WCG Clinical Inc. capitalization

The company didn’t attract venture capital financing before. The underwriters of the IPO are HSBC Securities (USA) Inc., Morgan Stanley & Co. LLC, William Blair & Company, L.L.C., BMO Capital Markets Corp., UBS Securities LLC, SVB Leerink LLC, Goldman Sachs & Co. LLC, Barclays Capital Inc., and Jefferies LLC. At first, the IPO was scheduled for August 5th, but organizers decided to postpone it. WCG Clinical was planning to sell 45 million common shares at the price of $15-17 per share. The IPO may have raised $720 million and the company’s capitalization might be up to $6.05 billion.

To assess the potential capitalization of WCG Clinical, we use a multiplier, Price-to-Sales ratio (P/S ratio). If shares are sold at the highest price in the above-mentioned range, P/S will be 12.1. For the company’s sector, an average P/S value is 8, so one can expect speculative growth during the lock-up period. As a rule, this multiplier reaches 20-25. The maximum upside for WCG shares may be 106.51% (25/12.1 * 100%).

I’d recommend this company for short-term investments if the P/S ratio is higher than 9 at the end of the second quarter. Otherwise, WCG should be considered for long-term investments.