How to Invest in Metaverse

8 minutes for reading

The stock market expects that the Federal Reserve System will soon increase the interest rate, and this cause a lot of tension. The S&P 500 index has already lost 8% since the beginning of the year and remains in a downtrend. The tech sector is also suffering: over the last three months it has lost 9%, becoming one more outsider.

There is no crisis these days: the interest rate is being raised to cool down the economy a bit, i.e. slow down its growth and avoid forming of a bubble. Hence, the current decline of the indices can be looked upon as a correction.

The decline of stock prices and, consequently, the decline of the capitalization of companies can be used by corporations that manager to accumulate plenty of cash on their accounts during the pandemic. They will start engulfing other companies, so that 2022 can become a year of mergers.

Microsoft Corporation buys Activision Blizzard

The one to get started is Microsoft Corporation (NASDAQ: MSFT): on 18 January, it became known that the company was buying Activision Blizzard Inc. (NASDAQ: ATVI). After such news, the shares of the game company grew by 33%.

The purchase will cost 74 billion USD. Microsoft can afford such spending: according to its fresh financial report, it has about 130 billion USD on the balance.

However, what is important here is not the sum that the IT giant will pay but the direction it is going in. As the official press release goes, buying Activision Blizzard will speed up the development of the game business of the corporation and, most importantly, will provide building blocks for the metaverse.

This confirms the idea that the metaverse is developing, not just in the form of empty talks nowadays but as real mergers that aim at getting closer to the virtual reality.

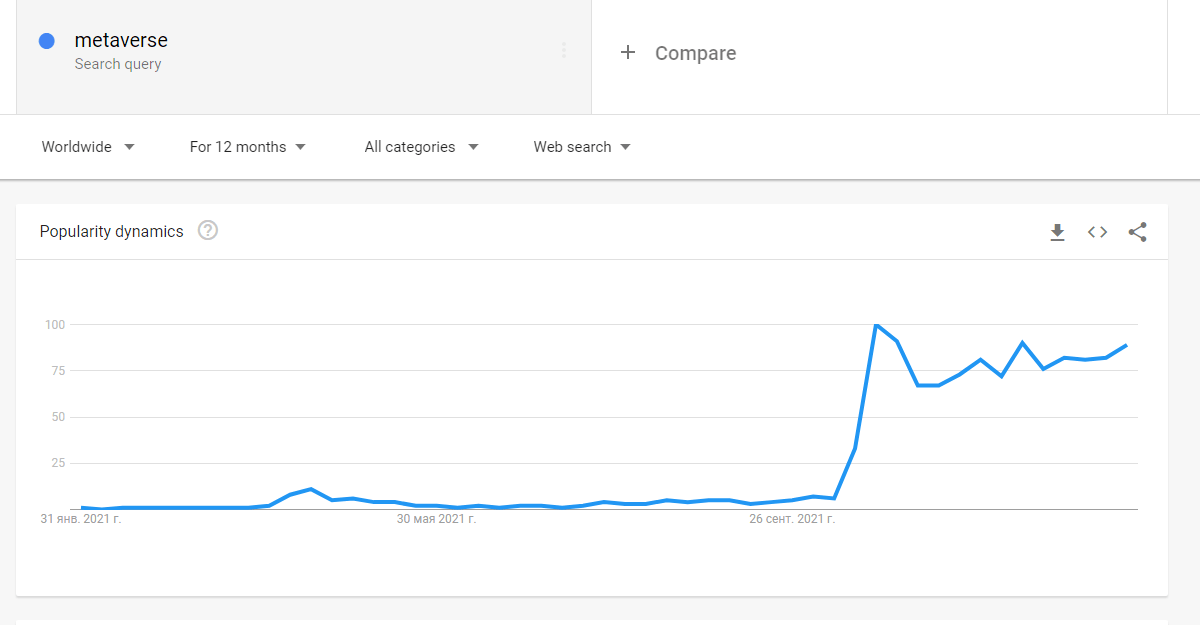

I have already touched upon this topic in the article about the trends of 2022. Today, it is of exception interest to many — just look at the dynamics of the "metaverse" inquiry in Google.

Let us get acquainted with several other companies that can increase their revenue thanks to the growth of the virtual reality industry.

Autodesk

Autodesk Inc. (NASDAQ: ADSK) is the largest software provider for industrial and civil building, car industry and entertainment in the world. With Autodesk software, you can create 3D animation for virtual and augmented reality, which is great for the metaverse.

Hedge funds demonstrate vivid interest in the company. Autodesk shares are held in the portfolios of more than 50 investment companies.

According to the report for Q3, 2021 — we will see the results of Q4 only in March — the revenue of the company reached 1.1 billion USD. This was 14% more than in Q3, 2020. EPS grew from 1.04 to 1.33 USD. However, these results turned out more modest than experts had expected, so Autodesk shares dropped and are trading in a downtrend.

They are further pulled down by the general decline in the stock market. Hence, this investment should become a promising one, where you will be waiting for the negative influence to subside. Currently, the optimum purchase level for Autodesk shares will be the support level at 220 USD.

Adobe

Adobe Inc. (NASDAQ: ADBE) designs software and is well-known for such products as Acrobat, Photoshop, Creative Cloud, and Aero.

Aero is an instrument for designers meant for creating images in the augmented reality and requiring almost no programming skills. Director-general of Adobe Shantanu Narayen considers Aero the best product for metaverse development of these days.

Adobe shares, as well as those of Autodesk, dropped quite a deal after the quarterly report was published. However, the difference is that Adobe revenue lived up to the expectations of experts. Alas, they were unhappy about the forecast for the next year made by the management: EPS is expected to be 12.48-13.7 USD while now it is 10 USD.

With that, the shares lost 20% of the price and keep going in a downtrend. Nonetheless, not all investors support the idea that Adobe shares are to be get rid of. Laura Desmond, a member of the board of directors of the company, used the downtrend to increase the number of the shares in her portfolio. On 7 January she bought 973 shares for about 500 thousands USD.

The leading analyst of Deutsche Bank Brad Zelnick thinks that Adobe shares are currently underestimated and recommends the target level of 715 USD. Out of 24 stock market experts, 18 recommended to buy Adobe shares. The average target price is 674 USD.

Currently, Adobe quotations are trading at the support level of 510 USD. You can try buying at this price though this is still risky because the shares can fall deeper. Wait for market players to get more interested in the shares, thus provoking the growth of the quotations. This will be indicated by a breakaway of 540 USD.

Matterport

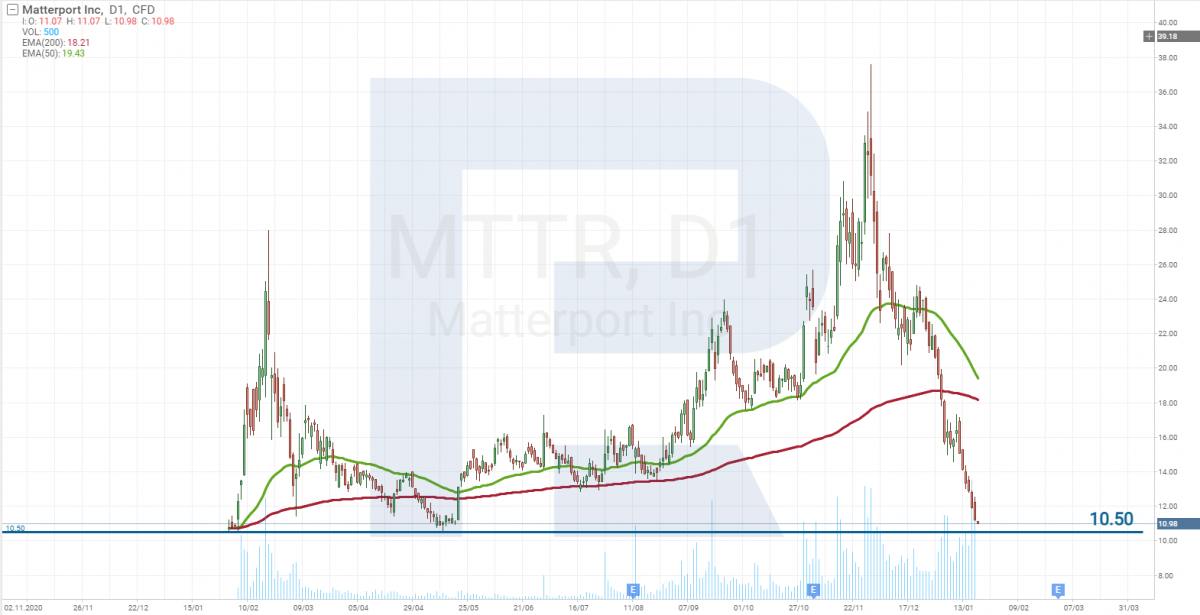

One more issuer that you should take a look at considering investments in the metaverse is a small company called Matterport Inc. (NASDAQ: MTTR). It digitizes the real world, i.e. creates digital twins of physical objects — houses, boats, cars, etc.

Nowadays, when even banks try to open offices in the metaverse, Matterport services of transmitting objects from physical to virtual reality seem to become quite popular.

Compared to the shares of the companies above, Matterport shares are rather affordable — they cost just 11 USD each. This investment is, of course, rather risky, especially if you recall that the company is not profitable yet.

The situation, however, can be changed by the factor of publicity: the name of the company in the media will be associated with a metaverse beneficiary, and, thanks to that, the shares might sky-rocket.

Matterport capitalization is just 3 billion USD, which makes it an interesting object for engulfment.

The quotations of the company are now approaching the support level of 10.5 USD. Do not hurry, this investment is rather risky: you should better wait and see what happens.

Example of a conservative investment in the legal cannabis sector

You can easily get mistaken about the issuer, so try looking for investments in the metaverse without putting your money in companies that participate directly in its development. Here is an example.

I think, many of you remember the boom around the legal cannabis market. The shares of weed makers used to sky-rocket by hundreds of percent but as soon as the agitation subsided, the quotations headed down. As a result, investments in these companies remain losing.

At the same time, there was a conservative way of making money on this sector. I mean investments in companies that give for rent specialized facilities for growing cannabis.

One such company is Innovative Industrial Properties Inc. (NYSE: IIPR). Even when the agitation in the sector subsided, the shares of the company kept growing. They started a decline only in November 2021, while the shares of the well-known Tilray Inc. (NASDAQ: TLRY) have been falling since February last year.

Giving this example, I am trying to explain that it is always hard to be sure about which company will bring a profit yet there is a more conservative way of investing in the metaverse. I mean companies that build and maintain data processing centres.

Digital Realty Trust

Digital Realty Trust Inc. (NYSE: DLR) provides a full range of solutions for data processing centres and works with 284 objects in 23 countries. Among its clients, you can find Meta Platforms Inc. (NASDAQ: META), AT&T Inc. (NYSE: T), and Verizon Communications Inc. (NYSE: VZ).

Digital Realty Trust can be regarded as a very long-term investment, and also, the company pays dividends. Its shares are now trading at the 200-days Moving Average, which is also the support level, which is a perfect moment for a long-term investment.

Bottom line

On 26 January, the Fed will hold a meeting at which it will decide upon the interest rate. The latter is expected to be increased by 0.25%. The market is already including this growth in the price. If things go as planned, 26 January can be a turning point in the market.

Investments on the metaverse presume holding shares for longer than one day, yet 26 January can be considered the first day of putting shares into your portfolio.

You have to decide yourself which company to choose. Some are ready to risk and invest in Matterport, while others prefer more conservative approaches.