Profit +50% Before the End of the Year

5 minutes for reading

Goldman Sachs predictions

Goldman Sachs (NYSE: GS) is one of the largest investment banks out there, its earnings coming from both traditional banking business, such as loans and deposits, as well as from stock trading. This bank also rates the exchange traded companies, releasing predictions other traders pay attention to. Currently, Goldman Sachs says some companies are going to rise by 50% before the end of the year. This is hard to believe, as the S&P500 is very unlikely to yield that much.

Donald Trump is saying he is about to secure the Chinese deal, and this could support the index. This could be true, were it for the first time ever. It is not, however, and this time it may prove a false promise again. So, while the S&P500 is unlikely to rise very much, Goldman Sachs still affirms some companies may, those being the companies with high stock prices. Let's see whether this may be true, based on the major financial indicators and the tech analysis.

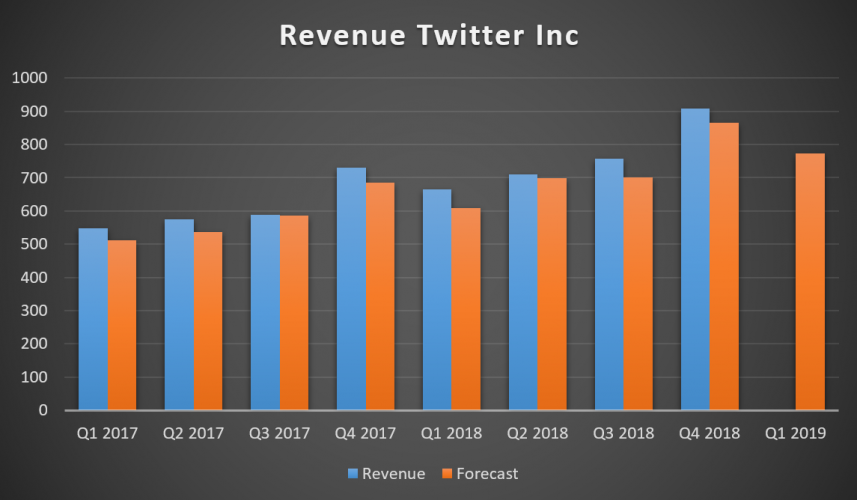

Twitter stock price rise

The company we'll analyze here is Twitter (NYSE: TWTR), which, according to Goldman Sachs, is going to rise by 49% before 2019 is out. The stock is currently trading at $34, and this prediction means it could exceed $50. Technically, this is a likely story: the price is above the 200-day SMA, with the historical highs at $75, and the market cap in 2013 higher than now. In 2016 and 2017, the stock was near the lows, forming a support at around $15. Currently, the resistance at $25 got broken out, and a sort of uptrend is being formed. If another resistance at $37 gets hit, the price may well get higher.

Twitter's earnings are also quite alright, having exceeded the expectations over the last few years.

In Q1, the earnings are expected to grow by 16% YoY, while the EPS has risen massively by 94%, from $0.16 to $0.31. The debt to equity ratio is at 0.26, which is very low and showing the company is stable. The free equity at $6.20B is also a good indicator. The P/E at 22.14 is virtually identical to the sector average (21.30), which proves the stock is not overbought. Finally, the short float is as low as 3%. Overall, the stock may well rise by 50%.

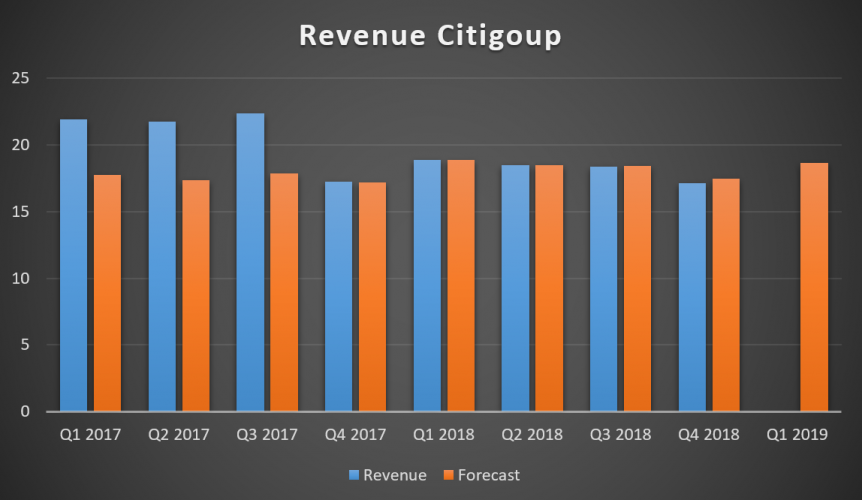

Predictions for Citigroup stock price

Another company in question is Citigroup (NYSE: C), which is now trading at $65 and is expected to get to $100. At first sight, this looks like too much expensive. The price is, however, above the 200-day SMA, and when it previously got lower, the market pushed it upwards to $55. So at least the investors are interested in Citigroup.

So if currently $100 looks overbought, it got as high as $500 before the 2008 crisis, so why not rise once more? This could well be the case.

However, if this looks logical technically, the fundamentals tell a different story.

In 2018, the earnings never met expectations, each time falling shorter. The $714B free equity looks great, but one should understand banks produce nothing but money; a bank never needs money for production facilities or R&D. Still, compared to Goldman Sachs, Citigroup has $300B more free equity, which is a lot. With the P/E at 9.82, the stock looks oversold compared to the average of 17.07.

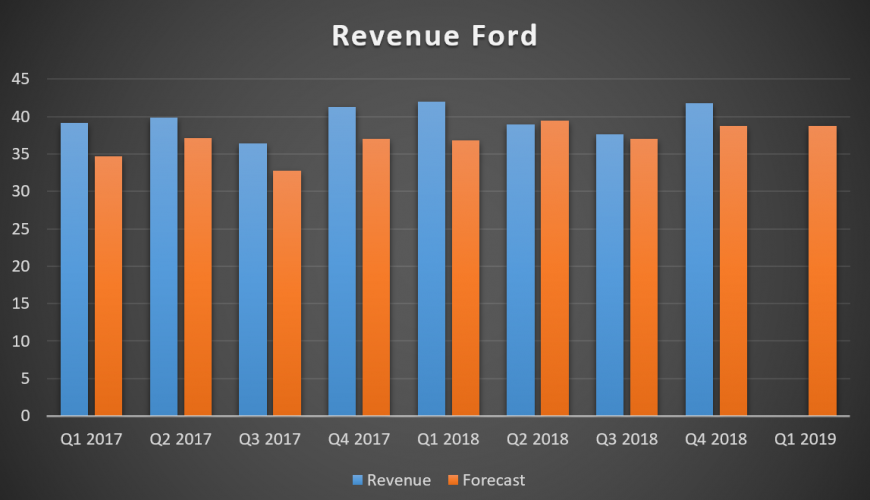

Ford stock price forecast

On April 15, the bank is reporting its Q1 2019 earnings. This time, it could be slightly better and let the price reach $100. The Ford (NYSE: F) stock looks quite odd in this list. The company is trading at $9 and has never exceeded $22 in history. Ford is no longer an automotive leader, with a lot of harsh competition and self-driven cars conquering the markets. On the other hand, $9 plus 50% makes just $13.50, which is achievable in a single day, with an unexpected event or a good quarterly earning report.

Technically, however, there are quite a few problems the stock will have to face. First, Ford has to break out the $9.50 resistance, then, the 200-day SMA, and then two resistance levels at $12 and $13.50.

Meanwhile, any good fundamental data may well help the price reach any of this resistance lines.

General Motors forecast

The chart shows the earnings exceeded the expectations in most cases, but were unable to stay above $40B. This could well be the limit, as General Motors (NYSE: GM) has reached this figure only once, and its earnings are now in line with Ford's. The GM EPS is, however, $1.43, compared to Ford's $0.30, so no wonder the GM stock is eight times more expensive. Ford could buy the shares out in order to boost the EPS, which would attract new investors.

The P/E is at 10.42, against the 14.76 average, which shows the stock is oversold and may soon start going up. The short float is meanwhile at 3%.

Overall, the company has very good earnings, it pays dividends, its brand is very much recognizable, and it has large production facilities. With a low stock price, the company may just cut the number of floating shares in order to push the price up. The management may also reduce costs in order to boost the profits, but a buyout may prove a better idea: Ford's free equity is at $33B, while spending just one billion on buying out 100M of shares would boost both the price and the dividend payments.

Delta Air Lines

For example, Delta Air Lines (NYSE: DAL) spent $1.30B on shares buyout, with just $1.70B of free equity. The company had to use loan money, but the price was boosted by 30%. Ford also has a good growing potential, but many things depend on the company's management.