Shares of Netflix, Johnson &Johnson, and Philip Morris Reacted Ambiguously to Quarterly Reports

6 minutes for reading

This week is full of interesting news, and I almost indulged in talking about Chinese electric cars or French vaccines, but I restrained myself – and will go on talking about quarterly reports.

Today you will hear about financial performance of Netflix, Johnson & Johnson, and Philip Morris. I will not only share some impressing statistics but also tell you how the quotations of the shares reacted to the publication of the reports. And, of course, a tech analysis by Maksim Artyomov will not be left behind. Stay tuned, and on we go.

Netflix quarterly report: investors not impressed

Cool releases, promised by Netflix management at the beginning of the year, yielded results. Due to the pandemic, the streaming platform had to leave the juiciest products for the second half of 2021. No that I’m happy about this, but I simply have to mention the super popular South Korean show “Squid Game”.

According to the published data, more than 142 million people worldwide watched the series over the first four weeks after the release. Bloomberg promises that the project will bring the American company about $900 million.

Netflix tries to create such conditions that users could spend even more time on the platform. Apart from traditional shows, series, and movies, the platform offers videogames. Representatives of the corporation state that games will be included in subscriptions and will not contain any built-in ads or purchases.

The number of paid subscribers of Netflix has grown by 9.4% compared to last year.

The number of users that pay for the content shows whether the company succeeds in attracting people. In Q3 this year, this number increased by 4.38 million users, while the overall number of paid subscribers amounts to 213.56 million people. Compared to the statistics of the same period of last year, growth has reached 9.4%.

As you remember, in Q2 2021, the increase in the number of paid subscribers amounted to 1.54 million people, which is 184% fewer than in Q3. According to the forecasts of the streaming platform, in Q4, there will be 8.5 million more users – as a year ago.

Netflix shares reacted weakly to the results.

After the report was published, the share price of Netflix (NASDAQ: NFLX) demonstrated quite feeble growth – by just 0.16% to $639 per share. Moreover, during the trading session, the quotations even dropped to $632.61.

Important report details

- Revenue - $7.48 billion, +16.3%, forecast - $7.48 billion.

- Return on stock - $3.19, +83%, forecast - $2.56.

- Net profit - $1.45 billion, +83%.

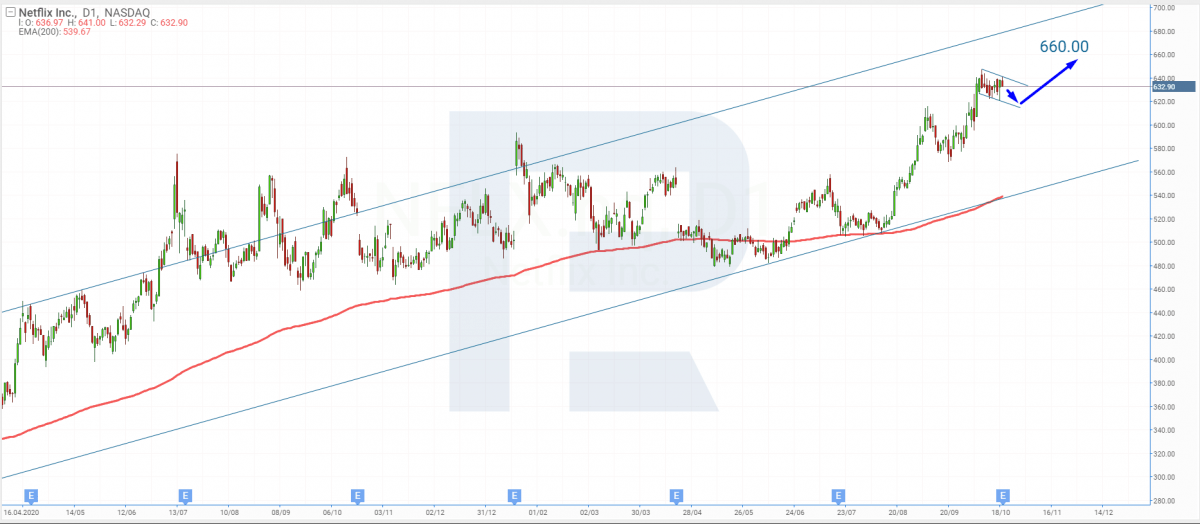

Tech analysis of Netflix shares by Maksim Artyomov

The corporation published a financial report that not only fulfilled all expectations but also exceeded them. Thanks to this, the quotations renewed their all-time highs even before the results were published. Currently, they are correcting as a tech analysis pattern Flag.

Upon testing the support level, the price might go by the pattern. The first aim of growth will be the high. Upon renewing it, the goal might move to $660. The growth is supported by the 200-days Moving Average that keeps growing.

Johnson & Johnson quarterly report: pharma business grew by almost 14%

Like Netflix, Johnson & Johnson published financial statistics for the last quarter on Tuesday, October 19th. In short, the return on stock exceeded expectations of Wall Street analysts but the revenue did not live up to the expectations.

Pharma business of J&J in Q3, 2021 yielded 13.8% more profit than last year.

As for the sales volume of their anticoronavirus vaccine, in Q3 it reached $502 million. In the company, they forecast that by the end of the year, the revenue brought by selling the vaccine would have reached $2.5 billion. Note specifically that over the last three months, the pharma business of the company has yielded $12.9 billion of revenue, which is 13.8% more than a year ago.

The management of Johnson & Johnson reviewed the expectations for this year. The forecast return on stock was increased from $9.6-9.7 to $9.77-9.82, and the forecast general revenue – from $93.8-94.6 billion to $94.1-94.6 billion.

Yesterday the trading session the shares of Johnson & Johnson (NYSE: JNJ) closed at $163.87, growing by 2.34%. As you remember, since the beginning of the year, the quotations have increased by a bit over 4%, rising from $157.38.

Important return details

- Revenue - $23.34 billion, +10.7%, forecast – 23.72 billion.

- Return on stock - $1.37, +3%, forecast - $1.15.

- Net profit - $3.67 billion, +3.2%.

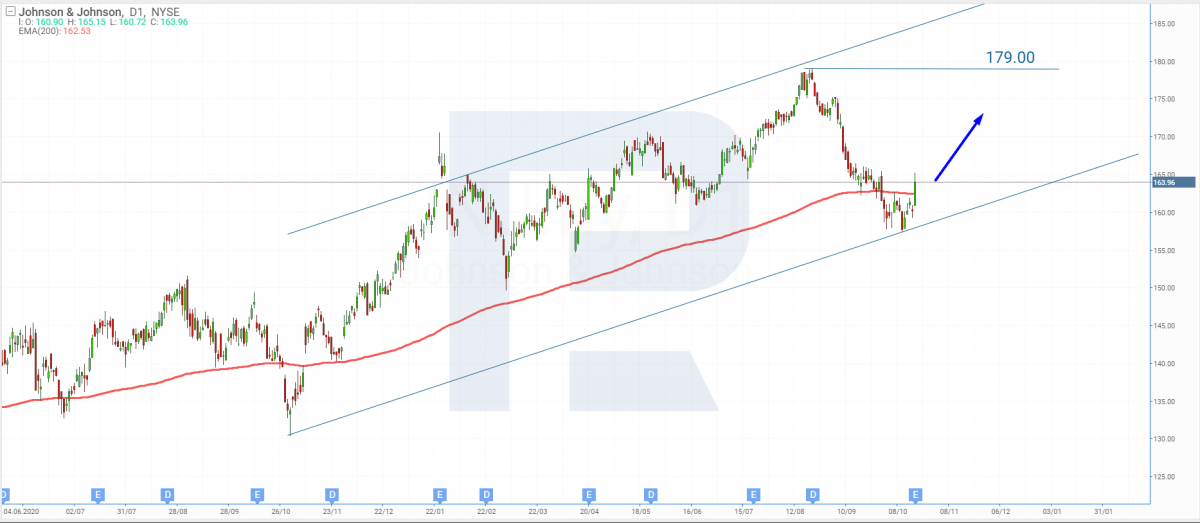

Tech analysis of Johnson & Johnson shares by Maksim Artyomov

With the net profit growing, the shares of Johnson & Johnson starting recovering. The quotations have bounced off the lower border of the channel and keep growing. Currently, the price has broken through the 200-days MA.

This might be a signal for the continuation of the ascending wave. The aim of growth is the resistance level at $179. However, there is a risk that the quotations might return under the 200-days MA and continue with the correctional wave.

Philip Morris quarterly report: shares react by a decline

Philip Morris International also reported its performance in Q3,2021 yesterday, on October 19th. The main financial results grew compared to the statistics of the same period in 2020 and exceeded consensus forecasts.

In the EU countries the overall supply of cigarettes and heated tobacco products dropped by 2.7% to 49 billion pieces. At the same time, the revenue grew by 8.2% to $3.2 billion.

In North and South America, sales of tobacco products grew by 2.5% from 15.8 billion to 16.2 billion pieces, and the revenue – by 14% to $456 million. At the Near East and in Africa the revenue leaped up by 23% to $945 million. General supply volumes also demonstrated growth – by 15% to 35.7 billion pieces.

The share price of Philip Morris dropped after the report.

However, the shares of Philip Morris International (NASDAQ: PM) reacted to the quarterly report by a decline by 1.7% to $95.79. Perhaps this is due to the information about the global shortage of semiconductors hindering supply of IQOS. Note that this is the third trading session in a row ending up with a decline. Over this time, the shares of the company lost 3%.

Important report details

- Revenue - $8.12 billion, +9.1%, forecast - $7.9 billion.

- Report on stock - $1.58, +4.7%, forecast - $1.54.

- Net profit - $2.43 billion, +5.2%.

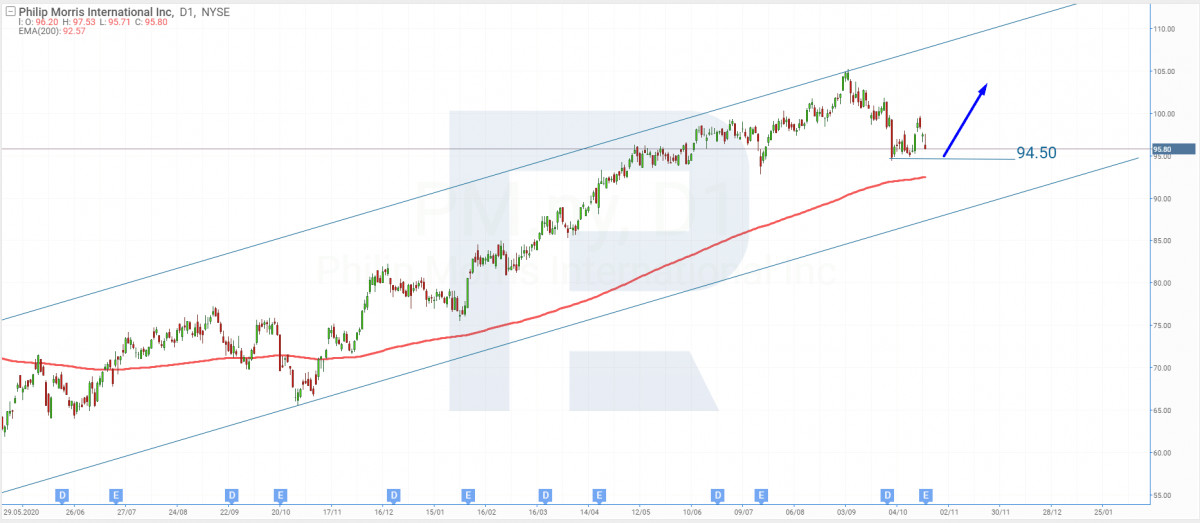

Tech analysis of Philip Morris shares by Maksim Artyomov

Regardless of the financial report exceeding expectations and forecasts, the shares of the corporation keep falling. This might be because the company supported the program of the British government against smoking traditional cigarettes and for replacing them with electronic cigarettes and smokeless tobacco heating agents.

The quotations are nearing the support level of $94.5. If later the attitude of investors changes for a more positive one, the price might bounce off it. The aim of growth might be the resistance level of $105.

Another factor supporting growth after the correction is over might be the 200-days MA that is going upwards. It might later become the support line off which the quotations will perhaps bounce.

Summing up

On October 19th, Netflix, Johnson & Johnson, and Philip Morris reported their performance in Q3, 2021. The share price of the first company increased by just 0.16% to $639. The quotations of the second one – by 2.34%, reaching $163.87. On the contrary, the quotations of the third one slumped by 1.7% to $95.79.