4 Stocks for Trading in Uncertainty

8 minutes for reading

Inflation, recession, stagnation, stagflation — and other scary words that investors keep hearing in the stock market. What else? Toughening of credit and monetary policy, cutting down on the CB balance, winding up the QE programme. With such news, it becomes hard to consider buying any stocks.

When stock indices drop abruptly

Normally, the stock market experiences panic and falling of indices right in the times when no one suspects any trouble. Investors are simply buying stocks and watching their profits grow.

Negative news does not always provoke immediate reaction: understanding the scale of a future disaster needs time. However, more experienced investors assess the situation fast and start acting at once.

As a result, the quotes in the stock market start going down and speeding up because other investors have no more time to think. Hence, stock indices drop when investors take their profit, not trying to make money on the decline.

What the market sentiment is now

The poll carried out in March by Investors Intelligence demonstrates that the number of those planning to buy shares had dropped to 30%, while the number of those who want to play short had grown to 34.5%. In other words, the current market is bearish.

Over the last 12 years, this has happened 6 times, and the quotes of S&P 500 always reached some lows from where it then started to grow. Market players either opt for cash or for short positions — and this is what stimulates growth of stock prices.

There is some saved cash that can support the stock market and increase the demand for shares. And there are sellers who will have to close their positions if the prices grow, which will also lead to an increase in quotes.

Why the Fed does not rush at increasing the interest rate

The current situation can be described as follows: the news is negative, one half of market players are waiting for an abrupt decline of the stock indices, while the second one is waiting for a good moment to buy some shares. But buying is scary because there is an increase in the interest rate to follow, which will affect companies with serious debt loads, possibly provoking their default and bankruptcy.

Bankruptcy of companies can influence their affiliates and suppliers, putting them on the verge of survival as well. In the end, we might become the witnesses of another crisis.

The Fed understands this all too well, hence, it does not hurry to lift the interest rate. The institution has been preparing the market for a change for several months, helping investors to assess all possible risks.

What to look at when making investment decisions

When there is much controversy in the market, and the arguments of all the sides are quite well-based, tech analysis will be the best choice for making investment decisions. It will help find the key levels, at the breakaways of which one can plan to open positions.

Moreover, tech analysis will demonstrate market sentiment: at which levels investors tend to buy stocks and at the decline of which stocks they are counting. One more advantage of tech analysis is the possibility to see the scenarios that can cancel current forecasts.

We have studied the market thoroughly and made up a list of four companies. As long as the market is currently bearish, the list chiefly contains companies whose shares have a chance for a soon decline.

Union Pacific

The shares of Union Pacific Corporation (NYSE: UNP) are trading in an uptrend. and at the first glance, there are no hints on a decline. However, upon a more thorough investigation, it can be noticed that volatility of the shares has increased. Quite often, this means the trend is coming to an end.

Upon sky-rocketing to 280 USD, the quotes quite soon returned to 240 USD and have already broken through it. This is the key level for the bulls because they have been holding it since December 2021.

The bears had made 12 attempts to break through it but always failed – until this time. Now we should expect further falling of the quotes to the support level of 220 USD. The bears are also supported by the bad news around and high market volatility.

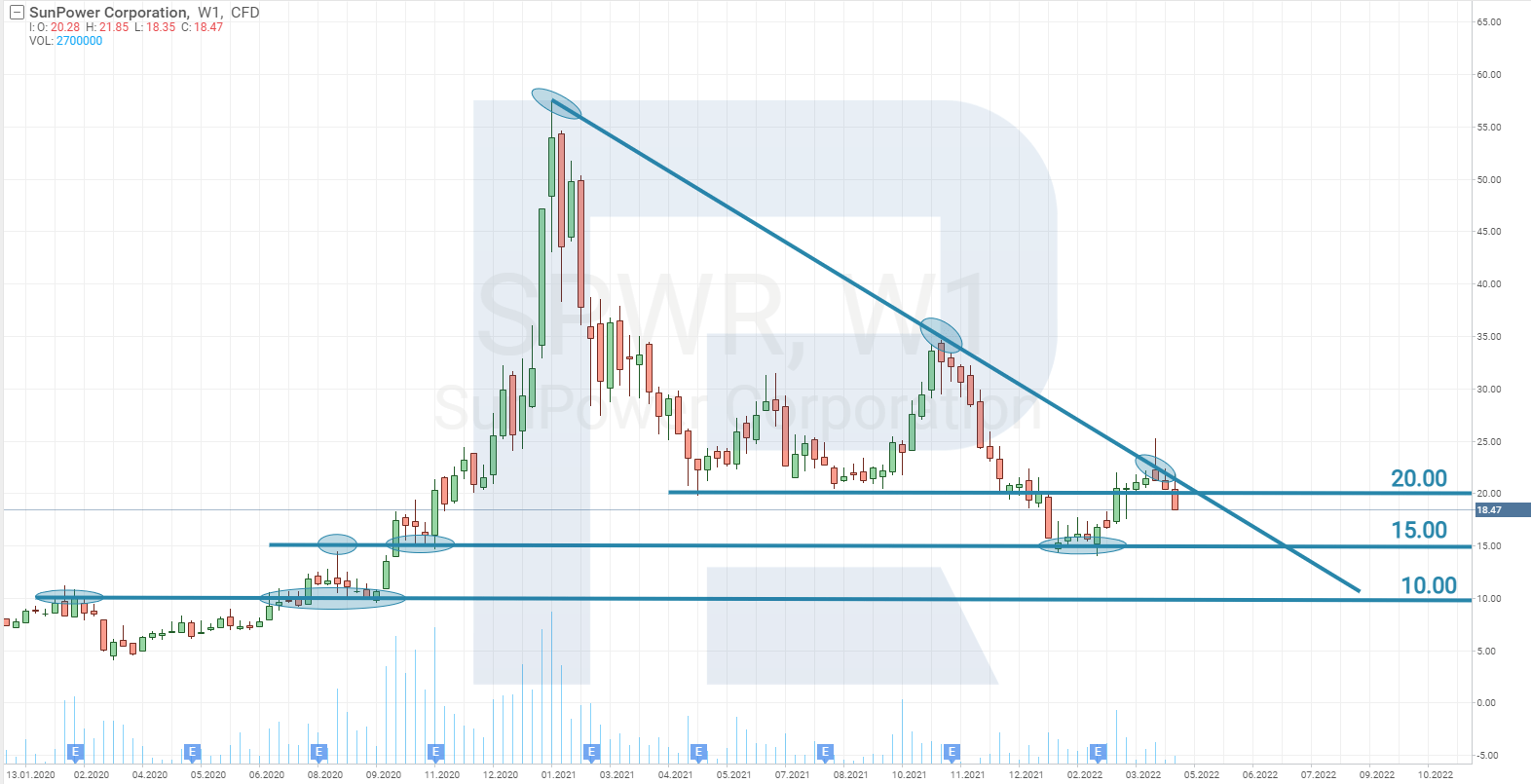

SunPower

The shares of Sun Power Corporation (NASDAQ: SPWR) have been under bearish pressure for three weeks already. On the chart, the shares are trading in a downtrend, and the price has already bounced off the trendline. This sped up faster falling of the shares.

Mind the resistance level at 20 USD. In February, the bulls tried to change the situation, the shares stopped falling at 15 USD, and the quotes started recovering. They grew by 50% over three weeks and secured above 20 USD.

A breakaway of such a serious resistance level signaled about a possible end of the downtrend. To win once and forever, the bulls had only to push the price above the trendline. However, the sellers turned out to be stronger. In the end, the quotes bounced of the trendline and broke through the support level of 20 USD downwards.

Now the price is to return to 15 USD. If the bulls fail to hold at this support level, the market will see an even lower price. The next support level for SunPower in 10 USD.

Plains All American Pipeline

By tech analysis, the shares of Plains All American Pipeline L.P. (NASDAQ: PAA) can grow. mind the sphere of business of the company: transportation of hydrocarbons in the USA and Canada.

Now the situation in the hydrocarbon market is as follows: the USA is trying to partially replace gas and oil supplies in Europe. Hence, the demand for hydrocarbon transportation to dispatch ports will grow, and this can increase the profit of the company. In other words, there are not only technical but also fundamental reasons for the growth of the company’s shares.

On the chart, it can be noticed that since May 2021, the shares of Plains All American Pipeline have been trading in a range between 9 and 12 USD. In January, buyers made a fierce attempt to rise above the upper border of the range. However, they failed to succeed and decided to choose different tactics.

After the quotes dropped to 10 USD, gradual growth to 12 USD started. It can be noticed now that the bulls buy back any declines of the price, and the price has secured above 11 USD. It looks as if the bulls are accumulating power before a decisive attack. The price is approaching 12 USD, and if it breaks through this level, further growth to 14 USD can be expected.

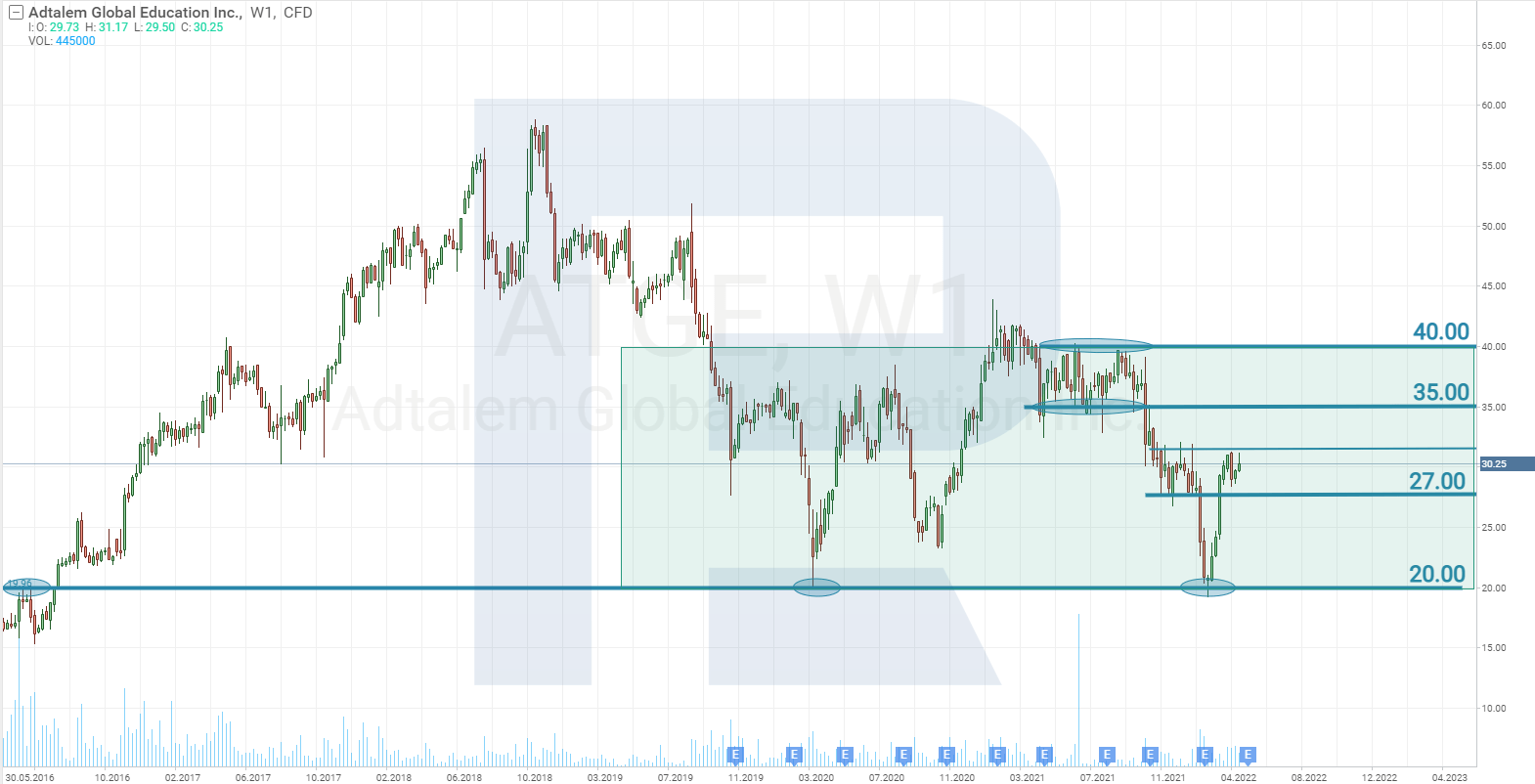

Adtalem Global Education

The shares of Adtalem Global Education Inc. (NYSE: ATGE) look quite bizarre. Since 2019, they have been trading between 20 and 40 USD, which means the range is 100%. In such a situation, profits can be made by just buying the shares at the lower border of the range and selling them at the upper one. The chart shows that most market players opt for this strategy.

When the price dropped below 25 USD, investors started buying the shares, and the price grew. For the last time, the support level of 20 USD was tested in February, after which the price started growing and rose by 45% over three weeks. Now the quotes are bouncing off the support level. Unfortunately, a large part of the profit has been missed, yet there is a potential for growth to the upper border of the range.

We cannot be sure whether the price will go higher up, so it is better to keep an eye on the chart. In this situation, the hint will be a breakaway of 31.5 USD. This will mean that investors keep buying at the previous speed, and this way the price can reach 40 USD.

Closing thoughts

When fundamental analysis is no help to make investment decisions, tech analysis will save us. It shows a fight between bulls and bears, and a moment will come when we will understand who will win.

In such cases, a trader should stand on the stronger side and trade in this direction. When fundamental and tech analyses agree, the probability of making a profit increases. Note that today, the stock market sentiment is negative.