USD/JPY Analysis: Fall of Japanese Yen Has Stopped; a Reversal Is Possible

7 minutes for reading

The USD/JPY currency pair demonstrated rapid growth in 2022, reaching a high of 152 Japanese yen for 1 US dollar. This year, the pair continues to show an upward trend, aiming to surpass its previous peak.

Today, we will examine the key factors influencing the dynamics of the USD/JPY pair under current conditions and analyse whether the upward movement could come to an end in 2023.

You can visit the RoboForex Market Analysis webpage for the latest forex forecasts.

Overview of the USD/JPY currency pair

The USD/JPY pair is one of the major currency pairs, known for its high liquidity. Together with EUR/USD and GBP/USD, it ranks amongst the top three most traded currency pairs in the foreign exchange market, accounting for approximately 13% of the total trading volume. The behaviour of its quotes reflects the state of the US and Japanese economies.

Key trading characteristics of the USD/JPY pair

- The pair is traded round the clock from Monday to Friday, with significant trading volumes during the Asian and American sessions, leading to major movements for USD/JPY

- The currency pair is characterised by moderate average daily volatility within the range of 700-800 pips. However, during times of stock market declines, it has the potential for strong movements exceeding 2,000 pips per day

- The spread for USD/JPY is considered minimal thanks to its high liquidity

Historical trends of the USD/JPY currency pair

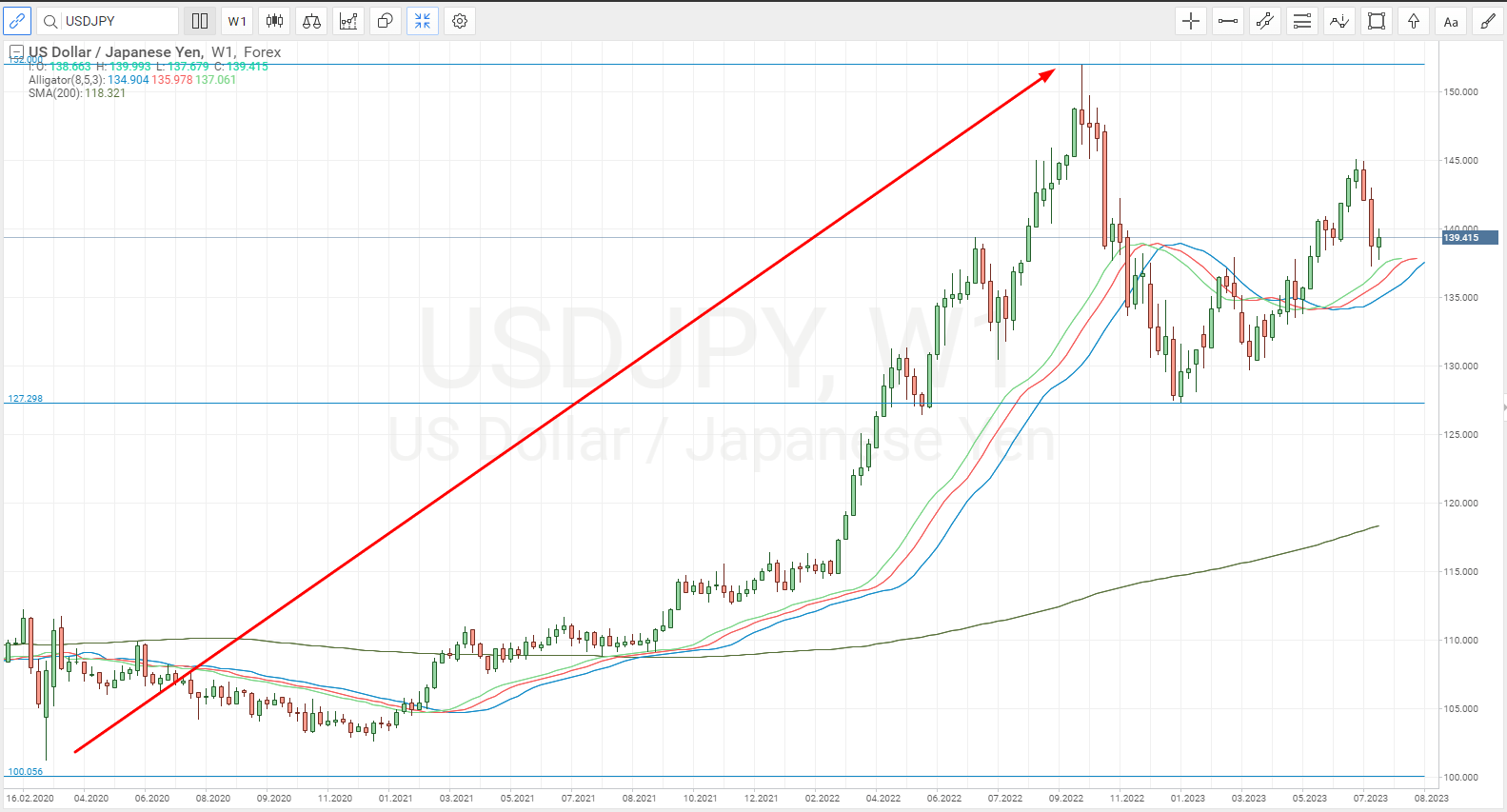

Since 2016, the interest rate has remained at −0.1% thanks to the soft monetary policy of the Bank of Japan. This rate makes the yen attractive for selling against higher-yielding currencies, including the US dollar. This trend became particularly noticeable in recent years when interest rates for the world’s leading currencies have risen, but not for the yen. As a result, the Japanese yen depreciated markedly: in 2020, the pair traded slightly above 100 yen for 1 US dollar, while in 2022, it reached the mentioned peak.

Fundamental factors affecting the USD/JPY quotes

Bank of Japan’s monetary policy

The Japanese economy has been in a state of deflation since the mid-1990s. It is a phenomenon opposite to inflation, in which the general price level of goods and services decreases, thereby negatively impacting the economy’s growth rate. The Bank of Japan and the country’s government have been attempting to eliminate deflation over the years by lowering interest rates and implementing a policy of quantitative easing (QE), involving injecting additional monetary funds into the economy.

Until the end of 2022, Bank of Japan’s dovish stance, in contrast to the aggressive interest rate hikes by the Federal Reserve System (Fed) and regulators of other countries, kept the yen undervalued. Its low-interest rate made it attractive for borrowing to fund investments. However, after the Bank of Japan’s meeting in December 2022, where the yield range of ten-year bonds was expanded, expectations for tightening monetary policy arose.

In April 2023, core inflation in the country reached 4.1%, which is the highest reading in over four years. This development may lead Kazuo Ueda, the Bank of Japan's governor, to consider raising market interest rates in the near future.

US Federal Reserve’s monetary policy

In recent years, the US Federal Reserve has been actively combating inflation by tightening monetary policies. Since 2022, the interest rate was raised from 0.25% to 5.25%. This significantly affected the USD/JPY quotes, which rose from 115.00 to 152.00 over this period.

In June, the Fed kept the interest rate at 5.25%. Comments from Jerome Powell, the chair of the Federal Reserve, suggest that the Fed is poised to bring the rate-hike cycle to an end. Experts anticipate a maximum of two more rate hikes this year, after which the rate will remain stable for some time and possibly even decrease depending on economic conditions.

The impact of carry trade

A carry trade is a trading strategy based on profiting from differences in interest rates between currencies. The higher the interest rate of a currency, the greater the potential swap earnings. In the foreign exchange market, a swap is an operation of accruing or withdrawing funds for carrying over an open position to the next day. The greater the difference in the rates of currencies in one pair, the greater the size of the swap.

Therefore, in recent years, investors have been actively buying the high-rate US dollar against the low-rate yen, thereby making a profit on the difference in rates. This explains the significant fall of the Japanese yen in 2022. But the situation may be changing now: while the interest rate hike cycle in the US is coming to an end, the Bank of Japan is, on the contrary, considering the option of tightening monetary policy due to rising inflation.

It is worth noting that analysts from Deutsche Bank AG caution about increased risks for carry trade operations due to possible economic deterioration in the US.

Fears of a recession in the US

The policy of raising interest rates is exerting considerable pressure on the US economy. High inflation and a slowdown in economic growth, combined with concerns about the stability of the banking sector and the risks of default on US debts, are creating conditions for the onset of a recession – a sustained and significant decline in economic development.

If the concerns are justified and a recession begins, investors are likely to flee from high-risk assets, which will trigger a decline in stock markets and an increase in the demand for safe-haven currencies, including the Japanese yen. In addition, the Fed will be forced to lower interest rates to improve economic conditions, which could become a significant catalyst for strengthening the yen and causing a drop in the USD/JPY pair.

Technical analysis of the USD/JPY pair

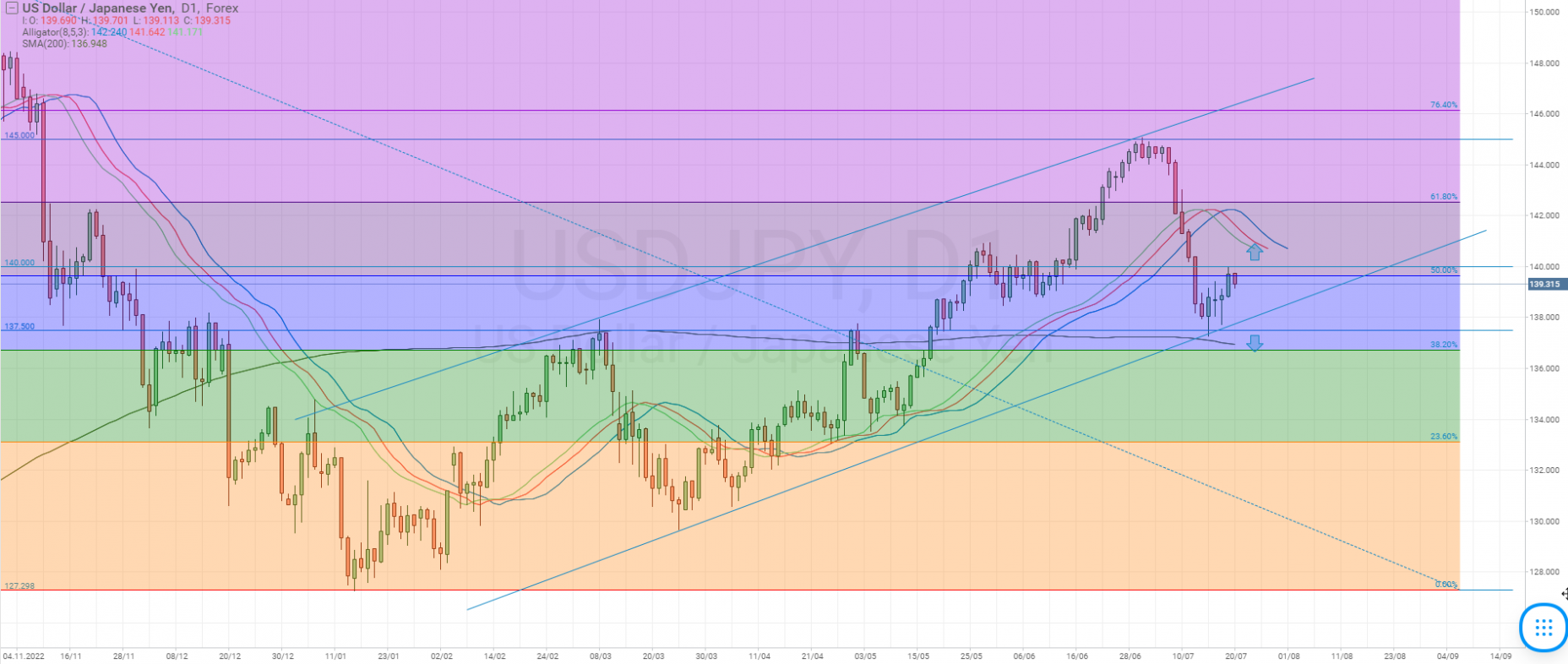

After hitting a local high at 152.00 in 2022, the USD/JPY corrected downwards and eventually stabilised at the level of 127.22. Subsequently, the pair resumed its uptrend, trading within an ascending daily channel since January 2023. In early July, the price showed a sharp downward reversal from the resistance level at 145.00, near which there is a 61.8% Fibonacci retracement level from the previous decline.

The quotes are currently at the level of 139.40, near the lower boundary of the ascending channel. A significant support level is 137.50, where the 200-day Moving Average is located. If the price secures below this level, it will signal the completion of the ascending movement and possible growth of the yen, potentially pushing the pair towards strong support at 127.22. If it closes the day above 140.00, this will pave the way for further growth to 145.00, and if this level fails to hold, a retest of the highs at 152.00 might occur.

USD/JPY analytical forecasts for 2023

- J.P. Morgan analysts expect the USD/JPY pair to hover around 128.00 by the end of 2023

- UBS analysts project that the currency pair will drop to approximately 124.00 by June 2024

- Analysts at Citibank predict that USD/JPY could fall to the level of 125.00 by the end of 2023 or at the beginning of 2024

Summary

In 2022, the US dollar received considerable support due to the increase in the country’s base interest rate, resulting in its strengthening against the yen from 115.00 to 152.00. The USD/JPY currency pair is currently showing growth on the daily chart, but there are factors that could halt further depreciation of the yen. These include the conclusion of the rate hike cycle in the US, leading to potentially worsened economic conditions, as well as the possible tightening of the Bank of Japan’s monetary policy. Analysts of the above-mentioned banks forecast that the pair quotes will correct to 124.00-128.00 in the medium term.