How to Use Earning per Share (EPS) for Evaluating Shares

6 minutes for reading

To choose interesting stocks for investing, market players evaluate carefully various economic indices and statistics. This overview is devoted to one index called Earning per Share, or EPS.

What is Earning per Share?

This Earning per Share (EPS) ratio evaluates how profitable a certain company is in terms of one share. This multiplier shows the relation of net profit over a year’s time and the number of its ordinary shares in turnover, giving an idea of what profit can be brought to the investor by each share they buy.

In essence, each shareholder holds their share of the authorized capital of the company that equals to the number of issued shares. The profit made is given proportionally to each shareholder. So, the EPS multiplier reveals how much money out of the invested sum will return to the investor. The higher the EPS, the more profitable it is to invest in the company.

The profit made by the company can be fully or partially given to the shareholders as dividends. Here, things depend on the decisions of the board of directors. Shareholders via their representatives on the board can influence the issue, altering the share of the profit that will be given out to the shareholders in the form of dividends.

How is EPS calculated?

For calculating EPS, we use the net profit minus dividends on privileged shares. the formula is as follows:

EPS = (P – Div) / N

Where:

- P is the net profit of the company for the reporting period (after taxes)

- Div is the dividends on privileged shares

- N is the number of ordinary shares in turnover in the reporting period.

Example of calculation:

As an example, let us use Netflix (NASDAQ: NFLX). Over the last financial year, the company reported 2,761,395,000 USD of net profit, while the total number of ordinary shares in turnover was 440,922,000 shares.

The balance report says that Netflix did not issue privileged shares, so in the calculation formula, we subtract nothing.

Dividing the net profit of 2,761,395,000 USD by 440,922,000 shares, we get EPS of 6.26 USD per share.

How to use EPS?

Using EPS, pay attention to two important issues:

1. EPS does not account for the market price of the share.

The multiplier calculates profit from a share, yet the formula does not include it's market price. Hence, depending on the latter, the result of investing may vary quite a bit. To find out which profit each invested dollar brings, divide EPS by the price you have bought the share at.

Let us compare two companies:

- Company A has EPS $10 and its shares in the market cost $200 each. So the profit potentially made is (10 / 200) * 100 = 5%.

- However, Company But has EPS $5, while its shares are traded for $50 each. Your profit will make (5 / 50) * 100 = 10%.

As a result, though Company A has larger EPS, Company But looks more attractive for investing because its shares are traded at a lower price and bring a better revenue.

2. Use the dynamics of EPS for evaluation

To check whether a company is attractive for investing, experts look not as closely at the current EPS as at its changes over a year's time. What investors want to see here is growth. The faster EPS grows, the more attractive the company is for investors.

EPS dynamics of a company may vary depending on the profit, the number of shares in the market, or both factors. The company can increase EPS by increasing the profit or decreasing the number of shares in the market via stocks buyback. Or, on the contrary, if the company increases the number of shares in turnover faster than its profit grows, its EPS will fall.

As a rule, investors assess EPS alongside other economic indices, such as P/E. If other indices are more or less the same, better EPS in the reporting period makes one company more attractive than others.

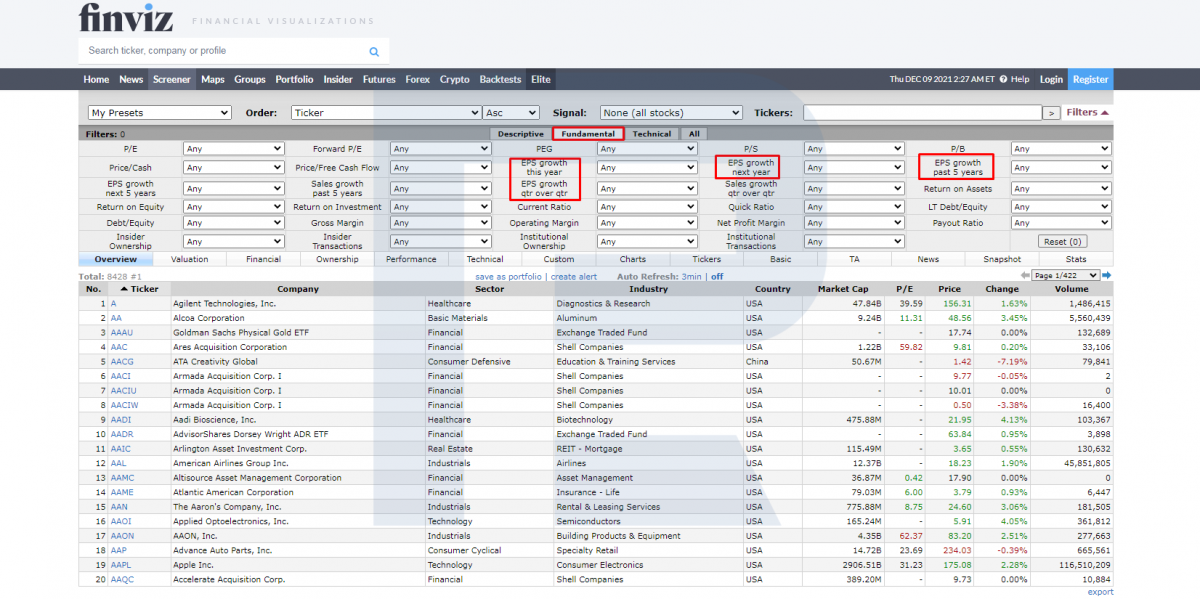

You can check EPS in economic reports or on websites. For EPS or American companies, for example, go to Finviz.com:

Advantages and drawbacks of EPS

The advantages would be:

- Availability and popularity

- Comprehensive approach: you can assess the ability of the company to bring you a profit per share at once

- Simple calculation formula and lots of open information sources where you can check the correctness of your data.

Some disadvantages:

- Companies with a short lifespan are hard to evaluate because normally, EPS is evaluated in dynamics over several years' time. So, use this one carefully if the company has been in the market for less than a couple of years.

- EPS value is absolute and needs to be related to the market price of the share for correctness. For a better result, use it alongside the P/E multiplier.

- The multiplier does not account for the influence of privileged shares if there are any.

Closing thoughts

EPS gives a chance to assess the potential profit made on one shares of the company you are planning to invest in. The multiplier has equally advantages and drawbacks, so it is recommended to be used alongside other multipliers, P/E being the most frequently used one.