Tesla Batteries Down: Investors Leaving

7 minutes for reading

With the company finally getting its first profit, building new units and expanding the business, well, here we are: after reaching $380, the stock went severely down! The short positions in Tesla (NASDAQ: TSLA) are already over 25%, while when the company reported large losses, the stock surprisingly soared.

Tesla stocks analysis and forecast

Around two months ago, in the previous Tesla stocks analysis we said it might have reached the top, and now it looks like our expectations came true. So, what happened? The stock should have started rising now, not six years ago, but in fact Elon Musk made the investors believe in the dream he was creating. He was so much successful in pitching his company that people ignored $700M+ losses and went on investing.

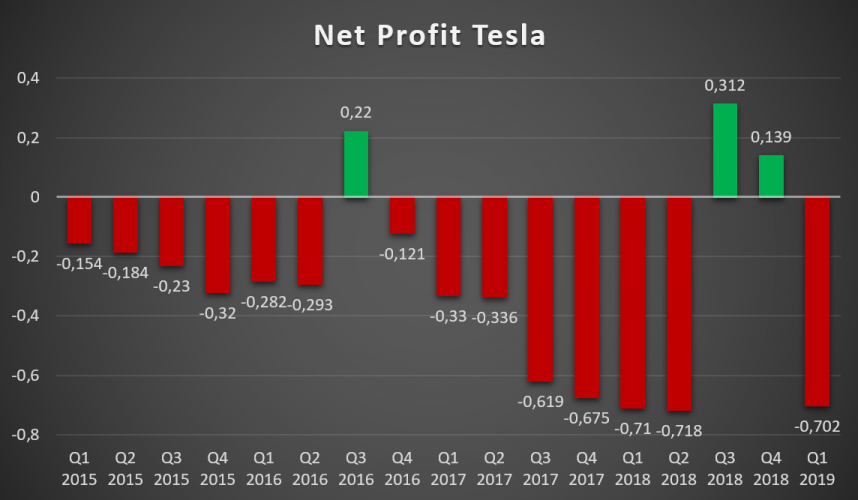

From 2015 to 2018, the company's losses increased from 150 million to 700 million USD, during this same time the company's shares rose in price from 190 to 380 USD. Naturally, there were those who saw these losses and considered such an increase in shares unreasonable, as a result of which they took short positions and, unfortunately, suffered huge losses.

In aggregate, sellers' losses on Tesla shares reached 5 billion USD. Due to them, there was such an increase in stock price, as they had to close their losing trades.

In our recent article, we also talked about how the crowd of inexperienced investors behaves and how dangerous it is to trade against of them. Tesla is a prime example of the crowd winning over the common sense of experienced traders who have decided to confront them.

What is the future of the company?

Now the company needs to raise 1.5 billion USD for further expansion. The source of money can be the sale of bonds and shares of the company itself. The company plans to sell 2,723,198 shares, and if the money is not enough, then their number can grow to 3,131,677.

Selling shares may put additional pressure on their value, which will benefit those who already have short positions in Tesla shares. Such people will not exit their positions, since the pain of losing money is still too great, and no one has forgotten about it, so they will wait until the last moment and will not support stocks, closing their positions.

Tesla's revenues are growing, but the net profit is now being consumed by payments on previously sold bonds. In March, the company repaid its liabilities in the amount of USD 920 million, i.e., in fact, it received a profit of about USD 200 million.

But now we see that the debt load continues to increase. At the end of 2016, the company's long-term debt amounted to 2.45 billion USD, today it has increased almost 4 times. The P/E ratio, which indicates how much the stock is undervalued or, on the contrary, overvalued by the market, is not possible to calculate for the first quarter, since earnings per share are negative. In Q4 2018, the P/E ratio was 126.00.

For comparison: the P/E of the entire technology sector is 21.67, General Motors is 5.94, Ford is 7.92, that is, the stock price is not only not true, but overvalued tenfold. Technically, on D1, the stock has already gone into a downtrend. The 200-day SMA is the resistance for the price, and any increase in the value of the stock can be stopped at its level.

On W1, the price tried several times to keep upward, constantly fighting off the 200-day MA, but the Q1 2019 financial report, which did not meet expectations and showed a loss in general, led to a change in trend. Now, even on the weekly chart, it is noticeable how the downtrend begins to develop. This is indicated not only by the 200-day moving average, but also by the usual trend line broken out in March.

Additionally, in terms of volume analysis, during 2013, there was an increase in trading volumes, as a result of which the value increased from 250.Still, while the majority of investors bought Tesla shares, then where are they going to take profits? This was the catch, because not everyone managed to purchase shares at 200 went into the standby mode and waited for better times to close positions with a profit.

They even were very lucky, because from 2014 to 2017 the shares were trading in the range between 180 and 280 dollars. During this time, the company did not reach net profit, but only accumulated losses, as a result of which an increasing number of new investors took short positions in stocks in anticipation of a collapse, which never occurred. Unluckily for the sellers, the rise provoked them to close positions.

In the stock market, it always happens this way: if some lose, others make money. This time, the bulls earned. The increase brought their positions in the money and, with the newly growing volumes at the highs, they began to lock it. Thus, the resistance was formed at $385, which subsequently could not get broken out. It is difficult to even imagine that one of the major investors would risk investing money into a loss-making but promising company, the price of which is already overestimated tenfold.

As a result, everyone who wanted to make a profit from the growth in the value of shares has already received it, and now it is time for the sellers. It is possible that investors accumulated short positions from 2014 to 2017, but not all of them had a loss. Therefore, the closest level where the price will be able to find support will be the support at $170.

However, in order for the share price to stop at this level, the company must make profit, Musk's pitching not working very much anymore. The support must be based upon fundamental factors, otherwise the price will fall lower, and at this time, the competition will start conquering the electric car market, while Tesla will have to further reduce the cost of their vehicles, once again not allowing itself to make profit.

This is a kind of a vicious circle: the company needs investments to expand its business and increase the number of electric cars sold, but the new investments lead to obligations to meet. In order to earn money, Tesla needs to either increase the sales or raise the prices. With the competition ready to take over, the price cannot be increased. On the contrary, some on-site stores have been closed recently in order to reduce costs, which means that the only possible way to make profits is boost sales.

Fortunately, the company has no problems with sales: Tesla Model 3 became the best-selling model (63,150 units were sold in Q1 2019), the Model X ranked second (14,050 units), and Model S took the third place in sales ( 13,500).

The plant built in China will help to increase the number of electric cars produced by the company, because the demand at the moment still exceeds supply. But the increase in production is very expensive for the company, the debt load is growing, and in fact the company is working to pay off previously taken debts.

Conclusion

Tesla definitely remains the most promising in the electric car market. It does not pay dividends currently, but invests money in business expansion, and the only income is the stock price rise. The financial reports, the P/E and the number of open short positions show that the stock is much overvalued. The best solution for now might be selling only, and with this being not a long term strategy, we would advise the buyers to look for other companies to invest into, and then come back to TSLA when it reaches its lows.