Quarterly Reports Pushed HP and Dell Shares Up

4 minutes for reading

Today I'll present you with the most interesting details of this week's quarterly reports of two American companies: HP and Dell Technologies. Both companies belong to the sector of PCs and laptops, office and server equipment.

I'll tell you how the shares of HP and Dell reacted to the statistics of August-October 2021 and will share with you a fresh tech analysis by Maksim Artyomov.

HP report for Q4, financial 2021: return on stock grows by 453%

HP report for Q4, financial 2021 was issued on Tuesday, November 23rd, when the trading session closed already. The main results turned out above the expectations of experts.

Sales of laptops in August-October grew by 13% against the same period of 2020, reaching $8.3 billion. PC sales increased by 11% to $2.5 billion, and sales of working stations — by 39% to $0.49 billion.

In Q4, financial 2021 the revenue from selling laptops grew by 13% to $8.3 billion.

According to the director-general of the corporation Enrique Lores, such high demand for computers is thanks to quarantine measures being abolished gradually and the employees of medium-sized and large companies partially returning to offices.

The strong quarterly report made the shares of HP Inc (NYSE: HPQ) grow. On November 24th, the trading session closed with the growth of the shares by 10.1% to $35.44. The quotations have been growing for five trading days in a row, by 14.6% total. Since the beginning of 2021, the share price has increased by 44%.

Important report details

- Revenue — $16.68 billion, +9.3%.

- Return on stock — $2.71, +453%.

- Net profit — $3.1 billion, +364%.

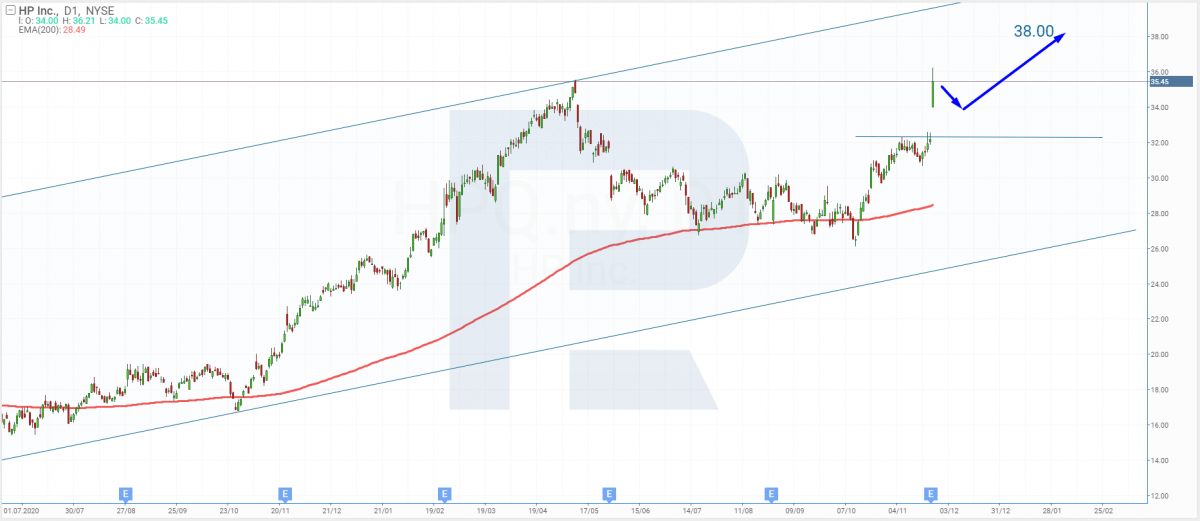

Tech analysis of HP shares by Maksim Artyomov

With the positive financial report and increased revenue, the shares of the company broke through the resistance level and renewed the all-time high. We can currently expect that after such swift growth the quotations will correct slightly trying to cover the gap at least partially. Buyback of shares carried out by the company can support the pullback.

Meanwhile, the 200-days Moving Average confirms the uptrend by going upwards. In the nearest future, the quotations might teach $38. This can push the price up to the upper border of the ascending channel.

Dell report for Q3, financial 2022: net profit grows by 341%

Dell published its financial report for August-October on November 23rd, after trades closed. As with HP, the results were above the expectations of Wall Street analysts.

Overall revenue from selling computers grew by 35% to $16.5 billion, while experts had forecast this below $15.1 billion. Out of the whole sum, $12.3 billion was earned by selling hardware to commercial clients and $4.3 billion — by working with physical clients.

In Q3, financial 2022, the revenue from selling PCs grew by 35% to $16.5 billion.

On November 24th, the shares of Dell Technologies Inc (NYSE: DELL) grew by 4.81% to $57.3. Since January, the share price has dropped by almost 22%. As you remember, at the beginning of November the company singled out it's cloud services into a separate company called VMware, and as a result, the quotations dropped by 51% from $111.51 to $54.61.

Important report details

- Revenue — $28.39 billion, +21%.

- Return on stock — $4.87, +351%.

- Net profit — $3.89 billion, +341%.

Tech analysis of Dell shares by Maksim Artyomov

With the growing profit, the shares of the corporation renewed their all-time high and corrected. Investors must not be very impressed by the financial report, though it exceeded expectations. The price is growing inside the ascending channel, which might mean that the current dynamics will remain in force, and the quotations will soon test $60.

The growth is supported by the 200-days MA that is also going upwards. One more renewal of the high in the future might result in the continuation of the uptrend.

Summing up

On Tuesday, November 23rd, HP and Dell filed their reports for August-October. The statistics of both companies turned out to be above expectations. The growth of the profit of the first corporation amounted to 364% and of the second one — to 341%. With such quarterly reports, the shares grew by 10.1% and 4.8%, respectively.