Electric Car Market: Demand Still Growing

8 minutes for reading

Due to the geopolitical tension, gasoline prices in the US grew by roughly 45% over a year. In the EU, the situation is more or less the same, so the government tries to hold back the prices by decreasing taxes on fuel. What do people do? They actively look for alternatives to gas and diesel.

Electric cars become more popular

The demand for electric cars and hybrids grows every day, and increasing oil and fuel prices do not make the situation any better. Some say that popular electric car-makers will fail to satisfy the demand fully.

Even now people who want to buy an electric car have to go through a long waiting list before they can actually get one. In such circumstances, not-so popular car-makers are getting a good chance. There only needs to be enough spare parts and microchips for everyone.

Such agitation around companies that produce ecologically clean transport makes their shares quite attractive for investors. Moreover, the shares of electric car-makers are now trading under those highs that they should have reached last year.

How to choose a car-maker for investing

The answer is simple: first thing, check the leaders of the electric car market. Such companies have large and modern production powers to satisfy the demand, have developed logistics, long-time and efficient partnerships with suppliers of car accessory, and so on.

Mind the profitable relationship with major car rental services and taxis. For example, in 2021 Hertz Global Holdings Inc. (NASDAQ: HTZ) announced an agreement with Tesla Inc. (NASDAQ: TSLA). By the agreement, Hertz car park will have expanded by 100,000 new electric cars by the end of this year.

It is just one client, yet it brings in more than $4 billion. However, take a look at the terms of the agreement on the side of Tesla. For example, Lucid Group Inc. (NASDAQ: LCID) would need no less than 8 years to complete such an order with its current production powers.

So, start with the leaders, then look at the middle of the segment, then go to the end of the list. Also remember that with small companies, risks are always higher but potential return can also be much better.

Leaders of American electric car market

The leaders of the market are Tesla, Ford Motor Company (NYSE: F), and General Motors Company (NYSE: GM). However, with such a high level of demand and swift growth of the electric car market many other representatives of the industry can be promising investments.

Nowadays any representative of the car industry does not need to expand its market presence for larger profits – they need to increase production because consumers buy almost everything available.

However, even in such circumstances one should not buy shares at any price – they should wait for a breakaway of the key levels that would mean the correction is over and the shares will start growing again. Now take a look at the charts of Tesla, Ford Motor Company, and General Motors Company to find such levels.

Tesla

Tesla shares are trading above the 200-days Moving Average, indicating the prevalence of an uptrend. Some days ago, the quotes rose above a strong resistance level of 950 USD. This event signals about high demand for the shares.

Now Tesla shares look stronger than any rivaling shares, which is logical because the company is the leader of the electric car industry. As long as the key resistance level has already been passed over, there is nothing to prevent quotes from further growth and reaching an all-time high of 1,250 USD.

Being optimistic is good, but one has to be prepared for anything in the market. So keep in mind a possible return to 950 USD and a bounce off it.

Ford

Ford Motor Company looks like a more attractive investment. If Tesla shares have already bounced off the 200-days MA and headed upwards, Ford Motors shares are just testing it.

The key resistance level is 18 USD. When they rise above it, the correction will come to an end and the uptrend will resume.

General Motors

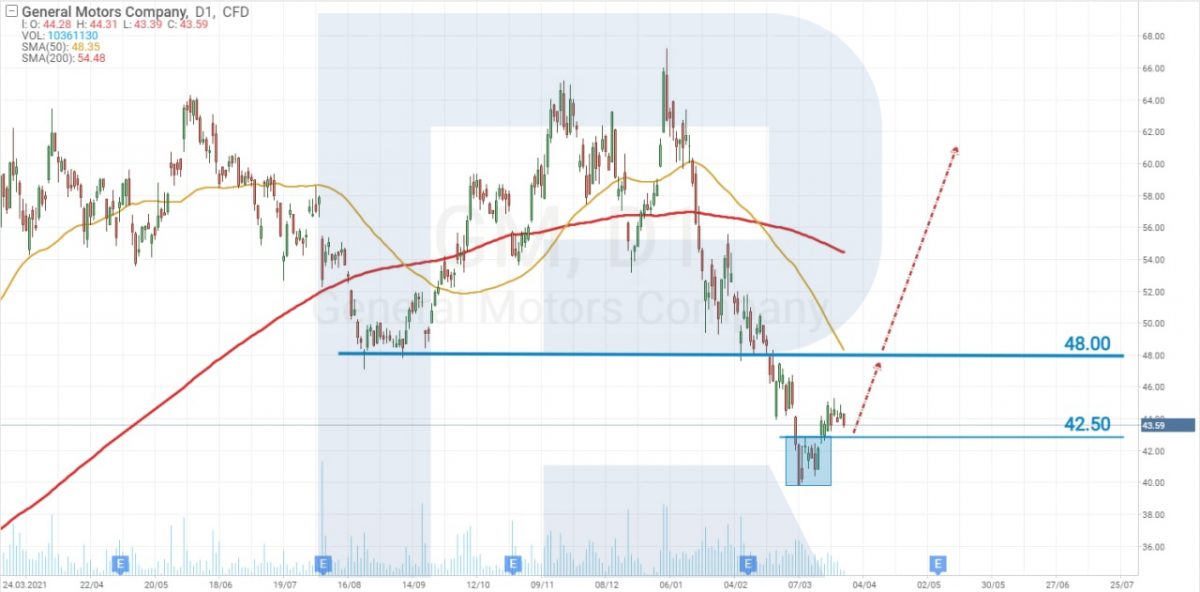

With General Motors shares, the situation is somewhat more complicated. The quotes have broken through the 200-days MA and are trading underneath it, which means the trend is descending.

One thing that can reverse the trade is a reversal pattern on the chart. Suh a pattern has already formed: on D1, a Double Bottom is quite noticeable, and it predicts an upwards movement.

A signal line at 42.5 USD has already been broken away, which means the price can start growing. However, to be more confident, one needs to wait for the resistance level of 48 USD to be broken away.

Share of Chinese companies start recovering

The shares of most Chinese companies that produce electric cars are now declining. The initial reason was the regulatory pressure on the market from the government, and later possible delisting of Chinese shares by US exchanges added up to it.

However, quite recently the Chinese government decided to change tactics and avoid being so tough on businesses – including let companies reveal some income info so that they would not be delisted.

As a result, investors are beginning to change their minds about Chinese issuers. The leaders on the Chinese electric car market are NIO Inc. (NYSE: NIO), Xpeng Inc. (NYSE: XPEV), and Li Auto Inc. (NASDAQ: LI).

NIO

As for NIO shares, after a steep decline to 13 USD, they started recovering and are now trading near 20 USD. However, the first evidence of a trend reversal will be a breakaway of a resistance level of 25 USD.

Xpeng

With Xpeng shares, the situation is similar. The shares are trading under the 200-days Moving Average and after a steep decline they have already played back some of the lost positions.

These shares do not cost that much, and their liquidity is not as high as of Ford shares, hence, they are more volatile, and a tiny movement can lead to high profitability.

For example, over the last 9 days, Xpeng shares grew by over 40%, and to decrease investment risks, one should wait for a breakaway of a resistance level of 34 USD.

Li Auto

While in the shares above there was at least some trend, with Li Auto shares things are quite different. The quotes have spent a long time in a range between the levels of 17 and 37 USD.

This range is rather large, and one can make quite a good profit of over 100% buying at its lower border and selling at its higher one. So, if a long-term investment is planned one should wait for a breakaway of a resistance level of 37 USD. In case of speculations, buying at the lower border and selling at the upper one can be a good option.

Leaders of European car market

In the European car market, take a look at Volkswagen AG (XETRA: VOW) that has such brands as Volkswagen, Audi, Skoda, Porsche, Seat, Cupra, Lamborghini, Bentley, and Ducati. One more famous car-maker – Renault Sa, a member of Renault–Nissan–Mitsubishi alliance – is also a promising investment.

Volkswagen AG

In Volkswagen AG shares, the situation is similar to that in Nio and Xpeng shares. They are trading under the 200-days MA and a couple of days ago they started recovering after a steep decline to 180 USD.

In such circumstances, the key level will be the resistance line at 245 EUR. A breakaway of this will be the first signal that the downtrend is coming to an end and a longer uptrend is beginning.

Renault Sa

From 18 February through 7 March, the shares of Renault Sa (PARIS: RNO) lost 45% and broke a strong resistance level of 28 EUR. In this situation, it seemed that the support level of 20 EUR will not resist either.

However, investors got interested in the cheapening shares, and the quotes started recovering – the support of 20 EUR pushed the price away. One can count on a longer term growth of Renault shares only after the resistance level of 28 EUR will be broken away. In this case, the price has a chance to return to 41.35 EUR, an all-time high.

ETFs that can be useful

When the whole sector of economy is growing, finding a company for investing is no big deal, yet there is always a risk of a mistake. So one should take a look at the Global X Autonomous & Electric Vehicles ETF (NASDAQ: DRIV).

The fund invests in companies that develop autonomous vehicle technology, electric cars, components and spare parts for them. The return on an investment in an ETF can be lower than on investment in one of the companies because this is a more conservative approach.

Bottom line

The more traditional fuel costs, the more investors get interested in electric cars. Until 2022, the main reason for people to opt for green transport was taking care of the environment, yet nowadays the trend has sped up due to the frightening growth of prices for hydrocarbons.

Anyway, the tendency has begun and is nowhere to stop soon, and this means the number of electric cars and hybrids on the roads will only increase. And now, when this trend has just started, and electric cars make up for just 5% of all vehicles in the world, it is quite a high time for investing in the sector.