Virgin Galactic May Fly Again: Stocks Heading Up

3 minutes for reading

At the beginning of September I wrote that Virgin Galactic shares dropped by over 6% after the Federal Aviation Administration of the USA reported an investigation started and suborbital flights of Richard Branson’s company put on a halt.

Well, the investigation is over, the regulator has lifted the ban, and the shares of the holding are sure to start growing. This is what I’m going to tell you about today. And if you’ve been craving for a fresh tech analysis by Maksim Artyomov – good news: there it is waiting for you several paragraphs down, Let’s move on!

What was the investigation about?

On September 2nd, the FAA announced that it was going to find the reasons why the spacecraft Unity-22 had breached the borders of its assigned air corridor on July 11th. As you remember, it was the first suborbital flight with passengers by Virgin Galactic.

Representatives of the holding admit that on that day the spacecraft, indeed, deviated from the route for 101 second due to strong gushes of wind. Simultaneously, they deny that this could impose extra danger on other aircrafts and localities.

Virgin Galactic: flight cleared

On September 29th, Richard Branson’s company shared good news that the FAA was lifting the ban from suborbital flights and winding up the investigation. Virgin Galactic will have to somewhat correct the flight preparation procedure and flight techniques. As you may guess, this is what the regulator has kindly asked about.

What does Virgin Galactic have to do?

Firstly, the company will need to expand safe airspace or next flights. For this, calculations of the air corridor will be amended. Wider airspace will decrease the risks of a disaster if the flight trajectory gets erratic.

Secondly, the preparatory and active phases of launches and flights have to be perfected. Among other things, there must be real-time communication with the FAA representatives.

How high did Virgin Galactic shares grow?

After this information was published, the shares of Virgin Galactic Holdings (NYSE:SPCE) on the premarket on September 29th started growing – by almost 10%. On September 30th, trades of the shares closed with 12.15% growth. Trades closed at $25.3 thought the high reached during the session was $26.5.

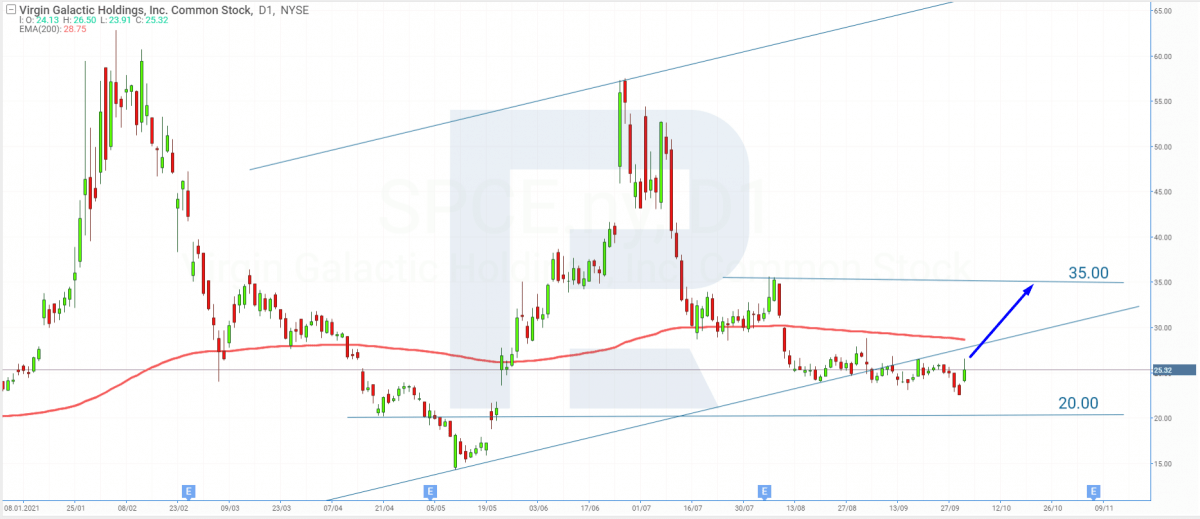

Tech analysis of Virgin Galactic shares by Maksim Artyomov

The shares are trying to recover after the ban imposed on suborbital flights of the company. Currently, they are trading near $25. As long as the news are positive, I think, we can hope that investors will believe in the company again. The aim of the growth is the lower border of the ascending channel and the 200-days Moving Average.

After a breakaway of the MA, it is quite probable that the downtrend will soon change for an uptrend. The aim of growth is $35. However, before an ascending trend forms, the quotations might drop to the support level of $20.

Summing up

After the news that the FAA was finishing investigation and lifting the ban off suborbital flights of Virgin Galactic, the shares of the company started growing. The quotations grew on the premarket and closed with more than 12% growth.

This means that the first commercial mission of the holding announced on September 2nd will not be cancelled. As you remember, at the end of the month, a mission with the Italian air forces is planned.