Nasdaq 100 Forecast: Analysing Trends and Predictions for 2024

8 minutes for reading

On 13 December, we analysed the popular stock index Nasdaq 100 (NAS100) to discover which companies from its basket can be called growth leaders in 2023. We conducted a technical analysis of the Nasdaq 100 chart and explored analysts' forecasts for 2024.

You can visit the RoboForex Market Analysis webpage for the latest Indices forecasts.

Overview of the Nasdaq 100 index

Nasdaq is one of the leading exchange platforms in the US. It was founded in 1971 and specialises in the stocks of high-tech companies. Nasdaq 100 is a capitalisation-weighted stock index created in 1985. It tracks approximately 100 non-financial companies whose shares are traded on the Nasdaq.

Thanks to the index basket containing the stocks of the most well-known technology companies, it is perceived as a barometer of this sector and enjoys popularity among investors.

Top 7 shares with the largest capitalisation in Nasdaq 100

According to the data from Investopedia as of 30 September 2023, the Top 7 list of stocks by weight in the index features:

| No | Company | Index Weighting | Market Capitalisation in USD |

| 1 | Apple Inc. (NASDAQ: AAPL) | 10.82% | 2.75 tn |

| 2 | Microsoft Corporation (NASDAQ: MSFT) | 9.48% | 2.36 tn |

| 3 | Amazon.com Inc. (NASDAQ: AMZN) | 5.3% | 1.35 tn |

| 4 | NVIDIA Corporation (NASDAQ: NVDA) | 4.34% | 1.04 tn |

| 5 | Meta Platforms Inc. Class A (NASDAQ: META) | 3.78% | 0.774 tn |

| 6 | Tesla Inc. (NASDAQ: TSLA) | 3.21% | 0.784 tn |

| 7 | Alphabet Inc. Class A (NASDAQ: GOOGL) | 3.14% | 1.66 tn |

Distribution of Nasdaq 100 companies by sectors

- Technology - 57.1%

- Consumer Discretionary - 18.73%

- Healthcare - 7.12%

- Telecommunications - 5.48%

- Industrials - 4.87%

- Consumer Staples - 4.23%

- Utilities - 1.24%

- Basic Materials & Energy - 0.96%

Reviewing the Nasdaq 100’s Journey in 2023

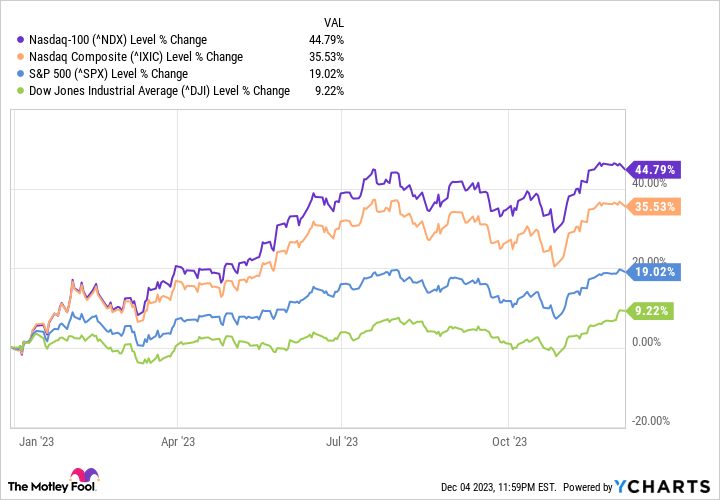

As you know, the Nasdaq 100 concluded 2022 with a 33% decline. When writing this article, the index demonstrated a confident growth of over 45% since the beginning of 2023. According to Motley Fool, the index surpassed the three leading indices that track US stocks in early December – the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite.

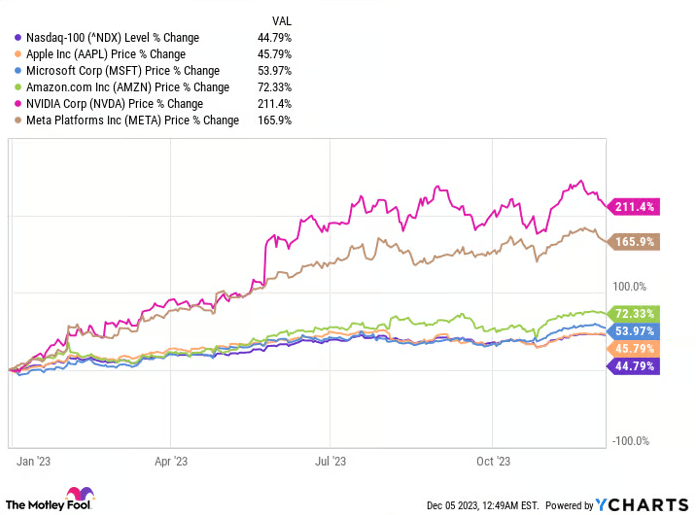

It can be supposed that the sturdy growth of the Nasdaq 100 in 2023 represents investors' optimism and the progress of the technology sector as a whole, given that the index comprises the shares of the US technology giants. A substantial increase in the stocks of the largest technology representatives drove the Nasdaq 100 quotes growth in 2023. Since the beginning of the year, the most noticeable increase was demonstrated by the following stocks:

- NVIDIA Corporation +211.4%

- Meta Platforms Inc. +165.9%

- Amazon.com Inc. +72.33%

- Microsoft Corporation +53.97%

- Apple Inc.+45.79%

Global economic dynamics shaping the Nasdaq 100

- The Fed's monetary policy. Changes in the interest rate can influence technology companies’ expenditures and their approach to borrowing, subsequently impacting index quotes

- Global economic growth. Sustained growth in the global economy typically results in increased demand for technology sector products and services, positively affecting the profits of companies listed in the index and the prices of their stocks

- Currency exchange rates. Many Nasdaq 100 companies derive a significant portion of their income from outside the US. Fluctuations in currency exchange rates, crucial in converting revenue from foreign currencies to the US dollar, can influence quarterly and annual financial reports

- Financial reports of companies. Positive quarterly and yearly results for companies in the Nasdaq 100 can trigger an increase in their stock prices, creating favourable conditions for the growth of the index

- Important domestic events. For instance, tax reforms or regulatory changes can significantly impact the stock market and, consequently, the index

- Global geopolitical events. For example, military conflicts can lead to the rupture of trade agreements and disruption of supply chains, causing increased uncertainty and volatility in financial markets

- Market sentiment and investor behaviour. Speculative activity, for example, can strongly influence the dynamics of index quotes

Technical analysis of Nasdaq 100 trends

After a descending correction in 2022, Nasdaq 100 quotes experienced an ascending rally in 2023. Beginning the year near 11,000 points, they approached the high set in 2021 at 16,764 points by December. There was a robust ascending impulse when this article was written, and the Alligator and SMA (200) indicators confirmed the uptrend.

On 13 December 2023, the quotes were near 16,354 points, not far from the high of 2021 and the resistance line. This level is likely to be tried soon. If the quotes fail to break it at once, a descending correction might start aiming at the nearest support level at 15,932 points or the support line of the ascending channel. However, if the index does break the resistance, good conditions will appear for rising higher and setting a new all-time high.

Technical Analysis of Nasdaq 100*

Future outlook: Nasdaq 100 predictions for 2024

- According to the LeoProphet portal, the Nasdaq 100 index might drop to 15,012 points by the end of the year

- According to the Wallet Investor portal, the index might reach 16,387 points by December 2024

- The Economy Forecast Agency (EFA) experts expect the decline in inflation worldwide could let central banks decrease the interest rates, thanks to which the Nasdaq 100 might reach an all-time high of 27,101 points by the end of 2024

Potential growth factors for Nasdaq 100

- Use of artificial intelligence. Decisions based on AI technologies could enhance the performance of technology companies and help them save costs, which can have a positive impact on their stock prices and index quotes

- Introduction of blockchain. Companies incorporating blockchain technology in their business processes could benefit from additional fundraising opportunities and increased operational efficiency

- Investors' interest in innovations. The use of novelties by technology companies attracts investors, which usually has a positive influence on the general dynamics of index quotes

Risk management in Nasdaq 100 investments

While stock indices typically demonstrate upward trends over the long term, investing in the Nasdaq 100 carries inherent risks. For example, a global economic crisis can precipitate a prolonged decline in the stocks of technology companies and the Nasdaq 100 index.

Let us recall the dotcom crash of 2000-2002 following the exuberant rise of the US stock market and the bubble formation in 1995-2000; Nasdaq 100 quotes plummeted by 76% from the high of 2000. It took the index 15 years to recover and resume growth.

Conclusion

The Nasdaq 100 is renowned as one of the world's most popular stock indices, consisting of stocks from the largest non-financial companies traded on the Nasdaq.

In 2022, a downward correction occurred, but since the beginning of 2023, the index has been on a robust uptrend. Most stock market experts express optimism, expecting the index to continue its growth in 2024 and reach new all-time highs.

However, it is essential to acknowledge that these forecasts might not materialise, given the potential risk of a slowdown in the US economy due to worsening economic conditions, possibly influenced by the Fed's high interest rates.

FAQ

What is the Nasdaq 100 index?

Nasdaq 100 is a stock index comprising approximately 100 of the largest non-financial companies registered on the Nasdaq exchange.

Which sectors are the drivers of the Nasdaq 100?

The main drivers of the index are technologies and consumer services. However, the performance of these sectors can change annually depending on economic and industry-specific factors.

Which companies are included in Nasdaq 100?

The list of companies from the Nasdaq 100 basket and real-time market information provided by Nasdaq Last Sale can be found here.

What was the performance of the Nasdaq 100 in 2023?

After the descending correction in 2022, the index has demonstrated a stable upward rally since the beginning of 2023. As of 13 December 2023, the index rose more than 45% from the start of the year.

What prospects do experts forecast for the index in 2024?

Most stock market experts are optimistic, expecting continued growth in 2024 and the establishment of new all-time highs.

How can I buy the Nasdaq 100 index?

To invest in Nasdaq 100, you can use ETFs, such as Invesco QQQ Trust or spot index funds that can be bought via brokers or mutual funds. Before making any investments, thorough research is essential, and consulting with a financial advisor is recommended.

Which strategies should be considered when investing in Nasdaq 100?

Common strategies include diversification, long-term investments, and using stock indices or ETFs. Investors should align their strategy with acceptable risks and follow their investment goals.

What risks are associated with investing in the Nasdaq 100?

Risks include market volatility, technological sector decline, and economic factors. Investors should consider their risk tolerance and consult a financial advisor before investing.

* – The charts featured in this article originate from the TradingView platform, renowned for its extensive set of tools designed for financial market analysis. Functioning as a user-friendly and advanced online market data charting service, TradingView allows users to perform technical analysis, explore financial data, and connect with fellow traders and investors. Furthermore, it offers valuable guidance on effectively understanding how to read forex economic calendar, in addition to providing insights into various other financial assets.