What is happening to shares of Facebook and other IT giants?

5 minutes for reading

Today we’ll talk about several IT companies at once, such as Facebook, Apple, Amazon, Netflix, Alphabet, and Microsoft. Shares of all these IT giants dropped during Monday’s trading session and it won’t be natural if we don’t try to figure out the reasons and the consequence of what happened.

But that’s not all: Maksim Artyomov has already prepared tech analysis of shares of some companies mentioned above. Do you want to know which ones? Then don’t waste time, the article won’t read itself!

Facebook shares plummeted after its services

On October 4th, there was a technical failure on Facebook, Instagram, WhatsApp, and Messenger. For almost six hours, users from different countries couldn’t connect to these online platforms. According to New York Times, not only did the company’s major services stopped working, but internal tools and instruments as well.

The report from Cloudflare said that the company’s websites and applications malfunctioned because of the router update error, which made DNS servers unavailable. Experts believe it was one of the longest failures in the operation of these platforms.

On the same day, shares of Facebook (NASDAQ:FB) lost 4.89% at the end of the trading session and plummeted to $326.23 per share. Since the beginning of 2021, it’s been the biggest plunge of Mark Zuckerberg’s company. We should note that during the trading session, the decline was even more significant, down to $322.7 per share.

Was this the only reason for Facebook shares drop?

We believe it wasn’t. On October 3rd, the day before popular websites and applications failed, there was an interesting piece of news on the Bloomberg website. A former Facebook employee Frances Haugen appeared on CBS’s popular TV show “60 minutes” and said that she handed over the company’s in-house documentation to journalists and regulating authorities, and filed a complaint to the US Securities and Exchange Commission (SEC).

According to Bloomberg, Frances Haugen, based on these documents, is accusing Facebook of the following:

- Hiding and ignoring the research data on the negative impact of the company’s services on the mental health of users of various ages.

- Ignoring the facts of active usage of the company’s platforms by organized crime.

- Creating just an illusion of fighting the spread of misinformation about the coronavirus infection, as well as the dangers of vaccination.

- Disabling the settings that block the spread of political and social information and disbanding the department responsible for developing and updating respective software solutions.

Shares of other IT corporations also dropped

On October 4th, not only Facebook shares plunged: Amazon (NASDAQ:AMZN) lost 2.85%, down to $3,189.78, Apple (NASDAQ:AAPL) — 2.46%, down to $139.14, Alphabet (NASDAQ:GOOGL) — 2.11%, down to $2,673.2, Microsoft (NASDAQ:MSFT) — 2.07%, down to $283.11, Netflix (NASDAQ:NFLX) — 1.6%, down to $603.35.

Analysts say that the global plunge in the IT sector can be explained by a strong rally in the US 10-year bond yield. We should think about it – was it a global technical failure or an interview of a former employee that hit Mark Zuckerberg’s empire so hard?

On October 5th, shares of all IT giants mentioned earlier recovered. Netflix, which was leading the way, added 5.21%, up to $634.81 per share and was followed by Microsoft (+2%, up to $288.76), Alphabet (+1.77%, up to $2,720.5), Apple (+1.42%, up to $141.11), and Amazon (+0.98%, up to $3,221). Truth be told – even Facebook shares rose and added 2.06%, up to $332.96.

American indices “copycatted” the decline-growth maneuver

On Monday, Nasdaq 100 (NDX) lost 2.16%, down to 14,472.12 points but the next day it added 1.4%, up to 14,674.14 points. S&P 500 (SPX) dropped 1.3%, down to 4,300.46 points and recovered by 1.05%, up to 4,345,72 points on Tuesday.

Dow Jones Industrial Average (DJI) lost 0.94% and was 34,003.58 points and then added 0.92%, up to 34,315.99 points. NYSE Composite (NYA) decreased by 0.77%, down to 16,198.6 points, and then expanded by 0.79%, up to 16,327.1 points over the same period.

Tech analysis of Facebook, Amazon, and Netflix shares by Maksim Artyomov

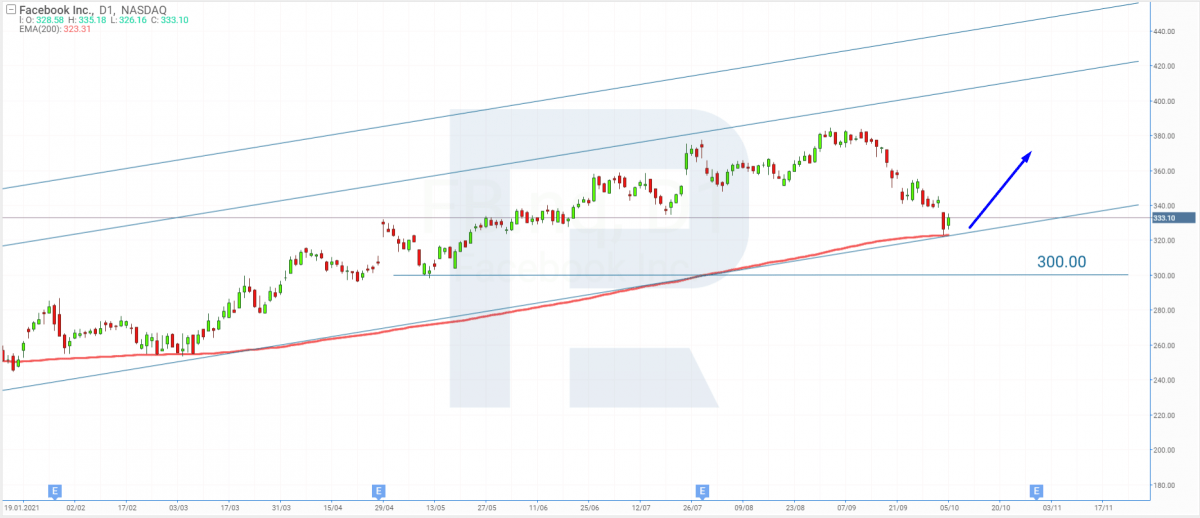

“Facebook shares continue the correction; right now, they are testing the rising channel’s downside border. At the same time, the 200-day Moving Average acts as the support level. Considering the latest events, we may assume that the current decline is a temporary factor within the correctional wave.

After completing the pullback, the price may rebound from the support level and resume its ascending tendency. In this case, the upside target will be the local high at $380. However, if the company’s services continue failing, its shares may lose investors’ trust and plummet towards the support area at $300”.

Amazon

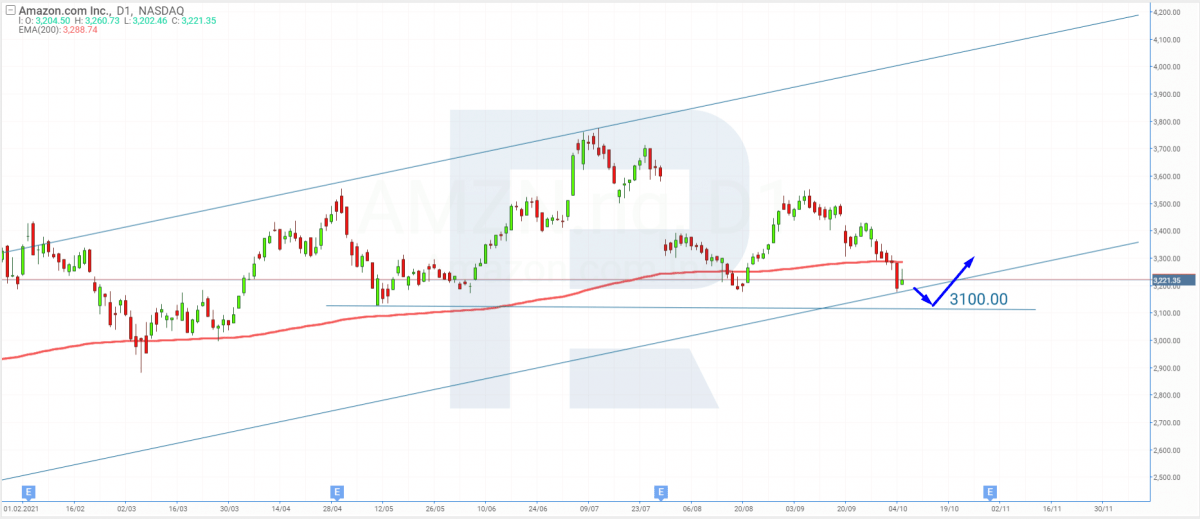

“In the daily chart, Amazon shares are testing the rising channel’s downside border. Taking into account a breakout of the 200-day Moving Average, we may assume that the price is going to continue correcting to the downside.

In this case, the target is at $3,100. In the future, after testing the support level, the asset may rebound and resume moving within the global uptrend. The upside target will be the closest high”.

Netflix

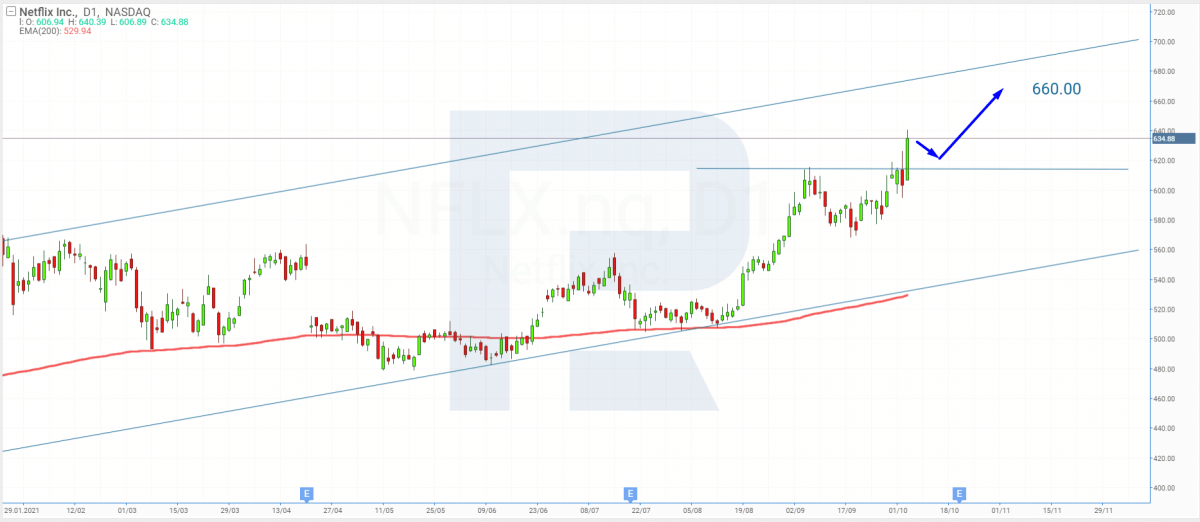

“Influenced by negative news about competitors, Netflix shares are moving within the rising channel and updating their highs. We may assume that after skyrocketing, the price may correct a bit to return to $614.

After completing the pullback, Netflix shares have every chance to recover and continue their ascending tendency. A signal to confirm this idea is the 200-day Moving Average, which is also rising”.

Summing up

A rally in the US 10-year bond yield resulted in a global decline of the IT sector stocks. Shares of such corporations as Facebook, Apple, Amazon, Netflix, Alphabet, and Microsoft “took a serious beating”. However, they all managed to recover the next day.

As for the social network, it was not the only factor that hurt: the global failure damaged all services of the company. Apart from that, the media and regulating authorities got the in-house documents with some rather unpleasant data on the company management’s policy and decisions.