IPO of Sterling Check Corp.: Identity Check by Means of Artificial Intelligence

5 minutes for reading

Sometimes when a person applies for a job at a new place of employment, apart from the HR department paperwork, they have to go through the company’s security check, which is intended for conducting an audit of the data provided by an applicant. The key problem here lies in the lack of access to many databases that help to assess an applicant from the point of view of loyalty and reliability (no record of convictions, misdemeanours, etc.). Many available vacancies require “good legal standing”, that’s why checking biographies and information from previous employers are critically important for efficient personnel policy in any company.

Sterling Check, the company that developed a platform for automated personnel check, is planning to have an IPO at the NASDAQ on September 22nd. Its shares will start trading the next day under the “STER” ticker. In this article, we’ll find out whether its shares are worth investing in. As usual, we’ll start with its business model analysis.

Business of Sterling Check Corp.

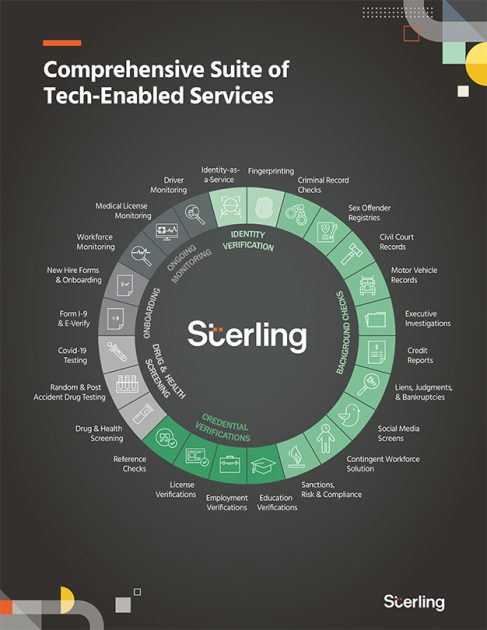

The company was founded in 1975 with a headquarters in Portland, the USA. Sterling Check developed a technological solution for performing background and identity checks of available vacancy applicants, their biography, and personal records. Sterling Check Corp. created a comprehensive solution for managing hiring risks, which includes personal identification, civil court records, criminal background checks, drug and health screening, and global medical checks.

The platform also provides the company’s clients with the functionality for processing employees’ personal data for hiring and monitoring risks. That’s exactly what made it a comprehensive tool in Sterling Check’s clients’ personnel policy.

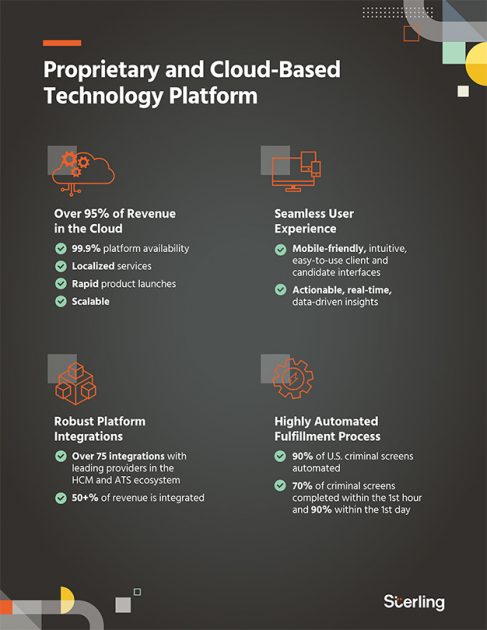

The company provides its services through a field-specific patented cloud platform with heavy use of artificial intelligence. The platform allows clients to get analytical data online and helps their management to make immediate personnel decisions, especially amid the increasing number of employees that work remotely.

There are two versions of the platform, for employers and applicants. One can send their CVs even from a smartphone. The platform allows to accumulate experience of applicants and current employees, thus helping to draw analytical reports.

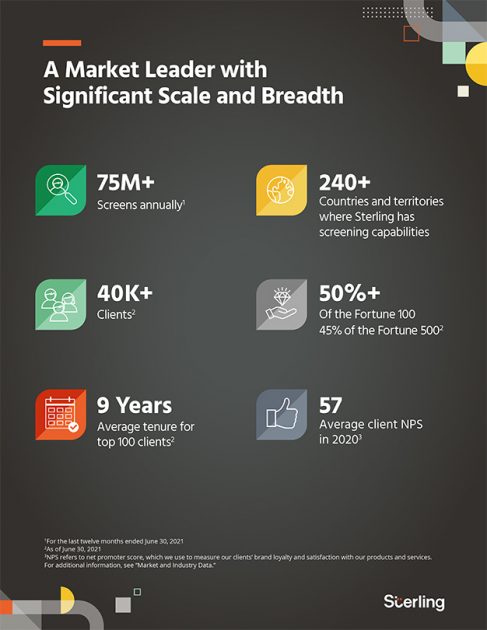

Sterling Check performs over 75 million background checks every year. The company’s clients are over 40,00 companies, 50% and 45% of which are from Fortune 100 and Fortune 500 respectively. Sterling Check offers its services in over 20 countries. Now let’s take a closer look at the company’s target market.

The market and competitors of Sterling Check Corp.

According to the company’s research, the global background and identity services market in 2020 was estimated at $16 billion. By 2025, it is expected to reach $29 billion with a compound annual growth rate (CAGR) of 12%.

As reported by Acclaro Growth Partners, Sterling’s target market consists of three segments:

- Personnel background check after hiring ($3 billion in 2020, up to $5 billion by 2025).

- Vacancy applicant background check ($6 billion in 2020, up to $8 billion by 2025).

- Current employee background check ($8 billion in 2020, up to $16 billion by 2025).

The company holds the leading position in the industry and dominates its competitors.

Financial performance

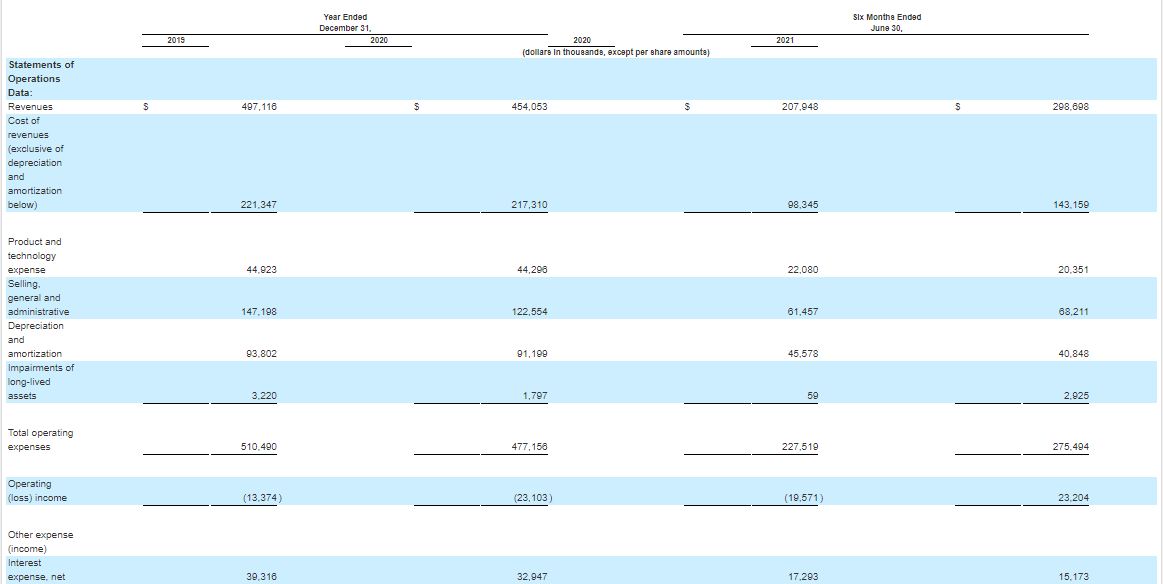

The company hadn’t been generating a net profit for a long time. However, after the first two quarters of 2021, Sterling Check recorded positive financial results, that’s why we’ll start analysing the company’s financial performance with its revenue.

In 2020, Sterling Check’s sales were $454.05 million, with an 8.66% decrease relative to 2019. A negative factor that influenced this aspect was the coronavirus-related restrictions, that prevented many companies all over the world from hiring new personnel.

Over the first 6 months of 2021, this indicator was $298.7 million, with a 43.64% increase if compared with the same period of 2020. In the last 12 months, sales were $544.8 million.

The company’s net loss in 2020 was $52.29 million, a 12.01% increase in comparison with 2019. Over the first 6 months of 2021, Sterling Check’s net profit was $4.03 million. The profit is highly likely to continue rising – the company started generating a positive cash flow.

Cash and cash equivalents on the company’s balance sheet are $94.29 million. At the same time, its total debt is $606.69 million, and that’s a threat to the company’s financial stability.

Strong and weak sides of Sterling Check Corp.

Having acquired comprehensive information on the company’s business model, let’s highlight its strong sides and investment risks.

I believe the company’s advantages are:

- At the time of the IPO, Sterling Check generates the net profit.

- The company leads its market.

- The revenue in 2021 is adding over 40%.

- The target market growth rate exceeds 10%.

- The company’s platform has a built-in AI.

- Sound management.

Risks of investing in Sterling Check shares are:

- Sales dropped because of the COVID-19 pandemic.

- The company doesn’t pay dividends.

- The revenue growth rate is unstable.

IPO details and estimation of Sterling Check Corp. capitalization

The underwriters of the IPO are Nomura Securities International, Inc., Stifel, Nicolaus & Company, Incorporated, KeyBanc Capital Markets Inc., ING Financial Markets LLC, R. Seelaus & Co., LLC, J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, William Blair & Company, L.L.C., KeyBanc Capital Markets Inc., J.P. Morgan Securities LLC, R. Seelaus & Co., LLC и Goldman Sachs & Co. LLC.

During the IPO, Sterling Check is planning to sell 14.3 million common shares at the price of $20-22 per share. The IPO volume is expected to be $300 million. In this case, the company’s capitalization may be $1.97 billion.

To assess Sterling Check’s potential capitalization, we use a multiplier, the Price-to-Sales ratio (P/S ratio). At the time of the IPO, the company‘s P/S value is 3.62. An average P/S value for the technological sector is 5. As a result, Sterling Check’s capitalization may reach $2.72 billion (5/3.62*100%), while the upside for its shares may be 38.11%.

Considering everything mentioned above, I’d recommend this company for a mid/long-term investment portfolio.