JPMorgan, Bank of America, Morgan Stanley, Citigroup, and Wells Fargo Give Reports for Q3, 2021

6 minutes for reading

The season of quarterly reports is starting, and among the first companies to show their performance to the public were such large banks as JPMorgan, Bank of America, Morgan Stanley, Citigroup, and Wells Fargo. I will share with you the statistics of these financial world giants, and Maksim Artyomov will make the article even more appetizing by adding his technical analyses.

JPMorgan quarterly report: net profit grows by 24%

N October 13th, JPMorgan Chase & Co filed a report for July-September. And though Wall Street analysts had forecast a slow-down in the growth of the main results of the entity, they had still undervalued JPMorgan.

The main reason for the growth of the net profit should be the getting rid of the the reserve amounting to $2.1 billion made last spring. As you remember, the money was allocated for covering up possible losses from the COVID-19 pandemic.

- Revenue — $30.44 billion, +1.67%

- Net profit — $11.7 billion, +24.5%

- Return on stock — $3.74, +28%, forecast — $2.95.

On the day when the report was published, the stock price of JPMorgan Chase & Co (NYSE: JPM) declined by 2.64% to $161. However, over the next trading session, the quotations changed direction and grew by 1.53%, rising to $163.47 per share.

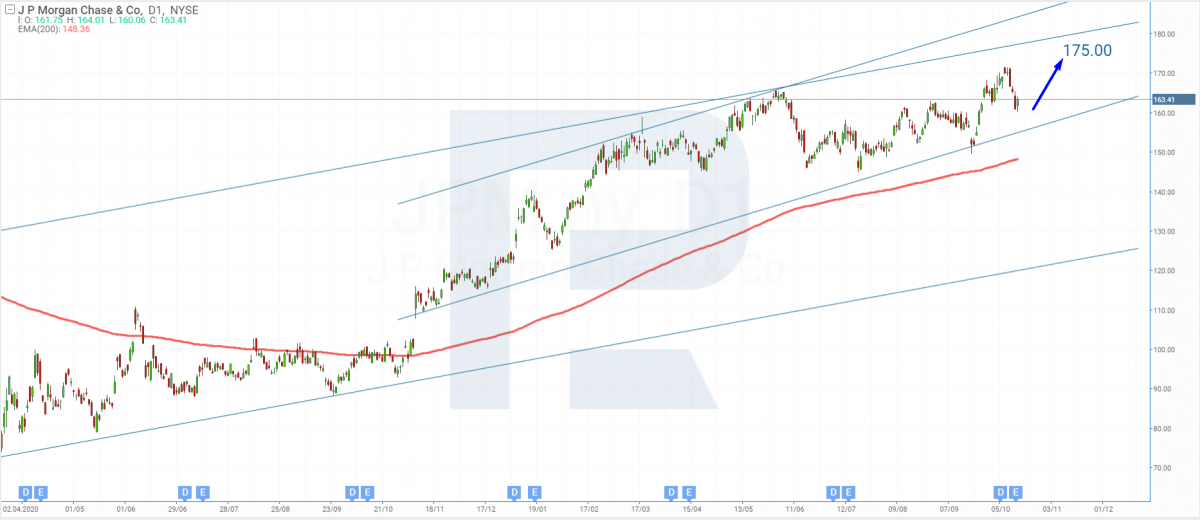

Tech analysis of JPMorgan shares by Maksim Artyomov

Renewing the highs, JPMorgan shares keep correcting, going inside an ascending channel. With all the good news in the report, the correction must soon be over, and the quotations are likely to go on growing.

At this stage, the aim of growth is the high. A breakaway will mean that the uptrend continues. The growth is confirmed by the 200-days Moving Average. In the medium run, after all-time highs are renewed, I would expect a test of $175.

Bank of America quarterly report: EPS growing by 66%

On October 14th, Bank of America issued a press release of its performance in Q3, 2021. Director-genetal Brian Moynihan noted that, thanks to the economic recovery, the BoA restored the pre-pandemic dynamics of the organic growth of the client base. He also said that the number of deposits was strong and that even with low interest rates the net interest income grew thanks to the growth of loan balances. Over July-September, the bank unlocked a $1.1 billion reserve.

- Revenue — $22.87 billion, +12%, forecast — $21 65 billion.

- Net profit — $7.7 billion, +57.1%

- Return on stock — $0.85, +66.7%, forecast — $0.71.

The shares of Bank of America Corp (NYSE: BAC) reacted positively to the published financial news and grew by 4.47% to $45.07. However, note that before that the share price had been decreasing for three trading sessions in a row, losing 2.7% over this period.

Tech analysis of Bank of America shares by Maksim Artyomov

After the report of the Bank of America was published, the shares keep growing. The price has renewed the highs. The growth is supported by the 200-days MA that is demonstrating an ascending impulse.

The next goal of growth might be $48. However, the price might correct to $42. Then after a test it might bounce off the support line and go on growing.

Morgan Stanley quarterly report: revenue of investment banking grows by 67%

On Thursday, October 14th, Morgan Stanley shared its performance in the previous quarter. It exceeded the forecast of Wall Street analysts. The revenue of the investment department had grown by 67% to $2.85 billion, setting a new record. In the sector of personal capital management, there had also been some growth — by 27.5% to $5.4 billion.

- Revenue — $14.75 billion, +23.8%, forecast — $13.93 billion

- Net profit — $3.7 billion, +36.4%

- Return on stock — $1.98, +19.3%, forecast — $1.69.

After the report, the quotations of Morgan Stanley (NYSE: MS) headed upwards by 2.48%, reaching $101.01. They have been growing for three days in a row.

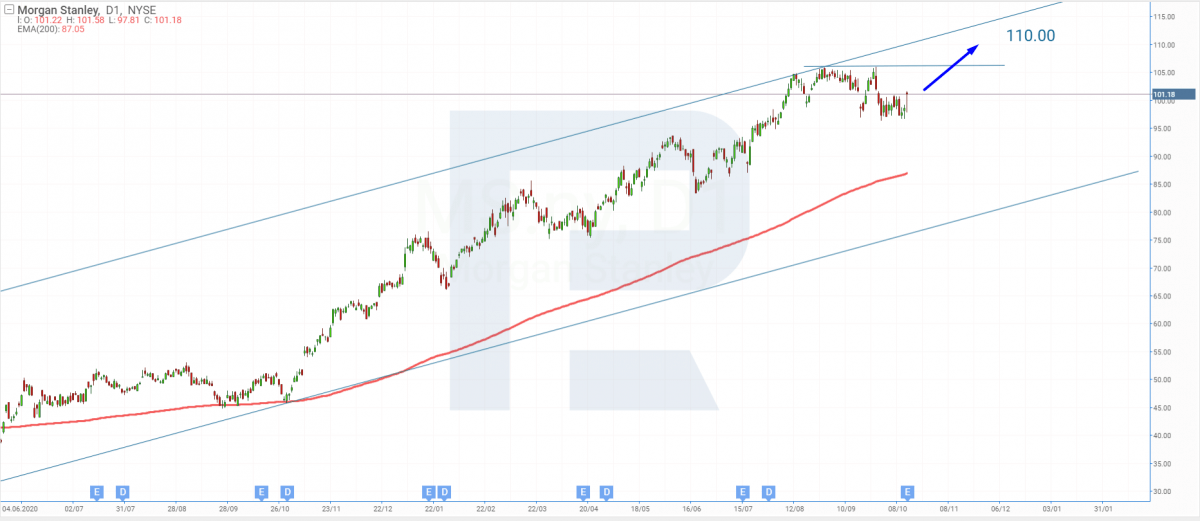

Tech analysis of Morgan Stanley shares by Maksim Artyomov

Winding up a correction, Morgan Stanley shares are trying to rebuild the uptrend. They are now heading towards the resistance level which is at its all-time high.

In the future, the price might renew the highs and continue growing, which is supported by the 200-days MA demonstrating an ascending impulse. The aim of further growth might be $110.

Citigroup quarterly report: EPS leaping up by 58%

Like the banks above, Citigroup Inc filed its report on October 14th. The results were beyond expectations. Spending the reserve on covering up losses allowed for unlocking some $1.16 billion and increasing the profit noticeably.

Director-general Jane Fraser said she was happy with the results of the previous quarter because they were excellent for the current situation.

- Revenue — $17.15 billion, -0.9%, forecast — $17.06 billion

- Net profit — $4.7 billion, +47.2%

- Return on stock — $2.15, +58%, forecast — $1.74.

The quotations of Citigroup Inc (NYSE: C) demonstrated feeble growth after the performance of the company in July-September was published. They grew by just 0.77%, rising to $70.8. Over three days afterwards, the share price dropped by almost 3%.

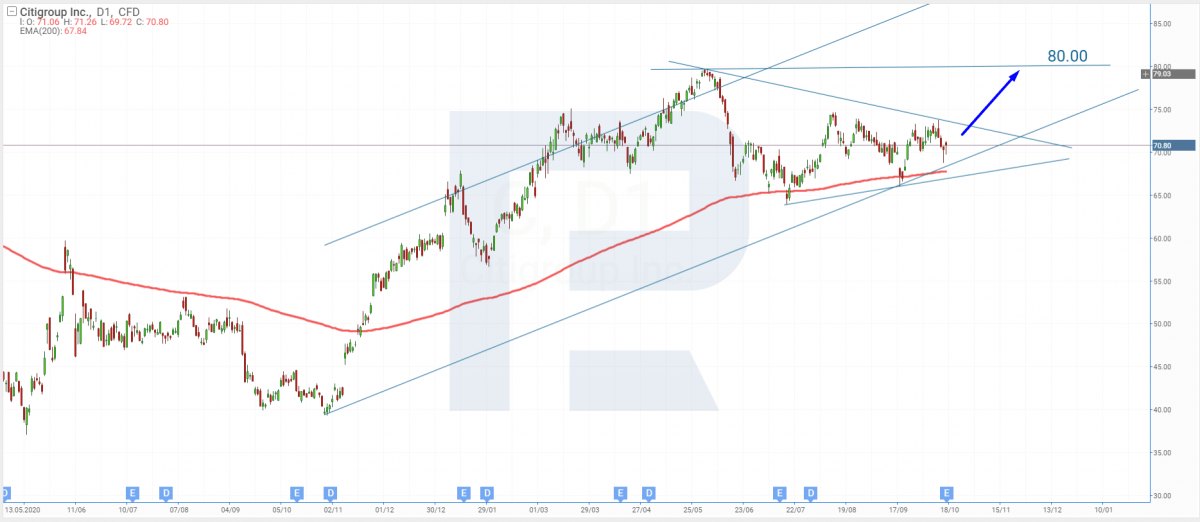

Tech analysis of Citigroup shares by Maksim Artyomov

Citigroup shares are moving on in a flat, forming a Wedge tech analysis pattern. I suppose that after the report, the price will break through the resistance level and go by the pattern. This is also confirmed by the 200-days MA.

In the future, the ascending might continue towards the next resistance level of $80. If everything goes right, the quotations might renew the highs and continue growing.

Wells Fargo quarterly report: net profit growing by 59%

The company reported its performance in Q3 on Thursday, October 14th, and surprised many analysts, exceeding forecasts. The bank used a trustworthy way of making the net profit grow: it liquidated a reserve of $1.65 billion.

In the last trimester, the volume of loans dropped, and this caused a negative effect to the overall revenue. A fine amounting to $250 million did not help either. As you remember, a fiscal regulator noticed some suspicious activity in the loan program if the bank.

- Revenue — $18.83 billion, -2%, forecast — $18.22 billion.

- Net profit — $5.12 billion, +59%

- Return on stock — $1.17, +67%, forecast — $0.99.

The shares of Wells Fargo & Company (NYSE: WFC) dropped by 1.61% on the day of the report, reaching $45.31. Note that they have been falling for four sessions in a row, losing 5.6% totally.

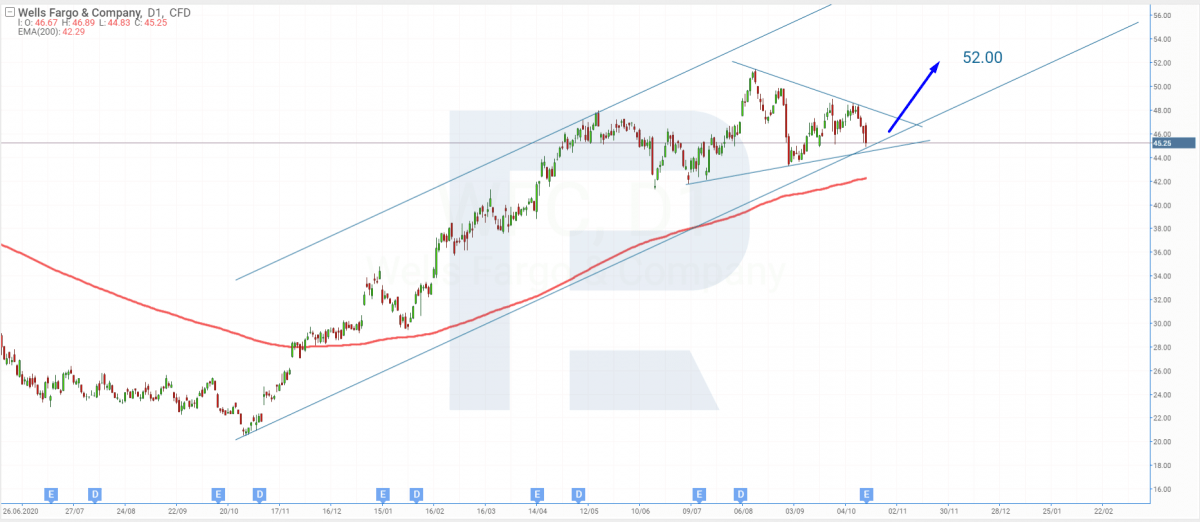

Tech analysis of Wells Fargo shares by Maksim Artyomov

Wells Fargo shares, regardless of a positive report, go on falling. They have formed a tech analysis pattern Triangle and are testing the support level.

Going by the pattern might result in an uptrend. This is confirmed by the 200-days MA which is still below the chart. The aim of growth might be the resistance level at $52.

Summing up

This week such large banks as JPMorgan, Bank of America, Morgan Stanley, Citigroup, and Wells Fargo reported their performance in July-September, 2021. They all had decided to liquidate their reserves for possible losses and thus noticeably increased their quarterly profit.

The quotations of almost all these entities reacted positively to the statistics, demonstrating growth. The only exception was Wells Fargo shares that lost almost 2%, going down for four days.