New COVID-19 Strain Crashes Markets

5 minutes for reading

Last week ended in unbelievable falling of markets because investors feared the newly discovered coronavirus strain. What's happened to stock indices? Which sectors suffered more than others? Are there those making a profit on the situation? I'll try to give you the answers.

WHO emergency meeting

On Thursday, November 25th, as CNBC and Financial Times say, the World Health Organization called for an emergency meeting for discussing the situation around the new strain of COVID-19. The meeting took place on Friday, November 26th, in Geneva.

Several days before this, scientists from South Africa discovered a new strain of the coronavirus that was given a technical index B.1.1.529 and a name Omicron. It features over 30 mutations, which made rumors spread that the strain is more viral and dangerous than Delta and that vaccines are useless against it.

On November 28th, WHO issued a press release, saying that there is too little information to make such conclusions. We'll here more about Omicron in the nearest future.

Stock indices fall steeply

On Friday, the Hong Kong Hang Seng (HSI) declined by 2.67% to 24080.52 points, the Japanese Nikkei 225 (N225) — by 2.53% to 28751.62 points, the South Korean KOSPI (KS11) — by 1.47% to 2936.44 points, the Chinese Shanghai Composite (SSEC) — by 0.56% to 3564.09 points.

The European Euro Stoxx 50 (STOXX50E) fell by 4.74% to 4089.58 points, the French CAC 40 (FCHI) — by 4.75% to 6739.73 points, the German DAX (GDAXI) — by 4.15% to 15257.04 points, the British FTSE 100 (FTSE) — by 3.64% to 7044.03 points. In the US market, the deepest slump was demonstrated by Dow Jones Industrial Average (DJI) — by 2.51% to 34908.1 points. This is the deepest overnight slump of the index since October 2020. S&P 500 (SPX) dropped by 2.27% to 4594.62 points, and NASDAQ Composite (IXIC) — bt 2.23% to 15491.7 points.

Tech analysis of US stock indices by Maksim Artyomov

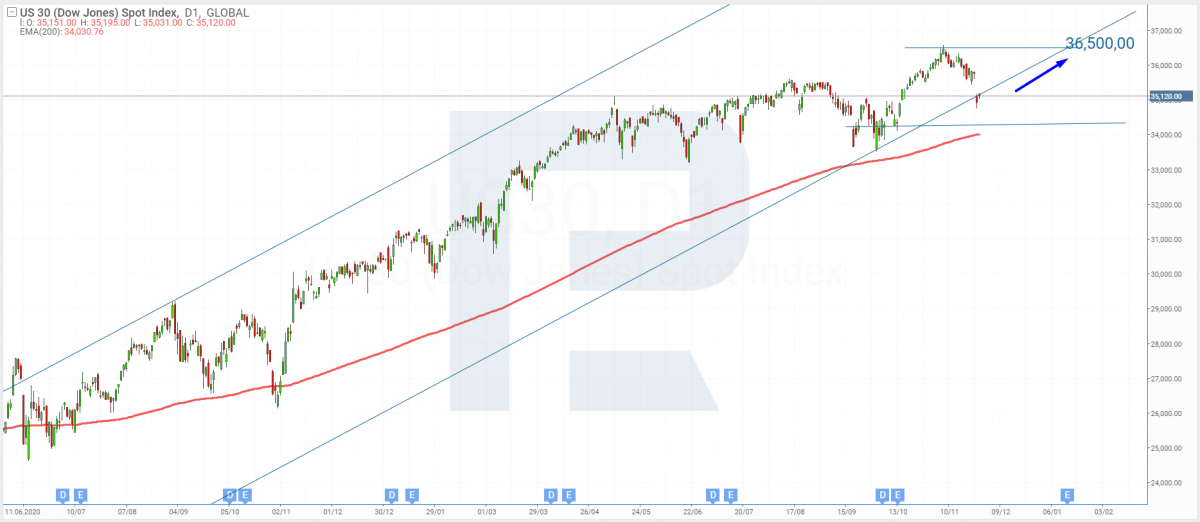

Dow Jones Industrial Average

On D1, the index started the trading session with a gap and reached the lower border of the ascending channel. I suppose that this is a correction due to overall panic around COVID-19.

Then the quotations can bounce off the support line, and the index will continue the uptrend. The goal of growth inside the ascending channel is the resistance level of 36,500 points.

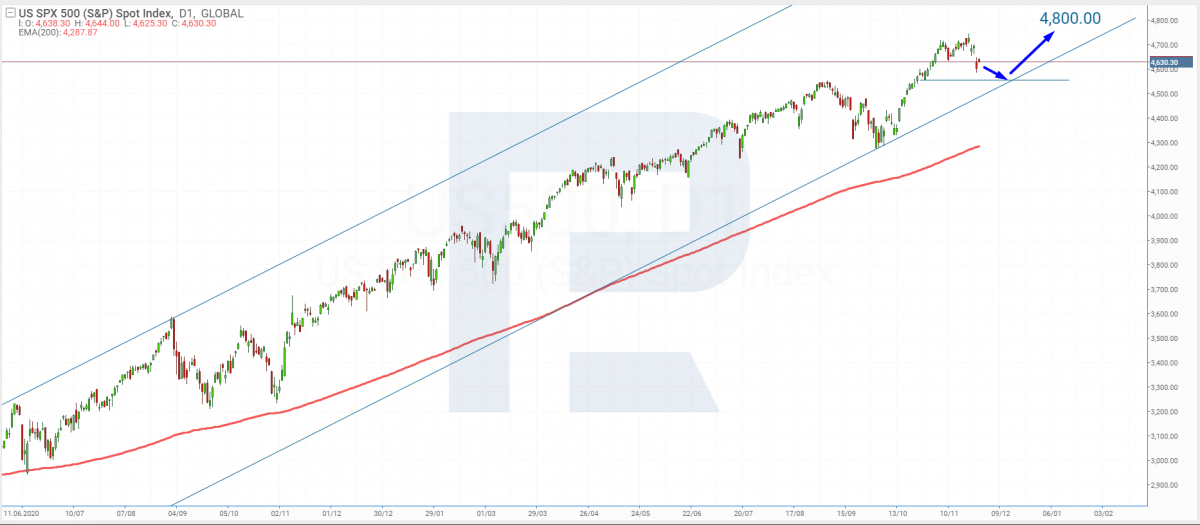

S&P 500

Upon renewing the highs, the index is forming a correctional wave. I guess that after the pullback is over, the next goal of growth will be 4,800 points. A breakaway of this one will mean further development of the uptrend.

Further growth is confirmed by the 200-days Moving Average: it stays below the chart and continues the uptrend. Later the quotations can continue growing inside the ascending channel.

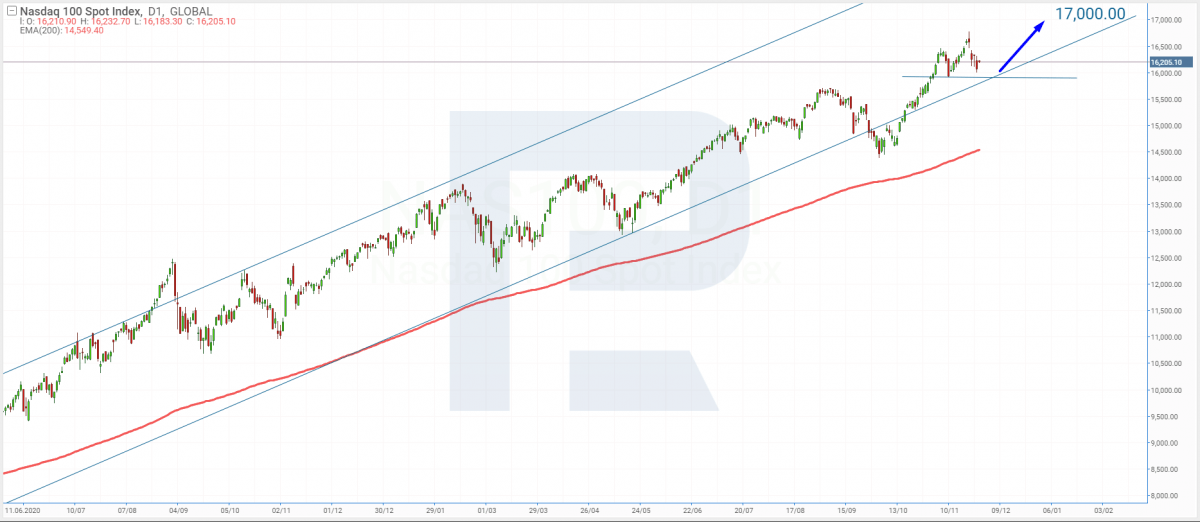

NASDAQ Composite

The index renewed the highs and now continues the correctional wave at the lower border of the ascending channel. The goal of growth after the pullback is 17,000 points. The growth is confirned by the 200-days MA that remains below the chart and continues the ascending dynamics.

However, judging by the recent news having a negative effect on most companies, the correction can last several weeks. After the trust of investors recovers, the index will renew the highs rapidly, and the quotations will be growing inside the ascending channel.

Shares of airlines fall

After news spread about the new strain of COVID-19, the USA, EU, Great Britain put on a halt flights with certain African countries, and Israel closed its borders for foreigners, investors started a grand sale of airline shares.

On Friday, the shares of International Consolidated Airlines Group S.A. (LON: ICAG) that includes British Airways, dropped by 14.85% to £131.4. The quotations of Wizz Air Holdings PLC (LON: WIZZ) dropped by 15.23% to £3,729, and of EasyJet Airline Company (LON: EZJ) — by 11.45% to £499.8.

The share price of United Airlines Holdings Inc (NASDAQ: UAL) shrank by 9.57% to $42.26, of American Airlines Group (NASDAQ: AAL) — by 8.79% to $17.75, Delta Air Lines Inc (NYSE: DAL) — by 8.34% to $36.38.

Oil also falls

Investots think that the spreading of the new coronavirus strain can impede the recovery of the global economy and, hence, the demand for the black gold. Such market moods made February futures for Brent (BG2) fall by 11.55% to $72.72 per barrel.

January futures for WTI (TF2) lost 11.96% of price, falling to $68.15 per barrel. Over the Friday trading session, the minimal price was $67.4.

Which shares did grow?

While the shares of many market players dropped, the securities of companies that were popular over the quarantine — tech companies and vaccine makers — grew, on the contrary.

The quotations of Moderna Inc (NASDAQ: MRNA) leaped up by 20.57%, reaching $329.63. The shares of another vaccine maker Pfizer Inc (NYSE: PFE) grew by 6.11% to $54.

The shares of Zoom Video Communications Inc (NASDAQ: ZM) that owns a popular platform for video communication, grew by 5.72% to $220.21. However, the quotations of a service for fitness at home Peloton Interactive Inc (NASDAQ: PTON) grew by 5.67% to $46.41.

Summing up

In November, a new strain of COVID-19 was discovered — B.1.1.529 or Omicron. WHO hasn't yet confirmed that the new type is more dangerous or catchy than Delta. However, fears that the new strain will spread and that the vaccine is barely efficient against it caused stock market panics on Friday.

Stock indices of various countries decreased noticeably, the share price of airlines lost quite a deal, and the price for oil futures headed down again. According to Forbes, on November 26th, the fortune of 10 world's richest people decreased by $37 billion.