Alibaba Stock Price Analysis 2024: Insight into Ma and Tsai's Share Purchase

10 minutes for reading

Alibaba Group Holding Limited (NYSE: BABA) shares plummeted more than 80% from October 2020 to October 2022 inclusive, dropping from 315 USD to 58 USD.

Their further growth did not instil confidence in investors, and by mid-January 2024, the stock retraced to the 2022 low.

However, two events followed that may positively impact the Chinese giant’s stock price and revive investor interest in its shares. What is it all about? What do the experts forecast? On 29 January 2024, we aimed to answer these and other important questions.

You can visit the RoboForex Market Analysis webpage for the latest forex forecasts.

Introduction to Alibaba Group

Alibaba Group Holding Limited is a Chinese multi-industry conglomerate specialising in e-commerce, cloud computing, financial services, digital media, and technology. It was founded by Jack Ma in 1999. The company’s American depositary receipts (ADR) are listed on the New York Stock Exchange (NYSE). In October 2020, its market capitalisation reached 780 billion USD, making it one of the world’s largest public companies.

Main business areas of Alibaba Group Holding Limited

- E-commerce. This primarily refers to platforms such as Alibaba, Taobao, and Tmall

- Cloud computing. Alibaba Cloud focuses on cloud computing, AI technologies, Big Data, and IoT solutions

- Digital media and entertainment. Projects such as Youku Tudou and Alibaba Pictures are worth mentioning in this segment

- Financial services. Ant Group, a company affiliated with Alibaba Group Holding Limited, provides digital payment, lending, asset management, investment, and insurance services

Reasons for recent fluctuations in Alibaba’s stock price

In his public speech in October 2020, Jack Ma criticised China’s financial system. That same month, the Chinese authorities scuttled Ant Group’s IPO, which could have been the world’s biggest. It is worth noting that the subsidiary company planned to hold the initial public offering for 34 billion USD.

In December 2020, Chinese regulators launched an antitrust investigation into Alibaba Group Holding Limited, resulting in the largest fine in Chinese history of 2.8 billion USD being imposed on the giant. In addition, the company was obliged to change the cooperation policy with merchants on its platforms and improve its internal control system.

Amid these events, from 28 October 2020 to 24 October 2022, Alibaba Group Holding Limited stock plummeted by 81.6% from 315 USD to 58 USD per unit.

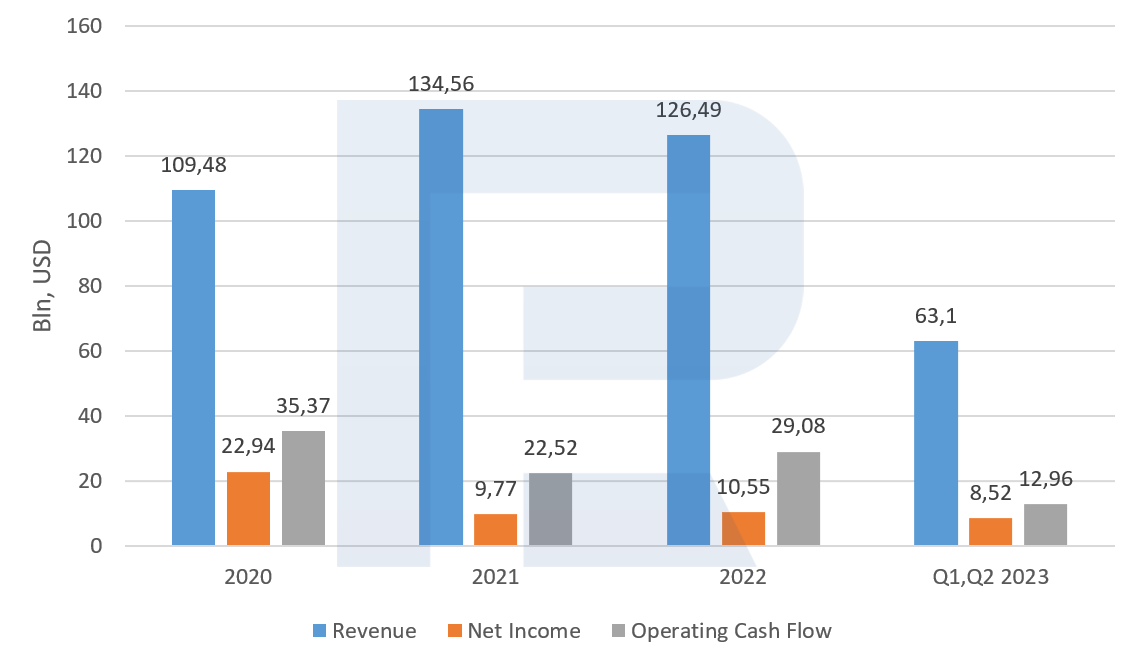

Financial health and performance metrics of Alibaba Group Holding

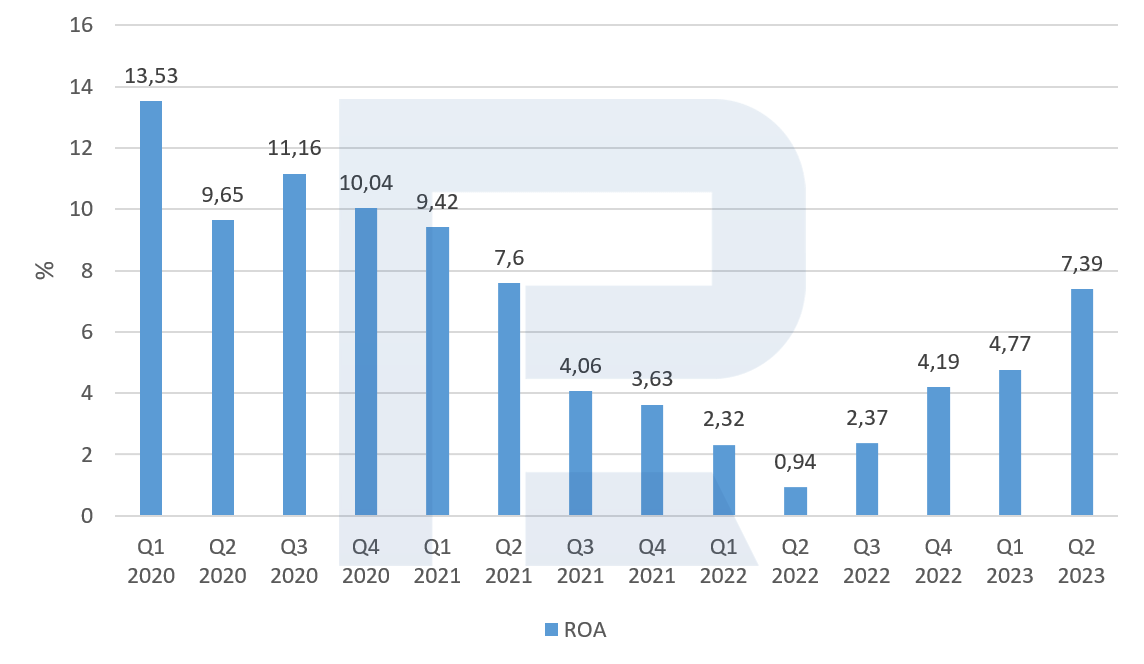

To gain insights into Alibaba Group Holding Limited’s financial position, we will provide data on some indicators over the period from Q1 2020 to Q2 2023:

- Revenue. Its growth often indicates good business health

- Net Income. The company’s amount of profit, less all expenses and taxes, typically demonstrates the efficiency of cost management

- Operating Cash Flow. The amount of funds the company receives from its core business operations reflects liquidity and its ability to generate funds

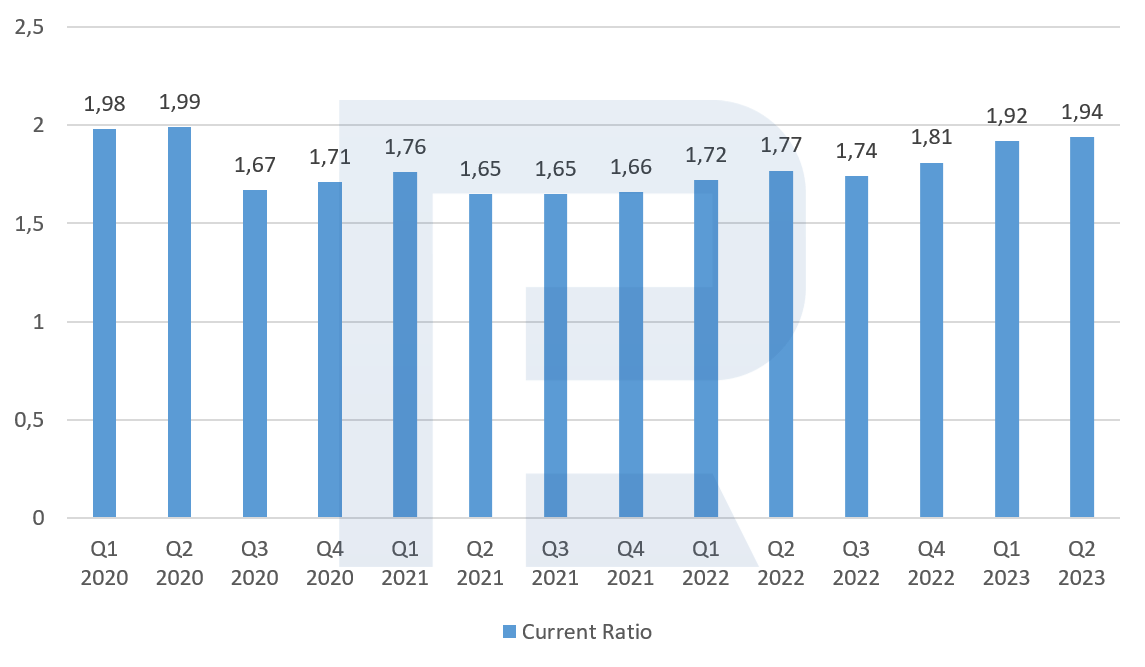

- Current Ratio. This ratio represents the relationship between current assets and current liabilities. A value exceeding 1 indicates that the company has sufficient current assets to meet its current obligations

- Return on Assets (ROA). The ratio of net income to total assets indicates the efficiency with which the company utilises its assets to generate profit

The above statistics indicate that 2021 and 2022 were challenging years for the Chinese giant, while 2023 saw positive dynamics. Given this, it can be assumed that the company’s financial position may continue to improve in 2024.

China allocates funds to support the stock market

The Shanghai Shenzhen CSI 300 (SSE: 000300) stock index, which reflects the performance of the 300 largest companies traded on the Shanghai and Shenzhen stock exchanges, plummeted by 21.7% from 30 January 2023 to 25 January 2024. In comparison, the S&P 500 gained 21.1% during this period. China’s government plans to allocate funds to buy shares to support the stock market.

According to Bloomberg, the country’s authorities intend to establish a stabilisation fund for approximately 278 billion USD to purchase shares of Chinese companies through the Hong Kong exchange system.

This plan aims to halt the market decline and restore investor confidence amidst several challenges in the Chinese economy. These include a real estate market crisis, dwindling consumer sentiment, declining foreign investments, and decreasing confidence among local businesses. Authorities are also considering other supportive measures, which might be announced later.

Although the support plan has not been approved yet, the CSI 300 already gained 4.1% on rumours from 23 to 25 January. Alibaba Group Holding Limited's stock responded with a 9.6% increase. However, it is worth noting that the shares had one more reason to rise: the co-founders bought a significant number of company shares.

Jack Ma and Joseph Tsai’s investment moves

On 23 January 2023, it was announced that Jack Ma and Joseph Tsai purchased 200 million USD worth of shares in Alibaba Group Holding Limited. Blue Pool, owned by Tsai, acquired shares worth 150 million USD, and Jack Ma purchased stock worth 50 million USD.

The purchases were made in Q4 2023, when the stock value of the Chinese company averaged 78.40 USD. The New York Times suggests that these purchases might signal the co-founders’ belief in the undervaluation of Alibaba’s business following an over 80% decline in the stock price.

Alibaba stock analysis

Alibaba Group Holding Limited’s stock has been trading between 80 to 120 USD since March 2022. Breaking below its lower boundary on 19 September 2022, the quotes reached a low of 58 USD. Surpassing the 80 USD level on 28 November 2022, they retraced to the previous trading range and continued to move within it until 12 November 2023.

Another breakout of the lower boundary occurred on 13 November. But news of government incentives and Jack Ma and Joseph Tsai’s purchases in the Chinese conglomerate halted a decline in stock value, propelling it from 67 USD to 74 USD.

It may be assumed that if the quotes break above the resistance level of 80 USD again, they might reach the upper range boundary at 120 USD, driven by positive news. Otherwise, we will likely see a test of the low at 58 USD again.

Alibaba Group Holding Limited stock analysis*

Expert and analyst forecasts for Alibaba stock price for 2024

- According to Barchart, 14 out of 12 analysts rated Alibaba Group Holding Limited shares as Strong Buy and two as Hold, with an average price target of 117.75 USD

- Based on the information from MarketBeat, 13 out of 15 experts assigned a Buy rating to the stock, while two gave a Hold rating, with an average price target of 119.80 USD

- According to TipRanks, 18 out of 20 specialists designated a Buy rating for the Chinese giant’s stock, while 2 gave a Hold recommendation, with an average price target of 118.60 USD

- As Stock Analysis reports, 12 out of 23 analysts rated the shares as Strong Buy, four as Buy, two as Hold, three as Sell, and two as Strong Sell. The average 12-month price forecast for the company’s stock is 128.39 USD

Investor strategies based on Alibaba stock predictions

Regarding the Chinese stock market and Alibaba Group Holding Limited shares, several investment ideas for 2024 can be considered:

- Interest rate reduction. Unlike the US, where the Federal Reserve has raised the interest rate since 2022, the People’s Bank of China is pursuing a soft monetary policy. The interest rate has been reduced from 3.85% in January 2022 to 3.45% in January 2023. Based on the December 2023 results, China is experiencing deflation of −0.7%, prompting the regulator not to tighten monetary policy

- Economic stimulus. Deflation in China will force the government to introduce stimulus measures to revive the economy, which might positively affect the country’s stock market and the most prominent local public companies, including Alibaba Group Holding Limited

- Global economic growth. The US, EU, UK, Canada, and Australia regulators refrained from raising interest rates at their last meetings. Market participants expect monetary policies to be eased in these countries, potentially positively impacting the national economies. Given that China is one of the key trade partners of each of these countries, it may be assumed that positive dynamics in their economies may have a beneficial effect on China’s economy, potentially creating favourable conditions for an increase in imports of goods and services from China

Conclusion: Synthesising Alibaba stock predictions

For Alibaba Group Holding Limited's stocks in 2024, there are positive factors that may contribute to the growth of their value. These include incentives from the Chinese government and significant securities purchases by the company's founders.

The conglomerate's financial condition analysis shows improving statistics, with revenue gradually returning to the 2020 levels. Additionally, experts from the mentioned platforms predict an increase in the prices of these stocks.

Considering all these factors, a positive news background is probably forming around the Chinese company in 2024, which will likely impact the value of its securities positively.

FAQ

Is Alibaba a good investment?

Investing in Alibaba, like any stock, carries both potential rewards and risks. The company's robust position in e-commerce and technology, particularly in the Asian market, offers growth potential. However, investors should consider factors such as regulatory risks in China, market volatility, and global economic conditions. Conducting personal research or consulting with a financial advisor to determine if Alibaba aligns with your investment goals and risk tolerance is essential.

How to invest in Alibaba stock

To invest in Alibaba stock, you can follow these general steps:

1. Open a trading account: choose a brokerage account that suits your trading needs. For example, RoboForex offers several account types for different platforms.

2. Make a deposit: fund your account with the minimum required deposit. For RoboForex, the minimum first deposit starts from 10 USD, depending on your account type.

3. Select Alibaba stock: research and choose Alibaba (BABA) as your desired investment.

4. Decide on investment volume: determine the amount of Alibaba stock you want to buy based on your budget and investment strategy.

5. Execute the trade: log into your trading platform, select Alibaba stock, and place your buy order. You can choose from different order types like market, limit, or stop orders.

6. Monitor your investment: keep track of your Alibaba stock position, analyse performance, and make adjustments as needed.

For more information, visit the RoboForex website here.

Will Alibaba's prices go up in 2024?

Various experts and analysts ' forecasts for Alibaba's stock price in 2024 indicate a generally positive outlook. Most analysts from Barchart, MarketBeat, TipRanks, and Stock Analysis have given the stock ratings ranging from "Strong Buy" to "Hold." According to Stock Analysis, the average price targets from these sources vary, with the highest being 128.39 USD. Overall, while a definitive increase in Alibaba's stock price cannot be guaranteed, the analyst consensus leans towards a positive outlook for 2024. Remember, stock market predictions are inherently uncertain, and conducting thorough research or consulting with a financial advisor is essential.

Where can I find the live Alibaba stock price chart?

You can find a live price chart of Alibaba (BABA) on the R StocksTrader platform. To access this, simply go to the platform and use the search field to type "Alibaba." This will provide you with Alibaba's current and historical stock price data.

Is Alibaba paying dividends?

As of 2023, Alibaba had a dividend yield of 1.38% and paid 1.00 USD per share in dividends. The dividends are disbursed annually, with the last ex-dividend date being 20 December 2023. Investors should note that dividend policies can change, so staying updated with the company's latest financial reports and announcements is advisable for the most current information.

* – The TradingView platform supplies the charts in this article, offering a versatile set of tools for analyzing financial markets. Serving as a cutting-edge online market data charting service, TradingView allows users to engage in technical analysis, explore financial data, and connect with other traders and investors. Additionally, it provides valuable guidance on how to read forex economic calendar effectively and offers insights into other financial assets.