ROKU Shares Falling, Hedge Funds Buy Thousands of Them: What to Do?

7 minutes for reading

The stock market is full of controversies. Some players are selling a certain share, while others are rushing to buy the very same share. Who do we trust and follow?

In the stock market, you can only trust yourself. No one knows where the price for a financial instrument will be going. However, we can always assess all pros and cons and decide for ourselves whether to buy a share that everyone else is selling.

Today, we will look into such a situation with the shares of ROKU.

ROKU, Inc

ROKU, Inc (NASDAQ: ROKU) alongside its subsidiaries managers a streaming TV platform, produces and sells hardware for streaming services, and makes money on advertising. After the company published a quarterly report, the shares of the company lost 10% over two days and kept falling.

In the previous article, I told you what investors base their decision on when considering whether to buy/sell this or that share. Particularly, I mentioned expectations of a future profit made/loss suffered by the company.

I am bringing this up because ROKU management announced that in Q4 it expected a certain slow-down in the growth of income. For investors, this was enough to start selling the shares, regardless of decent results of Q3.

MoffettNathanson, an analytic company, added oil to the fire, decreasing the share price of ROKU to 220 USD and rating the company as Sell. The falling of the stock price sped up, and the shares lost 15% more.

ARKK and ARKW trusts buying ROKU shares

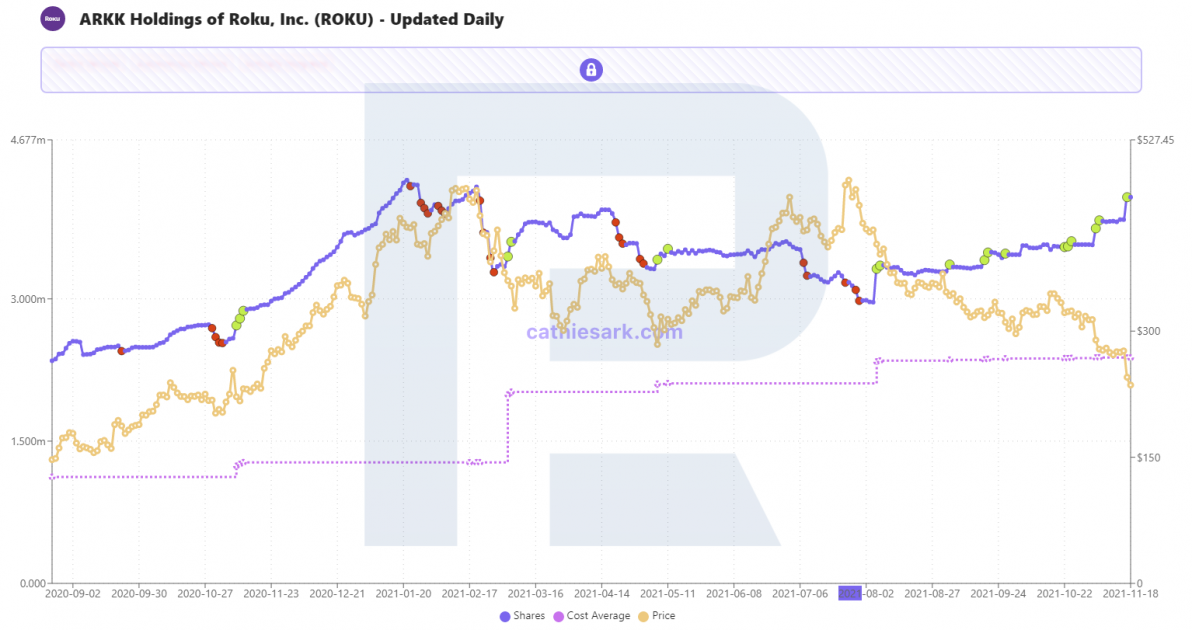

Out of nowhere, Cathie Wood came to the scene and started buying thousands of ROKU shares. On November 17th, the trust she manages, ARKK, bought 245,321 shares for about 62 million USD, while her second trust, ARKW, bought 64,931 shares more for 16 million USD. Now Cathie holds 4,860,000 ROKU shares and is not apparently going to sell them on the current decline.

So what do we do: buy now, following Cathie Wood, or sell and wait until the quotations drop to 220 USD?

ROKU quarterly report

To get started, let us see what was there in the quarterly report of ROKU. So, in Q3, the revenue of the company reached 679.95 million USD, a bit less than the forecast 683 million USD. However, compared to the results of the same period of last year, growth amounted to over 50%.

Note that since the beginning of 2017, it was the first time when the quarterly income of ROKU turned out inferior to the forecasts of analysts. This is bad news. Conversely, the return on stock amounted to 0.48 USD, i.e. 700% more than expected.

The free money flow is also at its all-time high of 2.1 billion USD. The debts of ROKU grew to 1.2 billion USD, but with 2.1 billion USD on the accounts, this is not a big spread. The revenue from ads grew by 82%, watching time – by 21%, which amounts to 18 billion hours in Q3.

Quarterly results turned out better than expected, on the whole, yet the shares have been trading in a downtrend since July, losing 50% of price. Partially, this can be explained by announcements of the management: in Q2, they admitted that expected a slow-down in the growth of revenue.

Obstacles in the way of ROKU

I cannot say that the forecast of the management came true. Investors thought that weakening of the lockdown might have a negative influence on ROKU business because people will spend less time watching TV. In fact, the company keeps increasing its income, and risk is in quite a different thing. The main issues that worry ROKU are breaches in supply chains and shortage of semiconductors.

The MoffettNathanson agency, explaining the reason for decreasing the rating of ROKU, claims that the company has certain troubles sustaining former scales of income growth because new lockdowns are hardly probable; moreover, the shortage of semiconductors will be affecting the income, while the delivery issues, including its high price, will follow suit, also affecting the marginality of ROKU.

The company, in turn, states that it is not going to increase the price of its products. The main goal is not the profit from selling equipment but extending the market share because rivalry keeps growing. With all these facts, the arguments of MoffettNathanson are reasonable, and the revenue of ROKU might slow down for a time.

Worst scenario is already in the share price

The other side of the medal: Cathie Wood and other supporters of buying ROKU shares state that the worst scenario has already been included into the price. The shares have been falling since July 2021, but the financial performance of the company keeps improving.

An even more interesting fact is that, though ROKU management makes a timid forecast for Q4, it still expects the revenue to reach 900 million USD. This is 38% more than in the same period of last year.

Note: on November 19th, the government of Austria announced a new lockdown that comes into force on November 22nd. If lockdowns spread again, the shares of ROKU will head for the all-time high again.

Just a year ago, the company started generating a net profit, and a slow-down in the growth of its growth is a natural instance that entails no real threats in the future. Also remember that Q2 and Q3 are not the times when one wants to sit on a coach and watch TV. And even in such circumstances the company manages to make a profit and never let people decrease average time in front of TV.

General news background around ROKU

Also, you should check general news background ROKU. Currently, in most articles about the company, experts advise to invest in the shares, while the average target price after growth stocks to 375 USD. Only MoffettNathanson sets the target price at 220 USD and recommends selling.

Stock analysis of ROKU, Inc

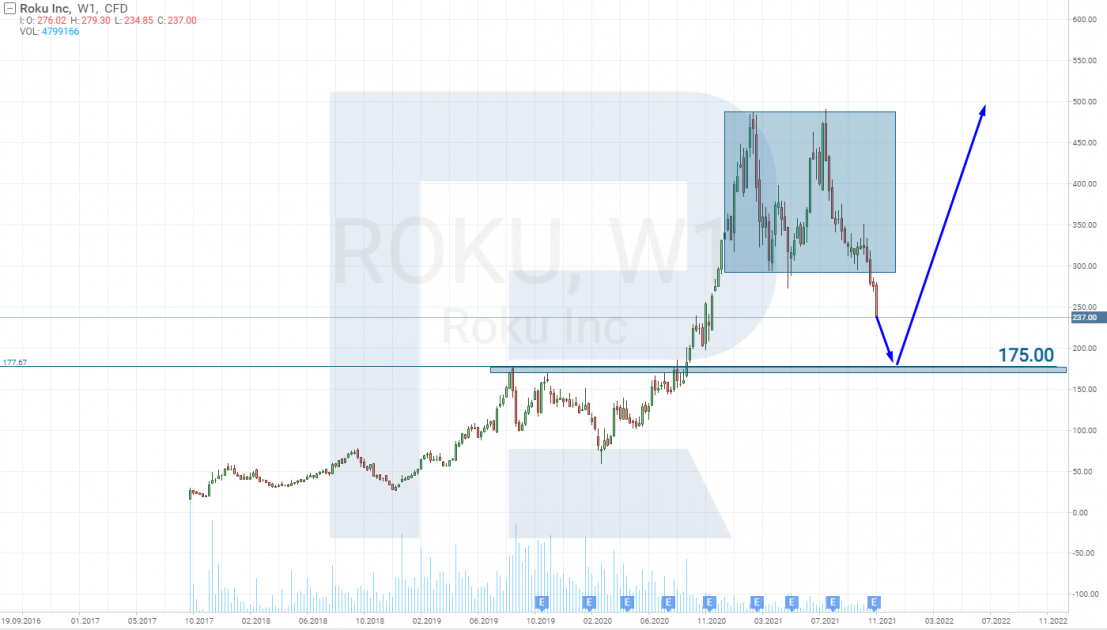

Now let us look at the chart. On W1, the situation looks sad: there is a reversal Double Top pattern that means the price can decline to 175 USD.

Yes, Cathie Wood is buying ROKU shares, but according to the chart, she has taken some profit at the price of 400 USD, while the average buying price is 268 USD, i.e. her position became losing just now.

This is for you to decide whether to follow the example of Cathie. Yet on D1 the shares are trading in a downtrend, which is indicated by the 200-days Moving Average and the descending channel. The Moving Average is a slow indicator, and if we wait for a signal to buy from it, you can skip growth of the price by 100 USD. Hence, try to concentrate on the trend lines and a breakaway of the key resistance levels.

Now things look so that the quotations might drop to the lower border of the channel, coinciding with the support level of 175 USD. A subsequent bounce off this level will signal a recovery. Additional signals will be a breakaway of the descending trendline and then – a breakaway of the resistance levels of 280 USD and 300 USD.

However, things might change drastically if the world slumps into a new quarantine. Then the revenue of ROKU from advertising will grow rapidly. In this case, a breakaway of 280 USD will mean the shares are growing again.

Closing thoughts

Currently, from the point of tech analysis, the shares of ROKU do not look attractive for investments, whatever experts say. I suggest that you should just watch.

Yes, it is quite probable that investors are being too dramatic, and the current price already includes a future slow-down in the growth of revenue. However, to buy the share, wait for some signs of a reversal anyway. Catching the bottom in ROKU shares might be too pricy.