Top 3 Stocks From the S&P 500 List with the Highest Dividend Yields in 2023

10 minutes for reading

In June 2023, the annual inflation in the US reached 9.1%, a level not witnessed by Americans since the 1980s. The Federal Reserve System (Fed) began swiftly increasing the interest rate, leading to a reduction in inflation to 3% by August 2023. While this value still exceeds the regulator's target by 1%, it can be acknowledged that the efforts of Jerome Powell, the head of the Fed, have proven effective.

Nevertheless, it is crucial to note that even a 3% inflation rate will yearly erode the purchasing power of money. One of the tools capable of generating returns equal to or surpassing the inflation rate is stocks. There are two ways to profit from this asset class: firstly, through the appreciation in the stock value, and secondly, through dividend payments.

Identifying a company whose stock value will significantly increase is notably more challenging than finding a company that offers substantial dividends. Today, we will delve into three issuers that are part of the S&P 500 list and pay dividends exceeding the inflation rate, namely Pioneer Natural Resources Company (NYSE: PXD), Coterra Energy Inc. (NYSE: CTRA), and Diamondback Energy Inc. (NYSE: FANG).

Criteria for selecting companies with the highest dividend yields

1. Dividend Yield: This signifies the ratio of the annual dividend per share to its cost, expressed as a percentage. It serves to assess the attractiveness of a security in terms of receiving passive income from owning it – higher percentage values denote enhanced attractiveness.

2. Debt Load: A minimal or absent debt load indicates that the company's profits are ample both for business development investments and dividend disbursements. This can be gauged through the Long-Term Debt/Equity ratio.

This ratio mirrors the issuer's financial risk and leverage degree, revealing its reliance on borrowed funds. A lower ratio indicates a better scenario, as it implies the company relies more on its equity capital rather than borrowed funds. The optimal Long-Term Debt/Equity ratio varies by industry and business specifics, but a ratio of 0.5 generally indicates financial stability.

The mentioned dividend yields and market capitalisations for each firm are accurate as of the material's preparation date – 4 August 2023.

1. Pioneer Natural Resources Company

- Dividend yield – 10.18% per annum

- LT Debt/Eq ratio – 0.23

- Founded in – 1997

- Included in the S&P 500 – 2008

- Registered in – the US

- Headquarters – Irving, Texas

- Market capitalisation – 54.5 billion USD

Pioneer Natural Resources Company is engaged in hydrocarbon exploration and production and is one of the largest independent oil and gas companies in the US in terms of reserves and production.

Due to the decline in oil prices, Pioneer Natural Resources Company’s net profit for Q2 2023 decreased by 53% to 1.1 billion USD compared to the corresponding period last year, and earnings per share dropped 47% to 4.42 USD.

Pioneer Natural Resources Company pays two types of dividends: fixed and variable. Based on the Q2 results, the fixed dividend amounted to 1.25 USD per share, and the variable one was 0.59 USD.

Pioneer Natural Resources Company (PXD) stock analysis

From May to June 2023 inclusive, the stock of Pioneer Natural Resources Company traded between 200 USD to 209 USD. On 11 July, there was a breakthrough above the upper boundary of the range, and the quotes headed towards resistance at 234 USD. The breach of this level could drive the prices further up to an all-time high of 275 USD.

Pioneer Natural Resources Company stock analysis

2. Coterra Energy Inc.

- Dividend yield – 7.77% per annum

- LT Debt/Eq ratio – 0.17

- Founded in – 2002

- Included in the S&P 500 – 2015

- Registered in – the US

- Headquarters – Houston, Texas

- Market capitalisation – 20.8 billion USD

Coterra Energy Inc. specialises in hydrocarbon exploration and production. The company operates in the Permian Basin, Marcellus Shale, and the Anadarko Basin. The corporation pays both fixed and variable dividends.

Coterra Energy Inc.’s net profit for Q2 2023 plummeted by 83% to 209 million USD or 0.28 USD per share from the corresponding period of last year amid falling oil prices. The company will only pay a fixed dividend of 0.2 USD per share for April to June.

Coterra Energy Inc. (CTRA) stock analysis

On 11 July, Coterra Energy Inс. quotes broke strong resistance at 26 USD and headed upwards. At the time of writing, the stock was testing the 27.8 USD level. A breakout of this level could trigger further price growth up to 32 USD, the historical maximum being 36.5 USD.

Coterra Energy Inc. stock analysis

3. Diamondback Energy Inc.

- Dividend yield – 6.67% per annum

- LT Debt/Eq ratio – 0.45

- Founded in – 2007

- Included in the S&P 500 – 2021

- Registered in – the US

- Headquarters – Midland, Texas

- Market capitalisation – 32.3 billion USD

Diamondback Energy Inc. is involved in oil and natural gas exploration and production in the Permian Basin. Net profit for Q2 2023 decreased 60% to 556 million USD from the corresponding period of last year. The fixed dividend for April to June amounted to 0.84 USD per share, and no variable dividend was announced.

Diamondback Energy Inc. (FANG) stock analysis

Diamondback Energy Inc. shares were trading in the range between 125 USD to 135 USD until 11 July 2023. Then they broke above the upper boundary of the range and headed towards resistance at 150 USD. At the time of writing, the quotes were testing this level. If breached, they could continue to rise to their all-time high at 167 USD.

Diamondback Energy Inc. stock analysis

Analysis of the oil prices and outlook for the Top 3 stocks of the S&P 500 with the highest dividend yields

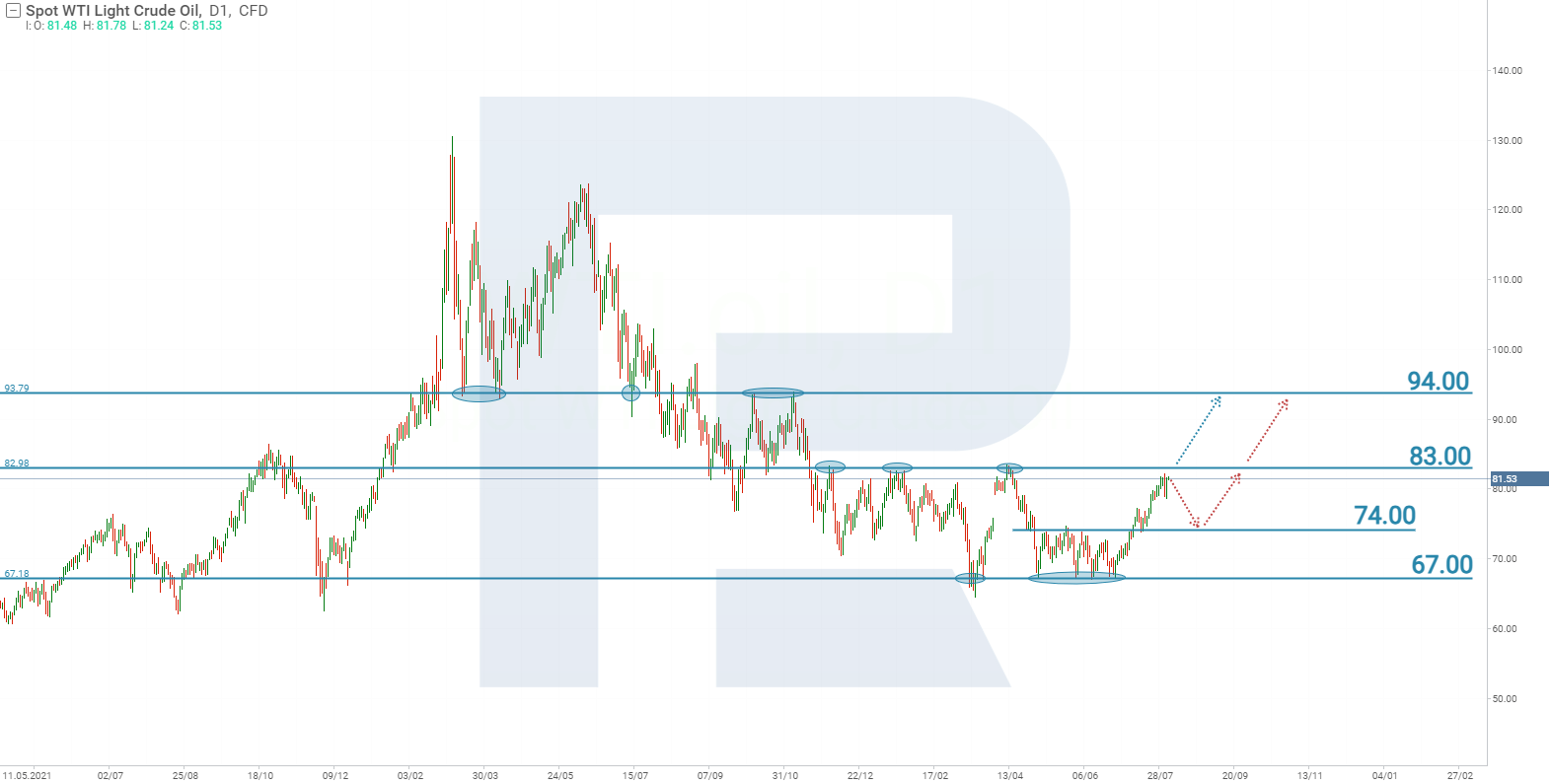

The companies mentioned above operate within the oil and gas sector, which means that their revenue and stock value are subject to oil price fluctuations. This correlation is evident in the financial reports for Q2 2022 and Q2 2023. During this period, the average price of WTI oil per barrel tumbled from 107 USD to 74 USD, causing an average profit decline of 63% for the said companies.

The date of 11 July 2023, when the stocks of today’s Top 3 companies surpassed their resistance levels, also confirms the link between oil prices and the value of the stocks. On that day, WTI oil quotes also breached the resistance level of 74 USD and headed upwards.

Therefore, to understand whether the mentioned companies can sustain large dividend payouts in the future, it is necessary to analyse the oil price chart and determine the prospects of growth for this commodity.

Among the fundamental events that could drive oil price growth is the economic stimulus programme announced by China. In August 2023, the Chinese regulatory body mandated local authorities to allocate funds from the budget towards infrastructure projects as a measure to bolster the economy. In an effort to stabilise gasoline prices, the US government initiated the sale of oil from its strategic reserves. This action led to a notable 52% reduction in reserves, amounting to 354 million barrels. Efforts are presently being made to replenish these reserves. However, on 1 August, it was announced that the US Department of Energy withdrew a request to buy 6 million barrels of oil, attributing the decision to high prices. This development might mean that the US will consider entering the market only if oil prices decrease, which could serve as a constraint on oil quotes.

In addition, oil-exporting countries are disinclined to lower oil prices, as their budgets are directly tied to the sales of this commodity. Saudi Arabia extended a reduction in the daily output by 1 million barrels for August and September, a decision originally communicated in June. Furthermore, it became known that Russia is reducing its oil exports by 0.5 million barrels per day in August and 0.3 million barrels per day in September.

All the above-listed facts could trigger a surge in oil quotes, subsequently increasing the earnings of oil and gas companies. According to technical analysis, WTI crude oil quotes are currently testing the resistance level at 83 USD. If they break it, they could probably continue moving further up towards the next resistance at 94 USD.

However, if the demand for oil is not robust enough to breach the 83 USD resistance, prices could drop to support at 74 USD. At this level, there is a possibility that the US government might initiate the purchase of oil to replenish its reserves, thereby averting further price declines.

Risks of investing in the Top 3 stocks of the S&P 500 with the highest dividend yields

The reasons behind the resilience of oil quotes not falling below this year's established lows, or potentially continuing their upward trajectory, have been outlined above. However, the actions of the Federal Reserve regarding the interest rate could trigger a complete reversal of the situation.

Should the American regulatory body persist in raising the interest rate and drive the nation's economy into a recession, which will subsequently influence Europe's economy, the demand for oil will diminish. In such a scenario, oil prices will plummet, mirroring the declining profits of oil and gas companies.

A precedent has been set in the past: in 1980, US inflation peaked at 15%, leading the Federal Reserve to dramatically hike the rate to 20% to combat it. While inflation was subdued, commodity prices plummeted from their 1980 peak of 148 USD to a 1986 minimum of 29 USD.

Conclusion

The top 3 stocks from the S&P 500 list with the highest dividend yields in 2023 at the time of writing are Pioneer Natural Resources Company, Coterra Energy Inc., and Diamondback Energy Inc. Their dividend yields stand at 10.18%, 7.77%, and 6.67% annually, respectively.

All the above issuers operate within the oil and gas sector. If oil prices experience a swift surge in the future, it would positively impact the companies' profits and the value of their securities. Consequently, this scenario would pave the way for the continuation and growth of dividend payouts. However, maintaining the Federal Reserve's policy of raising the interest rate could potentially impact oil prices and consequently affect the operations of entities within the oil and gas sector.

FAQ

Are investments in stocks that pay dividends considered safe?

Dividend investing can prove to be a solid investment strategy. Historically, dividend stocks have outperformed the S&P 500 with lower volatility. This is because dividend stocks offer two sources of income: regular income from dividend payouts, and an appreciation in stock value. This combined income can accumulate over time.

How do you calculate dividend yield?

Dividend yield is calculated by dividing the annual dividend per share by the current market price of the stock and then multiplying by 100.

Can dividend yield indefinitely exceed inflation?

Some companies manage to achieve this, but it depends on economic conditions. It is therefore essential to select companies with strong fundamental indicators and growth prospects.

What is the S&P 500?

The S&P 500 is a stock market index that tracks the performance of 500 major publicly traded companies in the US.

What does the ex-dividend date mean?

The ex-dividend date is set for the first business day after the dividend payout date (as well as after the registration date). If you sell your shares before the ex-dividend date, you also forfeit your right to receive dividends for those shares.

How often do companies pay dividends?

Companies can distribute dividends quarterly, semi-annually, or annually.