The Gap is shown in the chart above as yellow rectangles. This is a practical gap in the flow of quotations reflecting a serious difference between the opening and closing prices in trading sessions. A quick look at the chart captures a large number of such phenomena. This means that if we classify them we may find a lot of opportunities to use them in trading. But first, let us talk about the reasons which a Gap emerges for.

All posts

To succeed in market trading you should learn to analyze and forecast price movements. The market price is influenced by a whole range of various factors, all of which we literally cannot know. A question emerges: in this case, how does forecasting become possible? This question is answered by one of the basic and most necessary types of market analysis — technical analysis.

Playing on exchange markets, including Forex, a trader will inevitably come across such phenomena as Margin Call and Stop Out. At first they seem to be synonyms but in fact their meanings are completely different. Let us look at the terms more closely.

The influence of fundamental data on the dynamics of financial instruments is studied by a special type of analysis – fundamental analysis, an integral part of any trader training program. Fundamental analysis is applied to regularly published macroeconomic indices of certain countries and the world economy on the whole as well as to political events, relevant for the financial world.

In essence, a VPS is a remote desktop; or, in other words, it is a computer that allows to install necessary trading software irrespective of the main computer.

Stop Loss (SL or stops) and Take Profit (TP or target price) are orders meant for the player’s safety. They are, by nature, reverse orders: ex. if a pair was bought, a triggered stop or target price initiates a reverse transaction (selling) thus locking in profits (TP) or losses (SL).

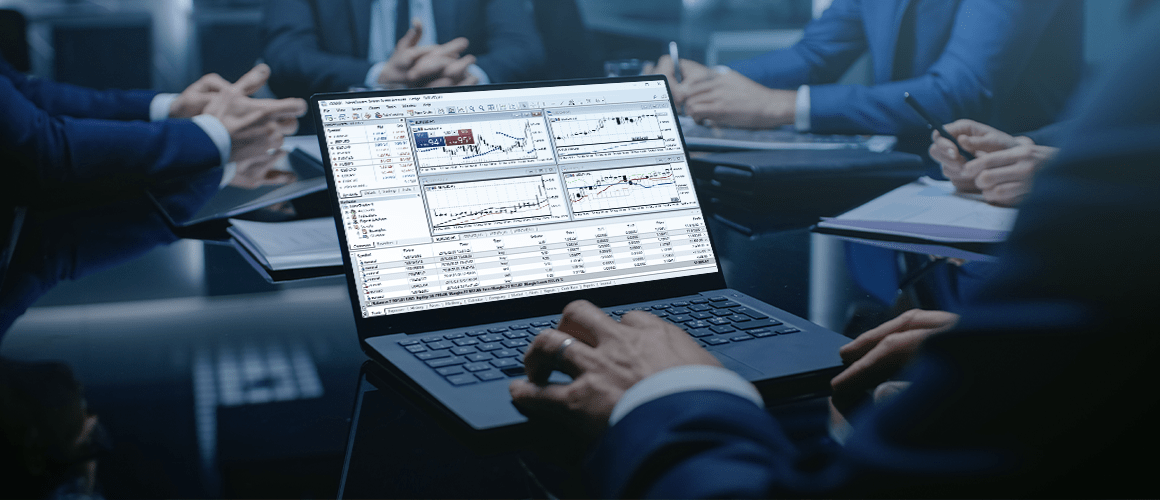

MetaTrader 5 was released in 2010. It is intended for performing trading operations on different financial markets. This program is an updated and improved version of MetaTrader 4, a very famous terminal, which is extremely popular among traders.

Day trading or intraday is short-term transaction on stock exchanges performed during the same trading session without roll-overs. This way of trading is quite peculiar, because this approach requires traders to consider all incoming information, such as news, statistics, external factors, and a lot of other events.

An application for trading on financial markets, MetaTrader 4 was developed and is supported by MetaQuotes Software. Despite its quite deep history (released in 2005), MetaTrader 4 has been one of the most popular and actual software for traders ever since. Its recipe for success can be explained by three words, availability, simplicity, and effectiveness. MT4 terminal is free and multi lingual (supports about 40 languages), has a user-friendly interface all necessary features for manual and automated trading. Initially, the application was intended for trading on the Forex market, but later traders started using the terminals for other assets as well, such as CFDs on stocks, indices, cryptocurrencies, metals, commodities, etc. Result: an intuitive and user-friendly multi-purpose terminal, which allows to trade a wide range of instruments.

The economic calendar has long stopped being some sort of a secret; one does not have to be a “pro” economist or trader to use it. Presently, this calendar is yet another instrument for market analysis. Or let us put it different: it is not only an instrument but also a set of signals, indicators that can tell a lot about a certain branch of world economy as well as predict the market reaction to such publications. If you divide the publications in the calendar into different categories (described below), the market reactions and fluctuations will become even more obvious.

When an uninitiated reader encounters the collocation "financial market", they discern no difference between such terms as "stock market", "exchange", "Forex", "equity market", "bond market", "currency market", "derivative market", etc. So, I think there should be an explanation what the financial market really is. First of all, understand and remember that the financial market is not just a place for trading, but the entire system of the economic relations, which appeared in the process of exchanging different goods and recourses.

Leverage means the ratio between the money you own and that borrowed from the broker. Different brokers offer different leverage sizes, which also depend on the market you are trading.

To trade with leverage, one must understand what it is and what we need it for. Leverage is a ratio of borrowed money to your own funds. It is also called trading leverage or financial leverage. To better understand what leverage is, study an example below.

Are there any beginners, who haven’t asked themselves a question what a CFD is and how it is different from a real asset? Let’s go deeper in these terms and try to determine which one of them is more interesting and easier-to-use for both beginners of stock exchange markets and experienced investors. What is CFD? […]

In very simple words, liquidity indicates an asset’s ability to be sold in a short period of time at the price that is close or equal to the requested price. If we dig into the matter, we’ll find out that liquidity means an opportunity to convert an asset into its monetary equivalent. An asset may […]