Alibaba Group Shares Growing Four Sessions in a Row: What’s the Reason?

3 minutes for reading

Last Monday, Alibaba Group shares at the Hong Kong exchange closed at 137 HKD, which means that since the beginning of the year the shares had lost 41%. However, the situation started changing, and the quotations of the giant headed upwards.

What made the shares grow? Does it mean they will recover? Let’s figure this out right now, with the help of a tech analysis by Maksim Artyomov.

What’s going on with Alibaba Group shares?

Last week was a success for the corporation, especially with the beginning of the year being so lame. The shares of Alibaba Group (HK: 9988) started growing on Wednesday, October 6th. That day, at the Hong Kong exchange, they rose by 1.48%, reaching 137.3 HKD. On Thursday, they grew by 7.28%, Friday – by 5.57%, and today – by 7.91%.

They are now trading at 167.8 HKD, demonstrating growth for 4 sessions in a row. The growth amounts by about 24%, which is quite substantial, isn’t it?

At the New York stock exchange, the shares of Alibaba Group (NYSE: BABA) followed close: last week, they grew by 15.7% from $139.63 to $161.52. As in Hong Kong, growth lasted for 4 days.

Why did the growth start?

The first reason is the actions of an American publisher and tech company Daily Journal Corporation, managed by Warren Buffett’s ally Charlie Munger.

Daily Journal bought 136,740 shares of Alibaba Group, which means its share in the company increased by 82.7%. It now holds 302,060 shares of the Chinese corporation, which is 20% of the company’s investment capital.

The second reason is the news that we heard on October 7th: President Joe Biden (USA) was meeting with the Chinese head Xi Jinping.

The exact date of the meeting is kept secret: the media only mentions that the meeting will take place until the end of the year. Most probably, the leaders will discuss the solutions to trading conflicts between the two countries and the heated situation in Taiwan.

On Thursday, this news provoked growth of not only Alibaba Group shares but other Chinese companies as well:

- JD.com (NASDAQ: JD): +6.16% to $76.3

- Tencent (HK: 0700): +5.6% to 471.4 HKD.

- Baidu (HK: 9888): +4.88% to 150.3 HKD.

- Didi (NYSE: DIDI): +3.3% to $7.83.

Tech analysis of Alibaba Group by Maksim Artyomov

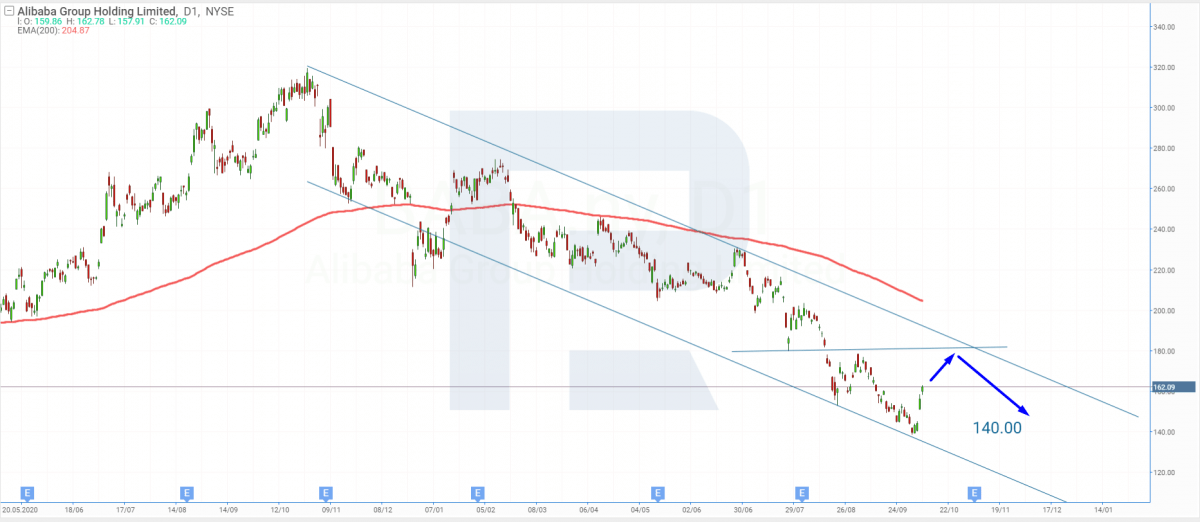

On D1, Alibaba shares are forming another correctional wave in the overall downtrend. At this stage, the quotations have tested the support level at $140; they are now trying to restore lost positions and are heading for the upper border of the channel.

I presume that next thing, the price will bounce off the tested resistance level and go on declining. Further falling is forecast by the 200-days Moving Average that also keeps a downtrend. The aim of the declining is probably the support level of $140.

Summing up

As all large tech companies in China, Alibaba Group is losing positions due to strong pressure from Chinese regulators, conflicts between China and USA, and a palpable slow-down in the Chinese economy.

However, Alibaba Group still holds 47% of the online commerce market in the country. After hearing the news about a possible meeting of Joe Biden and Xi Jinping, as well as about Daily Journal buying 136,740 shares of Alibaba Group, the quotations of the IT giant headed upwards. Over four trading session, the shares grew in the Hong Kong exchange by 24% and in NYSE – by 16%.